Polyhedra Network (ZKJ)

Polyhedra Network (ZKJ)

- 46Social Sentiment Index (SSI)- (24h)

- #7Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 0%24h KOL Bullish Ratio1 Active KOL

- SummaryZKJ fell 12.24%, with high volatility, social hype stable, traders hold negative sentiment towards high risk.

- Bullish Signals

- Previously saw a 50% rise

- Short-term volatility provides opportunities

- Social hype hasn't decreased

- Partial KOL attention

- Bearish Signals

- Price down 12% in 24h

- High volatility causing large losses

- Leverage risk warning

- Lack of stop loss leading to losses

- Overall negative sentiment

Social Sentiment Index (SSI)

- Data Overall46SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bearish (100%)SSI InsightsZKJ social hype is moderate (45.5/100) stable, activity score full (40/40) but positive sentiment only 5/30, KOL attention 0.5/30, consistent with the 12% drop and negative sentiment.

Market Pulse Ranking (MPR)

- Alert InsightZKJ warning rank #7, social anomaly 100/100, sentiment polarization 100/100 extremely high, while KOL attention only 0.5/100, corresponding to a 12% drop and high volatility risk.

X Posts

梭教授说 Trader Influencer C173.09K @hellosuoha

梭教授说 Trader Influencer C173.09K @hellosuoha✍️Trading is tough and not suitable for everyone; this is written for myself. Actually it's just my personal ramblings, which can't represent everyone. The article might not clearly distinguish spot/futures/leverage, so if it's hard to read, better not to look 😭. 🌟Don't dare to roll over positions; only risk small positions when chasing highs. Whenever I see some assets being pumped, I think for a long time about whether to chase and how much, then decide to buy a small lead position, planning to add more if it falls. Generally, people with this mindset never profit from dips; they watch their small lead position turn into a heavy position, feeling no joy, but rather falling into regret. Maybe it could be said that the right side appeared, but I couldn't judge, so I was afraid to take a large position on the right side. 🌟Enthusiastic about bottom‑fishing, endless bottom hunting. Actually it's not really bottom‑fishing; it's more of a left‑side operation—buy a little when the price seems right, but the more you buy, the more it falls, the more you buy, the more you lose. A funny thing is that many altcoins are often thought to have zero value, but once you buy them you stop believing that. Bottom‑fishing is basically a grind; it depends on whether this time you can reach the true bottom. 🌟Can't cut losses, always a “diamond hand”. This actually forms a misconception that not cutting losses equals having diamond hands. Many things should be stopped decisively when the stop‑loss point arrives, instead of holding on stubbornly. Initially a 20% loss turned into a 99% loss—why? Originally you only needed to spend 1% of the amount to buy back, why spend a hundred times more? So it's not “diamond hands”, just not knowing whether to cut losses or run, opting to hold on. You still need your own “logic”, unless you truly “believe” in it or completely “don’t care”. Especially with “front‑running” and “inside info”, it's truly a case of not knowing whether to stop loss. It reminds me of $ZKJ, which went from –50% to +50%, then –70% to –95%. Just saying, that's ruthless @PolyhedraZK ??? 🌟Blindly using leverage without position management skills. Most people can't control their leverage; a 10× position might be easy, but 1000× becomes overwhelming. Eating poorly, sleeping badly, constantly nervous—ending up with no money and a broken body. Moreover, leverage can go to zero directly, and much faster than spot positions. Always thinking this time is different, I must stitch a future, then it just brings you back to square one. When the direction is right, I keep wondering how much I can make this time; When the direction is wrong, I keep thinking I must run to break even; When the market is sideways and unclear, I keep wondering if I can move at my desired speed; In the end, it's still gambling with unknown odds. 🌟Focus on what you're good at and avoid what you're not. I know a lot of things, but I'm not proficient in any, which means I know a bit of everything but not really master anything. You still need to stick to your strengths; at least losses will be clearer. Hope everyone feels the same. Or perhaps everyone will “specialize and learn”; indeed, learning makes progress. 🌟When caught in a losing position, open a hedge, then can't unwind. When opening contracts, fear the direction reverses, ending up with both long and short positions being locked. Then chasing longs when it rises and shorts when it falls leads to frequent trades, but you never actually profit; fees pile up. If you think being clever and making money both ways, you're doomed. Stick to a single direction; avoid dual positions, or you might end up working for someone else 😭. Then the operation becomes distorted. ✍️Conclusion Brothers, are you really choosing the trading path? Anyway, I'm not suitable; I only fit for a fool's approach: buy a little on dips, sell a little on rises, just rely on luck 😧. On this path, success depends on your own skill; others can't help you. Copy trading can't produce a future, and others' experiences only matter if you can learn something—still your own skill. This path isn’t harder than “crossing a single-plank bridge”, and it's roughly as tough as becoming a “chain king”.

