Polygon Ecosystem Token (POL)

Polygon Ecosystem Token (POL)

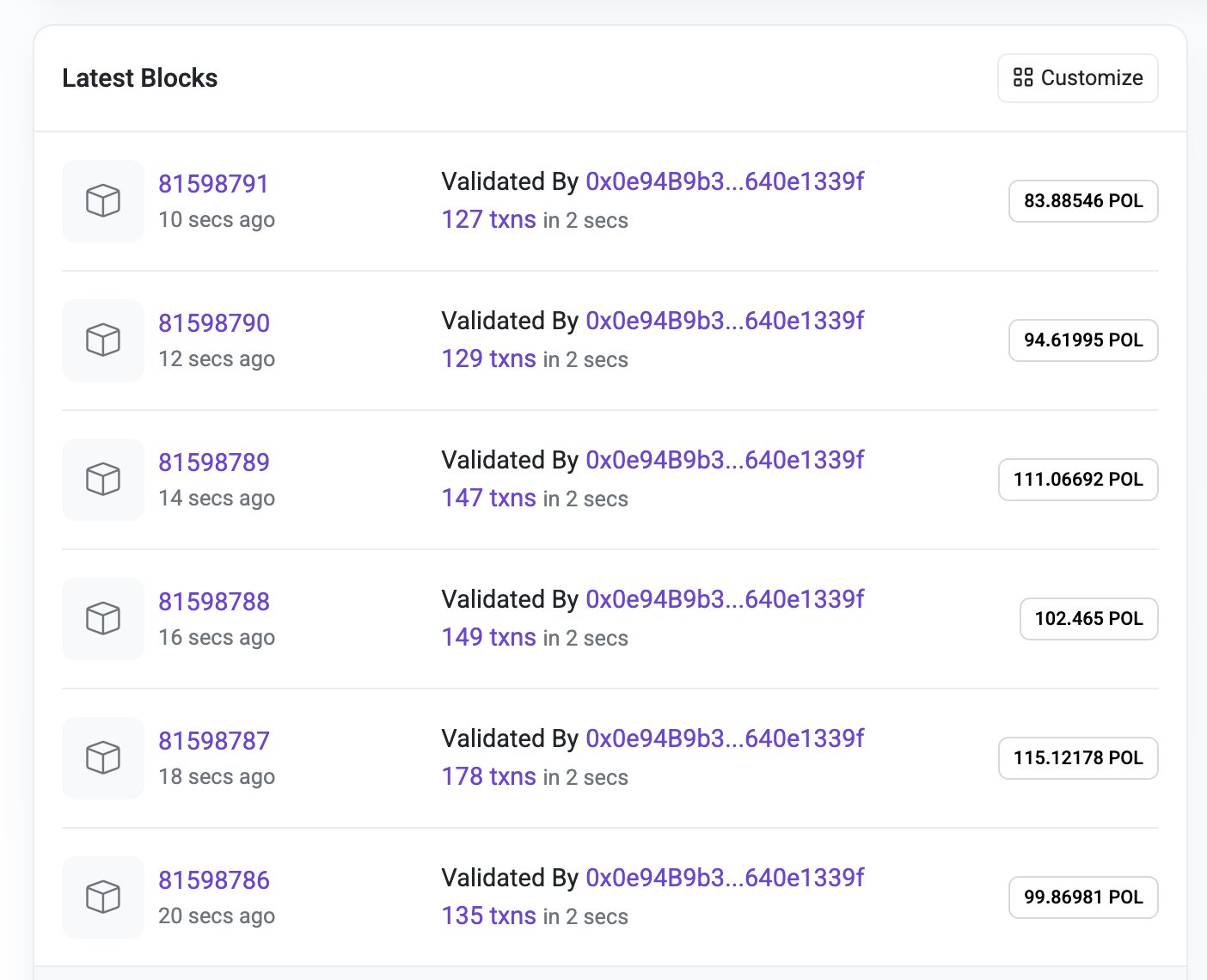

$0.14857 -2.15% 24H

- 37Social Sentiment Index (SSI)+2.22% (24h)

- #138Market Pulse Ranking (MPR)+24

- 424h Social Mention-33.33% (24h)

