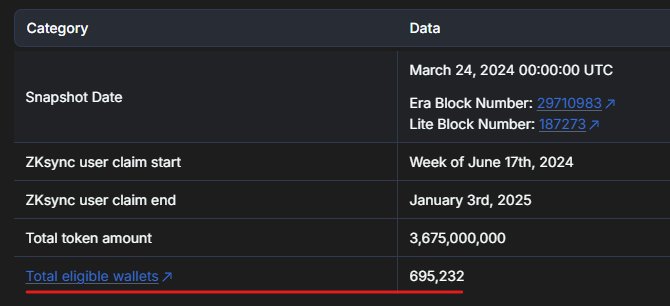

ZKsync (ZK)

ZKsync (ZK)

$0.02179 -6.12% 24H

- 42Social Sentiment Index (SSI)+22.53% (24h)

- #79Marktimpuls-Ranking (MPR)+10

- 224-St. in Social Media+100.00% (24h)

- 50%24 Std-Bullisch-Verhältnis2 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt42SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungBullisch (50%)Neutral (50%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

MadMaxx (∎, ∆) Community_Lead Influencer C13.55K @MadMaxx_eth

MadMaxx (∎, ∆) Community_Lead Influencer C13.55K @MadMaxx_eth CZ 🔶 BNB Founder Influencer C10.69M @cz_binance25 1 746 Original >Trend von ZK nach VeröffentlichungBullisch

CZ 🔶 BNB Founder Influencer C10.69M @cz_binance25 1 746 Original >Trend von ZK nach VeröffentlichungBullisch O.N.Y.E.M.A🕵🏽♂️ Community_Lead DeFi_Expert B5.41K @ioDeFi

O.N.Y.E.M.A🕵🏽♂️ Community_Lead DeFi_Expert B5.41K @ioDeFi KalqiX D1.05K @kalqix

KalqiX D1.05K @kalqix 20 8 179 Original >Trend von ZK nach VeröffentlichungNeutral

20 8 179 Original >Trend von ZK nach VeröffentlichungNeutral f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH Uma Roy D23.72K @pumatheuma236 32 16.98K Original >Trend von ZK nach VeröffentlichungBullisch

Uma Roy D23.72K @pumatheuma236 32 16.98K Original >Trend von ZK nach VeröffentlichungBullisch Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u 15 4 533 Original >Trend von ZK nach VeröffentlichungExtrem bullisch

15 4 533 Original >Trend von ZK nach VeröffentlichungExtrem bullisch VietnamPenguin Tokenomics_Expert Derivatives_Expert A2.43K @VietnamPenguin

VietnamPenguin Tokenomics_Expert Derivatives_Expert A2.43K @VietnamPenguin

ZKsync Founder Regulatory_Expert D1.48M @zksync2 2 459 Original >Trend von ZK nach VeröffentlichungBärisch

ZKsync Founder Regulatory_Expert D1.48M @zksync2 2 459 Original >Trend von ZK nach VeröffentlichungBärisch ManLy FA_Analyst OnChain_Analyst B95.44K @ManLyNFT