7 1 312 Original >Trend of ZKJ after releaseExtremely BearishThe tweet reveals the numerous difficulties and common pitfalls of cryptocurrency trading, warning of its high risk.

7 1 312 Original >Trend of ZKJ after releaseExtremely BearishThe tweet reveals the numerous difficulties and common pitfalls of cryptocurrency trading, warning of its high risk. belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95老贾 MemeMax ⚡️ D16.94K @miraflores0327

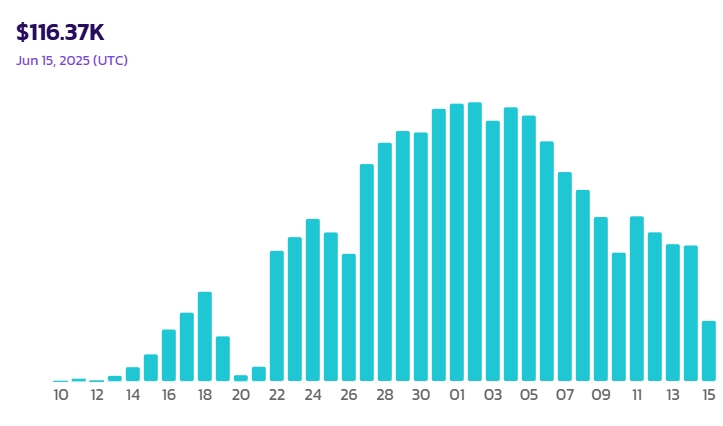

belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95老贾 MemeMax ⚡️ D16.94K @miraflores0327Three days ago I warned that $ZKJ price might experience a flash crash, didn't expect it to happen so quickly 🥲 ZKJ veteran traders are all familiar with it, it's the famous Panda King, considered a shining example of domestic projects, NFT sales generate good profits. Later when Zksync launched it even snatched its ticker, this guy even rallied the community to start a name‑snatching battle. To be frank, its price has been quite sturdy, and community members jokingly call it the real ZK 🤣 After the ZKJ whales hopped on the Alpha high‑speed train, the money‑making speed was comparable to printing money. At the beginning of the month the daily pool earnings reached $500,000, and as recently as yesterday it was still $260,000. ZKJ was originally a meme coin, but it was forcefully brushed into a stablecoin by everyone's “enthusiasm”. Everyone compressed the LP price to the extreme, also pushing the pool APR to stay above 450%. However, this play requires high trading volume and continuous liquidity to keep buying the dip. The chart clearly shows that after the peak earnings at the beginning of the month, the returns have been sliding down. In the last 24 hours it dropped 68.11%, and the trading volume fell 20.16%. Recently many people announced they were exiting Alpha, feeling the returns were not worth it, and the majority of that withdrawing volume originally belonged to ZKJ. This may be the first domino to fall, the negative flywheel spins faster and faster, the group that builds LP to earn returns and the group that panics and rushes to pull LP to survive are basically the same wave of people.. This flash crash was predictable, just a matter of early or late and fast or slow. I now regret that I opened too few short positions, the crash speed and depth exceeded expectations 🤣

396 259 146.89K Original >Trend of ZKJ after releaseExtremely BearishZKJ flash crash due to liquidity depletion, author regrets insufficient short position

396 259 146.89K Original >Trend of ZKJ after releaseExtremely BearishZKJ flash crash due to liquidity depletion, author regrets insufficient short position nzt DeFi_Expert Researcher B1.38K @nazarius_amb

nzt DeFi_Expert Researcher B1.38K @nazarius_amb nzt DeFi_Expert Researcher B1.38K @nazarius_amb

