#Roadmap 🇬🇧

#dYdX ( $DYDX ) — Complete Roadmap 🧵

From an Ethereum-based margin trading experiment to a fully sovereign, community-governed DeFi powerhouse, #dYdX has evolved remarkably fast.

Here’s the complete journey: Past → Present → Future

#CryptoRoadmap

📜 Past: Development & Launch

dYdX started as a vision by Antonio Juliano, a former Coinbase engineer, aiming to bring advanced trading features like margin trading and perpetual contracts to decentralized environments on Ethereum.

Key Milestones:

🔹 Early Protocols

Initial smart contracts enabled lending, borrowing, and leveraged positions, tackling early DeFi challenges such as scalability and gas fees.

🔹 V1 Margin Protocol

Introduced flash loans and DEX aggregators for efficient capital use; followed by user-friendly leveraged token apps.

🔹 Solo Margin Trading

Launch of a robust margin protocol inspired by pooled lending models, enabling sophisticated order books and full exchange capabilities.

🔹 Perpetual Contracts Expansion

Bitcoin markets launched first, quickly adding Ethereum and other assets, establishing dYdX as a leader in decentralized derivatives.

🔹 Layer 2 Migration

Move to StarkWare’s Layer 2 solution enabled faster, cheaper executions via cross-margin perpetuals while preserving security.

🔹 dYdX Foundation & Token Launch

Formation of the non-profit foundation and launch of the DYDX token for community governance, solidifying the transition from Ethereum mainnet dependency to scalable, user-centric DeFi infrastructure.

🔹 Sovereign Blockchain

Transition to the independent dYdX Chain (v4) via Cosmos SDK, enabling native token migration, app-specific optimizations, and full decentralization beyond Layer 2 constraints.

Impact:

A shift from Ethereum-based DeFi protocols to a fully community-owned, high-performance trading ecosystem with enduring infrastructure.

#dYdXHistory

⚡ Present: Current Status & Developments

dYdX today operates on its sovereign chain, offering high-performance perpetual trading with deep liquidity, advanced order types, and low-latency API integrations for professional and algorithmic traders.

Ecosystem Expansion:

Community-driven market launches, live rewards programs, and specialized tools like MegaVault empower permissionless, self-custodial trading environments compatible with popular wallets.

Technical Progress:

Significant API reliability enhancements, order gateway optimizations, and network software updates ensure seamless, low-latency trading while improving decentralization through designated proposers.

Governance & Incentives:

The DYDX token enables onchain proposals for protocol updates, market listings, and feature launches. Initiatives like affiliate upgrades and revenue share programs reinforce community participation.

Ecosystem Challenges:

Maintaining liquidity, incentivizing long-term engagement, and balancing decentralization with institutional usability remain ongoing priorities, with a strong developer and community base driving resilience.

#dYdXNow #DeFiGrowth

🚀 Future: Planned Roadmap (2025–2030+)

dYdX’s future emphasizes expanding beyond perpetual contracts toward “Trade Anything,” global accessibility, token utility, and ecosystem-wide integrations.

Key Roadmap Directions:

🔹 Spot Trading & Cross-Chain Bridges

Launching spot markets and enabling interoperability across chains to increase trading options and accessibility.

🔹 Mobile & Social Integration

Seamless mobile trading, Telegram bot rollout, social login features, and staking-based fee discounts to enhance user experience.

🔹 Layer 2 & Cross-Chain Optimizations

Instant deposits/withdrawals, fiat onramps, real-world asset perpetuals, and improved UX for broader adoption.

🔹 Governance & Tokenomics Refinement

Buyback mechanisms, staking rewards, and sustainable revenue allocation to strengthen network security and long-term stability.

🔹 Ecosystem Expansion

Developer grants, permissionless market listings, and decentralized hosting infrastructure (DePIN) to support uninterrupted protocol operation.

🔹 Advanced Trading Tools

AI-driven analytics, hybrid on/off-chain matching, and real-time dashboards empower professional traders while maintaining decentralization.

Impact:

Enhanced trading accessibility, institutional-grade tools in a permissionless environment, and long-term community governance at the core of DeFi innovation.

Risks & Opportunities:

Market cycles, regulatory developments, and technological upgrades introduce challenges, but dYdX’s robust infrastructure, community governance, and evolving ecosystem position it for sustained growth.

