APRO (AT)

APRO (AT)

- 49Social Sentiment Index (SSI)- (24h)

- #72Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- SummaryAT is driven by Apro's decentralized oracle technology and completed airdrop, price up 7.57% in 24h.

- Bullish Signals

- Decentralized oracle

- Multi-layer AI filtering

- Supports RWA DeFi

- Airdrop completed

- Price up 7.57% in 24h

- Bearish Signals

- Data accuracy not guaranteed

- Still relies on off-chain sources

- Solution has no absolute guarantee

- Market heat remains flat

- Many competing oracles

Social Sentiment Index (SSI)

- Data Overall49SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI InsightsAT social heat is moderate (48.5/100) and flat, sentiment is highly positive (27.5/30) with activity increasing (20/40), but KOL attention is low (1/30) linked to airdrop driving.

Market Pulse Ranking (MPR)

- Alert InsightAT warning rank #72, social anomaly 50/100, sentiment polarization 50/100, KOL attention 1/100 all show no significant fluctuation, indicating the current risk level is average, corresponding with price increase.

X Posts

Kriptoloji 🫶 Founder Researcher B27.46K @Kriptolooo

Kriptoloji 🫶 Founder Researcher B27.46K @KriptoloooApro protocol is designed as an infrastructure that collects and verifies the external data needed by cross‑chain applications not from a single central source, but from a distributed pool of resources. The system first passes the received data through multiple control layers, then performs consistency analysis using AI‑based filtering, converting it into a format usable by blockchains. This approach creates a more stable data foundation especially for RWA solutions, algorithmic models, and DeFi protocols that require automation. A notable aspect of APRO's architecture is that node groups operating on different networks perform parallel control on the same data set, and securely feed the results onto the chain. The staking model used during the @BinanceTR airdrop period was entirely participation‑focused, and the distribution was automatically completed by the system on 27 Kasım. Since oracle structures generally rely on off‑chain sources, no solution—including APRO—can guarantee absolute accuracy, but the design aims to minimize such errors. While the involvement of institutional investors shows that the technical approach is being developed with long‑term goals in mind, the price side still depends on overall market flow. In my view, APRO's decisive factor is not data provision but the claim to standardize the process of restructuring this data with AI and moving it onto the chain. If this model scales, a common data language could emerge across multi‑chain ecosystems. Nevertheless, as with any technical infrastructure, conducting personal due diligence before making decisions remains the healthiest approach. This does not constitute investment advice; it is for informational purposes only.

164 58 5.24K Original >Trend of AT after releaseBullishAPRO protocol utilizes AI‑enhanced data verification, aiming for multi‑chain data standards.

164 58 5.24K Original >Trend of AT after releaseBullishAPRO protocol utilizes AI‑enhanced data verification, aiming for multi‑chain data standards. Loki Educator DeFi_Expert S29.96K @kriptoloki

