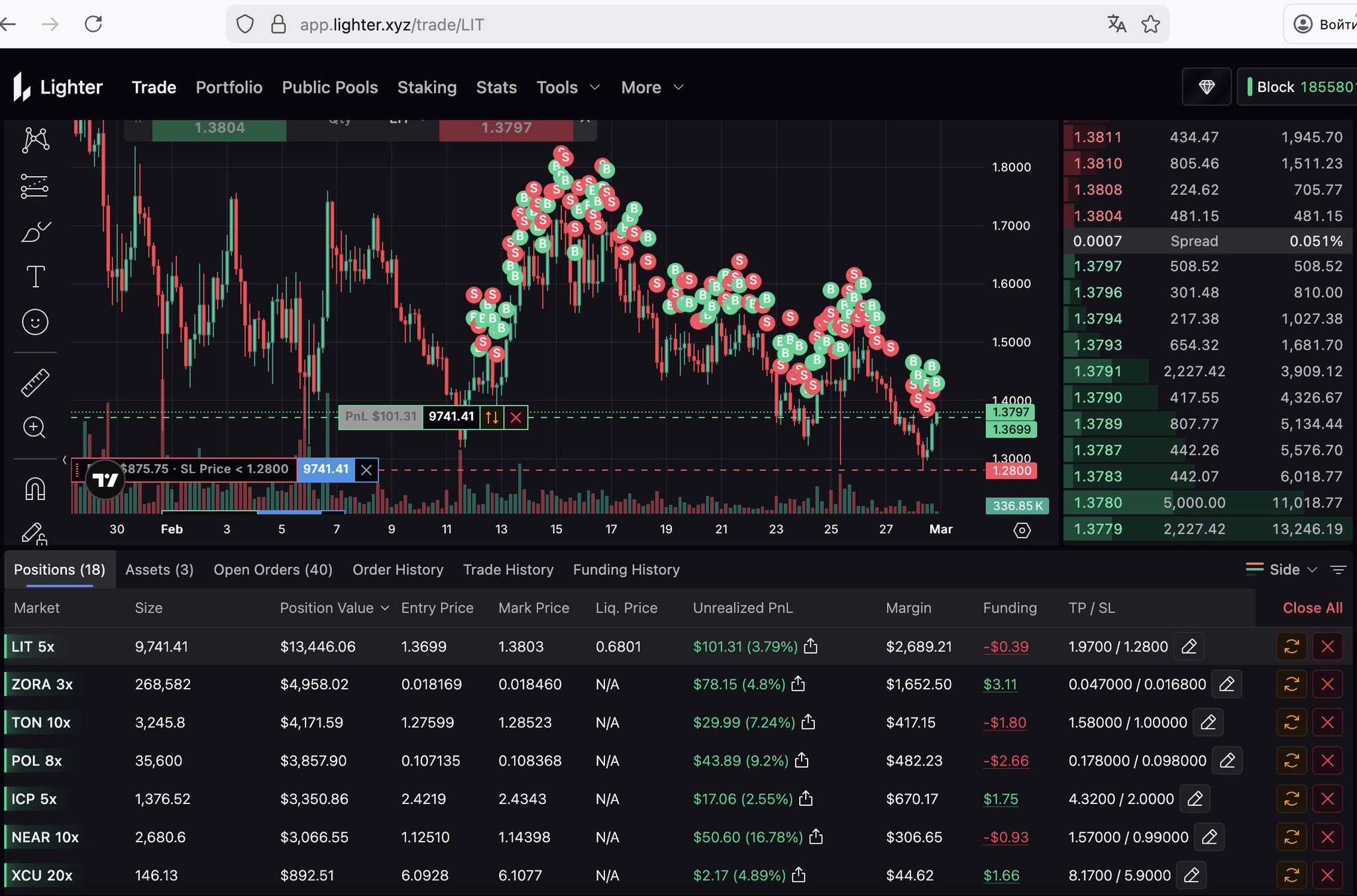

Lighter (LIT)

Lighter (LIT)

$1.381 -1.71% 24H

- 33Social Sentiment Index (SSI)-41.96% (24h)

- #55Market Pulse Ranking (MPR)-9

- 124h Social Mention-50.00% (24h)

- 0%24h KOL Bullish Ratio1 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall33SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBearish (100%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of LIT after releaseBearish

Rencrypta.eth FA_Analyst OnChain_Analyst D12.82K @Rencrypta

Rencrypta.eth FA_Analyst OnChain_Analyst D12.82K @Rencrypta

ajey.lit (Perp Dex arc) D4.24K @ajey_eth

ajey.lit (Perp Dex arc) D4.24K @ajey_eth 17 1 478 Original >Trend of LIT after releaseBearish

17 1 478 Original >Trend of LIT after releaseBearish- Trend of LIT after releaseBullish

Piv○t TA_Analyst Trader A4.94K @Pivot922

Piv○t TA_Analyst Trader A4.94K @Pivot922 Professor Satoshi.🕯️ Trader Derivatives_Expert A11.47K @satoshiheist

Professor Satoshi.🕯️ Trader Derivatives_Expert A11.47K @satoshiheist 5 1 952 Original >Trend of LIT after releaseNeutral

5 1 952 Original >Trend of LIT after releaseNeutral ivish Trader OnChain_Analyst B3.44K @beingivish

ivish Trader OnChain_Analyst B3.44K @beingivish Lighter D117.77K @Lighter_xyz247 18 18.88K Original >Trend of LIT after releaseBullish

Lighter D117.77K @Lighter_xyz247 18 18.88K Original >Trend of LIT after releaseBullish- Trend of LIT after releaseBullish

- Trend of LIT after releaseBullish

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

Luke Cannon D12.57K @lukecannon727

Luke Cannon D12.57K @lukecannon727 2 1 557 Original >Trend of LIT after releaseBullish

2 1 557 Original >Trend of LIT after releaseBullish- Trend of LIT after releaseBearish

ivish Trader OnChain_Analyst B3.44K @beingivish

ivish Trader OnChain_Analyst B3.44K @beingivish ajey.lit (Perp Dex arc) D4.24K @ajey_eth

ajey.lit (Perp Dex arc) D4.24K @ajey_eth 56 3 2.13K Original >Trend of LIT after releaseExtremely Bullish

56 3 2.13K Original >Trend of LIT after releaseExtremely Bullish