#dYdXFuture #DecentralizedTrading

✅ Conclusion

dYdX has evolved from Ethereum-based margin trading experiments into a fully sovereign, community-governed DeFi platform.

With innovations like the dYdX Chain, advanced perpetuals, cross-chain integration, and comprehensive governance, $DYDX continues to lead as a decentralized, high-performance trading ecosystem shaping the future of DeFi.

#RoadmapConclusion

🛒 Want to trade $DYDX on #WEEX?

WEEX is a global #Exchange where you can easily start trading crypto and futures:

✅ Access to 1,700+ #Altcoins

✅ Up to $30,000 USDT in #Bonuses for new users

✅ User-friendly app & web platform

✅ Trusted exchange with millions of traders worldwide

👉 Sign up now via the link below and claim your welcome bonus!

🔗 https://t.co/q8pSdzpIh8

#CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures

⚠️ Important Note:

🔹 This post is for educational purposes only and not financial advice!

🔹 Only invest what you are willing to lose!

📚 Useful resources and additional information:

Want to dive deeper into the world of #dYdX ( $DYDX ) or looking for the latest updates and developments?

These links will help you stay up to date:

🔹Discord: https://t.co/BZa3q4gmZM

🔹GitHub: https://t.co/iQkoMM4JNy

🔹Website: https://t.co/oACanUoyzl

🔹Reddit: https://t.co/FPA6rStVNb

🔹X (Twitter): https://t.co/1bDEVcfwc8

-----------------

👇Follow us👇

-----------------

🚨 Follow @CryptoJournaal – the go-to source for independent crypto information:

📰 News | 📊 Facts | 🧠 Insights | 🎓 Education

💬 No sponsored tokens

📜 Fully MiCAR-compliant

🔍 Knowledge over hype, always

📲 Join via:

🌐 Website: https://t.co/i0eHsaqt3O

📘 Facebook: https://t.co/he5bTXLFXR

💬 Telegram: https://t.co/i976fBvtv0

👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O

🐦 X-profiel: https://t.co/fd2bI2MInh

#Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

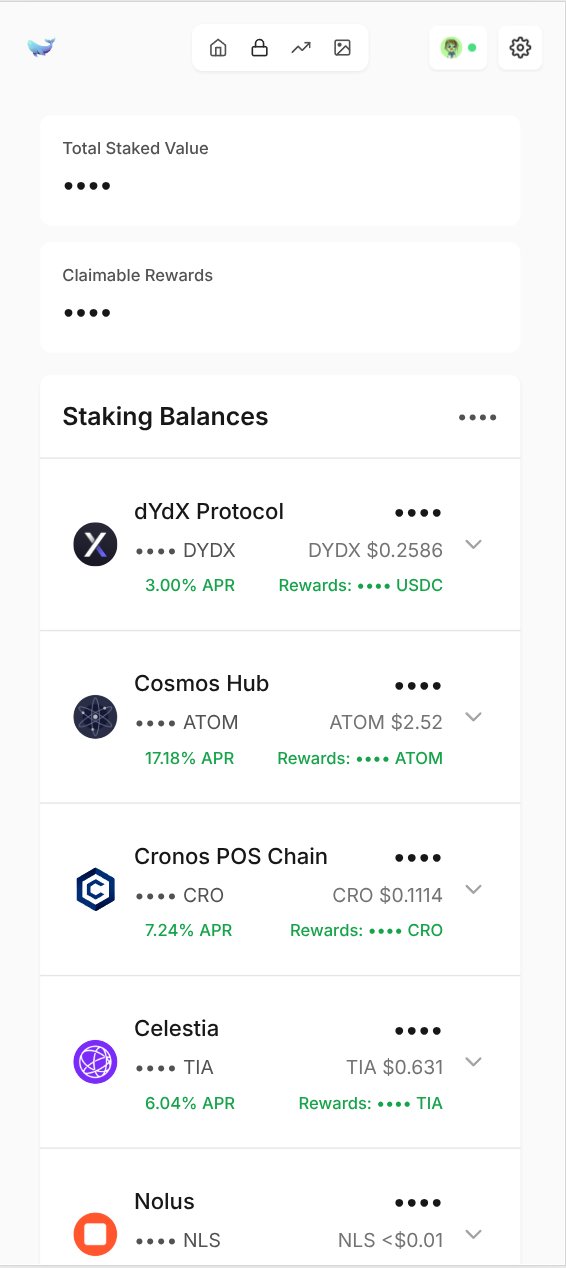

dYdX (DYDX)

