IO.NET (IO)

IO.NET (IO)

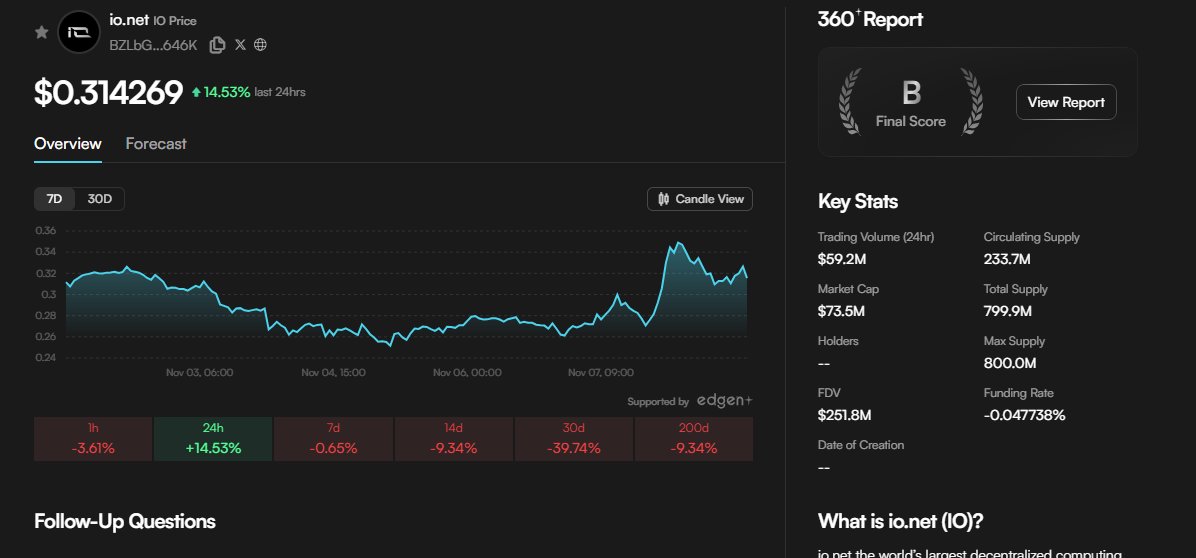

$0.1966 -12.31% 24H

- 69Social Sentiment Index (SSI)- (24h)

- #29Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall69SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of IO after releaseBullish

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124 CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124 0 0 231 Original >Trend of IO after releaseBullish

0 0 231 Original >Trend of IO after releaseBullish onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain 2 0 1.56K Original >Trend of IO after releaseBearish

2 0 1.56K Original >Trend of IO after releaseBearish- Trend of IO after releaseBearish

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124 3 0 454 Original >Trend of IO after releaseExtremely Bullish

3 0 454 Original >Trend of IO after releaseExtremely Bullish- Trend of IO after releaseExtremely Bearish

Pelin Ay OnChain_Analyst TA_Analyst C22.74K @PelinayPA

Pelin Ay OnChain_Analyst TA_Analyst C22.74K @PelinayPA

bayram D1.47K @harikaben17 0 959 Original >Trend of IO after releaseBullish

bayram D1.47K @harikaben17 0 959 Original >Trend of IO after releaseBullish- Trend of IO after releaseExtremely Bullish

- Trend of IO after releaseExtremely Bullish

- Trend of IO after releaseBearish