Injective Protocol (INJ)

Injective Protocol (INJ)

$3.005 -1.86% 24H

- 31Social Sentiment Index (SSI)-40.87% (24h)

- #90Market Pulse Ranking (MPR)-34

- 124h Social Mention-87.50% (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall31SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of INJ after releaseBullish

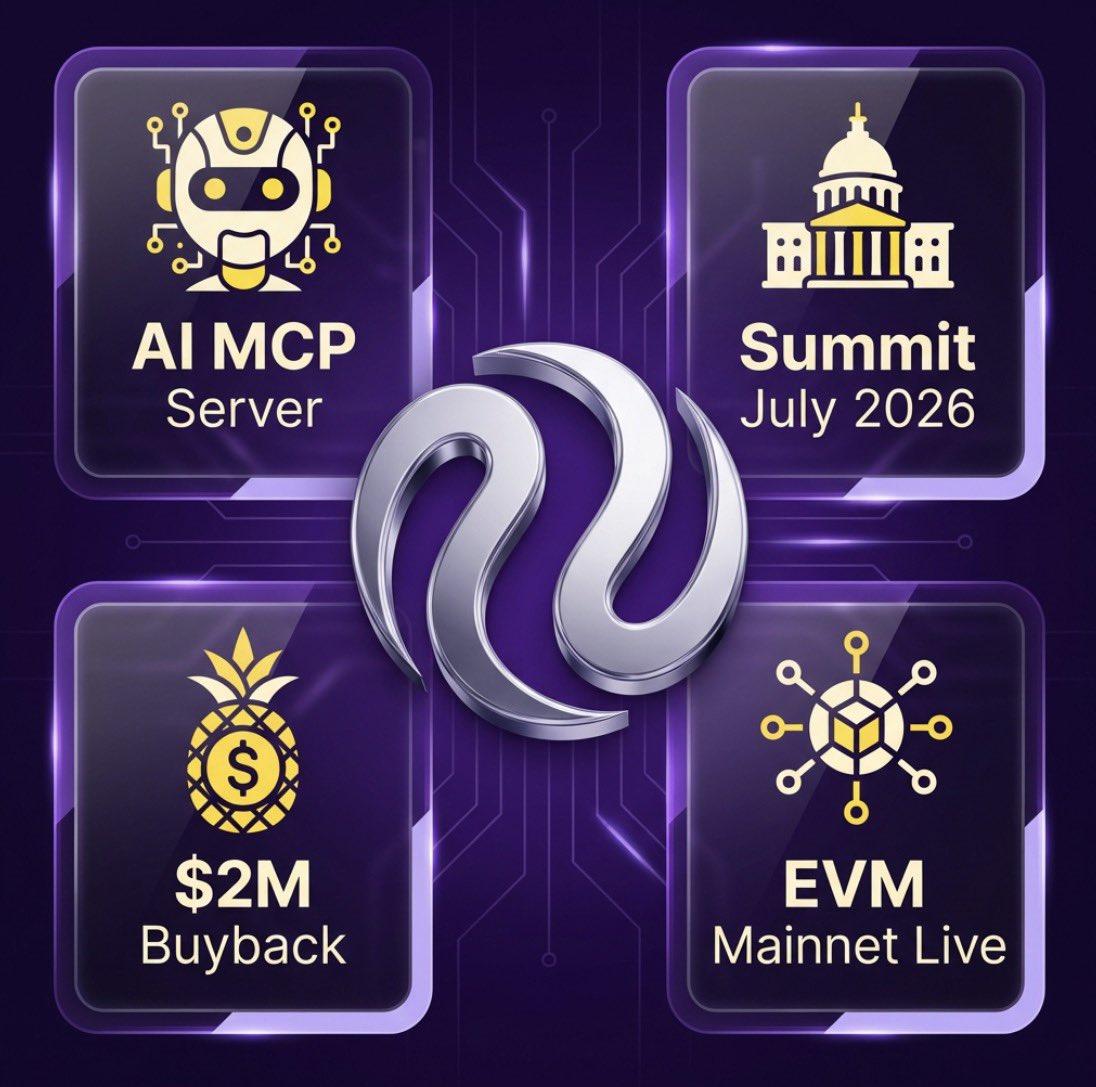

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

24 11 1.23K Original >Trend of INJ after releaseExtremely Bullish

24 11 1.23K Original >Trend of INJ after releaseExtremely Bullish- Trend of INJ after releaseExtremely Bullish

