Curve DAO Token (CRV)

Curve DAO Token (CRV)

$0.427 +0.95% 24H

- 78Social Sentiment Index (SSI)+21.51% (24h)

- #51Market Pulse Ranking (MPR)+18

- 724h Social Mention+75.00% (24h)

- 86%24h KOL Bullish Ratio8 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall78SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (43%)Bullish (43%)Bearish (14%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of CRV after releaseBearish

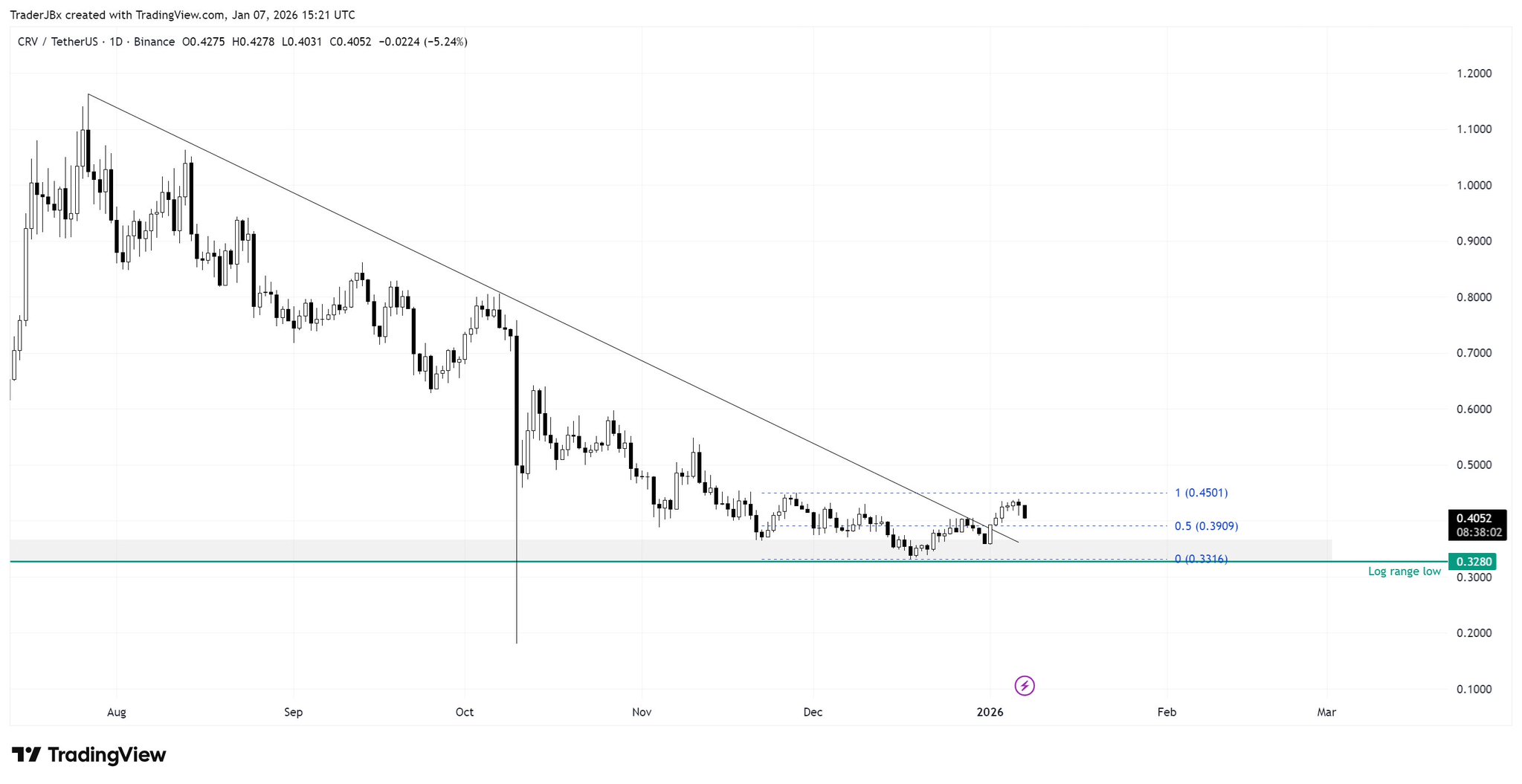

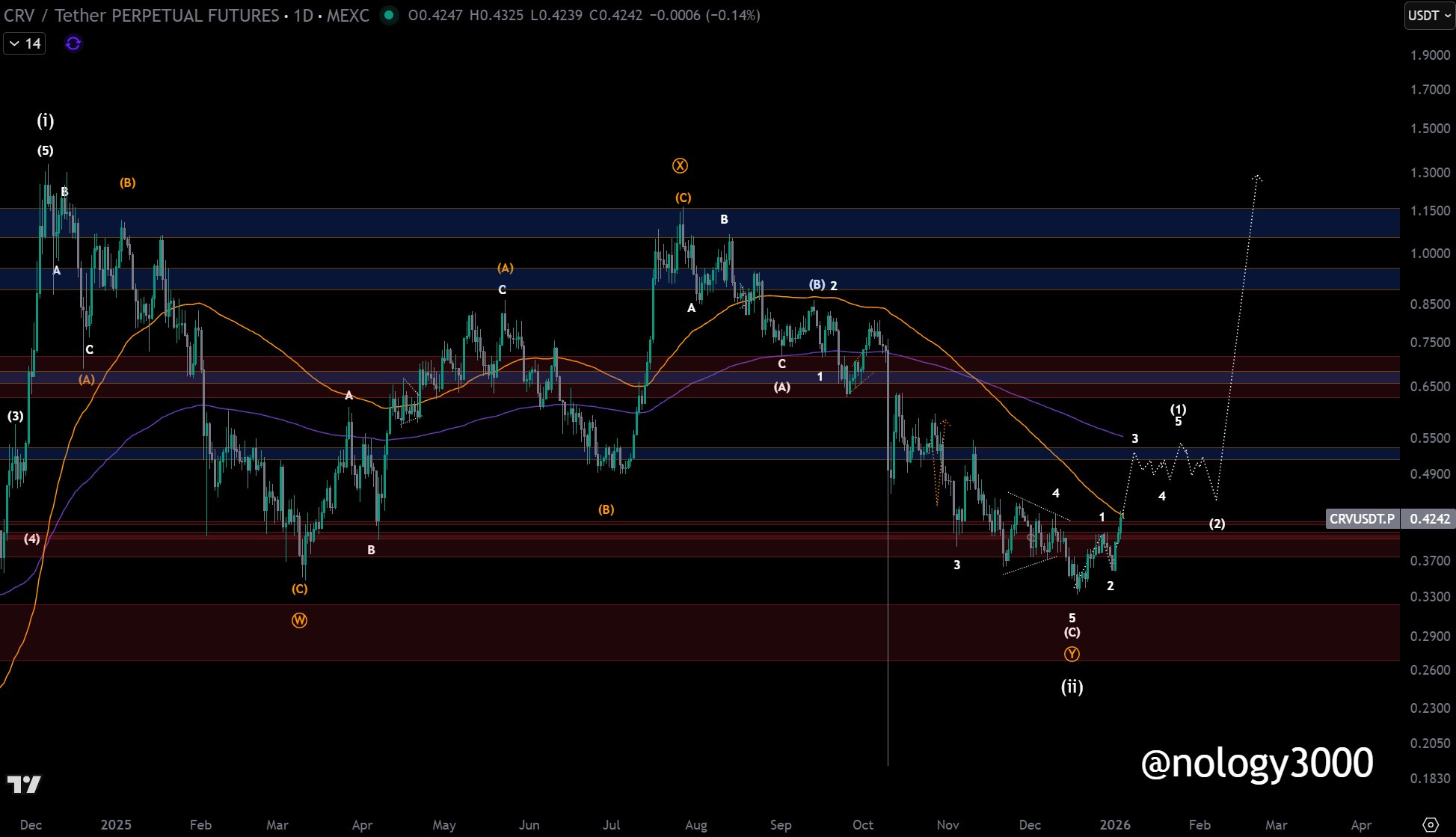

TraderJB TA_Analyst Trader A2.24K @TraderJBx

TraderJB TA_Analyst Trader A2.24K @TraderJBx

TraderJB TA_Analyst Trader A2.24K @TraderJBx

TraderJB TA_Analyst Trader A2.24K @TraderJBx 61 7 4.36K Original >Trend of CRV after releaseExtremely Bullish

61 7 4.36K Original >Trend of CRV after releaseExtremely Bullish- Trend of CRV after releaseBullish

- Trend of CRV after releaseBullish

Whitey TA_Analyst Trader A3.85K @TraderWhitey

Whitey TA_Analyst Trader A3.85K @TraderWhitey

Whitey TA_Analyst Trader A3.85K @TraderWhitey

Whitey TA_Analyst Trader A3.85K @TraderWhitey 66 7 6.63K Original >Trend of CRV after releaseExtremely Bullish