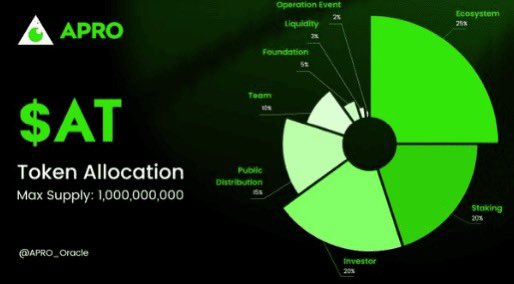

Loki Educator DeFi_Expert S29.96K @kriptolokiI compiled a lot of information for you about the newly listed and TGE-ed APRO | $AT. I prepared it bullet by bullet for easy reading. I gathered all the details I could find. It turned out to be a fairly comprehensive review. First, @APRO_Oracle What is APRO? •It is an oracle protocol that transfers real-world data to the blockchain in a secure, fast, and decentralized manner. •Provides data to RWA, AI, prediction markets and DeFi applications. •With 40+ blockchain integrations and 1,400+ data streams, it is one of the oracles with the widest coverage in the industry. •The entire verification process is supported by machine learning and artificial intelligence. APRO’s Purpose: •Enable the blockchain to establish a reliable bridge with the outside world. •Transport variable data such as prices, market data, RWA valuations onto the chain securely. •Provide critical data infrastructure for DeFi, DEX, prediction markets and RWA tokenization. •Ensure maximum security with multi-source verification + AI analysis layer that prevents data manipulation. APRO How It Works? Two Models: Data Pull & Data Push Data Pull: •Data is fetched only when needed → low cost, minimal latency. •Price, timestamps and signatures are verified on-chain. •4 scenarios: instant price, timestamped price, price verification, verified price read. Data Push: •Automatic updates based on price thresholds or heartbeat intervals. •Ideal for DeFi, Bitcoin L2 and projects requiring high frequency. Proof of Reserve (PoR): •Verifies reserves of tokenized RWA assets in real time. •APIs, banks, reports, regulatory documents → analyzed with AI. •Generates asset‑liability summary, collateral ratio, compliance and risk reports. Technical Infrastructure: •Two‑layer oracle network: •OCMP: Nodes collect data, detect anomalies, compare with other nodes. •Eigenlayer: Provides arbitration in case of disputes. •Node Security System: •Wrong data → margin is slashed. •Faulty escalation → margin is slashed. •Consensus: PBFT → 7+ verification nodes and a 2/3 majority requirement. •Risk Protection: Multi‑source data, TVWAP pricing, Z‑score anomaly, dynamic thresholds. APRO Use Cases: •DeFi & Derivatives: Real‑time price feed. •RWA Tokenization: Stock, bond, commodity, real‑estate prices. •Prediction Markets: Fair settlement with event‑based data. •Gaming / Social: Special data sets. •Enterprise: RWA verification, risk assessment, reserve monitoring. APRO Advantages: •Broad coverage with 40+ chains and 1,400+ data streams. •AI‑assisted verification → minimal manipulation risk. •Data Pull model → gas costs drop dramatically. •Dual‑layer security → OCMP + Eigenlayer. •Flexible usage → high‑frequency + event‑based data scenarios. Tokenomics & Investors: •Gas and service fees are paid with chain tokens or ERC20 versions. •Costs in Data Pull are optimized; a discount model can operate based on gas dynamics. •Investors include: •Polychain Capital •Franklin Templeton •YZi Labs •abcde •CMS •Oak Grove Ventures •UTXO •Comma3 •Presto •A strongly funded, Web3 data‑layer growth‑focused ecosystem.

224 19 10.37K Original >Trend of AT after releaseExtremely BullishDetailed introduction of APRO project's technical advantages and investment background

224 19 10.37K Original >Trend of AT after releaseExtremely BullishDetailed introduction of APRO project's technical advantages and investment background Şevki Kara TA_Analyst Trader A78.78K @sevkikara

Şevki Kara TA_Analyst Trader A78.78K @sevkikaraLet's close the day with another review ..🤝 #BinanceTR listed the 39th HODLer project with the $AT / $TRY trading pair. @APRO_Oracle is a platform that enables AI agents and blockchain applications to share data securely. It makes communication between different systems seamless and ensures that the data is correct. The purpose is very clear ⁉️ By bringing together AI and blockchain ecosystems, it makes data usage in the Web3 world reliable and standardized, ensuring that applications can always make decisions based on correct information. Now let's look at the Technical Infrastructure 🛠️ 1️⃣ Protocol Architecture Built on the ATTPs protocol that provides secure and verifiable data transfer among AI agents. The protocol uses a five-layer architecture: data transmission, data validation, identity management, trust score, and blockchain integration. These layers work together to make data transfer both fast and secure. 2️⃣ Data Validation The protocol uses advanced cryptographic methods such as Merkle tree and ZKP to ensure data accuracy. Data from AI agents is first validated off-chain, then recorded on-chain. This prevents data manipulation and makes the whole process transparently traceable. Additionally, the platform supports both Data Push and Data Pull models: Push: Nodes send data at certain thresholds or time intervals, ideal for real-time price changes. Pull: dApps request data when needed, suitable for high‑frequency access and low‑latency applications. 3️⃣ Identity Verification Each AI agent is identified by a unique on‑chain identity. This identity allows agents to recognize each other securely and conduct data exchange in a verified environment. Thus, false or unauthorized agents sending data within the system are prevented❗️ 4️⃣ Trust Score It measures each agent's reliability with a trust score. The score is based on past data accuracy, peer evaluation, and performance history. Agents with low trust scores have their data transmission limited, while high‑scoring agents can perform more operations. 5️⃣ Blockchain Integration All verification and recording operations are performed on the blockchain, making data immutable and traceable. This architecture makes @APRO_Oracle suitable as an infrastructure for oracle services and secure data feeding. Finally, thanks to multichain support, it can operate compatibly with different blockchains such as $ETH and $SOL.

