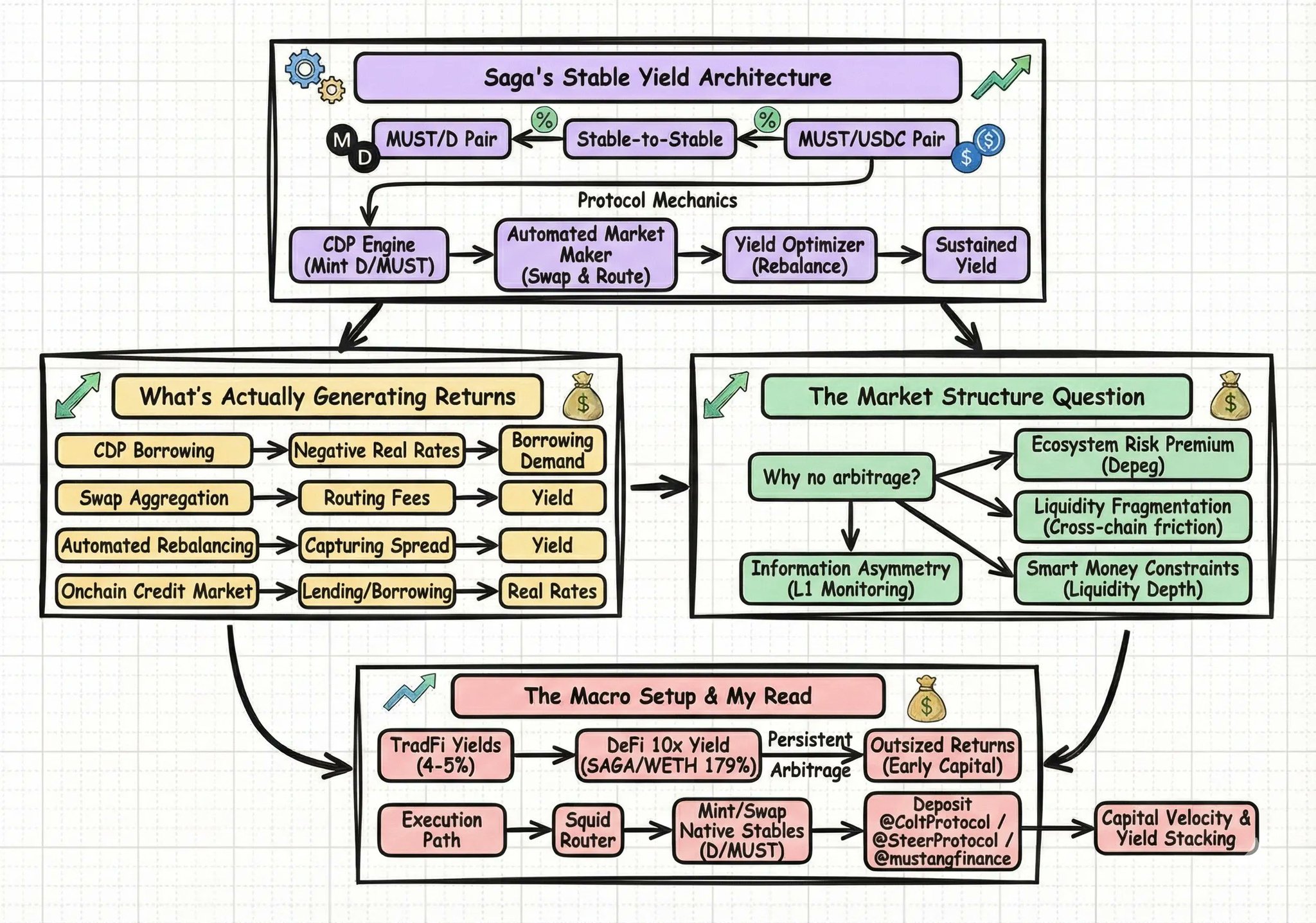

saga's stable yield architecture reveals structural inefficiencies across defi that nobody's arbitraging

75% APR on MUST/D stable-to-stable pairs

69% on MUST/USDC

36% on D/USD

these aren't promotional rates, they're sustained by actual protocol mechanics

the delta between saga's stable yields and base-layer lending (aave 5%, compound 4%) represents either mispricing or unrecognized risk. likely both

what's actually generating returns:

> CDP borrowing demand creates negative real rates for borrowers who pay to access leverage.

> liquidity routing fees from swap aggregation.

> automated rebalancing capturing spread.

> real credit market dynamics onchain

$D and $MUST are collateralized mechanisms designed for composability within saga's stack. the stable-to-stable pairing eliminates impermanent loss while capturing yield from orthogonal sources, borrowing fees not trading volume

this is fundamentally different from curve's model where stable yields come from CRV emissions (declining) or convex flywheel (ex