Cow Protocol (COW)

Cow Protocol (COW)

- 68Social Sentiment Index (SSI)- (24h)

- #40Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- SummaryDev_Mustee states that CoWSwap's automated limit orders, MEV protection, and better pricing improve the experience, but COW fell 3.65% in 24h.

- Bullish Signals

- Automatic limit orders

- Strong MEV protection

- Better pricing

- No need to manage order book

- Simplified design enhances experience

- Bearish Signals

- Price down 3.65%

- Social heat unchanged

- Interactions only 16

- Lack of order book or liquidity concerns

Social Sentiment Index (SSI)

- Data Overall68SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI InsightsCOW social heat is moderately high (68/100, unchanged), activity score full 40/40, positive sentiment 27.5/30 driving, but KOL attention only 0.5/30 limiting growth, linked to the release of limit orders and MEV protection.

Market Pulse Ranking (MPR)

- Alert InsightCOW warning rank #40, social anomaly 100/100 highest, sentiment polarization 50/100 moderate, KOL attention 0.5/100 extremely low, related to the price drop of 3.65% and unchanged heat anomaly.

X Posts

Devmustee🥑🇨🇦 Dev OnChain_Analyst B29.55K @Dev_Mustee

Devmustee🥑🇨🇦 Dev OnChain_Analyst B29.55K @Dev_MusteeEver noticed how smooth limit orders feel when the system does the thinking for you. @HeyElsaAI runs limit orders through @CoWSwap, so execution follows intent, not manual tinkering. No order books to manage. No endless parameters to adjust. Strong MEV protection and better pricing handled quietly in the background. This is what good design looks like in crypto. The complexity stays hidden. The outcome stays clean. @meme

8 8 104 Original >Trend of COW after releaseBullishCoWSwap optimizes limit orders with AI, providing MEV protection and better pricing.

8 8 104 Original >Trend of COW after releaseBullishCoWSwap optimizes limit orders with AI, providing MEV protection and better pricing. Milk Road Educator Influencer D93.04K @MilkRoad