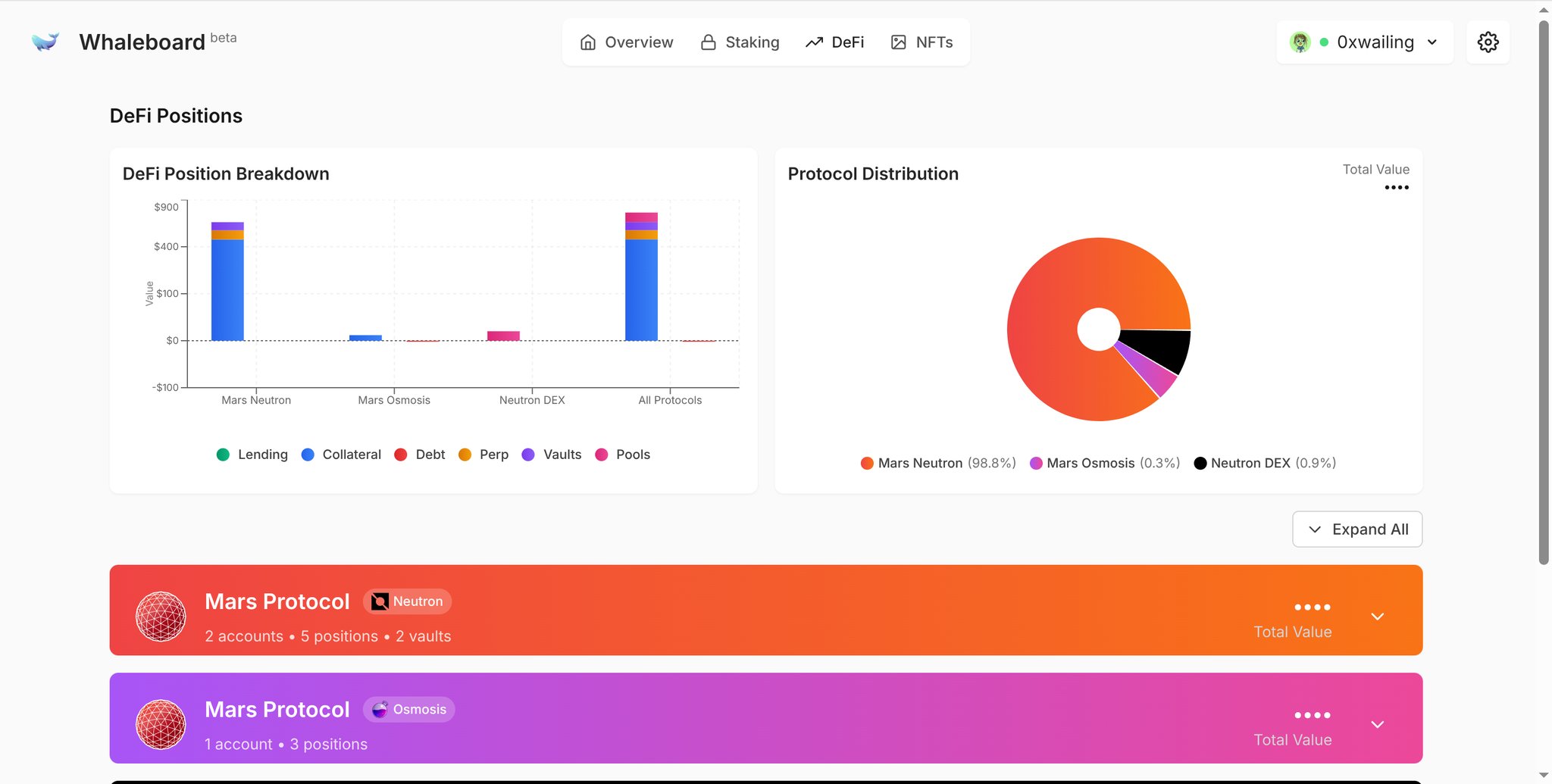

dYdX (DYDX) Sandro20212 | Mars Protocol DeFi_Expert Community_Lead B1.44K @sandro20212

