River (RIVER)

River (RIVER)

$14.592 +9.08% 24H

- 46Social Sentiment Index (SSI)-18.22% (24h)

- #64Market Pulse Ranking (MPR)-33

- 424h Social Mention0% (24h)

- 50%24h KOL Bullish Ratio4 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall46SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (25%)Bullish (25%)Neutral (25%)Bearish (25%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of RIVER after releaseBullish

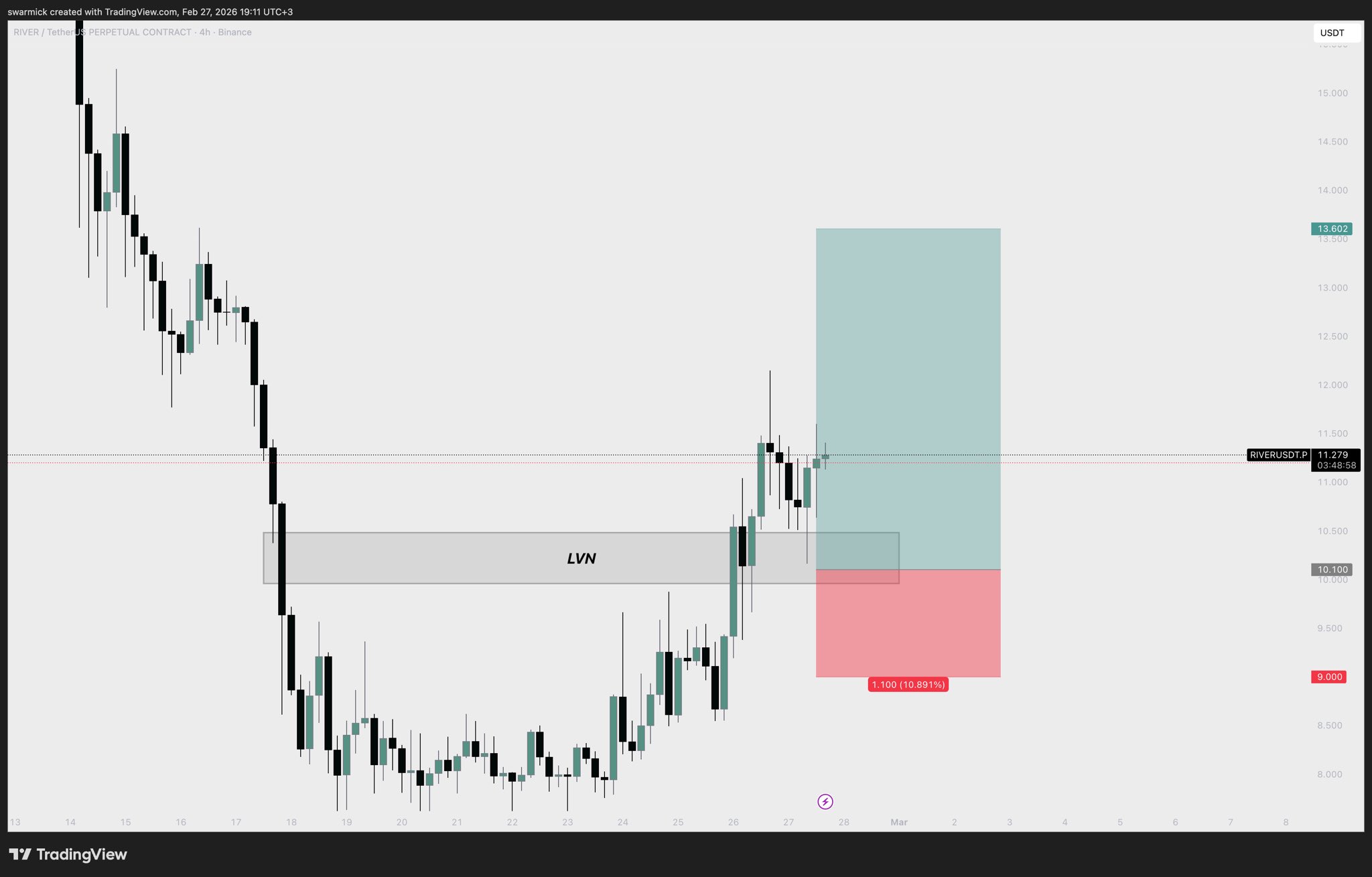

swarmik Trader TA_Analyst B3.34K @swarmister

swarmik Trader TA_Analyst B3.34K @swarmister

swarmik Trader TA_Analyst B3.34K @swarmister

swarmik Trader TA_Analyst B3.34K @swarmister 11 1 905 Original >Trend of RIVER after releaseBearish

11 1 905 Original >Trend of RIVER after releaseBearish- Trend of RIVER after releaseExtremely Bullish

- Trend of RIVER after releaseNeutral

AlexHUP ❤️ 🇻🇳 OnChain_Analyst DeFi_Expert B2.18K @Alex394959

AlexHUP ❤️ 🇻🇳 OnChain_Analyst DeFi_Expert B2.18K @Alex394959 Xora_pussy Ⓜ️Ⓜ️T | 🌊RIVER D2.21K @SangPham200598

Xora_pussy Ⓜ️Ⓜ️T | 🌊RIVER D2.21K @SangPham200598 16 0 122 Original >Trend of RIVER after releaseExtremely Bullish

16 0 122 Original >Trend of RIVER after releaseExtremely Bullish Crazy G TA_Analyst Trader B2.16K @CrazyGlazier

Crazy G TA_Analyst Trader B2.16K @CrazyGlazier

b̾i̾t̾s̾o̾f̾w̾e̾a̾l̾t̾h̾ D10.28K @bitsofwealth3 1 902 Original >Trend of RIVER after releaseBullish

b̾i̾t̾s̾o̾f̾w̾e̾a̾l̾t̾h̾ D10.28K @bitsofwealth3 1 902 Original >Trend of RIVER after releaseBullish- Trend of RIVER after releaseBullish

- Trend of RIVER after releaseExtremely Bullish

- Trend of RIVER after releaseBullish

- Trend of RIVER after releaseExtremely Bullish