Yei Finance (CLO)

Yei Finance (CLO)

- 81Social Sentiment Index (SSI)- (24h)

- #47Market Pulse Ranking (MPR)0

- 724h Social Mention- (24h)

- 100%24h KOL Bullish Ratio7 Active KOL

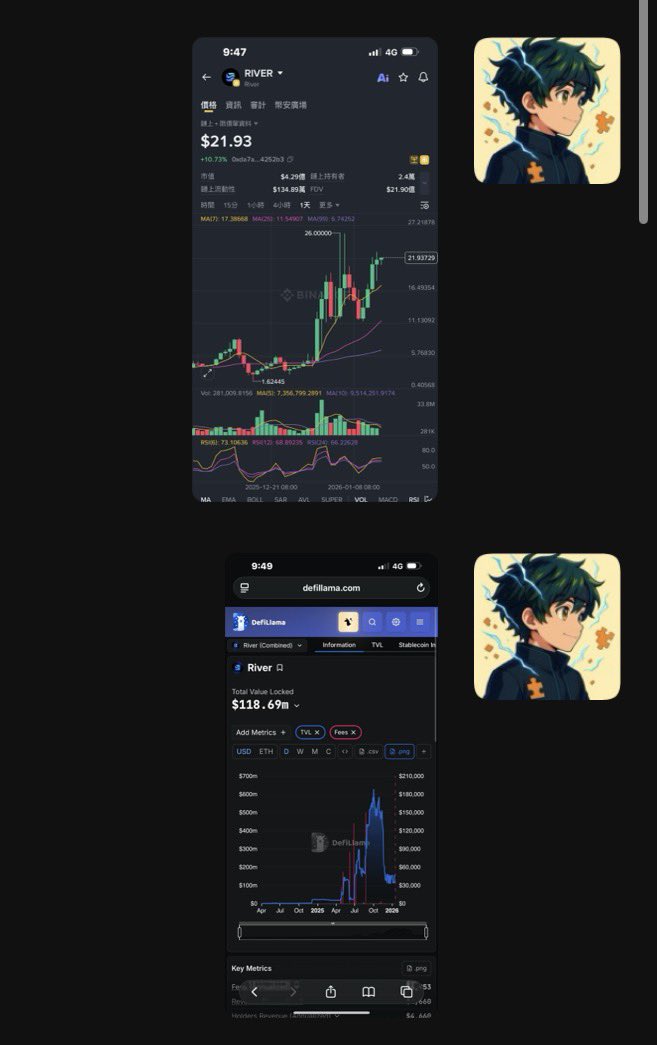

- SummaryCLO up 164% in the past 30 days, cumulative 400% since TGE, but down 6.39% over 24h, social hotness unchanged, KOL generally bullish.

- Bullish Signals

- 164% increase over 30 days

- 400% rise since TGE

- Rising trading volume

- Deflationary + low supply

- Boosted by Sei ecosystem

- Bearish Signals

- Price down 6.39%

- Short-term profit-taking

- Sentiment not warming

- Lack of new announcements

- Strong pullback pressure

Social Sentiment Index (SSI)

- Data Overall81SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (14%)Bullish (86%)SSI InsightsCLO social hotness high (80.68/100, unchanged), activity 31.61/40, positive sentiment 28.57/30, KOL attention 20.5/30, driven by 164% 30‑day increase and Sei ecosystem boost.

Market Pulse Ranking (MPR)

- Alert InsightCLO warning rank #47, social anomaly 83.08/100 high, sentiment polarization 47.14/100, KOL shift only 14.5/100, corresponding to recent 6.39% pullback.

X Posts

Campbell | New York New York arc Media Influencer B5.05K @CampbellEaston

Campbell | New York New York arc Media Influencer B5.05K @CampbellEaston Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

48 8 4.56K Original >Trend of CLO after releaseBullishCLO up 400% due to volume and revenue growth, outlook positive. Okan Founder Community_Lead S16.16K @okanaksoy54

Okan Founder Community_Lead S16.16K @okanaksoy54$CLO is building something strong. Growing volume on @YeiFinance, rising revenue, and rewards flowing back to users. Add a deflationary model and low circulating supply, and everything lines up. @SeiNetwork momentum is only pushing this further. Solid.

Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

112 47 3.11K Original >Trend of CLO after releaseBullishCLO trading volume surges, revenue rises, expected to continue climbing nbdieu.sei 🔴💨 Community_Lead Media B3.71K @nbdieu

nbdieu.sei 🔴💨 Community_Lead Media B3.71K @nbdieu Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

48 8 4.56K Original >Trend of CLO after releaseBullish$CLO rises 400% due to Yei platform’s trading volume surge, outlook optimistic Sei Community_Lead DeFi_Expert C782.18K @SeiNetwork

Sei Community_Lead DeFi_Expert C782.18K @SeiNetwork Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

48 8 4.56K Original >Trend of CLO after releaseBullishYei Finance $CLO up 400% in recent months, trading volume 685M, outlook bullish Phillip | SEI Founder Community_Lead A16.49K @phillip_xyz

Phillip | SEI Founder Community_Lead A16.49K @phillip_xyz Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

48 8 4.56K Original >Trend of CLO after releaseBullishCLO remains bullish due to surging trading volume and rising revenues Powerpei.ip DeFi_Expert OnChain_Analyst S12.35K @PWenzhen76938

Powerpei.ip DeFi_Expert OnChain_Analyst S12.35K @PWenzhen76938 DD 滴滴./ D7.64K @rtk17025

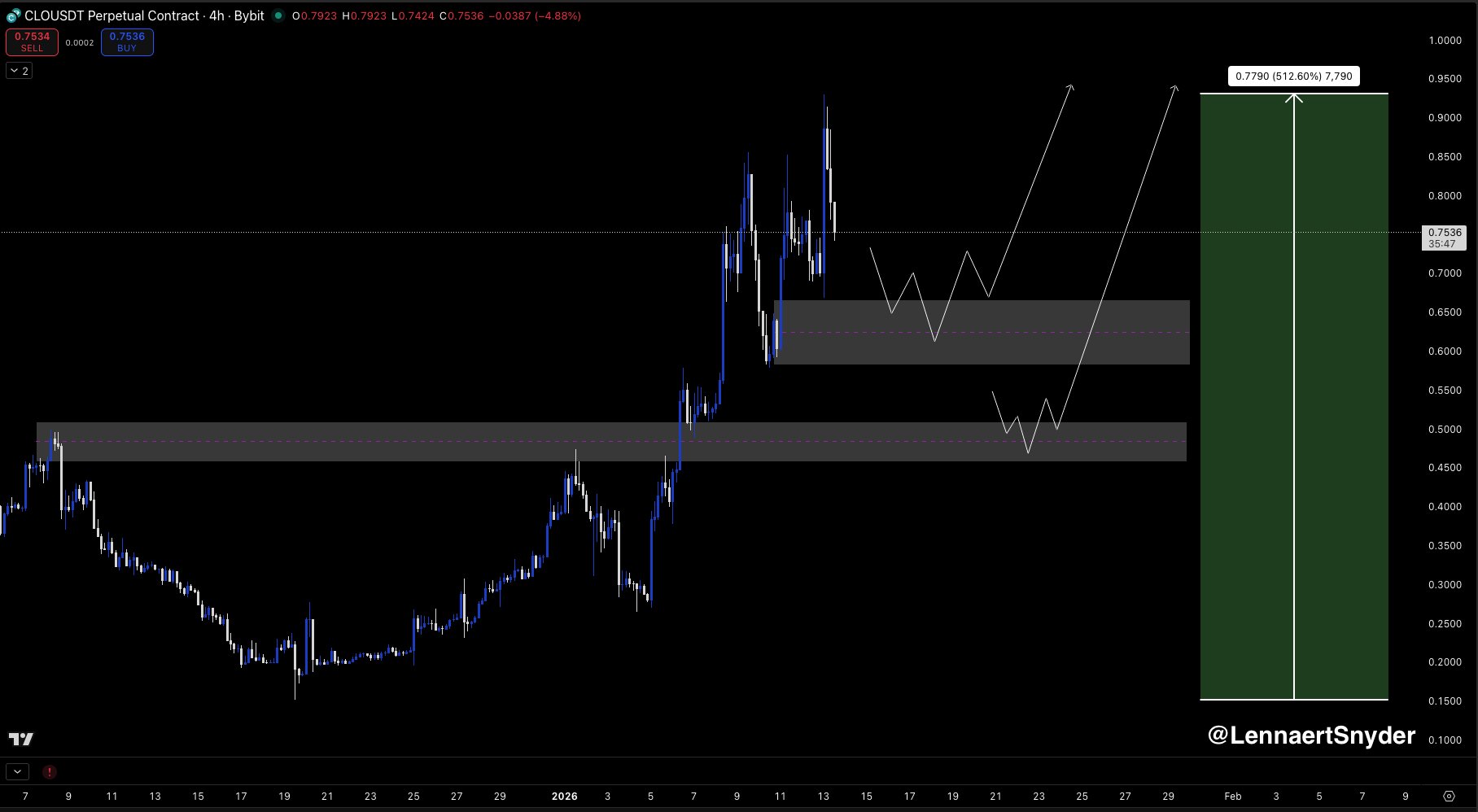

DD 滴滴./ D7.64K @rtk17025Didn't expect that a casual chat would bring so many people to me, hahaha. So many people ran to find me, hahahaha. Actually it was just a casual chat in the group yesterday. At that time I was discussing the latest updates of @ferra_protocol with @Jason23818126 and others. Because for us, posting any project or discussion on Twitter should be done rationally. So we ended up talking about the Ferra TVL that many people were mentioning. Some say it's 10M. Some say