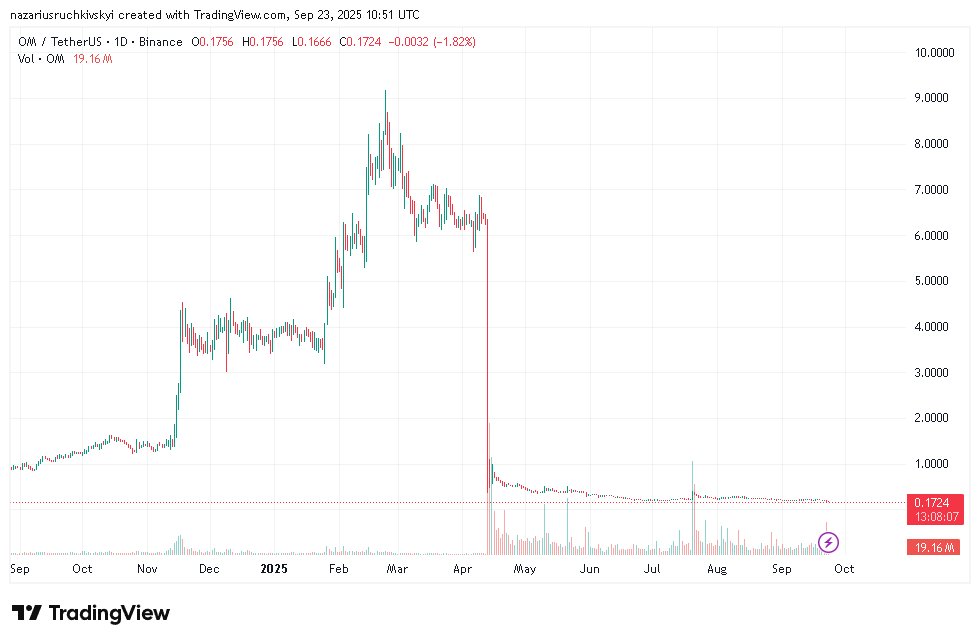

nzt DeFi_Expert Researcher B1.38K @nazarius_ambDays when some people made millions and others lost them in cryptocurrency These six months have been eventful, and we currently have three events that have caused a significant drop in token prices • Polyhedra $ZKJ • Mantra $OM • Uxlink $UXLINK

13 9 2.65K Original >Trend of ZKJ after releaseBearishThe tweet reviews the recent drastic price fluctuations experienced by Polyhedra ($ZKJ), Mantra ($OM), and Uxlink ($UXLINK), warning of the high risks in the cryptocurrency market.

13 9 2.65K Original >Trend of ZKJ after releaseBearishThe tweet reviews the recent drastic price fluctuations experienced by Polyhedra ($ZKJ), Mantra ($OM), and Uxlink ($UXLINK), warning of the high risks in the cryptocurrency market. nzt DeFi_Expert Researcher B1.38K @nazarius_amb

nzt DeFi_Expert Researcher B1.38K @nazarius_ambDays when some people made millions and others lost them in cryptocurrency These six months have been eventful, and we currently have three events that have caused a significant drop in token prices • Polyhedra $ZKJ • Mantra $OM • Uxlink $UXLINK

13 9 2.65K Original >Trend of ZKJ after releaseBearishThe tweet reviews the recent drastic price fluctuations experienced by Polyhedra ($ZKJ), Mantra ($OM), and Uxlink ($UXLINK), warning of the high risks in the cryptocurrency market.

13 9 2.65K Original >Trend of ZKJ after releaseBearishThe tweet reviews the recent drastic price fluctuations experienced by Polyhedra ($ZKJ), Mantra ($OM), and Uxlink ($UXLINK), warning of the high risks in the cryptocurrency market. 头雁 Researcher Dev C22.05K @alacheng