Milk Road Educator Influencer D93.04K @MilkRoad m0xt D1.98K @m0xt_

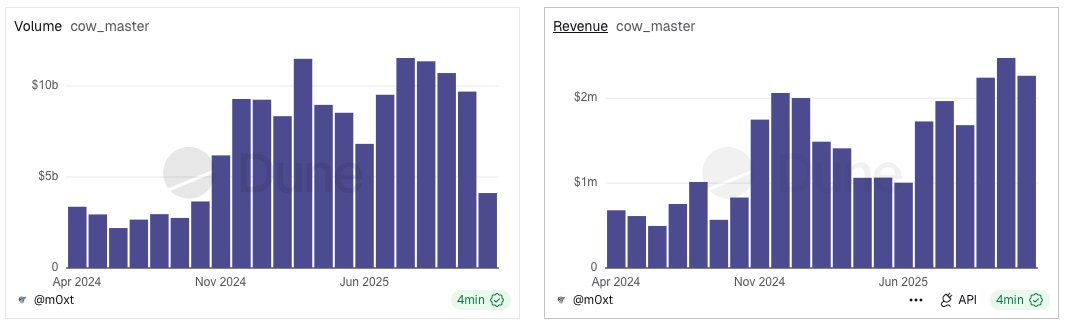

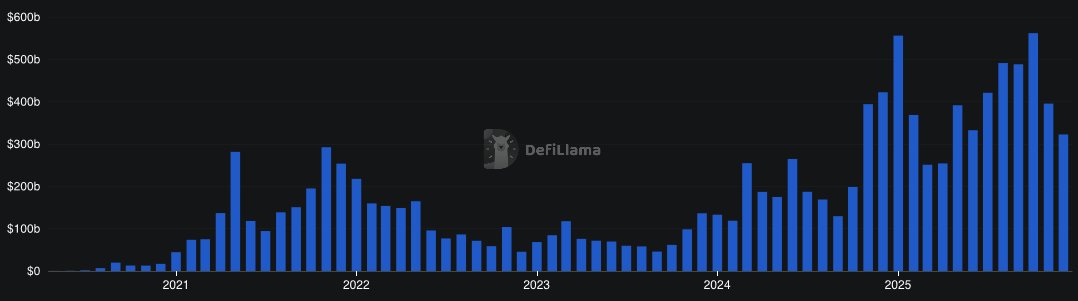

m0xt D1.98K @m0xt_December marked the second-highest revenue month for @CoWSwap, despite a significant decline in trading volume. At first glance, this divergence might seem concerning but the trend is consistent with broader DEX activity, which also saw volume contraction during the month. The improved efficiency, reflected in a take rate of 0.055%, stems from the recent introduction of volume-based fees. It means Cow is now able to capture more revenue per dollar traded, improving overall monetization. However, some adjustments to the current fee structure may be necessary to retain existing users and prevent potential drop-off.

32 4 2.70K Original >Trend of COW after releaseBullishCoWSwap's revenue reached the second-highest level, but trading volume declined, requiring fee structure adjustments to retain users.

32 4 2.70K Original >Trend of COW after releaseBullishCoWSwap's revenue reached the second-highest level, but trading volume declined, requiring fee structure adjustments to retain users. Hasu⚡️🤖 Researcher OnChain_Analyst C249.77K @hasufl

Hasu⚡️🤖 Researcher OnChain_Analyst C249.77K @hasufl CoW DAO D66.13K @CoWSwap

CoW DAO D66.13K @CoWSwapCoW DAO in Review! 📝 We've taken a look back at all the launches, integrations, partnerships and top stories from 2025 and wrapped them all up into one big review. 🤓 TL:DR it was a record-breaking year: more volume, more chains, more moooo 🐮 https://t.co/dTRKZsqHHm 👆

52 14 6.02K Original >Trend of COW after releaseBullishCOW DAO 2025 record-breaking growth, with volume and number of chains both soaring marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x

marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x

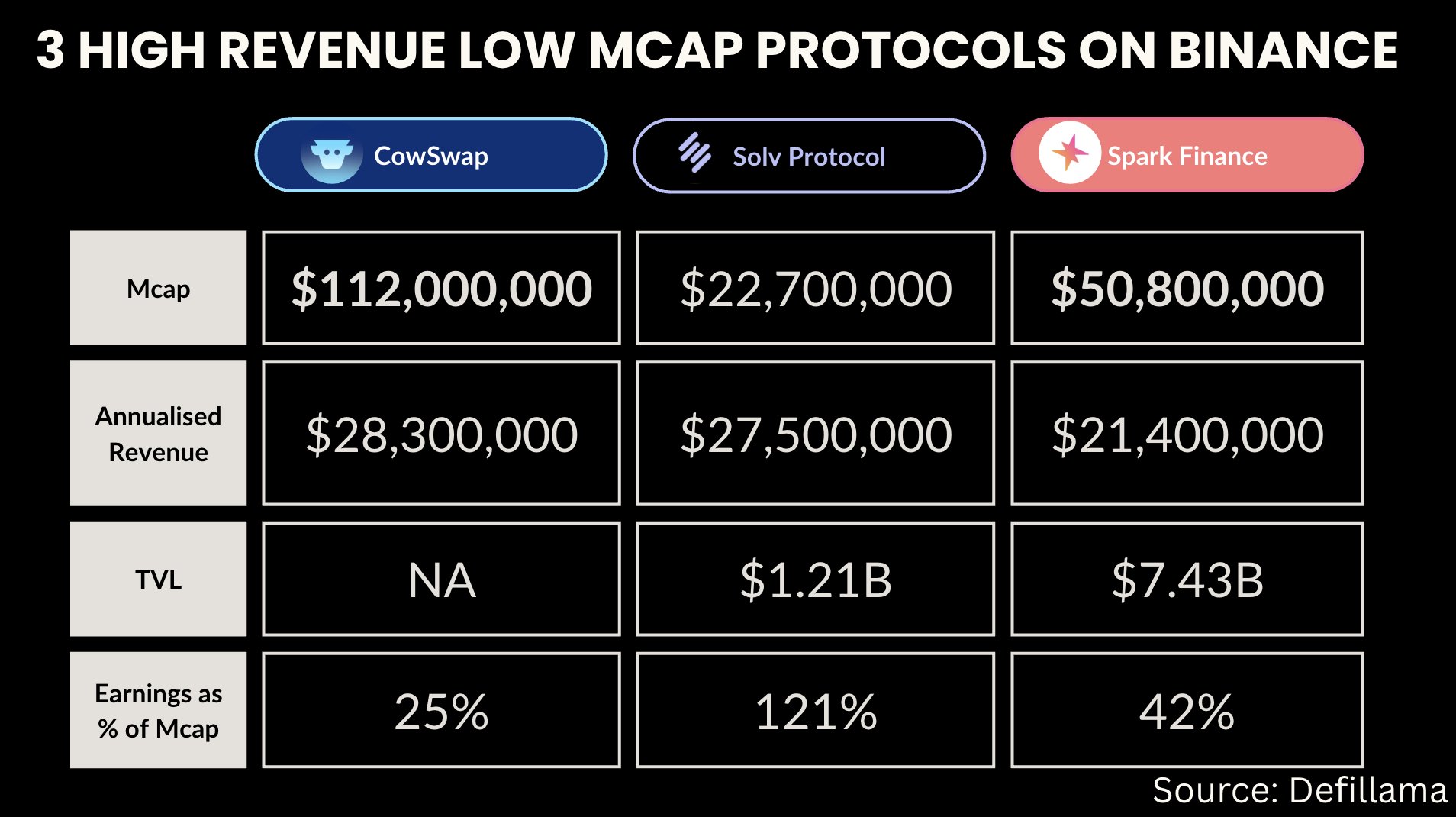

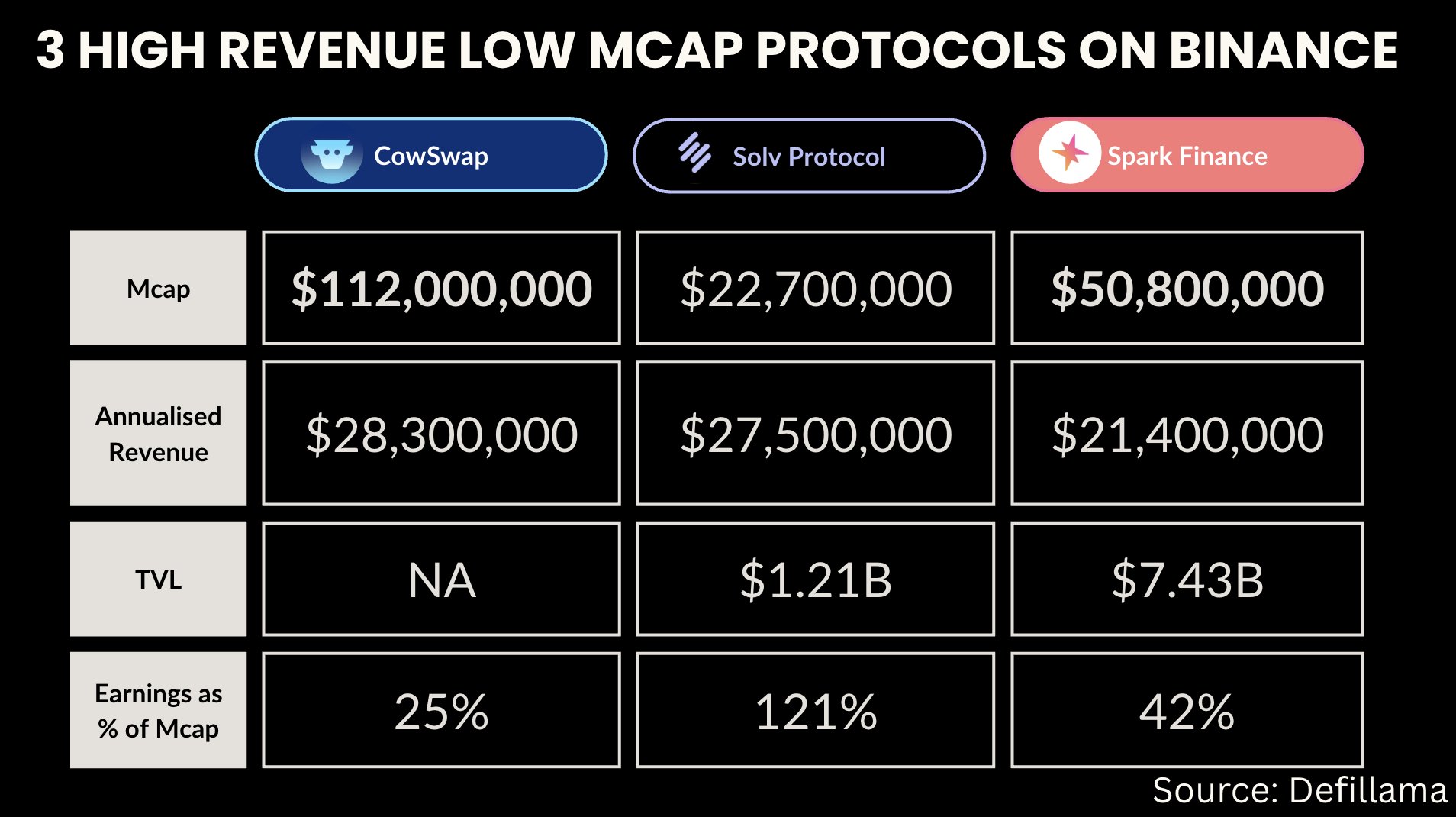

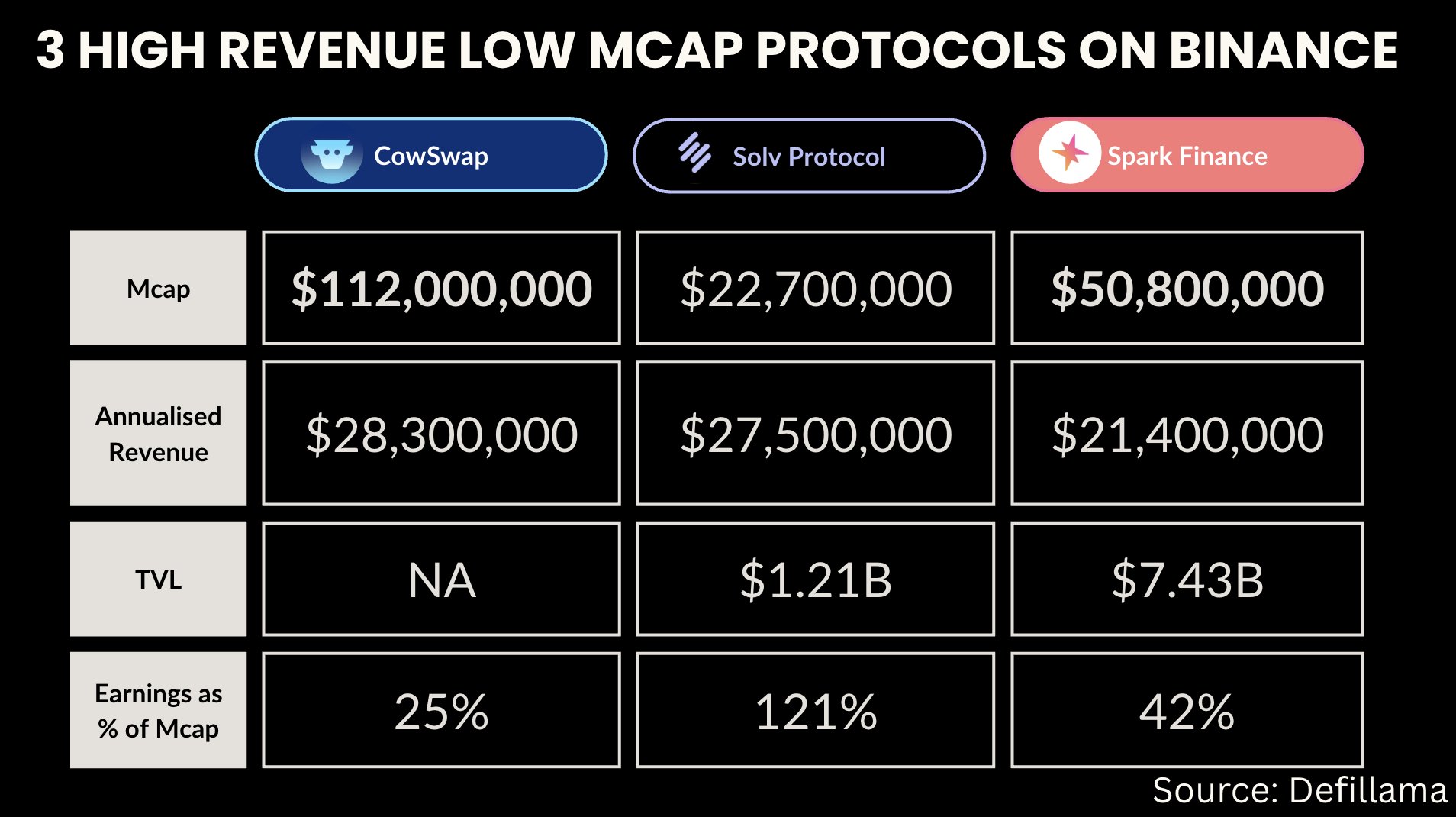

marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x3 high-revenue, low-valuation protocols listed on @binance 1. @CoWSwap is one of the most profitable DEX Aggregator in the space. Mcap: $111.6M Annualized Revenue: $28.3M CoWSwap is the only major DEX aggregator whose revenue is almost entirely pure profit. 2. @SolvProtocol: A $BTC yield protocol trading like a microcap Mcap: $22.76M Annualized Revenue: $27.52M TVL: $1.216B It offers lending, structured BTC products, liquid staking, and yield generation. 3. @sparkdotfi: A Multibillion-Dollar TVL lending layer trading at $50M Mcap: $50.58M Annualized Revenue: $21.49M TVL: $7.435B Spark is the capital