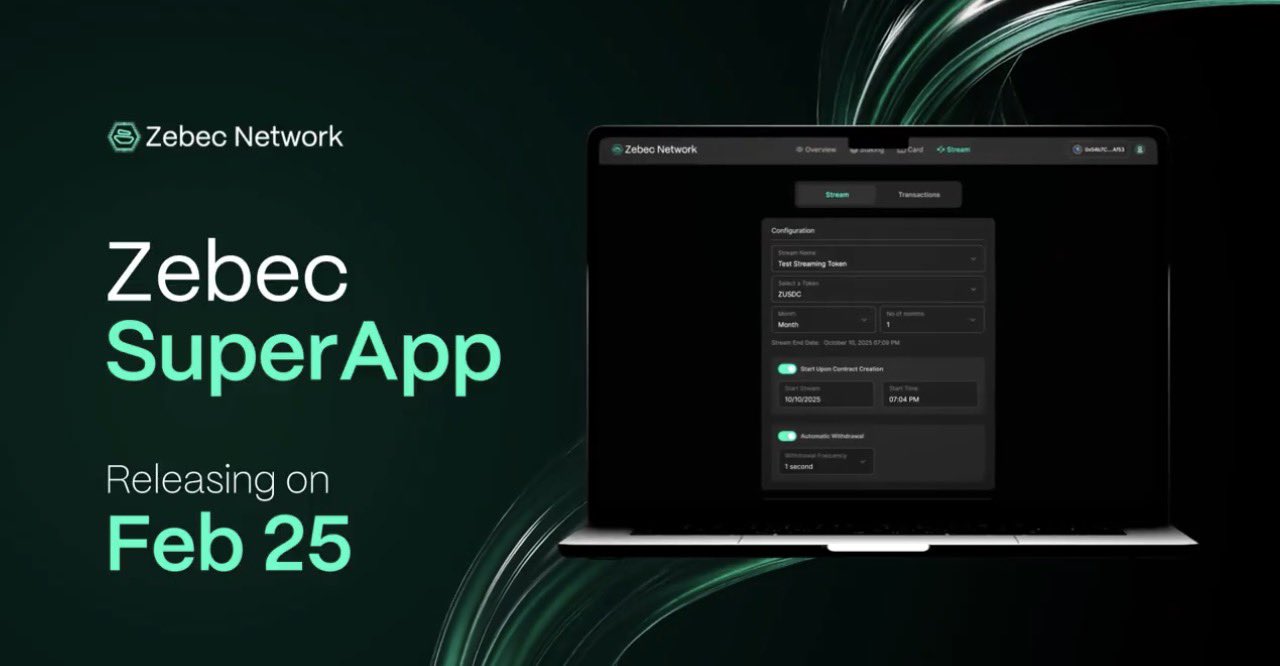

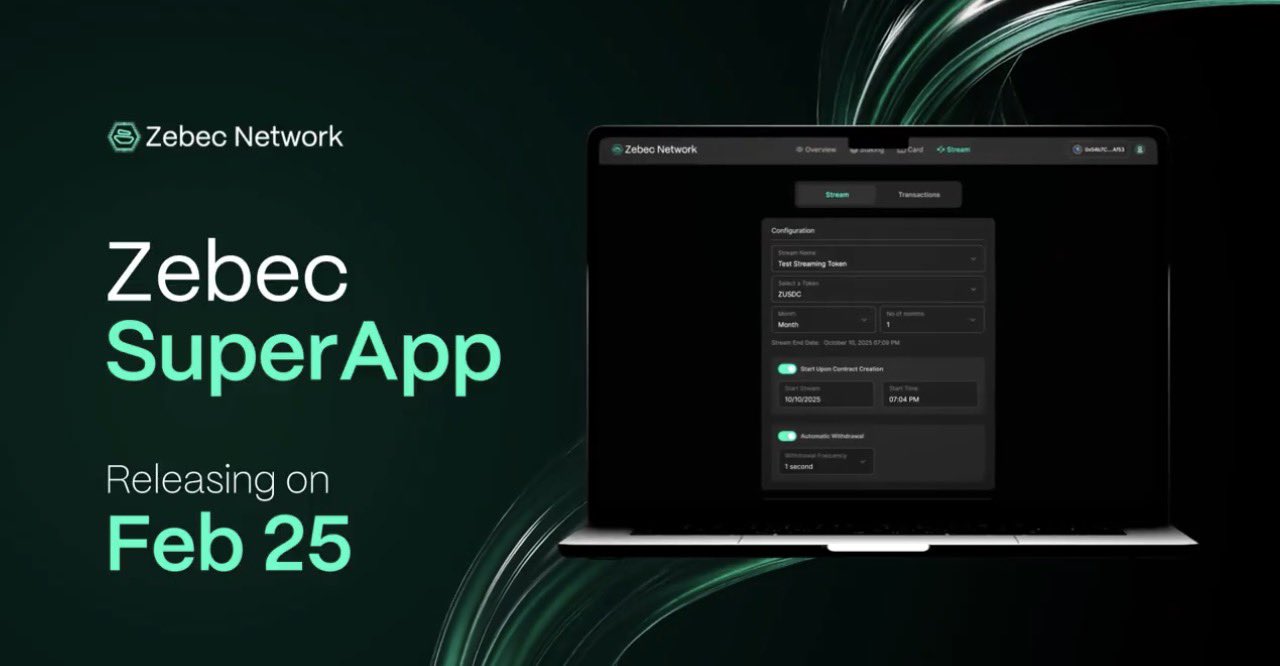

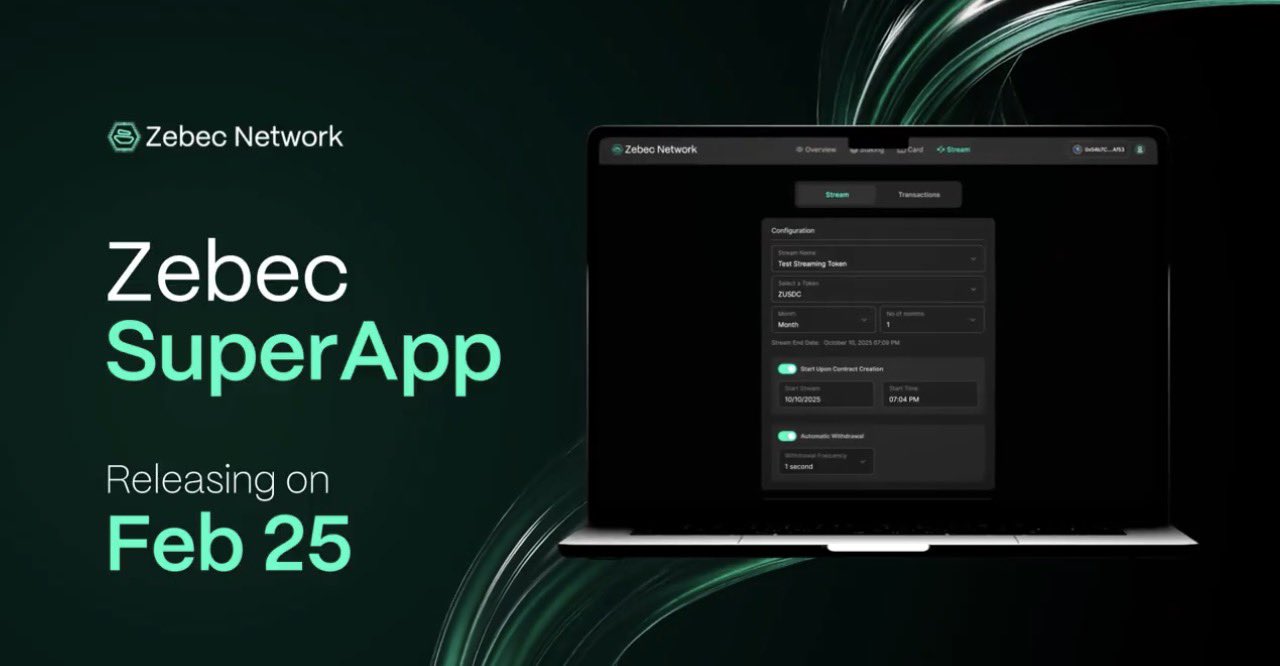

Zebec Network (ZBCN)

Zebec Network (ZBCN)

$0.002070 -5.82% 24H

- 55Social Sentiment Index (SSI)-12.42% (24h)

- #47Marktimpuls-Ranking (MPR)+7

- 224-St. in Social Media-50.00% (24h)

- 100%24 Std-Bullisch-Verhältnis1 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt55SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungBullisch (100%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