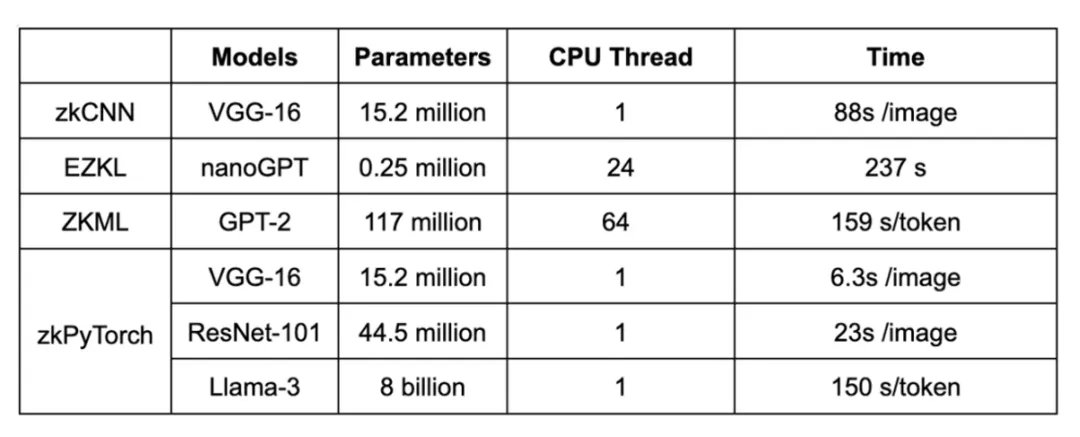

头雁 Researcher Dev C22.05K @alachengZKML still has a long way to go to be practical. Looking at this performance evaluation table, you can see that zk proofs for LLMs take about 150 seconds per token for proof generation. This represents a relatively advanced solution, but zk technology has always progressed very quickly. Let's revisit this in half a year. https://t.co/bGPg4Qs1kW https://t.co/P5VBTxqu4r

Polyhedra CN D5.13K @Polyhedra_CN

Polyhedra CN D5.13K @Polyhedra_CNRecently, at the Generative AI + Data Intelligence Forum, Dr. Tiancheng Xie, Co-founder & CTO of Polyhedra, delivered a keynote speech titled "The Prospects and Future of Verifiable AI," sharing the team's cutting-edge research. This event was co-hosted by Polyhedra, Google Cloud, AI Origin Community, OceanBase, and others. For more insights from the speech, please click: Polyhedra Chinese Official Account https://t.co/wGiJELjcRY https://t.co/oOzMVDj9p7

0 0 7 Original >Trend of ZKJ after releaseBullishZKML performance needs improvement, Polyhedra has made progress in verifiable AI.

0 0 7 Original >Trend of ZKJ after releaseBullishZKML performance needs improvement, Polyhedra has made progress in verifiable AI. Kurnia Bijaksana TA_Analyst Trader B38.64K @mkbijaksana

