Bittensor (TAO)

Bittensor (TAO)

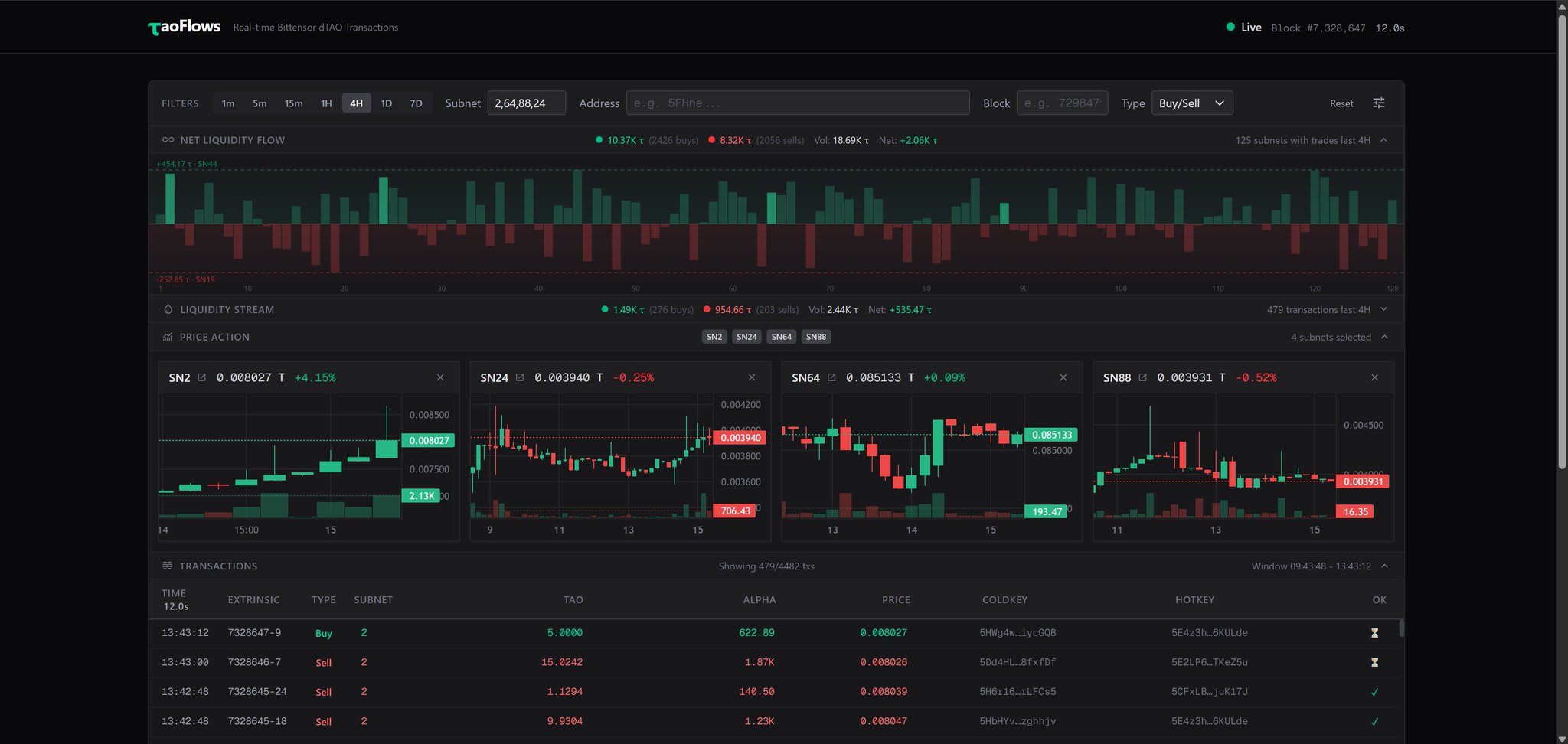

$275.29 -3.12% 24H

- 73Social Sentiment Index (SSI)+11.23% (24h)

- #119Market Pulse Ranking (MPR)+31

- 4324h Social Mention+48.28% (24h)

- 80%24h KOL Bullish Ratio24 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall73SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (40%)Bullish (40%)Neutral (5%)Bearish (15%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of TAO after releaseBullish

- Trend of TAO after releaseNeutral

- Trend of TAO after releaseExtremely Bullish

- Trend of TAO after releaseBullish

DeepFuckingValue (τ, τ) TA_Analyst FA_Analyst A3.12K @DFVTAO

DeepFuckingValue (τ, τ) TA_Analyst FA_Analyst A3.12K @DFVTAO Alex DRocks D4.69K @DrocksAlex2

Alex DRocks D4.69K @DrocksAlex2 5 0 258 Original >Trend of TAO after releaseExtremely Bullish

5 0 258 Original >Trend of TAO after releaseExtremely Bullish- Trend of TAO after releaseBearish

Tao Ouτsider D1.47K @TaoOutsider

Tao Ouτsider D1.47K @TaoOutsider Mark Jeffrey VC Community_Lead B68.47K @markjeffrey

Mark Jeffrey VC Community_Lead B68.47K @markjeffrey 48 4 1.34K Original >Trend of TAO after releaseExtremely Bullish

48 4 1.34K Original >Trend of TAO after releaseExtremely Bullish- Trend of TAO after releaseBearish

YVR τrader FA_Analyst Tokenomics_Expert B11.12K @YVR_Trader

YVR τrader FA_Analyst Tokenomics_Expert B11.12K @YVR_Trader Yuma Dev Founder S9.64K @YumaGroup16 2 901 Original >Trend of TAO after releaseBullish

Yuma Dev Founder S9.64K @YumaGroup16 2 901 Original >Trend of TAO after releaseBullish Andy ττ FA_Analyst OnChain_Analyst S10.21K @bittingthembits

Andy ττ FA_Analyst OnChain_Analyst S10.21K @bittingthembits Hermes | SN82 D94 @HermesSubnet

Hermes | SN82 D94 @HermesSubnet 22 2 1.31K Original >Trend of TAO after releaseExtremely Bullish

22 2 1.31K Original >Trend of TAO after releaseExtremely Bullish