Core Dao (CORE)

Core Dao (CORE)

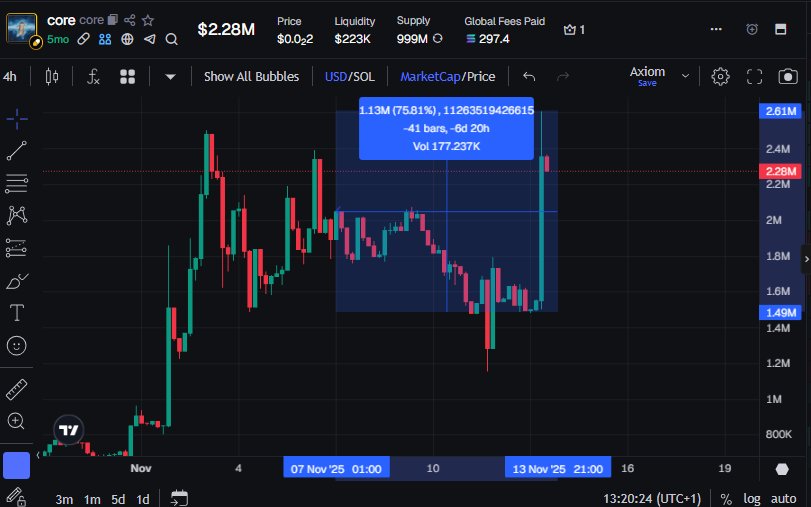

$0.0947 -29.80% 24H

- 56Social Sentiment Index (SSI)+14.29% (24h)

- #65Market Pulse Ranking (MPR)+58

- 124h Social Mention0% (24h)

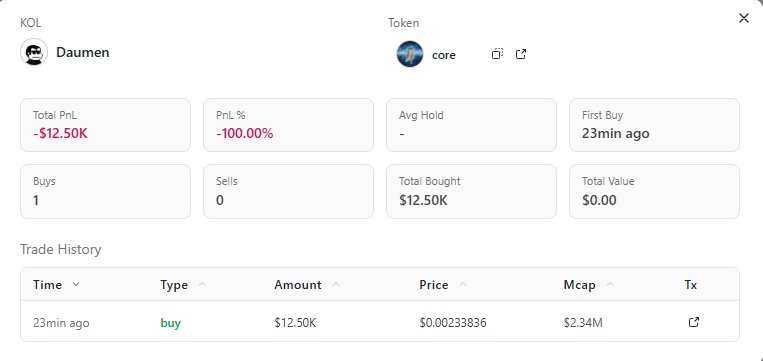

- 100%24h KOL Bullish Ratio1 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall56SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of CORE after releaseBullish

- Trend of CORE after releaseNeutral

Raajeev Anand Influencer Educator C17.34K @rajeevanandspur

Raajeev Anand Influencer Educator C17.34K @rajeevanandspur Core DAO 🔶 D2.32M @Coredao_Org

Core DAO 🔶 D2.32M @Coredao_Org 98 5 2.72K Original >Trend of CORE after releaseExtremely Bullish

98 5 2.72K Original >Trend of CORE after releaseExtremely Bullish- Trend of CORE after releaseBullish

- Trend of CORE after releaseBearish

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance Maple D58.13K @maplefinance19 2 4.48K Original >Trend of CORE after releaseNeutral

Maple D58.13K @maplefinance19 2 4.48K Original >Trend of CORE after releaseNeutral- Trend of CORE after releaseBearish

CryptoMage 🧙♂️ OnChain_Analyst Influencer A14.96K @CryptoMage_YT

CryptoMage 🧙♂️ OnChain_Analyst Influencer A14.96K @CryptoMage_YT Lasalad D448 @TRTtheSalad

Lasalad D448 @TRTtheSalad

16 3 4.27K Original >Trend of CORE after releaseExtremely Bearish

16 3 4.27K Original >Trend of CORE after releaseExtremely Bearish- Trend of CORE after releaseBearish

Stalkchain OnChain_Analyst Influencer C47.41K @StalkHQ

Stalkchain OnChain_Analyst Influencer C47.41K @StalkHQ

Stalkchain OnChain_Analyst Influencer C47.41K @StalkHQ

Stalkchain OnChain_Analyst Influencer C47.41K @StalkHQ

0 0 2.81K Original >Trend of CORE after releaseBearish

0 0 2.81K Original >Trend of CORE after releaseBearish