Sandro20212 | Mars Protocol DeFi_Expert Community_Lead B1.44K @sandro20212 whalingdotxyz D29 @whalingdotxyz

whalingdotxyz D29 @whalingdotxyz

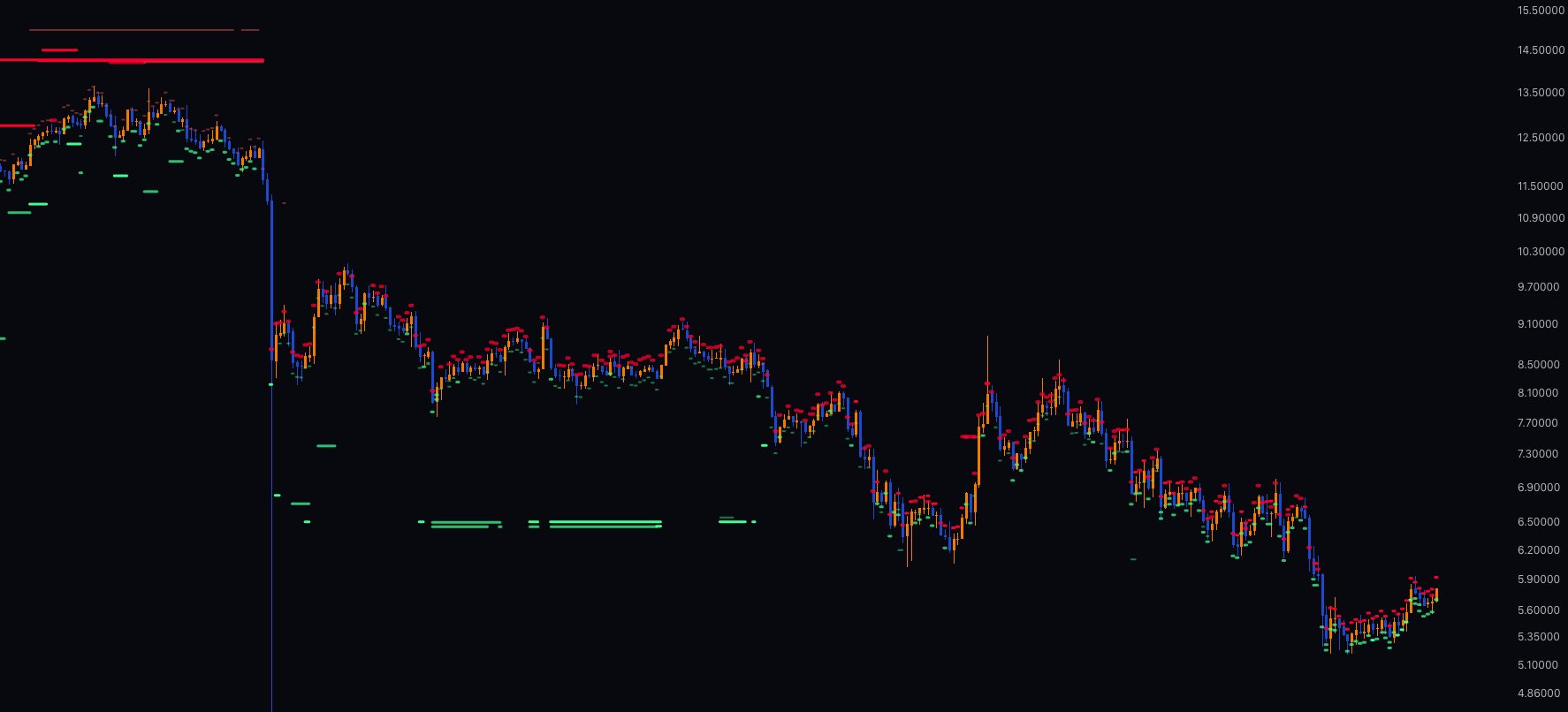

9 1 522 Original >Trend of DYDX after releaseBullish

9 1 522 Original >Trend of DYDX after releaseBullish CosmosBG Degen Fight Club⚛️🉐☯️🏴☠️🐉🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.92K @IvanM10529875

CosmosBG Degen Fight Club⚛️🉐☯️🏴☠️🐉🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.92K @IvanM10529875