it's 2M. Indeed, it's quite volatile. So I opened Alpaca and found that around 1/1 the TVL was still over 10M, but recently it suddenly dropped to 1.92M. But an interesting discussion then unfolded. Is there a strong correlation between TVL and token price? At this point, @dajingou1 in the group suddenly shared two factors that could link TVL to token price. 1. Token price moves first, TVL changes passively. TVL is mostly denominated in USD. Token price rises → same amount of tokens locked → TVL naturally increases. 👉 This is price influencing TVL, not the other way around. 2. Bull market narrative phase: capital and sentiment come in together. New narratives (L2, Restaking, AI, RWA) TVL growth + token price rise happen simultaneously. 👉 Both are driven together by sentiment and capital. But then @PWenzhen76938 said, Many TVLs are: Subsidy-driven (high APY) The same pool of capital moving repeatedly VC/team funds Conversely, like $CLO $RIVER, Although TVL has sharply declined recently, the token price has surged due to short-covering sentiment. That's the interesting part of financial markets. Am I right? Wrong? The market always has its own answer.

56 51 1.95K Original >Trend of CLO after releaseBullishThe tweet discusses the relationship between TVL and token price, with CLO and RIVER prices still soaring despite a decline in TVL.

56 51 1.95K Original >Trend of CLO after releaseBullishThe tweet discusses the relationship between TVL and token price, with CLO and RIVER prices still soaring despite a decline in TVL. Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.02K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.02K @ScarlettWeb3 Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.02K @ScarlettWeb3