136 24 10.49K Original >Trend of AT after releaseBullishThe AT project is listed on BinanceTR, is multichain compatible and has a solid technical architecture, worth attention onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

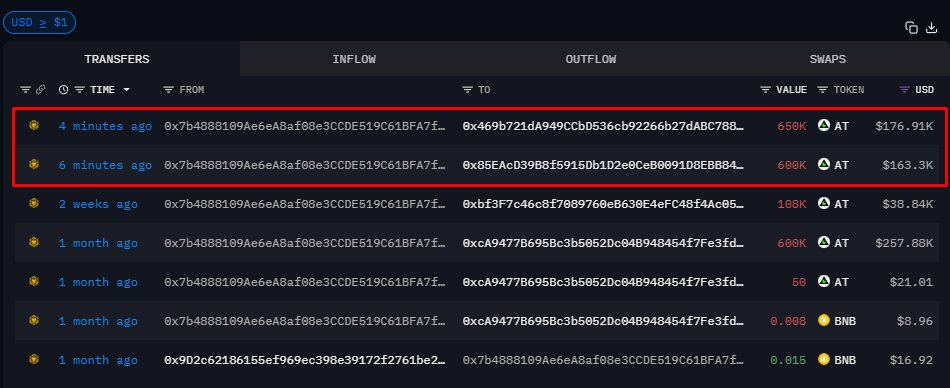

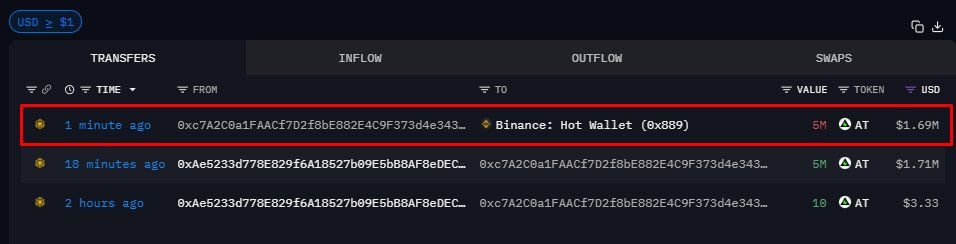

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain$AT MOVED TO FRESH WALLETS Just recently, $AT was transferred from the team wallet to two fresh wallets The total amount moved is $340K. There’s a high chance these tokens will be sent to exchanges soon Team wallet: 0x7b4888109Ae6eA8af08e3CCDE519C61BFA7f2380 Wallets that received the tokens: 0x469b721dA949CCbD536cb92266b27dABC78806E1 0x85EAcD39B8f5915Db1D2e0CeB0091D8EBB845b28

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

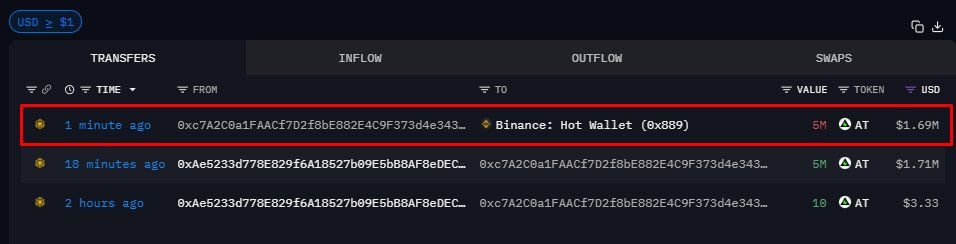

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain$AT TOKENS SENT TO BINANCE Recently, $AT was transferred from the team wallet to a newly created wallet, from which the tokens were already withdrawn to Binance The amount moved is $1.7M These tokens are potentially intended for providing liquidity on the exchange The token will soon be available for spot trading, so it’s important to watch how the price reacts If there are further transfers from team wallets, we will report them Wallet used for the transfer: 0xAe5233d778E829f6A18527b09E5bB8AF8eDECf35

6 0 1.93K Original >Trend of AT after releaseBullishThe AT token was moved from the team wallet to Binance, indicating an imminent listing for trading.