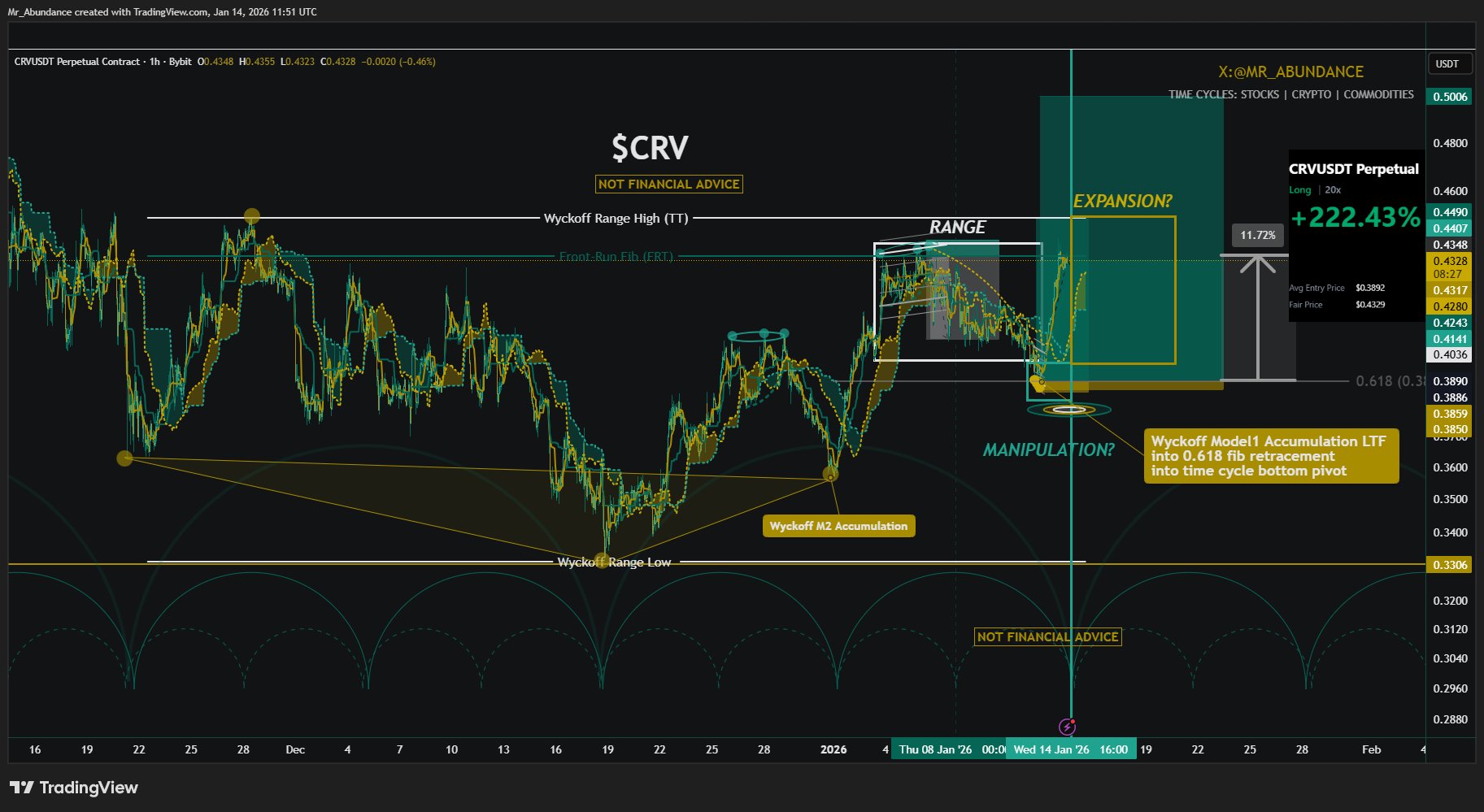

66 7 6.63K Original >Trend of CRV after releaseExtremely Bullish Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_ 59 4 5.99K Original >Trend of CRV after releaseExtremely Bullish

59 4 5.99K Original >Trend of CRV after releaseExtremely Bullish Nology TA_Analyst Influencer A8.93K @nology3000

Nology TA_Analyst Influencer A8.93K @nology3000

Nology TA_Analyst Influencer A8.93K @nology3000

