yearn.finance (YFI)

yearn.finance (YFI)

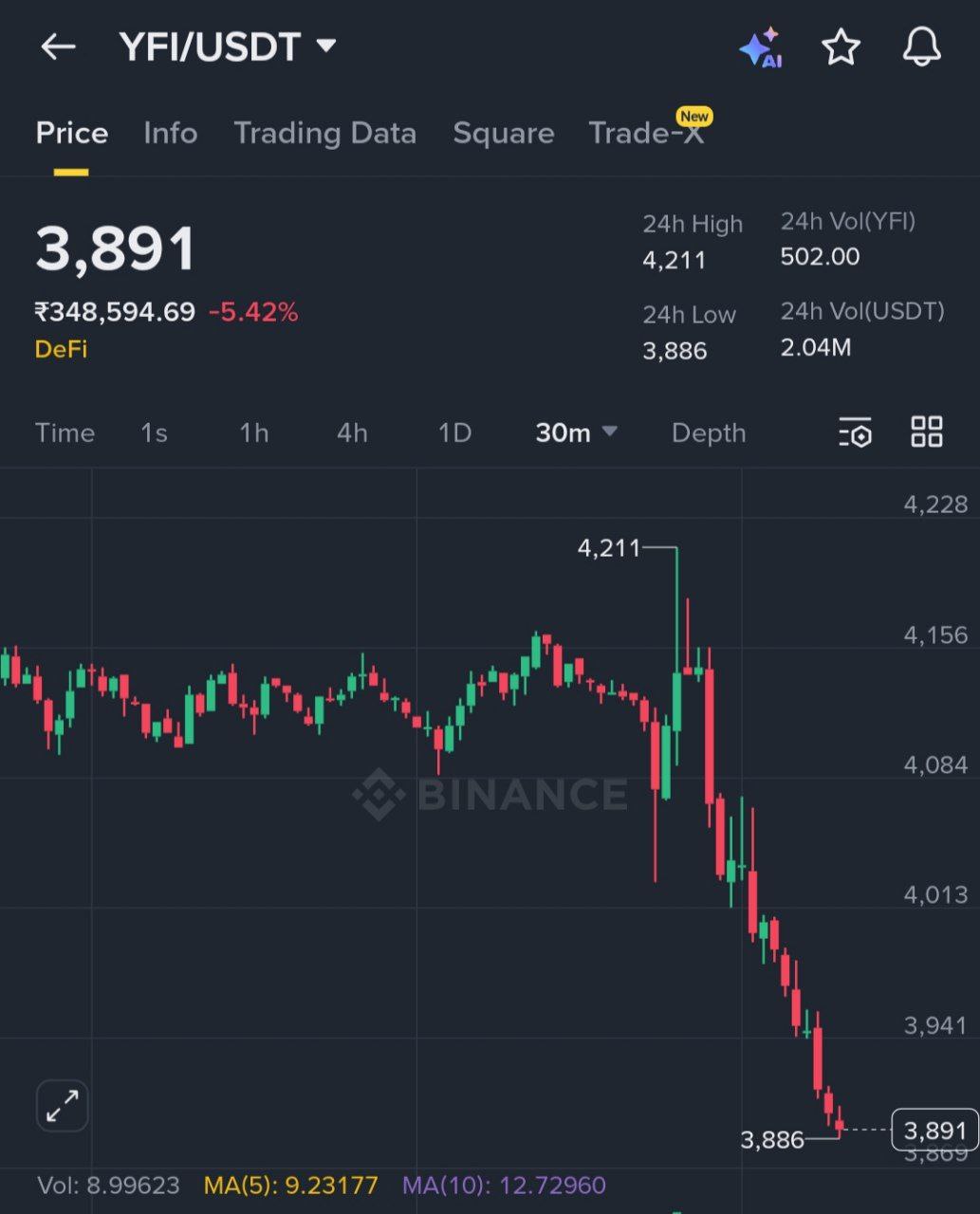

$3,825.6 -7.38% 24H

- 59Social Sentiment Index (SSI)- (24h)

- #10Market Pulse Ranking (MPR)0

- 1124h Social Mention- (24h)

- 0%24h KOL Bullish Ratio11 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall59SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBearish (45%)Extremely Bearish (55%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of YFI after releaseBearish

- Trend of YFI after releaseExtremely Bearish

Sumit Kapoor Educator Trader B38.97K @moneygurusumit

Sumit Kapoor Educator Trader B38.97K @moneygurusumit Wise Advice D318.84K @wiseadvicesumit

Wise Advice D318.84K @wiseadvicesumit 39 14 3.45K Original >Trend of YFI after releaseBearish

39 14 3.45K Original >Trend of YFI after releaseBearish- Trend of YFI after releaseExtremely Bearish