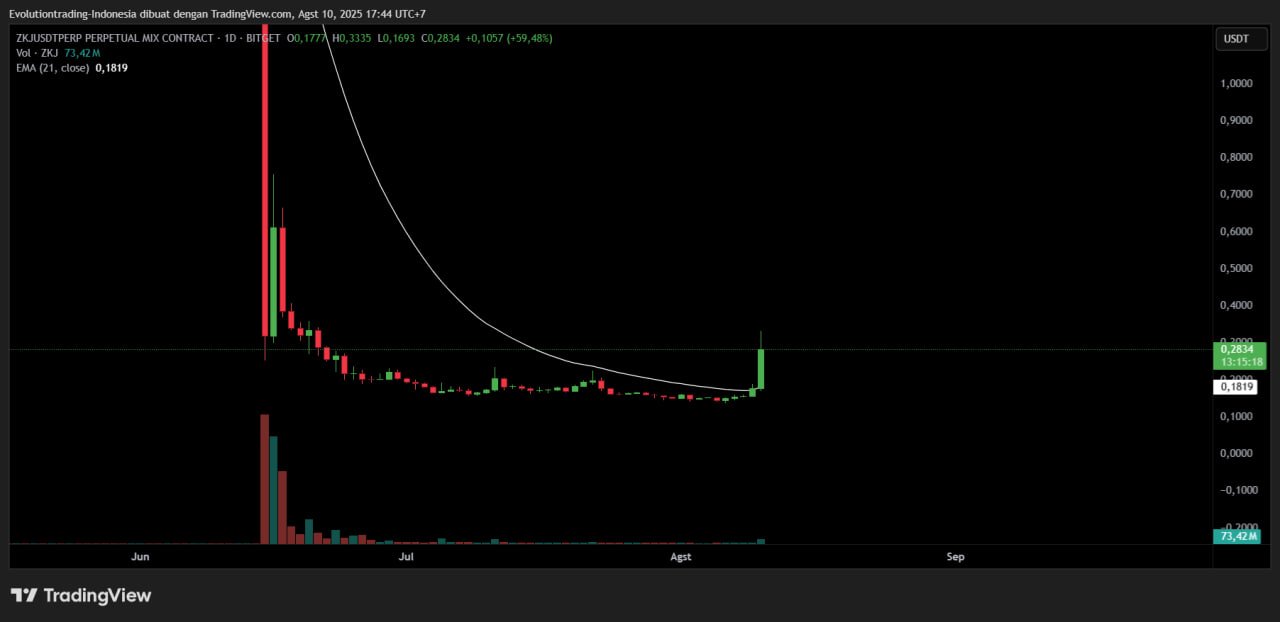

Kurnia Bijaksana TA_Analyst Trader B38.64K @mkbijaksanaZKJ ZKJ will probably consolidate in this 0.2637 and 0.3335 area The plan for ZKJ: 1. Look for buy position if price bounces from 0.2637 2. Buy on breakout if it breaks 0.3335 - aiming for 0.4 3. If ZKJ breaks down 0.24 - we wait until it reaches 0.1962 area https://t.co/LSHMqsHnRO

16 2 2.18K Original >Trend of ZKJ after releaseBullishZKJ consolidates in the 0.2637-0.3335 range, providing buy and target strategies based on key prices.

16 2 2.18K Original >Trend of ZKJ after releaseBullishZKJ consolidates in the 0.2637-0.3335 range, providing buy and target strategies based on key prices. Our Crypto Talk Media Educator C75.11K @ourcryptotalk

Our Crypto Talk Media Educator C75.11K @ourcryptotalk OCT Trades TA_Analyst Trader B4.94K @oct_trades