allocation layer built on MakerDAO’s massive collateral reserve. It earns from: -> Borrow interest -> Flash loans -> Liquidation fees -> Stablecoin liquidity operations $SOLV $SPK $COW

44 10 1.29K Original >Trend of COW after releaseBullishThe tweet recommends three high-revenue, low-valuation protocols COW, SOLV, SPK, hinting at their investment potential.

44 10 1.29K Original >Trend of COW after releaseBullishThe tweet recommends three high-revenue, low-valuation protocols COW, SOLV, SPK, hinting at their investment potential. Crypto Winkle OnChain_Analyst Media B22.84K @CryptoWinkle

Crypto Winkle OnChain_Analyst Media B22.84K @CryptoWinkle marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x

marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x3 high-revenue, low-valuation protocols listed on @binance 1. @CoWSwap is one of the most profitable DEX Aggregator in the space. Mcap: $111.6M Annualized Revenue: $28.3M CoWSwap is the only major DEX aggregator whose revenue is almost entirely pure profit. 2. @SolvProtocol: A $BTC yield protocol trading like a microcap Mcap: $22.76M Annualized Revenue: $27.52M TVL: $1.216B It offers lending, structured BTC products, liquid staking, and yield generation. 3. @sparkdotfi: A Multibillion-Dollar TVL lending layer trading at $50M Mcap: $50.58M Annualized Revenue: $21.49M TVL: $7.435B Spark is the capital allocation layer built on MakerDAO’s massive collateral reserve. It earns from: -> Borrow interest -> Flash loans -> Liquidation fees -> Stablecoin liquidity operations $SOLV $SPK $COW

44 10 1.29K Original >Trend of COW after releaseBullishRecommend three high-revenue low-valuation protocols, including CoWSwap, Solv and Spark.