0 0 238 Original >Trend of DYDX after releaseBullish

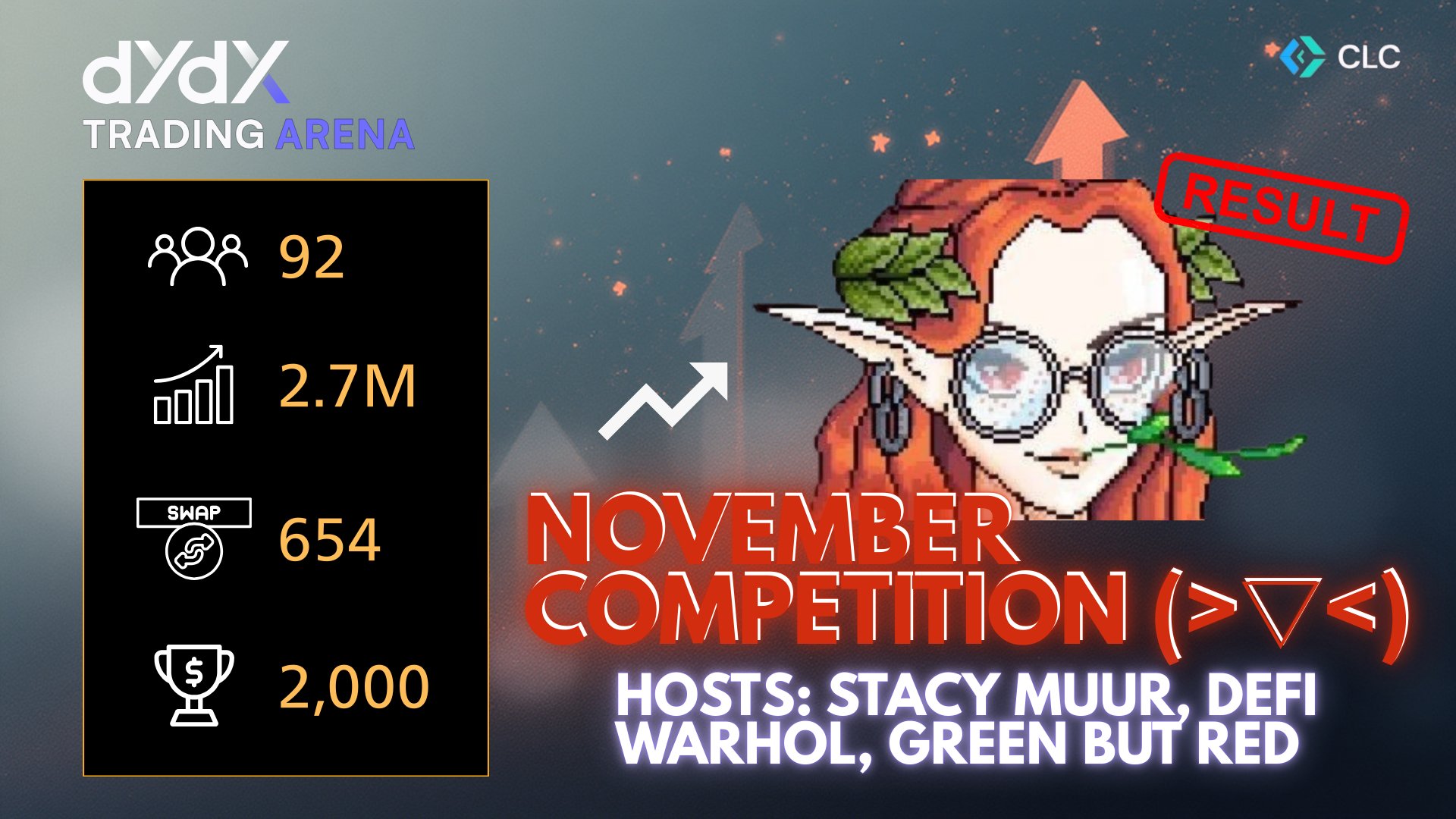

0 0 238 Original >Trend of DYDX after releaseBullish Stacy Muur Researcher DeFi_Expert C73.04K @stacy_muur

Stacy Muur Researcher DeFi_Expert C73.04K @stacy_muur dYdX Trading Arena | operated by CLC D2.62K @dydxarena

dYdX Trading Arena | operated by CLC D2.62K @dydxarena 109 14 6.32K Original >Trend of DYDX after releaseBullish

109 14 6.32K Original >Trend of DYDX after releaseBullish