Bitcoin (BTC)

Bitcoin (BTC)

-7.04% 24H

- 84Social Sentiment Index (SSI)+31.30% (24h)

- #3Market Pulse Ranking (MPR)+76

- 2,93724h Social Mention+110.45% (24h)

- 48%24h KOL Bullish Ratio896 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall84SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (12%)Bullish (36%)Neutral (10%)Bearish (30%)Extremely Bearish (12%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of BTC after releaseBearish

Rajat Soni, CFA FA_Analyst Influencer A131.18K @Rajatsoni

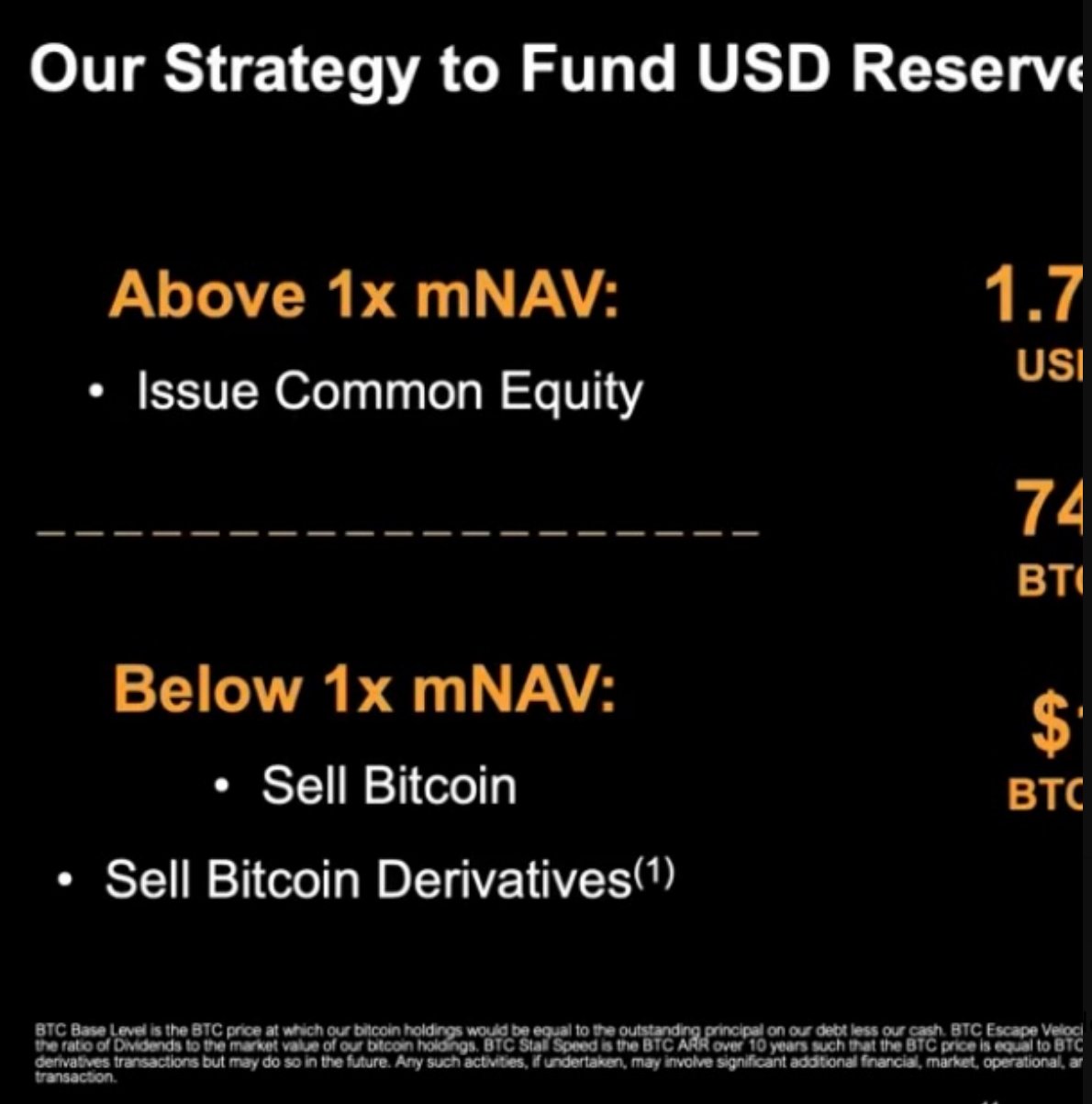

Rajat Soni, CFA FA_Analyst Influencer A131.18K @Rajatsoni Michael Saylor Founder Influencer B4.71M @saylor6 1 482 Original >Trend of BTC after releaseBullish

Michael Saylor Founder Influencer B4.71M @saylor6 1 482 Original >Trend of BTC after releaseBullish- Trend of BTC after releaseBullish

Vini Barbosa |「 thecoding 」 OnChain_Analyst Educator B10.68K @vinibarbosabr

Vini Barbosa |「 thecoding 」 OnChain_Analyst Educator B10.68K @vinibarbosabr The Kobeissi Letter Media Influencer A1.14M @KobeissiLetter1 0 20 Original >Trend of BTC after releaseBearish

The Kobeissi Letter Media Influencer A1.14M @KobeissiLetter1 0 20 Original >Trend of BTC after releaseBearish- Trend of BTC after releaseBullish

chainyoda FA_Analyst Researcher B41.86K @chainyoda

chainyoda FA_Analyst Researcher B41.86K @chainyoda Kevin Simback 🍷 VC Researcher S6.57K @KSimback

Kevin Simback 🍷 VC Researcher S6.57K @KSimback 6 2 1.74K Original >Trend of BTC after releaseBullish

6 2 1.74K Original >Trend of BTC after releaseBullish- Trend of BTC after releaseBullish

- Trend of BTC after releaseExtremely Bullish

- Trend of BTC after releaseBullish

- Trend of BTC after releaseNeutral