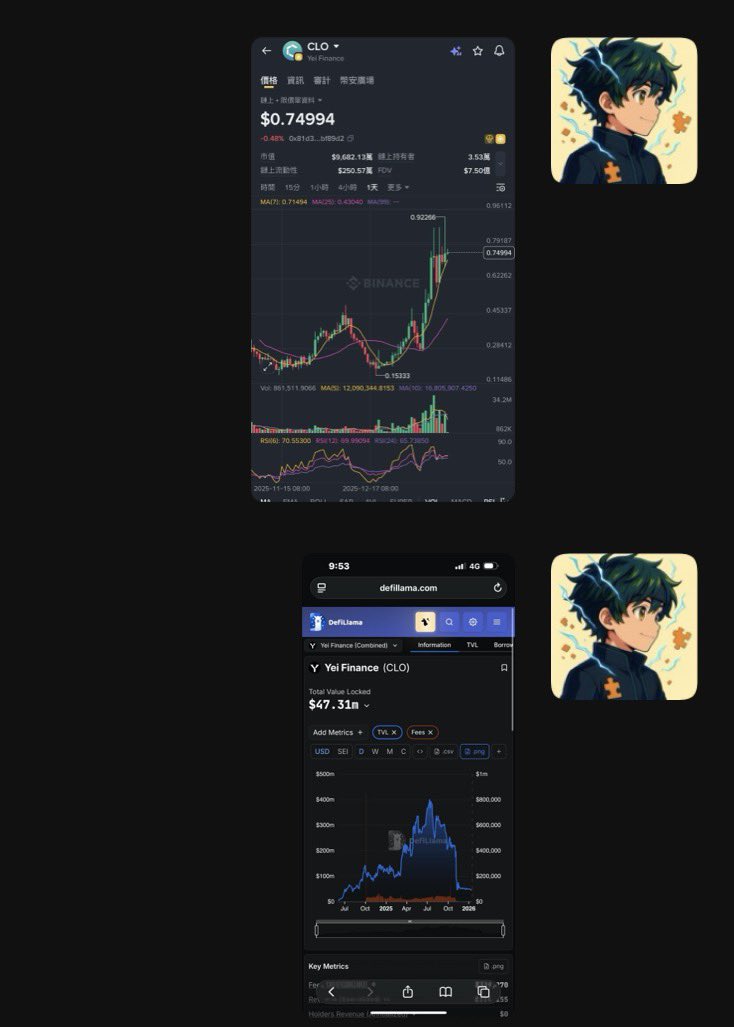

Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.02K @ScarlettWeb3Bull market returns, quick rally. As BTC broke through 96k this morning The best-performing token in my watchlist is: $CLO (Sei ecosystem) 30 days 164%, climbing from 0.318 to 0.748, peaking at 0.91 $CLO is the governance token of @YeiFinance and YeiFinance is one of the most important DeFi protocols on @SeiNetwork 1⃣ Will the rise of $CLO be the first shot of Sei DeFi explosion? 🔫 The first model has always emphasized to everyone: Altcoins are not unbuyable, but you should buy projects that can be profitable Project teams, VCs, and retail investors come into the crypto space to make money. If a project team cannot make money through the project itself, then, while protecting its own interests, the team will act maliciously, sprinkling tokens to you in exchange for its own exit liquidity $CLO is the core economic token of Yei Finance, one of the largest DeFi protocols on Sei Yei protocol TVL is $47.09 million, cumulative trading volume exceeds $685 million Cumulative revenue is $4.24 million, fully capable of generating real protocol income 💰 For the Sei ecosystem, the impressive performance of $CLO means: ▪️ Capital and trading activity on Sei ▪️ On-chain user participation and asset liquidity ▪️ Recognition from researchers and mainstream investors for Sei YeiFinance's success proves that Sei's technical advantages (400ms finality, parallel execution) can be turned into real user value (or reflected in the token price ~ 🙃 But Sei's ambition and core battlefield are not limited to this; it has always been high-frequency trading 2⃣ Sei ecosystem has many great projects 🏆 👉 @MonacoProtocol 👈 Because if YeiFinance is the “present tense” of the Sei ecosystem, then Monaco Protocol may be the “future tense” — it represents Sei's ultimate vision in the high-frequency trading field Monaco Protocol is a shared liquidity central order book trading layer incubated by @Sei_Labs, built specifically for the Sei network In simple terms, it aims to: Bring the speed advantage of traditional centralized exchanges (the millisecond-level matching of Binance, OKX) into the decentralized world Monaco will directly leverage Sei's Giga upgrade (50x EVM performance boost), targeting over 200,000 TPS. If this is moved to decentralization, handling Hype's volume is not impossible 🤪 The future shape of the Sei ecosystem will likely be: ▪️ YeiFinance providing lending + spot trading ▪️ Monaco filling high-frequency derivatives and orderbook spot Monaco is currently in the pre‑mainnet stage (expected launch Q1 2026), but has already passed RFP

77 72 16.74K Original >Trend of CLO after releaseExtremely BullishCLO token is performing strongly, Sei ecosystem DeFi is booming, and Monaco Protocol will bring a high-frequency trading vision.

77 72 16.74K Original >Trend of CLO after releaseExtremely BullishCLO token is performing strongly, Sei ecosystem DeFi is booming, and Monaco Protocol will bring a high-frequency trading vision. Okan Founder Community_Lead S16.16K @okanaksoy54

Okan Founder Community_Lead S16.16K @okanaksoy54$CLO price action has been pretty clear lately. While the market chops around, $CLO keeps moving up in a steady and controlled way. Volume follows, structure stays clean. This doesn’t look like a one-day hype move. On the @YeiFinance side, things look solid. The product is being used and liquidity is building, which explains why price keeps holding up. $1 doesn’t feel far-fetched at all. 2026 is going to be a great year for @SeiNetwork and the projects in its ecosystem. We can already see it. Some Sei ecosystem projects I’m keeping an eye on: @MonacoOnSei @TakaraLend @oxiumxyz @Kindred_AI Watching closely.