Nology TA_Analyst Influencer A8.93K @nology3000 21 2 3.50K Original >Trend of CRV after releaseBullish

21 2 3.50K Original >Trend of CRV after releaseBullish- Trend of CRV after releaseBullish

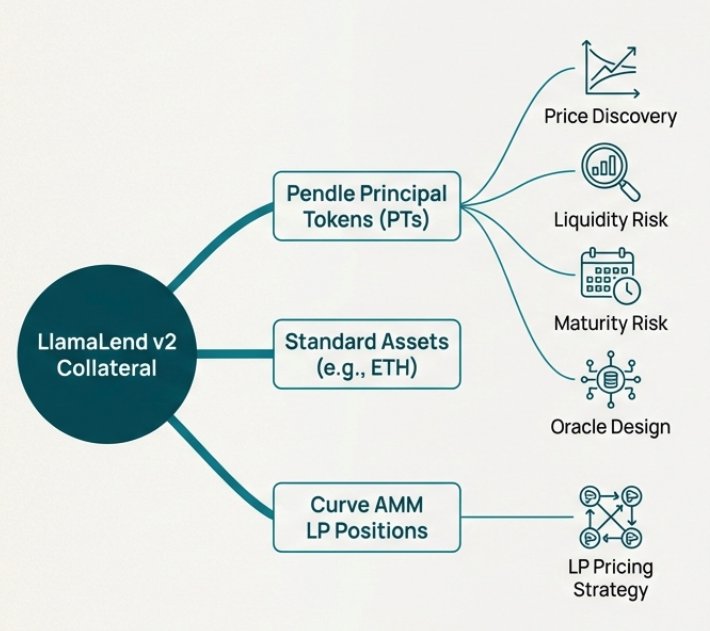

Michael Egorov Founder DeFi_Expert A42.19K @newmichwillJordi in Cryptoland D9.30K @lordjorx

Michael Egorov Founder DeFi_Expert A42.19K @newmichwillJordi in Cryptoland D9.30K @lordjorx