- Trend of YFI after releaseExtremely Bearish

- Trend of YFI after releaseExtremely Bearish

- Trend of YFI after releaseBearish

- Trend of YFI after releaseBearish

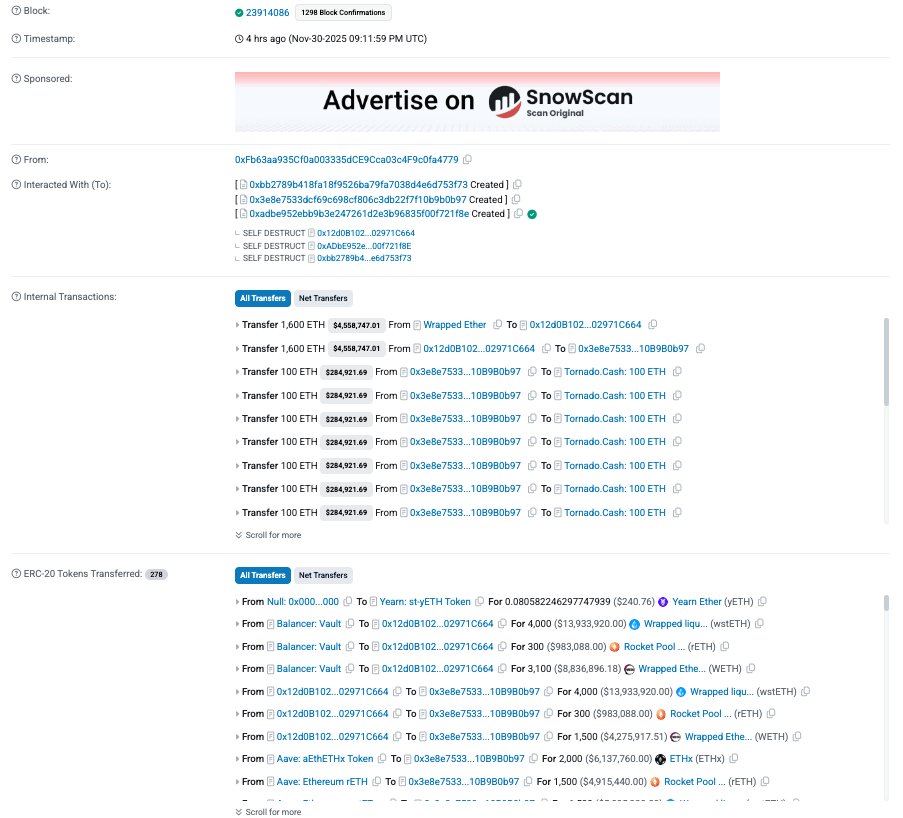

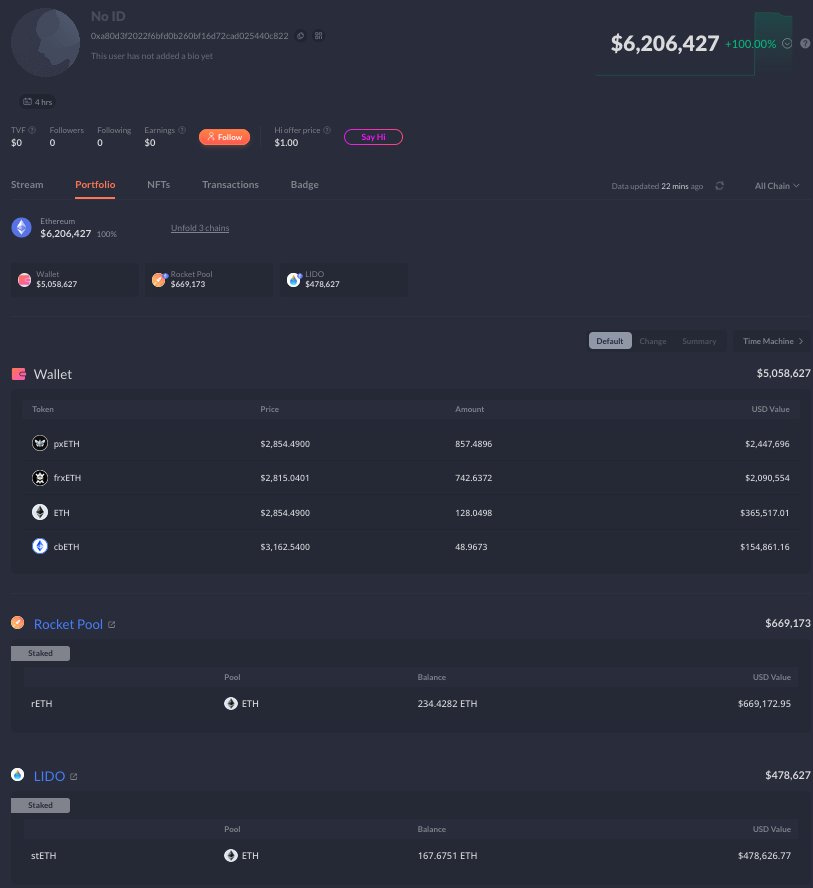

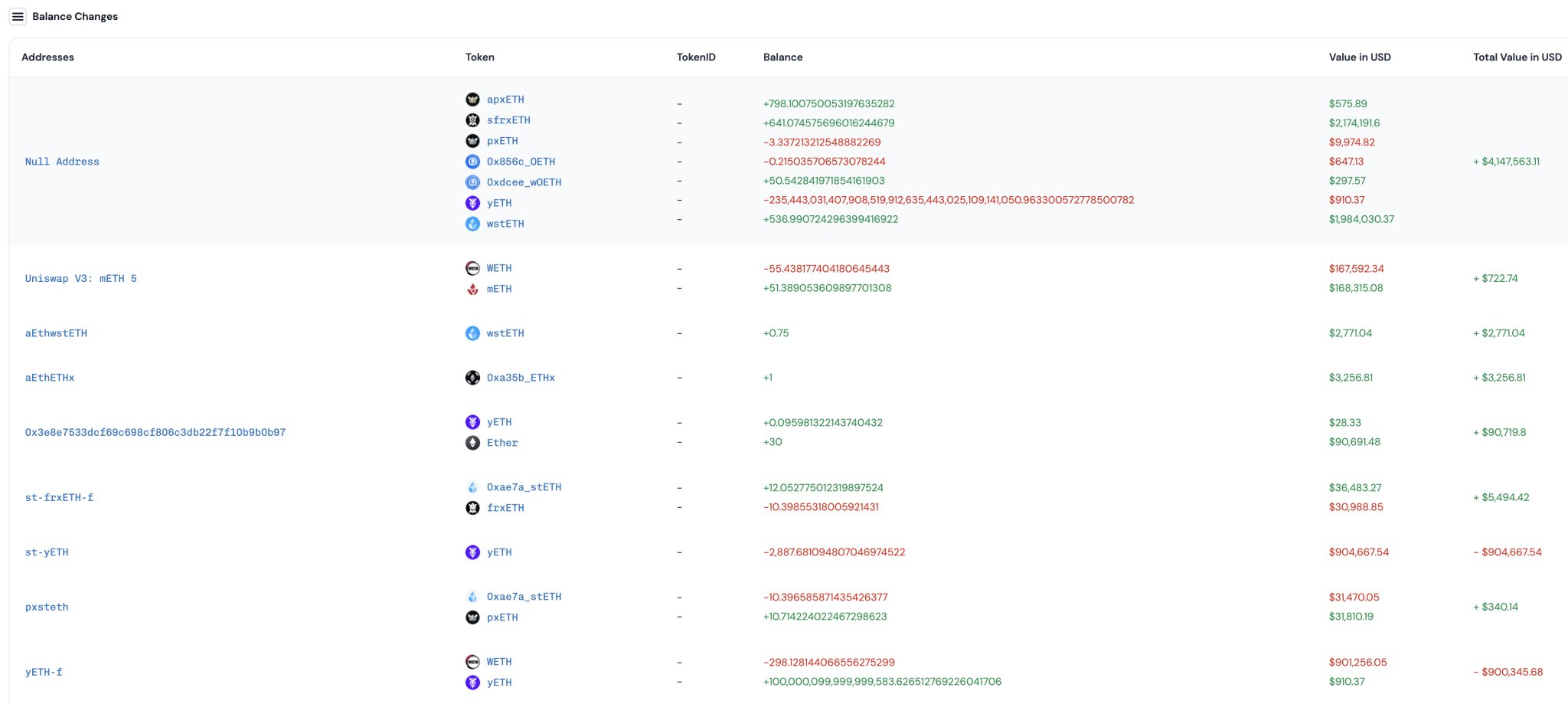

Digital Asset News Media Influencer C205.97K @NewsAsset

Digital Asset News Media Influencer C205.97K @NewsAsset PeckShieldAlert D93.32K @PeckShieldAlert

PeckShieldAlert D93.32K @PeckShieldAlert

24 8 5.81K Original >Trend of YFI after releaseExtremely Bearish

24 8 5.81K Original >Trend of YFI after releaseExtremely Bearish yueya.eth Founder Researcher A38.55K @yueya_eth

yueya.eth Founder Researcher A38.55K @yueya_eth CM FA_Analyst DeFi_Expert A54.05K @cmdefi

CM FA_Analyst DeFi_Expert A54.05K @cmdefi 73 23 19.26K Original >Trend of YFI after releaseExtremely Bearish

73 23 19.26K Original >Trend of YFI after releaseExtremely Bearish