6 0 1.93K Original >Trend of AT after releaseBullishThe AT token was moved from the team wallet to Binance, indicating an imminent listing for trading. 机灵的杰尼君🔶BNB Trader Derivatives_Expert B100.56K @Meta8Mate

机灵的杰尼君🔶BNB Trader Derivatives_Expert B100.56K @Meta8MateCongratulations $AT is officially listed on Binance @binancezh today, but many didn't notice – the real starting point of $AT is @Aster_DEX. Now the Aster Rocket Launch selects Alpha tokens, essentially already becoming a forward base for “Binance Perps → Binance Spot”. • 10.24 Aster Spot & Perpetual launch • 10.24–11.06 Aster Rocket Launch continuous exposure • 10.29 Binance contract launch (BN Perps) • 11.27 Binance Spot officially lands (BN Spot) Do you get it? This path is very standard: Aster launch → Rocket Launch preheat → Binance contract verification → Binance Spot main stage. In one sentence: To judge whether a project has a chance to hit Binance, first look at its performance on Aster; Aster is essentially acting as a Binance on-chain. *** This tweet does not constitute any investment advice, DYOR

93 35 89.79K Original >Trend of AT after releaseExtremely BullishAT successfully listed on Binance, and the massive trading volume on the Aster platform signals its potential.

93 35 89.79K Original >Trend of AT after releaseExtremely BullishAT successfully listed on Binance, and the massive trading volume on the Aster platform signals its potential. onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain$AT TOKENS SENT TO BINANCE Recently, $AT was transferred from the team wallet to a newly created wallet, from which the tokens were already withdrawn to Binance The amount moved is $1.7M These tokens are potentially intended for providing liquidity on the exchange The token will soon be available for spot trading, so it’s important to watch how the price reacts If there are further transfers from team wallets, we will report them Wallet used for the transfer: 0xAe5233d778E829f6A18527b09E5bB8AF8eDECf35

12 0 3.76K Original >Trend of AT after releaseBullishThe AT token was moved from the team wallet to Binance, indicating an imminent listing for trading.

12 0 3.76K Original >Trend of AT after releaseBullishThe AT token was moved from the team wallet to Binance, indicating an imminent listing for trading. Blog Tiền Ảo Media OnChain_Analyst B6.51K @blogtienao_hq

Blog Tiền Ảo Media OnChain_Analyst B6.51K @blogtienao_hq#Binance announces the 59th project on the HODLer Airdrop – APRO ($AT), an oracle data protocol providing real information to blockchain networks. Users who stake $BNB for Simple Earn and/or On-Chain Yields from 07:00 ngày 04/11 to 06:59 ngày 07/11 will receive the $AT airdrop. #Binance will then list $AT at 21:00 ngày 27/11 (VN time) and open trading pairs with $USDT, $USDC, $BNB and $TRY.

6 0 273 Original >Trend of AT after releaseBullishBinance announces the 59th HODLer airdrop project APRO ($AT), and BNB stakers are eligible for the airdrop and upcoming listing.