ManLy FA_Analyst OnChain_Analyst B95.44K @ManLyNFT

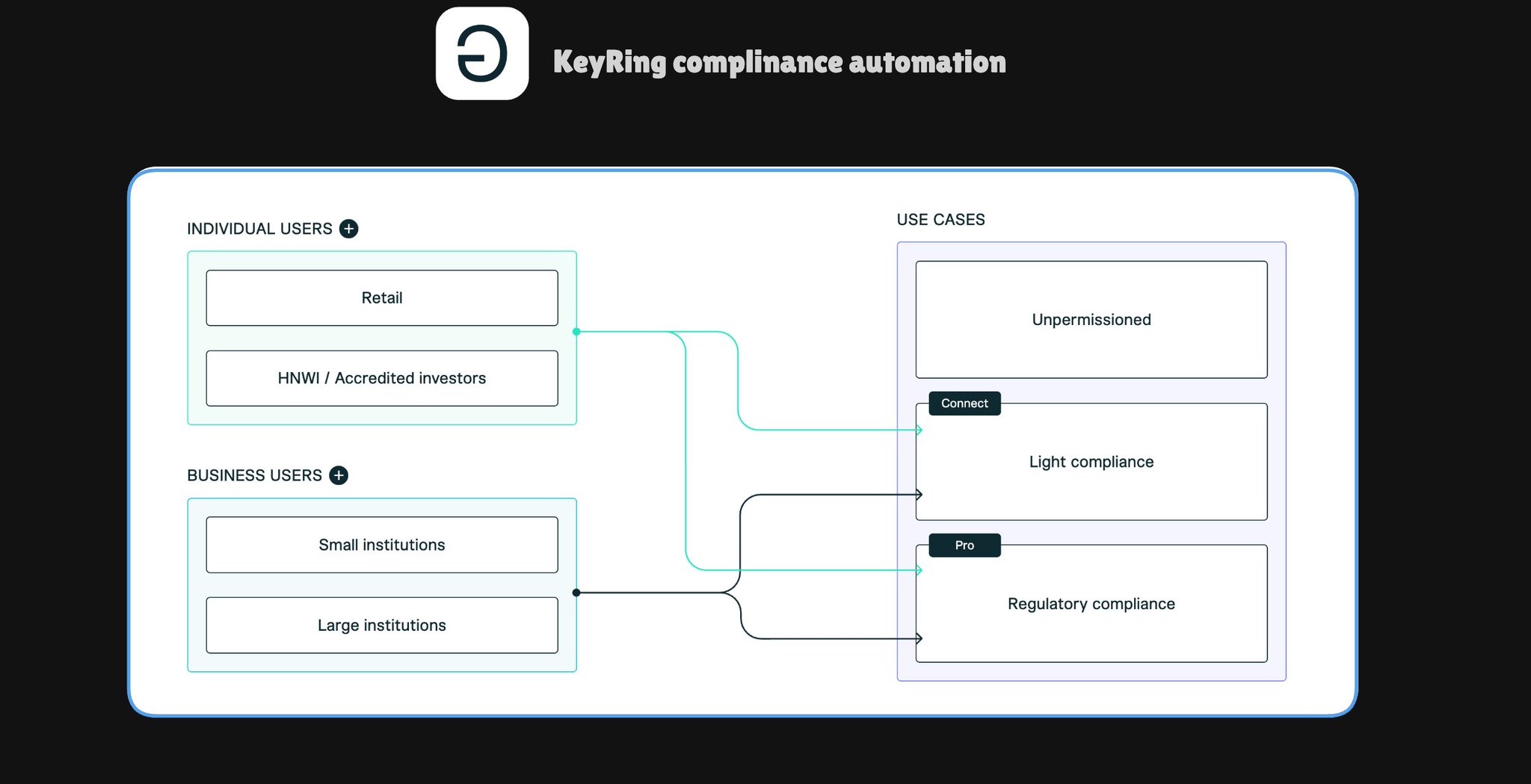

Keyring Research D1.17K @KeyringResearch228 55 10.60K Original >Trend von ZK nach VeröffentlichungExtrem bullisch

Keyring Research D1.17K @KeyringResearch228 55 10.60K Original >Trend von ZK nach VeröffentlichungExtrem bullisch Haris Ebrat OnChain_Analyst Influencer S12.29K @HarisEbrat

Haris Ebrat OnChain_Analyst Influencer S12.29K @HarisEbrat

Keyring Research D1.17K @KeyringResearch56 35 4.09K Original >Trend von ZK nach VeröffentlichungExtrem bullisch

Keyring Research D1.17K @KeyringResearch56 35 4.09K Original >Trend von ZK nach VeröffentlichungExtrem bullisch t0xic 🧪 DeFi_Expert Influencer B15.90K @amit0xic

t0xic 🧪 DeFi_Expert Influencer B15.90K @amit0xic

Keyring Research D1.17K @KeyringResearch76 35 2.60K Original >Trend von ZK nach VeröffentlichungBullisch

Keyring Research D1.17K @KeyringResearch76 35 2.60K Original >Trend von ZK nach VeröffentlichungBullisch Praetor OnChain_Analyst Educator S5.99K @FourVork

Praetor OnChain_Analyst Educator S5.99K @FourVork Neutize (ZK arc) D1.40K @neutize

Neutize (ZK arc) D1.40K @neutize 52 10 4.16K Original >Trend von ZK nach VeröffentlichungExtrem bullisch

52 10 4.16K Original >Trend von ZK nach VeröffentlichungExtrem bullisch Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

Keyring Research D1.17K @KeyringResearch15 4 533 Original >Trend von ZK nach VeröffentlichungExtrem bullisch

Keyring Research D1.17K @KeyringResearch15 4 533 Original >Trend von ZK nach VeröffentlichungExtrem bullisch