- 100%24h KOL Bullish Ratio4 Active KOL

- Summary

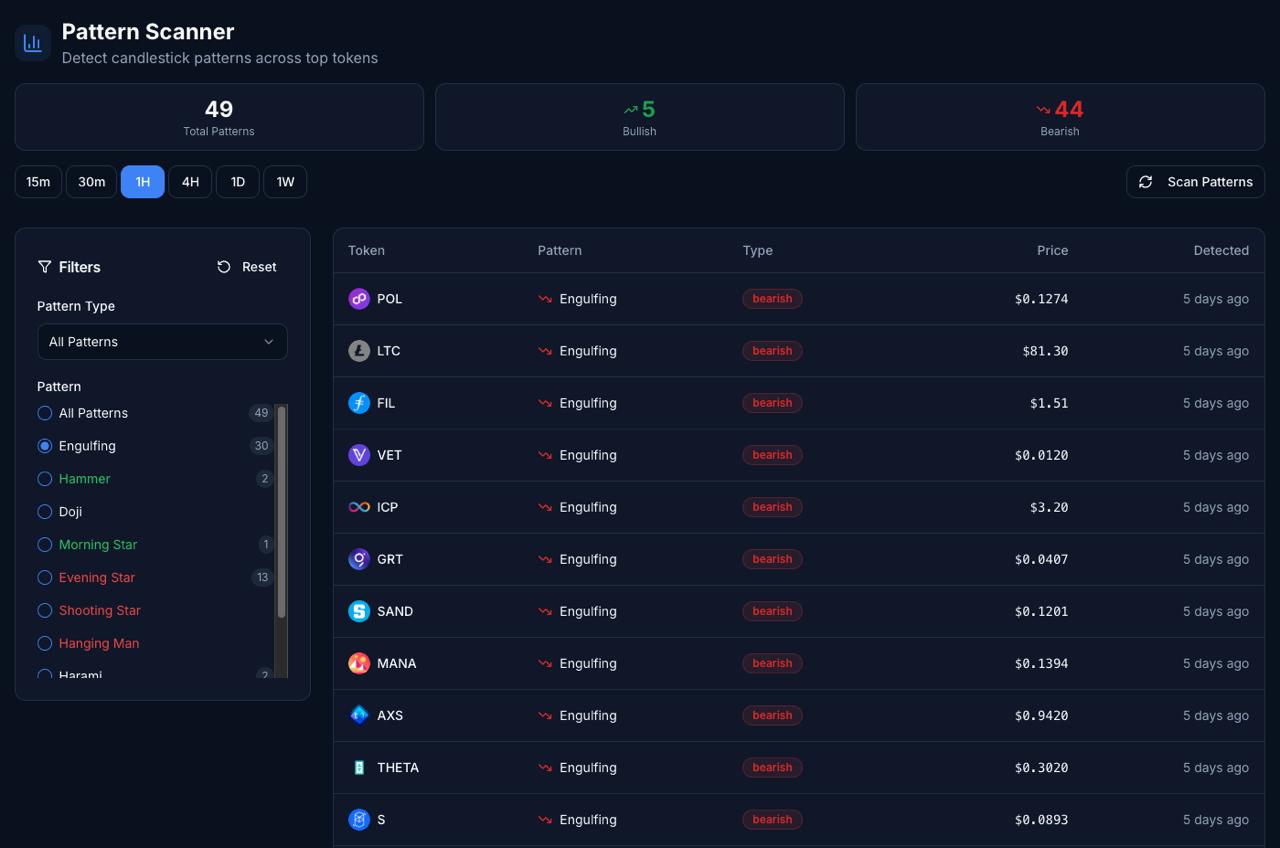

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall37SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (75%)Bullish (25%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of POL after releaseExtremely Bullish

kyle yuk 🇰🇷 ∞ KIN Researcher FA_Analyst B2.63K @kyle_yuk

kyle yuk 🇰🇷 ∞ KIN Researcher FA_Analyst B2.63K @kyle_yuk kyle yuk 🇰🇷 ∞ KIN Researcher FA_Analyst B2.63K @kyle_yuk

kyle yuk 🇰🇷 ∞ KIN Researcher FA_Analyst B2.63K @kyle_yuk 9 6 233 Original >Trend of POL after releaseExtremely Bullish

9 6 233 Original >Trend of POL after releaseExtremely Bullish DeFi Oracle 🔮 FA_Analyst OnChain_Analyst B20.41K @DeFiOracle_

DeFi Oracle 🔮 FA_Analyst OnChain_Analyst B20.41K @DeFiOracle_ Polygon | POL D2.09M @0xPolygon30 24 8.69K Original >Trend of POL after releaseBullish

Polygon | POL D2.09M @0xPolygon30 24 8.69K Original >Trend of POL after releaseBullish BAEK_PRO🌊 Community_Lead Educator B4.24K @baek_project

BAEK_PRO🌊 Community_Lead Educator B4.24K @baek_project BAEK_PRO🌊 Community_Lead Educator B4.24K @baek_project

BAEK_PRO🌊 Community_Lead Educator B4.24K @baek_project

19 13 349 Original >Trend of POL after releaseExtremely Bullish

19 13 349 Original >Trend of POL after releaseExtremely Bullish- Trend of POL after releaseBearish

- Trend of POL after releaseBullish

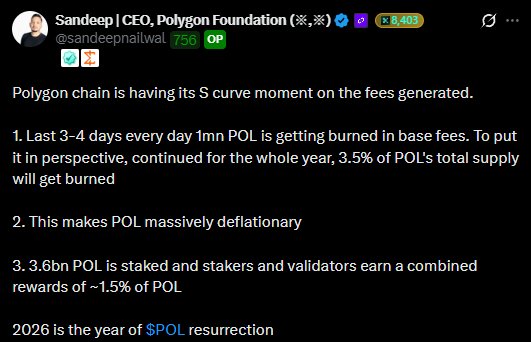

Sandeep | CEO, Polygon Foundation (※,※) Founder Tokenomics_Expert C348.82K @sandeepnailwal

Sandeep | CEO, Polygon Foundation (※,※) Founder Tokenomics_Expert C348.82K @sandeepnailwal Vadim D1.89K @crypto_vadim

Vadim D1.89K @crypto_vadim

83 23 4.83K Original >Trend of POL after releaseExtremely Bullish

83 23 4.83K Original >Trend of POL after releaseExtremely Bullish Neel Kukreti TA_Analyst Trader S4.36K @NeelKukreti

Neel Kukreti TA_Analyst Trader S4.36K @NeelKukreti

Neel Kukreti TA_Analyst Trader S4.36K @NeelKukreti

Neel Kukreti TA_Analyst Trader S4.36K @NeelKukreti 14 1 674 Original >Trend of POL after releaseExtremely Bearish

14 1 674 Original >Trend of POL after releaseExtremely Bearish- Trend of POL after releaseBullish

- Trend of POL after releaseExtremely Bullish