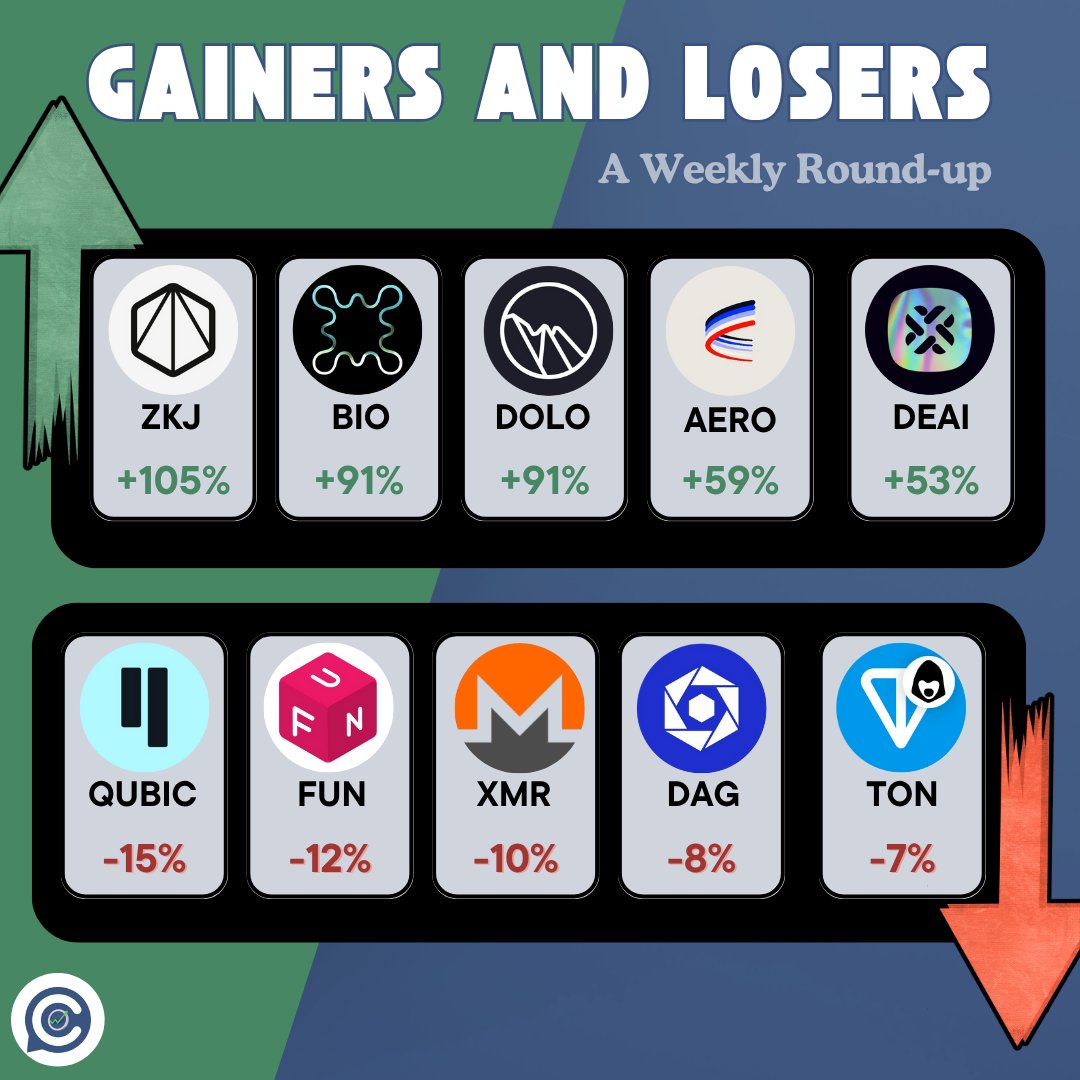

OCT Trades TA_Analyst Trader B4.94K @oct_tradesMissed navigating the crypto market this week? Here is all you need to know 👇 Top Gainers 📈 $ZKJ ↑ 105% $BIO ↑ 91% $DOLO ↑ 91% $AERO ↑ 59% $DEAI ↑ 53% Top Losers 📉 $QUBIC ↓ 15% $FUN ↓ 12% $AMR ↓ 10% $DAG ↓ 8% $TON ↓ 7% Key Reason Behind These Moves 👇 $ZKJ : Recovery after their massive crash in Q2 $BIO : Bio V2’s launch and 100M+ BIO staked, to Coinbase listing $DOLO : Total Value Borrowed 2X in 7 days. $AERO : Week with over $4 Billion in protocol volume. $DEAI : Over 42 million transactions processed $QUBIC : Price correction after pump last week $FUN : Lack of volume $XMR : Mining Centralization Concerns $DAG : Low investor attention $TON : Selling by large holders WHAT HAPPENED IN THE MARKET? 👇 • Ethereum surged past $4,000, hitting $4,240, up 10.7% for the week. • Institutional demand drove $1.2 billion into Ethereum ETFs, including $73 million on August 5. • SharpLink Gaming and BitMine Immersion acquired nearly 2 million ETH, boosting corporate adoption. • SEC clarified ETH staking

19 4 2.32K Original >Trend of ZKJ after releaseBullishThis week's crypto market review: ETH surged, ZKJ and other coins led the gains, and a list of top gainers and losers is provided.

19 4 2.32K Original >Trend of ZKJ after releaseBullishThis week's crypto market review: ETH surged, ZKJ and other coins led the gains, and a list of top gainers and losers is provided. CryptoMaid加密女仆お嬢様 .edge🦭 Influencer DeFi_Expert C137.43K @maid_crypto

CryptoMaid加密女仆お嬢様 .edge🦭 Influencer DeFi_Expert C137.43K @maid_cryptoProjects controlled by exchanges are openly priced and tradable https://t.co/WhqHhIm3VQ

带带带比特 D41.12K @daidaibtc

带带带比特 D41.12K @daidaibtcZKJ SOON The characteristics are very obvious, they are all 'dead' projects. No need to look at fundamentals, no need to look at quality. The commonality is that the chips are highly concentrated. With MYX as a precedent, everyone wants to ride the market trend and become MYX's shadow. Powerful, proactive market makers have approached them. Market makers are looking for projects, not projects looking for market makers. Unsure if it's the same group of people.

2 2 3.29K Original >Trend of ZKJ after releaseBullishExchange-controlled 'dead' projects, market makers may push or replicate MYX's trend, suitable for short-term speculation. Kurnia Bijaksana TA_Analyst Trader B38.64K @mkbijaksana

Kurnia Bijaksana TA_Analyst Trader B38.64K @mkbijaksanaZKJ Massive bullish candle forming on 1D timeframe. We can expect ZKJ to continue going up for the next few days. But we need more precise analysis for entry on intraday timeframe https://t.co/vqpLIb7b8T

Kurnia Bijaksana TA_Analyst Trader B38.64K @mkbijaksana

Kurnia Bijaksana TA_Analyst Trader B38.64K @mkbijaksanaUpside targets for ZKJ are 0.3592 and 0.4067 For entry, especially if you use leverage. We can wait for 0.2408 to be tested and anticipate a sweep. However, also consider a possibility that ZKJ may retrace deeper to RBS area around 0.1962 Or, entering now if you have balls to do it. Do what you want. It's your money

24 3 3.09K Original >Trend of ZKJ after releaseBullishZKJ's daily chart shows a massive bullish candle, expected to rise with targets at 0.3592 and 0.4067. Entry is suggested on a retest of 0.2408 or 0.1962.

