Euler (EUL)

Euler (EUL)

$4.074 -3.85% 24H

- -Social Sentiment Index (SSI)- (24h)

- -Market Pulse Ranking (MPR)0

- -24h Social Mention- (24h)

- -24h KOL Bullish Ratio0 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall-SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionSSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto

Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto168 148 1.68K Original >Trend of EUL after releaseBullish

Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto168 148 1.68K Original >Trend of EUL after releaseBullish Conny DeFi_Expert Influencer B10.59K @ConnyConny253

Conny DeFi_Expert Influencer B10.59K @ConnyConny253 Cheeezzyyyy D9.09K @0xCheeezzyyyy

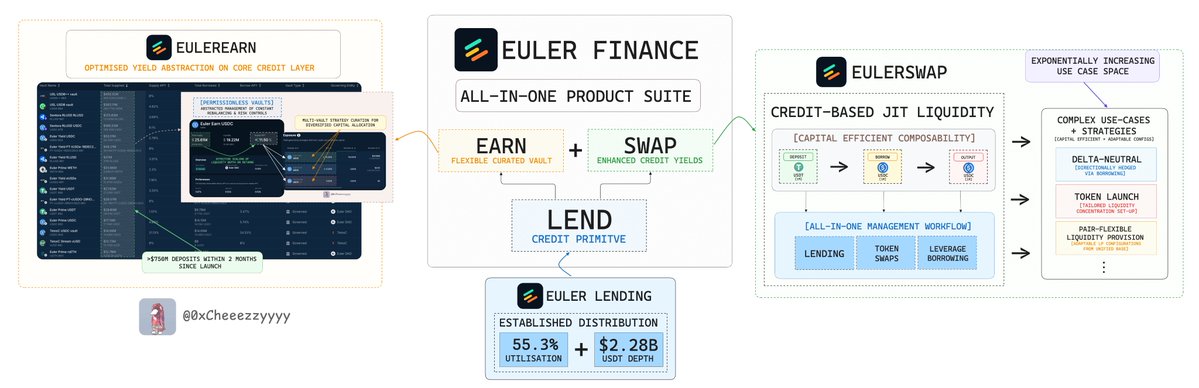

Cheeezzyyyy D9.09K @0xCheeezzyyyy 69 34 2.62K Original >Trend of EUL after releaseExtremely Bullish

69 34 2.62K Original >Trend of EUL after releaseExtremely Bullish- Trend of EUL after releaseExtremely Bullish

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto 31 13 4.37K Original >Trend of EUL after releaseExtremely Bearish

31 13 4.37K Original >Trend of EUL after releaseExtremely Bearish- Trend of EUL after releaseExtremely Bearish

- Trend of EUL after releaseBullish

- Trend of EUL after releaseNeutral

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap Michael Bentley D15.72K @euler_mab207 65 29.67K Original >Trend of EUL after releaseBearish

Michael Bentley D15.72K @euler_mab207 65 29.67K Original >Trend of EUL after releaseBearish Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap Euler Labs D72.77K @eulerfinance111 34 29.33K Original >Trend of EUL after releaseBullish

Euler Labs D72.77K @eulerfinance111 34 29.33K Original >Trend of EUL after releaseBullish- Trend of EUL after releaseBullish

- No Data