6 0 273 Original >Trend of AT after releaseBullishBinance announces the 59th HODLer airdrop project APRO ($AT), and BNB stakers are eligible for the airdrop and upcoming listing. 0xCrypto巫师💢 Influencer Educator A38.67K @Cryptowushi

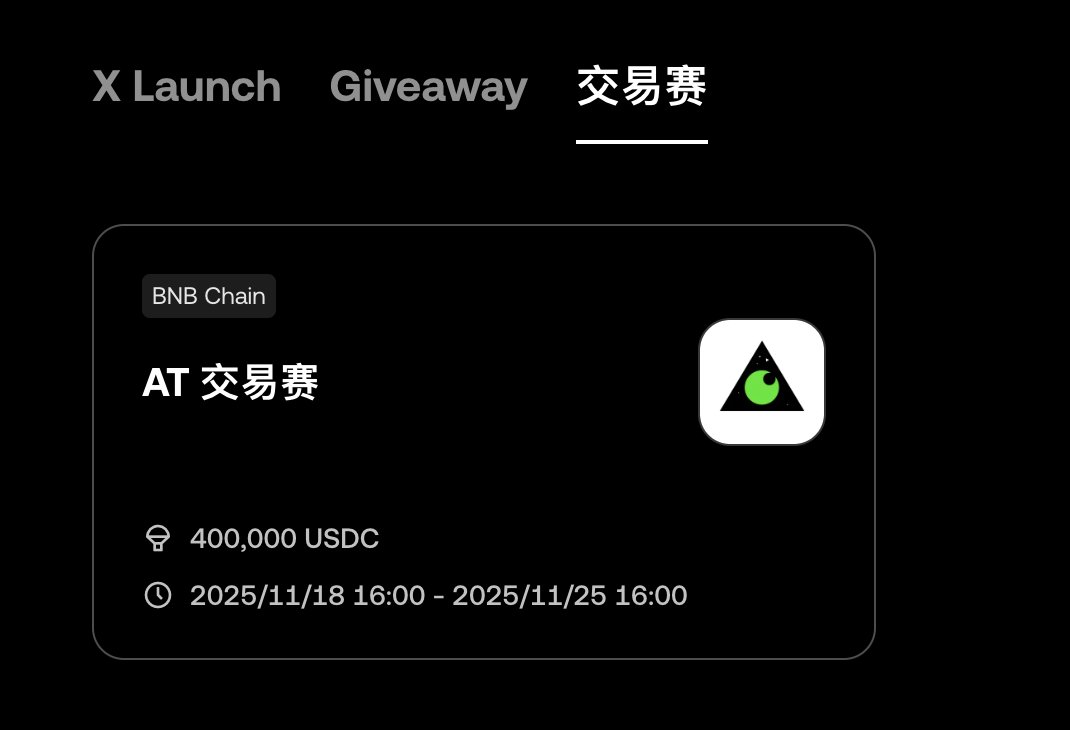

0xCrypto巫师💢 Influencer Educator A38.67K @CryptowushiIf you're currently using OKX Boost, consider combining it with the $AT trading competition The listed rewards can offset the points wear (similar to the Alpha trading competition) This should be the best cost-performance ratio The top five thousand participants all receive USDC The prize pool is 400,000 USDC, which is 100,000 more than the last $COAI If you only want a safety net, for example brushing 15,000, you'll lose about a hundred-plus oil The reward is fifty oil, which means you only spend a little over sixty oil to generate a 15,000 × 105 trading volume, firmly in the 3.5 tier. Much more cost-effective than pure brushing. Currently, the minimum listed trading volume is around 4,000!

54 44 10.96K Original >Trend of AT after releaseBullishCombining OKX Boost with the AT trading competition offers a high cost-performance way to earn USDC rewards; participation is recommended.

54 44 10.96K Original >Trend of AT after releaseBullishCombining OKX Boost with the AT trading competition offers a high cost-performance way to earn USDC rewards; participation is recommended. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