24 3 3.09K Original >Trend of ZKJ after releaseBullishZKJ's daily chart shows a massive bullish candle, expected to rise with targets at 0.3592 and 0.4067. Entry is suggested on a retest of 0.2408 or 0.1962. Sahar Ebrani Trader Influencer S7.58K @saharebz

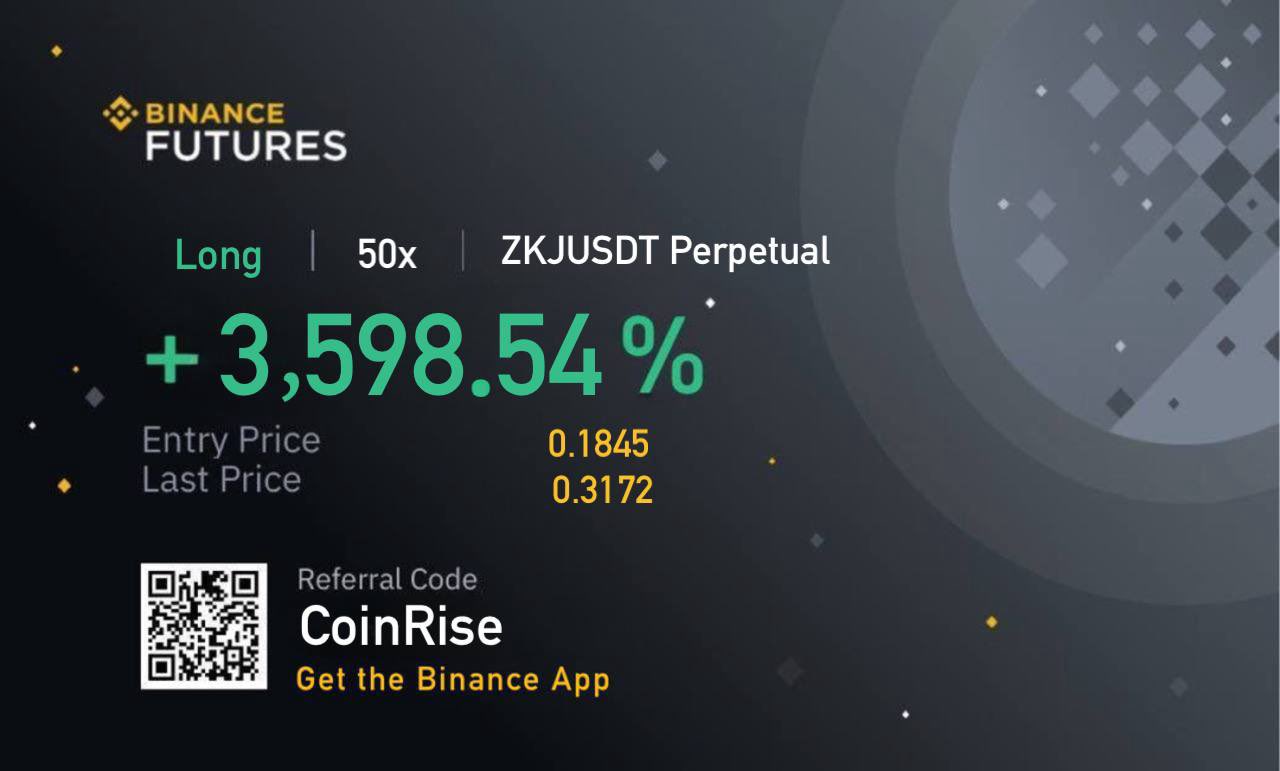

Sahar Ebrani Trader Influencer S7.58K @saharebzHow do you get these profits? What do they do to not get liquidated with 50x leverage? Who knows the answer to these questions? https://t.co/aE7kl0iNcr

134 54 8.63K Original >Trend of ZKJ after releaseExtremely BullishThe tweet questions how high returns from 50x leverage can avoid liquidation.

134 54 8.63K Original >Trend of ZKJ after releaseExtremely BullishThe tweet questions how high returns from 50x leverage can avoid liquidation.