169 92 17.94K Original >Trend of CLO after releaseExtremely BullishCLO price is rising steadily, fundamentals are strong, and the author believes it may reach $1 in the short term.

169 92 17.94K Original >Trend of CLO after releaseExtremely BullishCLO price is rising steadily, fundamentals are strong, and the author believes it may reach $1 in the short term. yueya Trader DeFi_Expert A52.09K @yueya_eth

yueya Trader DeFi_Expert A52.09K @yueya_ethgSei $CLO has delivered a 4x increase, essentially announcing that the Sei ecosystem has finally survived the “high‑tech, cold‑wallet” awkward period. As the DeFi flagship of the ecosystem, @YeiFinance ($CLO) has generated a 450% upward pulse, which actually reflects the “smart money” that has been deeply embedded in Sei and truly understands the parallel EVM logic, completing a systematic value vote. In crypto markets, price movements often precede public perception, and this breakout most likely indicates that capital has sharply sensed a fundamental transformation signal for $Sei. Many people still associate Sei with abstract terms like “fast” or “parallel technology”. However, if you look at the data, the undercurrents have already coalesced: over the past four months, Sei’s daily active addresses have doubled. If you missed the $CLO kickoff, there’s no need to force a trade at this point. In reality, the more valuable opportunities are usually hidden in projects that are being jointly polished by the official team and the market. For example, @MonacoOnSei, which has been heavily supported by Sei Labs. The community generally believes that such “lab‑incubated” projects embody the official ambition to turn traffic into application assets. Once Sei activates the so‑called “Giga mode”, Monaco could become the direct catalyst. Looking at @TakaraLend, which currently holds over $80 million in TVL and is sprinting along the lending track. Its role in the ecosystem resembles a massive liquidity reservoir. Everyone watches for its token launch, but I’m more interested in how it will absorb the capital pressure spilling over from top‑tier protocols after $CLO. There’s also @Kindred_AI. Kindred pursues a cross‑border path between AI and cultural IP, holding licenses for 25 world‑class IPs such as Astro Boy and Teletubbies. While everyone else is racing on compute power and model size, Kindred tries to run AI interaction and cultural consumption on Sei’s high‑speed network. This approach may actually break the ecosystem out of its niche, bringing tangible user sentiment and consumption scenarios. Today, @SeiNetwork’s ecosystem is undergoing an overall awakening from “point” to “plane”. From Yei’s explosion, to Monaco’s strategic positioning, to Takara’s scale effects and Kindred’s cultural layout, an inter‑supporting logic is now clearly visible. This full‑stack awakening—from infrastructure to applications—is something we haven’t seen on other new L1s for a long time. Instead of fretting over where the next breakout will be, it’s better to closely watch how far this “official support + core asset leadership” logic can extend on Sei. 🧬🏹

59 27 14.52K Original >Trend of CLO after releaseExtremely BullishSei ecosystem fully awakened, CLO leading the rally, multiple projects have huge potential.

59 27 14.52K Original >Trend of CLO after releaseExtremely BullishSei ecosystem fully awakened, CLO leading the rally, multiple projects have huge potential. Lennaert Snyder TA_Analyst Trader A38.35K @LennaertSnyder