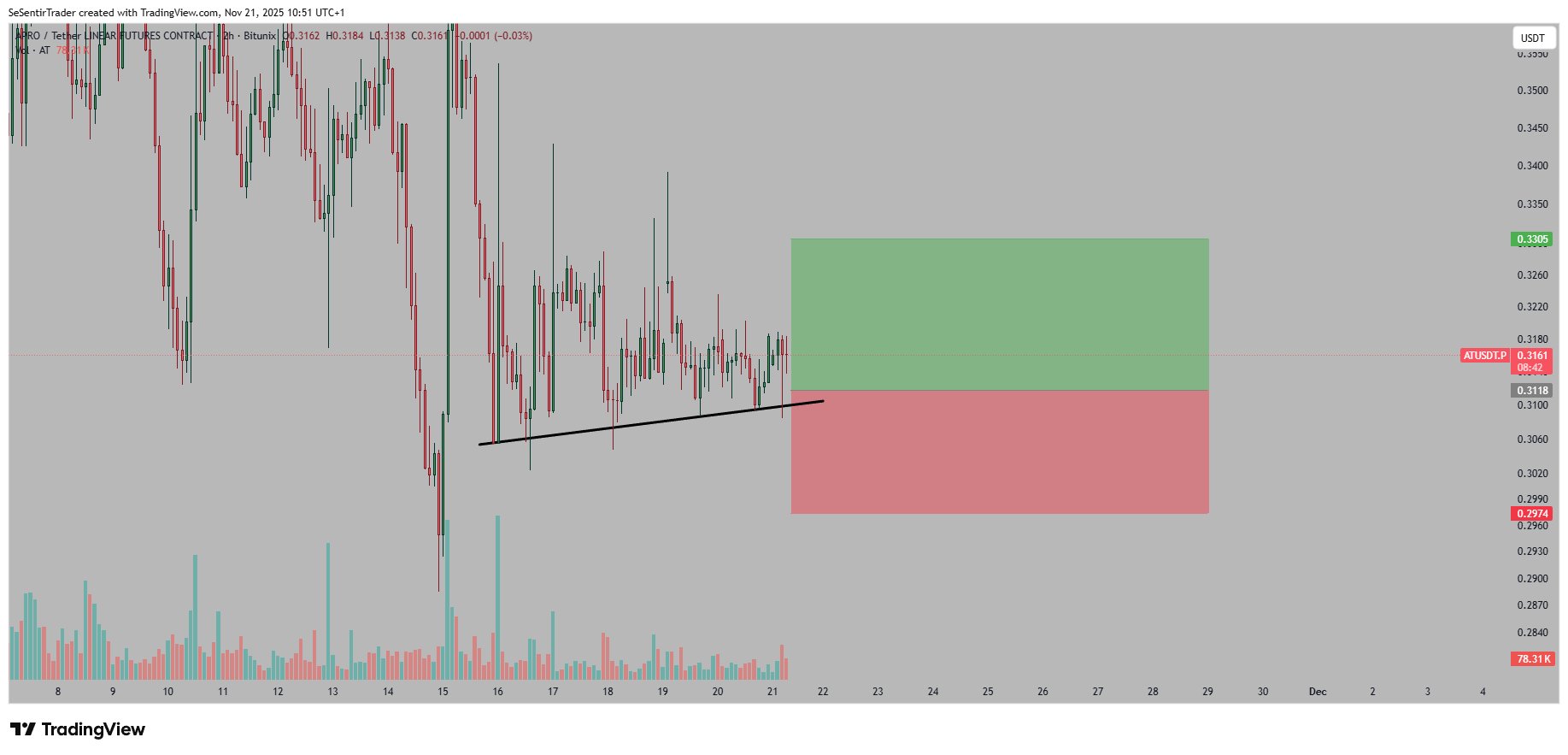

Tryrex Trader TA_Analyst S21.29K @TryrexcryptoGood morning. Long cancelled

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

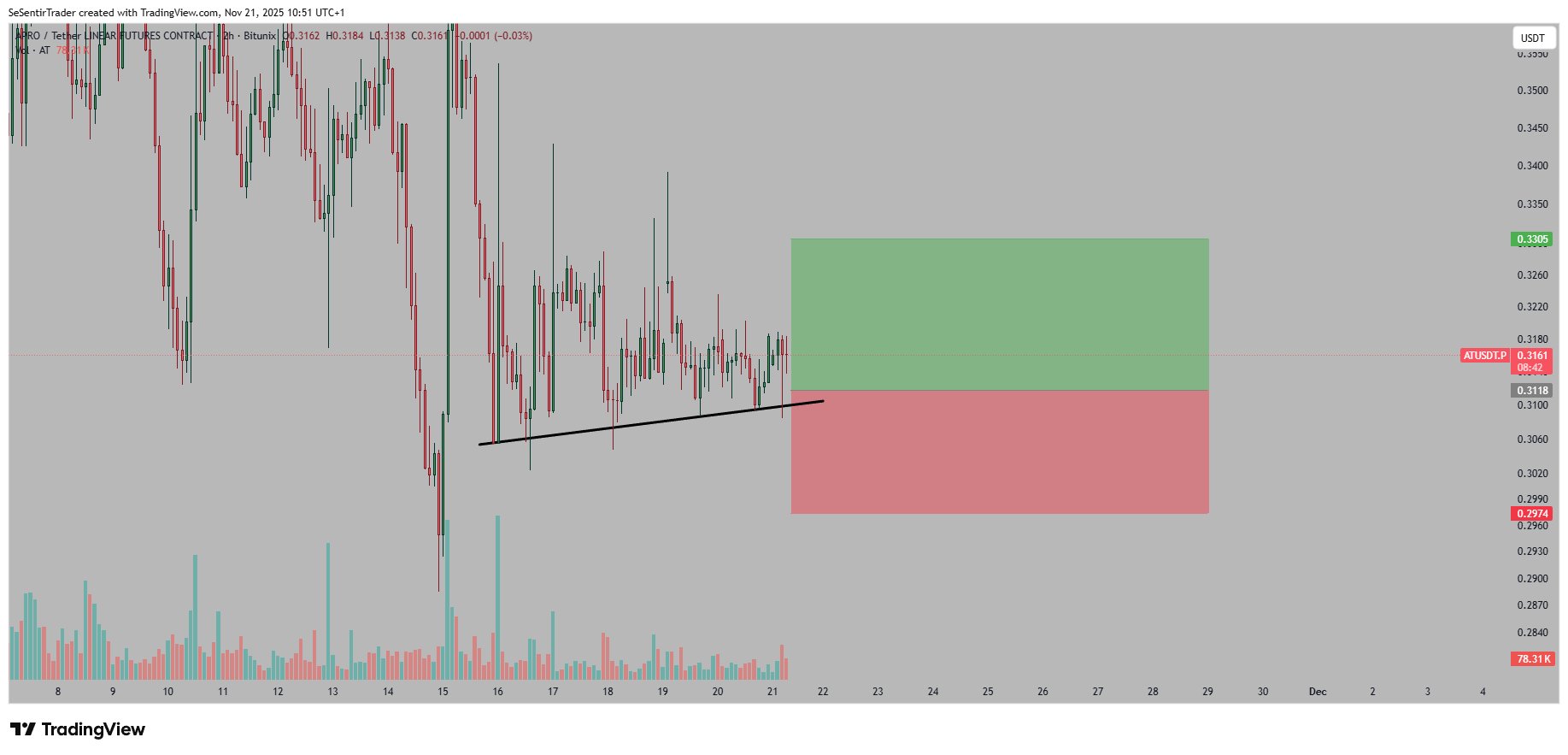

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto🟩🟩 AT LIMIT LONG TRADE 🟩🟩 $AT is one of the rare coins that's been holding well through this dip. Will long the bottom of this structure, hoping we can get a quick wick up or a decent bounce. ENTRY: 0.3118 STOP-LOSS: 0.2974 TAKE PROFITS: 0.3305 Leverage: 20X

27 13 4.45K Original >Trend of AT after releaseBullishThe author plans to go long AT, expecting a rebound, and provides detailed entry, stop loss, and take profit levels.

27 13 4.45K Original >Trend of AT after releaseBullishThe author plans to go long AT, expecting a rebound, and provides detailed entry, stop loss, and take profit levels. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto🟩🟩 AT LIMIT LONG TRADE 🟩🟩 $AT is one of the rare coins that's been holding well through this dip. Will long the bottom of this structure, hoping we can get a quick wick up or a decent bounce. ENTRY: 0.3118 STOP-LOSS: 0.2974 TAKE PROFITS: 0.3305 Leverage: 20X

35 10 8.34K Original >Trend of AT after releaseBullishThe author plans to go long AT, expecting a rebound, and provides detailed entry, stop loss, and take profit levels.

35 10 8.34K Original >Trend of AT after releaseBullishThe author plans to go long AT, expecting a rebound, and provides detailed entry, stop loss, and take profit levels.