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay 32 3 1.87K Original >Trend of INJ after releaseExtremely Bullish

32 3 1.87K Original >Trend of INJ after releaseExtremely Bullish IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay 32 3 1.87K Original >Trend of INJ after releaseExtremely Bullish

32 3 1.87K Original >Trend of INJ after releaseExtremely Bullish IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay 32 3 1.87K Original >Trend of INJ after releaseExtremely Bullish

32 3 1.87K Original >Trend of INJ after releaseExtremely Bullish- Trend of INJ after releaseExtremely Bullish

- Trend of INJ after releaseBullish

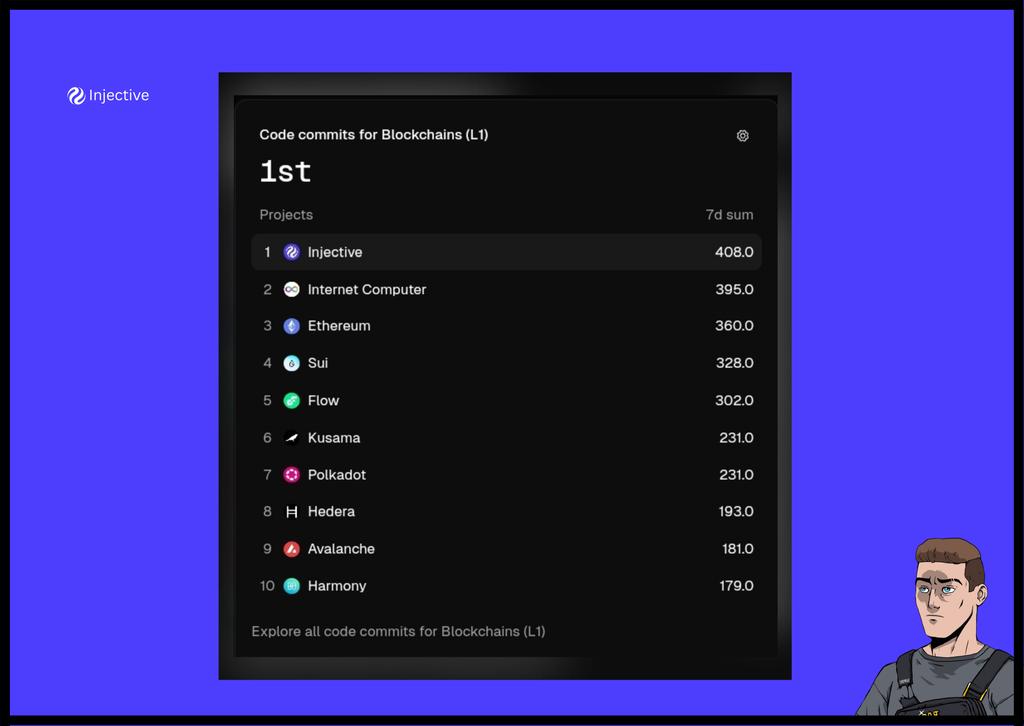

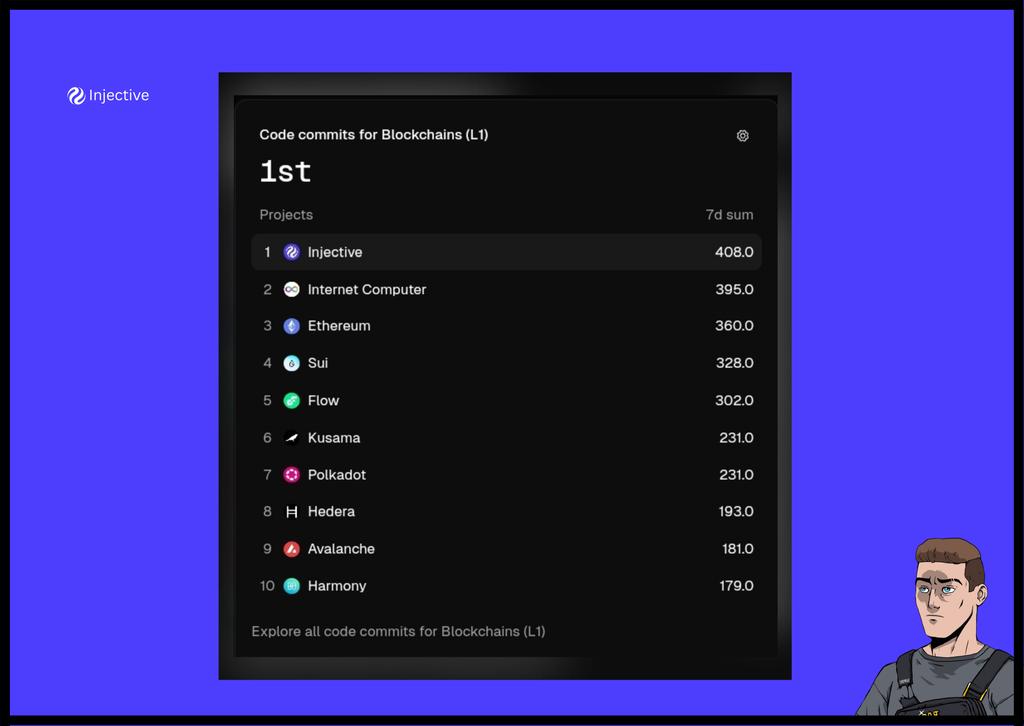

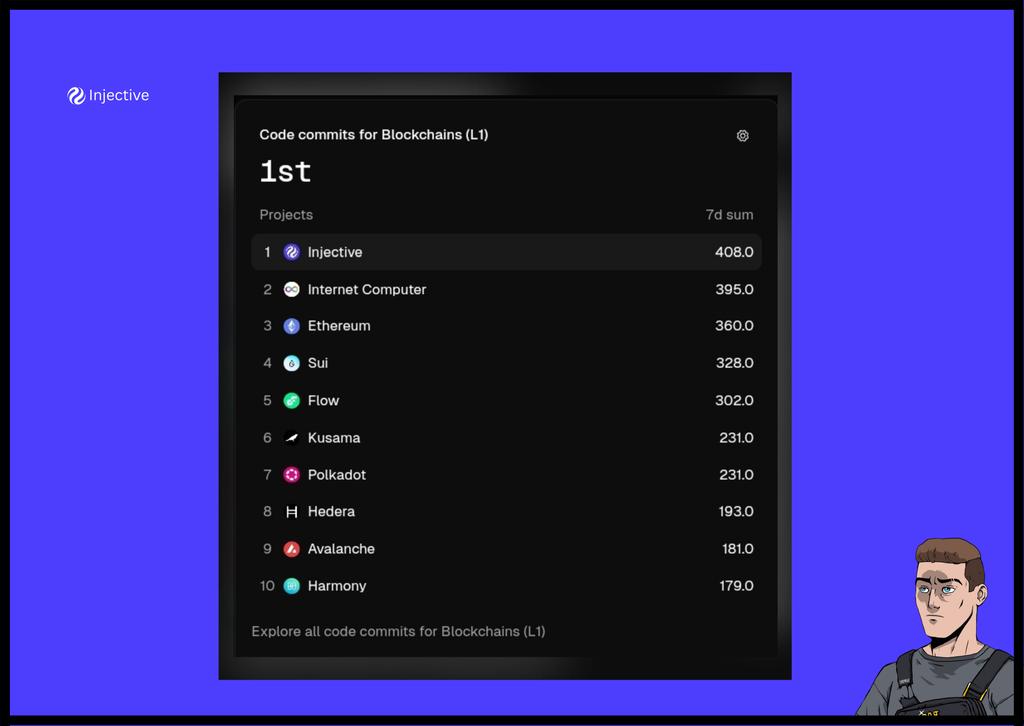

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub66 6 3.62K Original >Trend of INJ after releaseBullish

INJ Hub 🥷 Tokenomics_Expert Media C24.32K @Injective_Hub66 6 3.62K Original >Trend of INJ after releaseBullish Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey 33 4 526 Original >Trend of INJ after releaseExtremely Bullish

33 4 526 Original >Trend of INJ after releaseExtremely Bullish