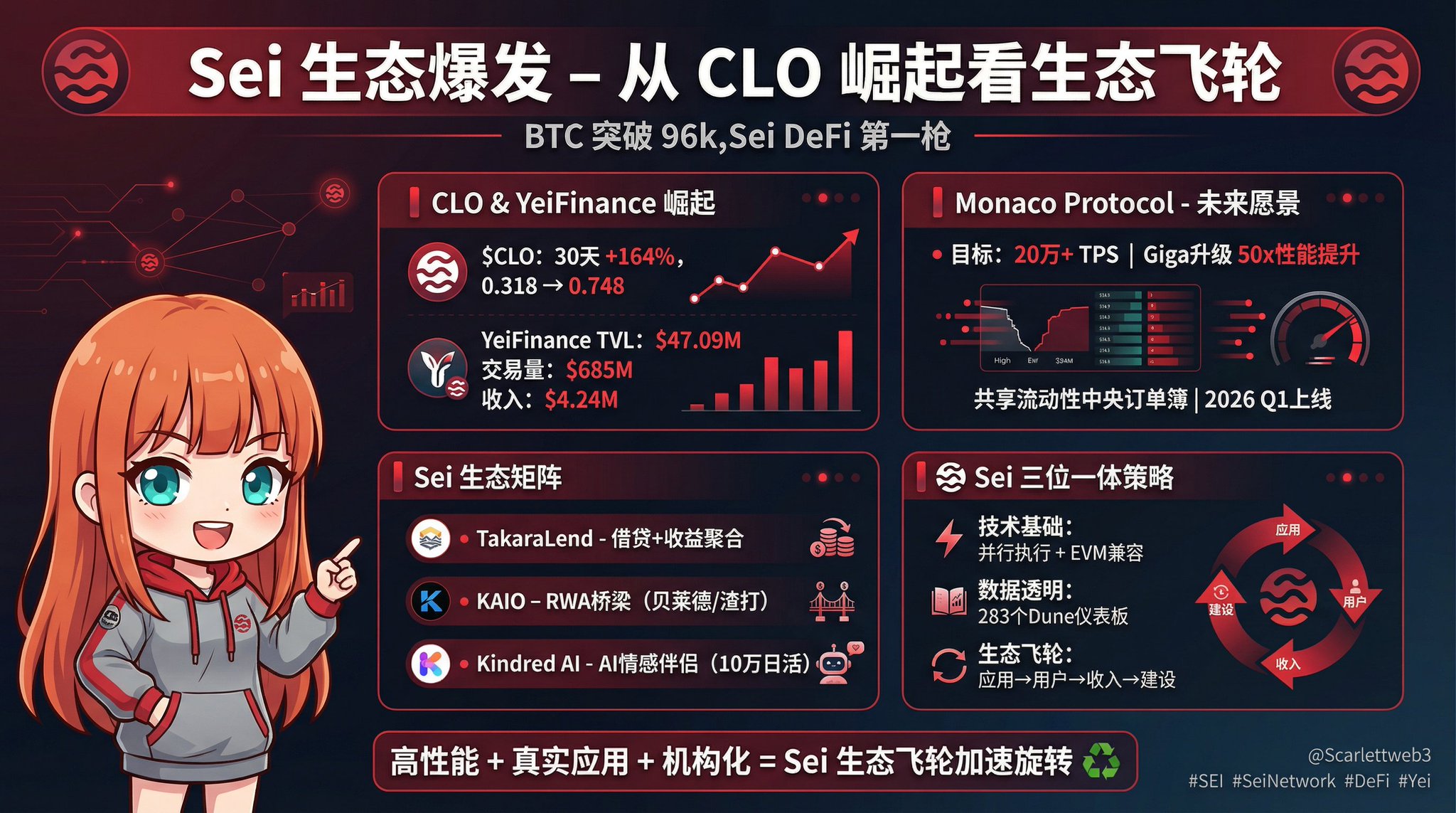

Lennaert Snyder TA_Analyst Trader A38.35K @LennaertSnyder$CLO pumped +512% in 1 month. I guess successful token launches are still possible in this market, and Yei Finance is obviously showing that. The token went live on October 14th 2025, and basically has been in an uptrend since. For potential long setups, I'm looking at two scenario's here. Remember this is not the time to fomo into longs, strong pumps have strong pullbacks. The first support zone that's interesting to me, is the upper ~$0.64 box. If price tests this region, I'll give it some time to consolidate and execute longs on quality reversals (H1 minimum). There's also interesting liquidity to be found at the ~$0.485 imbalance. Same strategy here, let price consolidate, and opening longs after quality reversals. Yei Finance is the top DeFi-protocol on Sei Network. I did some digging, and apparently there are more token launches coming from the SEI ecosystem. Seeing this, it might be worth it to carefully monitor next token launches from the Sei ecosystem. When you want to trade new tokens, remember to always let price form a structure first. And when confirmation is there, we strike.

116 13 6.43K Original >Trend of CLO after releaseBullishCLO surged 512%, and the author plans to go long on the pull‑back.

116 13 6.43K Original >Trend of CLO after releaseBullishCLO surged 512%, and the author plans to go long on the pull‑back.