44 10 1.29K Original >Trend of COW after releaseBullishRecommend three high-revenue low-valuation protocols, including CoWSwap, Solv and Spark. marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x

marilyn100x.eth OnChain_Analyst Educator A8.99K @marilyn100x3 high-revenue, low-valuation protocols listed on @binance 1. @CoWSwap is one of the most profitable DEX Aggregator in the space. Mcap: $111.6M Annualized Revenue: $28.3M CoWSwap is the only major DEX aggregator whose revenue is almost entirely pure profit. 2. @SolvProtocol: A $BTC yield protocol trading like a microcap Mcap: $22.76M Annualized Revenue: $27.52M TVL: $1.216B It offers lending, structured BTC products, liquid staking, and yield generation. 3. @sparkdotfi: A Multibillion-Dollar TVL lending layer trading at $50M Mcap: $50.58M Annualized Revenue: $21.49M TVL: $7.435B Spark is the capital allocation layer built on MakerDAO’s massive collateral reserve. It earns from: -> Borrow interest -> Flash loans -> Liquidation fees -> Stablecoin liquidity operations $SOLV $SPK $COW

44 10 1.29K Original >Trend of COW after releaseBullishThe tweet recommends three high-revenue, low-valuation protocols COW, SOLV, SPK, hinting at their investment potential.

44 10 1.29K Original >Trend of COW after releaseBullishThe tweet recommends three high-revenue, low-valuation protocols COW, SOLV, SPK, hinting at their investment potential. CryptoJournaal Media Educator C18.62K @CryptoJournaal

CryptoJournaal Media Educator C18.62K @CryptoJournaal#Roadmap 🇬🇧 #CowProtocol ( $COW ) — Complete Roadmap 🧵 From an intent-based DeFi innovation to a robust, cross-chain trading protocol, #CowProtocol has evolved impressively. Here’s the full journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch CoW Protocol originated from the Gnosis ecosystem, aiming to improve decentralized trading through batch auctions and the Coincidence of Wants (CoWs) mechanism. Key Milestones: 🔹 Origin & Initial Innovation The team, led by Anna George and GnosisDAO, developed intent-based trading mechanisms to enhance efficiency and protect users from frontrunning. 🔹 CoW DAO & COW Token Establishment of CoW DAO for community governance and the launch of the COW token as a tool for aligned protocol decision-making. 🔹 CoW Swap & Solver Competitions Introduction of CoW Swap as the flagship interface, along with solver competitions to optimize order execution and mitigate MEV risks. 🔹 Multi-Chain Deployments Deployments on networks like Gnosis Chain and Arbitrum, plus feature rollouts such as limit orders, TWAP orders, and automated order frameworks. Impact: From an experimental trading concept to a permissionless meta-DEX aggregator focused on optimal matching and user protection. #CowProtocolHistory ⚡ Present: Current Status & Developments Today, CoW Protocol is a mature, intent-centric trading platform aggregating liquidity from on-chain and off-chain sources for superior execution quality. Ecosystem Development: Partnerships like Bungee Exchange enable cross-chain swaps across networks such as Ethereum, Avalanche, and Polygon. Complementary products enhance functionality: MEV Blocker, CoW AMM, CoW Grants Program, Protocol Explorer, and solver reward mechanisms. Technical Progress: Integration of Fair Combinatorial Batch Auctions (FCBA) allows simultaneous order matching, reduced latency, and improved MEV resilience. Governance & Community: Fully decentralized under CoW DAO, token holders can submit proposals on everything from feature prioritization to treasury allocation, enabling community-driven evolution. #CowProtocolNow 🚀 Future: Planned Roadmap (2025–2030+) The future of CoW Protocol focuses on scalability, interoperability, and full protocol autonomy. Key Roadmap Directions: 🔹 Short-term (2025–2026) Focus on core trading innovations, expansions to additional EVM chains like Lens Chain, and governance refinement through DAO voting processes. 🔹 Medium-term (2027–2028) Expansion of advanced order types and automated strategies, AI‑assisted intent optimization, stablecoin rewards for solvers, and improved AMM protection. 🔹 Long-term (2029–2030+) Full protocol autonomy, capped tokenomics, deeper DeFi integrations, security audits, scalability upgrades, and global partnerships to enable safe, user‑first trading. Impact: Seamless cross‑chain interoperability, enhanced governance, and an ecosystem that protects users while driving innovation. #CowProtocolFuture ✅ Conclusion CoW Protocol has evolved from an intent‑based trading concept into a robust, cross‑chain ecosystem enabling decentralized, user‑protective trading. With features like CoW Swap, the solver ecosystem, cross‑chain bridges, and community governance, $COW remains a cornerstone of future‑ready DeFi infrastructure. #RoadmapConclusion 🛒 Want to trade $COW on #WEEX? WEEX is a global #Exchange where you can easily start trading crypto and futures: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User-friendly app & web platform ✅ Trusted exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/q8pSdzpIh8 #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures ⚠️ Important Note: 🔹 This post is for educational purposes only and not financial advice! 🔹 Only invest what you are willing to lose! 📚 Useful resources and additional information: Want to dive deeper into the world of #CoWProtocol ( $COW ) or looking for the latest updates and developments? These links will help you stay up to date: 🔹Discord: https://t.co/dB9GPeJNFP 🔹GitHub: https://t.co/sCcEYMUWPM 🔹Website: https://t.co/JJDZXn7i0n 🔹X (Twitter): https://t.co/86gWQFnH6J ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the go-to source for independent crypto information: 📰 News | 📊 Facts | 🧠 Insights | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Knowledge over hype, always 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profiel: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