46 3 4.46K Original >Trend of CRV after releaseExtremely Bullish

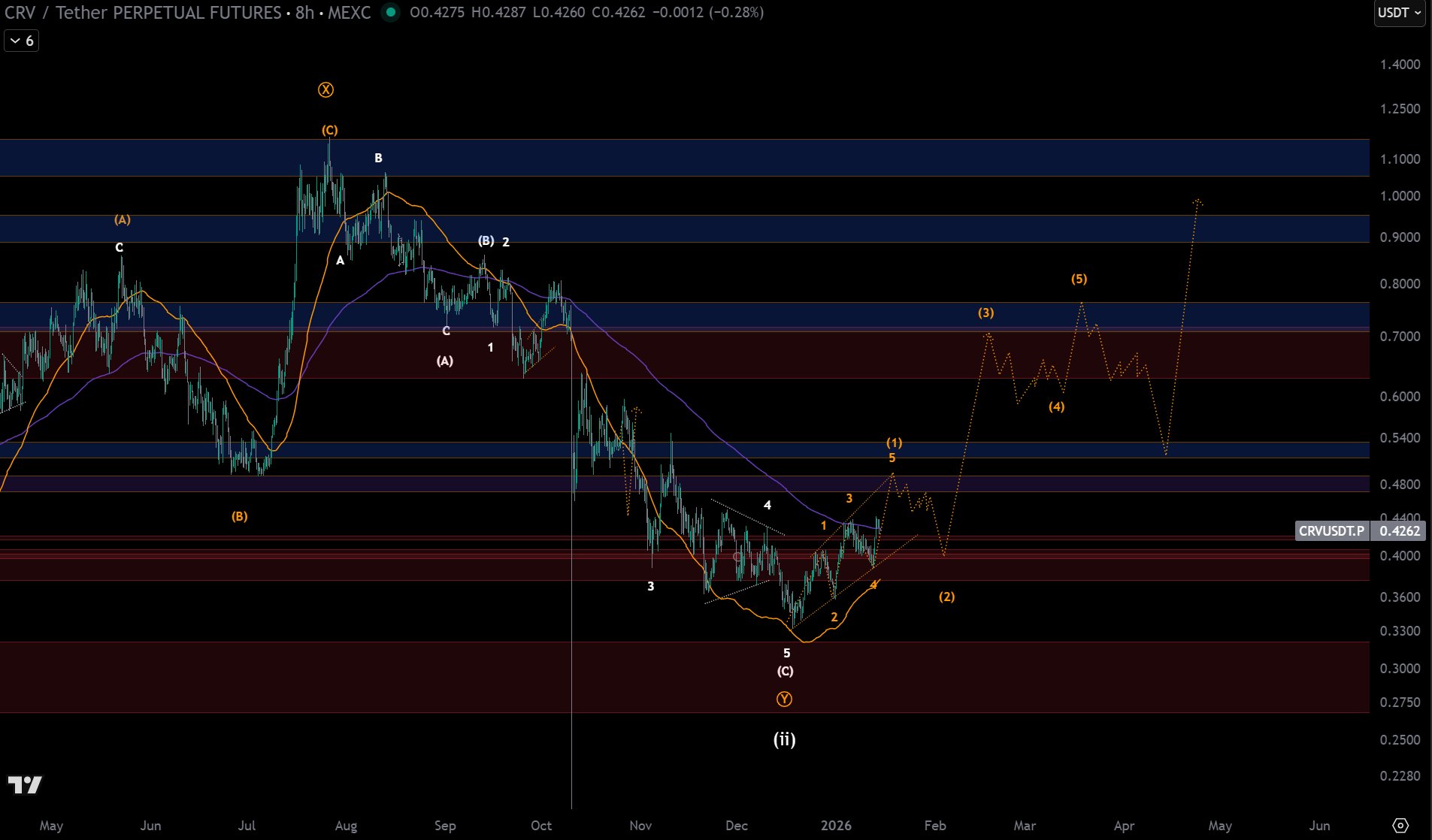

46 3 4.46K Original >Trend of CRV after releaseExtremely Bullish CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto

Kevin Howes D6 @kevhowes82530 40 75.08K Original >Trend of CRV after releaseExtremely Bullish

Kevin Howes D6 @kevhowes82530 40 75.08K Original >Trend of CRV after releaseExtremely Bullish