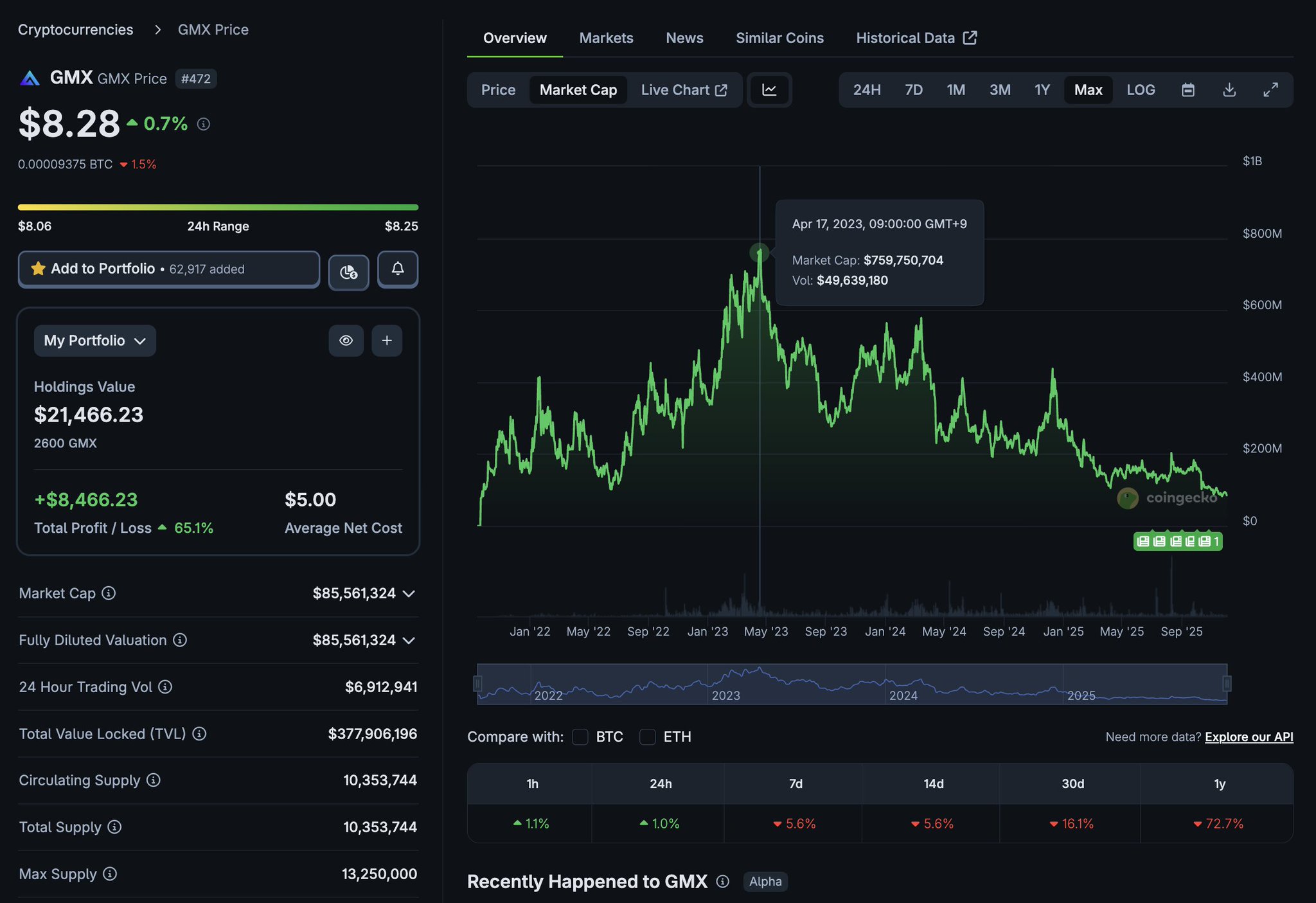

%20(1)-20221011143940.png) GMX (GMX)

GMX (GMX)

$7.9115 -1.24% 24H

- 68Social Sentiment Index (SSI)- (24h)

- #37Market Pulse Ranking (MPR)0

- 224h Social Mention- (24h)

- 100%24h KOL Bullish Ratio2 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall68SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of GMX after releaseBullish

- Trend of GMX after releaseBullish

𝕯𝖆𝖓𝖌𝖊𝖗 Media DeFi_Expert D51.74K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Media DeFi_Expert D51.74K @safetyth1rd Today in DeFi D17.25K @todayindefi

Today in DeFi D17.25K @todayindefi 5 1 679 Original >Trend of GMX after releaseNeutral

5 1 679 Original >Trend of GMX after releaseNeutral- Trend of GMX after releaseNeutral

- Trend of GMX after releaseBullish

- Trend of GMX after releaseBullish

- Trend of GMX after releaseBullish

3lixbt (🗣️,🤝) Trader Educator B16.70K @3liXBT

3lixbt (🗣️,🤝) Trader Educator B16.70K @3liXBT 3lixbt (🗣️,🤝) Trader Educator B16.70K @3liXBT

3lixbt (🗣️,🤝) Trader Educator B16.70K @3liXBT 148 39 13.67K Original >Trend of GMX after releaseNeutral

148 39 13.67K Original >Trend of GMX after releaseNeutral 𝕋𝕖𝕖 OnChain_Analyst DeFi_Expert B2.76K @Tee9ee

𝕋𝕖𝕖 OnChain_Analyst DeFi_Expert B2.76K @Tee9ee bold (q4 mode) D9.08K @0xBold56 5 10.10K Original >Trend of GMX after releaseBearish

bold (q4 mode) D9.08K @0xBold56 5 10.10K Original >Trend of GMX after releaseBearish 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.50K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.50K @Only1temmy hansolar.🕯️ D29.55K @hansolar21

hansolar.🕯️ D29.55K @hansolar21

28 6 5.48K Original >Trend of GMX after releaseBearish

28 6 5.48K Original >Trend of GMX after releaseBearish