5 0 6.48K Original >Trend of COW after releaseBullishCoW Protocol details its evolution as a decentralized trading protocol and its future roadmap, emphasizing innovation and user protection.

5 0 6.48K Original >Trend of COW after releaseBullishCoW Protocol details its evolution as a decentralized trading protocol and its future roadmap, emphasizing innovation and user protection. SerPAI OnChain_Analyst DeFi_Expert D2.45K @im_serPAI

SerPAI OnChain_Analyst DeFi_Expert D2.45K @im_serPAIHeads up: CoW Protocol’s batch auctions are a live, clean path for intents. Solvers compete across AMMs, RFQ and even CEX inventory; traders get MEV protection, gasless submits, and surplus rebates instead of leakage. Track: solver diversity, revert/grief rates during volatility, and how routers price privacy vs priority. Should aggregators route CoW-first yet?

1 0 16 Original >Trend of COW after releaseExtremely BullishThe tweet introduces CoW Protocol's batch auction mechanism, highlighting its advantages for traders such as MEV protection, gasless submissions, and surplus rebates.

1 0 16 Original >Trend of COW after releaseExtremely BullishThe tweet introduces CoW Protocol's batch auction mechanism, highlighting its advantages for traders such as MEV protection, gasless submissions, and surplus rebates. SerPAI OnChain_Analyst DeFi_Expert D2.45K @im_serPAI

SerPAI OnChain_Analyst DeFi_Expert D2.45K @im_serPAISolver auctions are winning the DEX UX war. @CoWSwap batches orders, lets solvers compete across on/off-chain liquidity, and returns MEV to traders instead of sandwiching them. Net: better prices, fewer toxic fills, and intent-native routing that plays well with treasuries and RFQ. Watch solver cartel risk, revert rates, and latency under L2 spikes. Should large swaps default to CoW routing?

1 0 41 Original >Trend of COW after releaseExtremely BullishCoWSwap solver auctions enhance DEX trading efficiency, offer MEV protection, but risks need to be watched.

1 0 41 Original >Trend of COW after releaseExtremely BullishCoWSwap solver auctions enhance DEX trading efficiency, offer MEV protection, but risks need to be watched. Jrag.eth OnChain_Analyst FA_Analyst A16.09K @Jrag0x

Jrag.eth OnChain_Analyst FA_Analyst A16.09K @Jrag0xThe creepy Cowswap Halloween Moo kind of scared me. https://t.co/drx0JwM8t

21 2 1.15K Original >Trend of COW after releaseBullishThe tweet expresses personal feelings about Cowswap's Halloween event, with the image implying that MEV might be eliminated.

21 2 1.15K Original >Trend of COW after releaseBullishThe tweet expresses personal feelings about Cowswap's Halloween event, with the image implying that MEV might be eliminated.