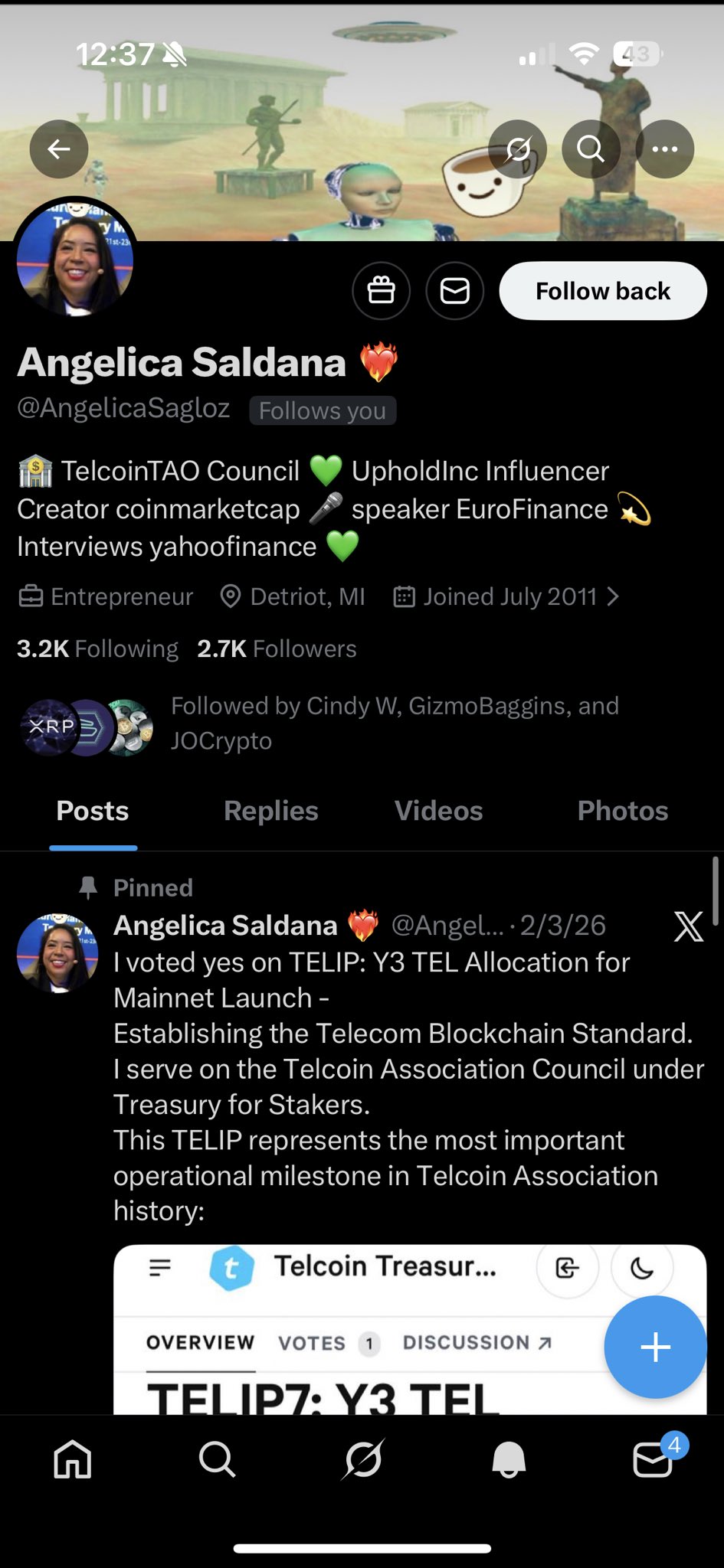

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH ZBCN Arc 🟩 D47 @TONEOFMANY8 0 766 Original >Trend von ZBCN nach VeröffentlichungBullisch

ZBCN Arc 🟩 D47 @TONEOFMANY8 0 766 Original >Trend von ZBCN nach VeröffentlichungBullisch- Trend von ZBCN nach VeröffentlichungBullisch

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH 311 6 8.73K Original >Trend von ZBCN nach VeröffentlichungExtrem bullisch

311 6 8.73K Original >Trend von ZBCN nach VeröffentlichungExtrem bullisch Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH 311 6 8.73K Original >Trend von ZBCN nach VeröffentlichungBullisch

311 6 8.73K Original >Trend von ZBCN nach VeröffentlichungBullisch Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH 311 6 8.73K Original >Trend von ZBCN nach VeröffentlichungBullisch

311 6 8.73K Original >Trend von ZBCN nach VeröffentlichungBullisch Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH THROBBING LANTERN D1.22K @XRPZBCNLANTERN

THROBBING LANTERN D1.22K @XRPZBCNLANTERN 6 2 593 Original >Trend von ZBCN nach VeröffentlichungExtrem bärisch

6 2 593 Original >Trend von ZBCN nach VeröffentlichungExtrem bärisch- Trend von ZBCN nach VeröffentlichungExtrem bullisch

CRYPTO FRONT TA_Analyst Trader S8.41K @cryptofrontio

CRYPTO FRONT TA_Analyst Trader S8.41K @cryptofrontio

CRYPTO FRONT TA_Analyst Trader S8.41K @cryptofrontio

CRYPTO FRONT TA_Analyst Trader S8.41K @cryptofrontio 1 0 531 Original >Trend von ZBCN nach VeröffentlichungBärisch

1 0 531 Original >Trend von ZBCN nach VeröffentlichungBärisch Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH149 7 4.51K Original >Trend von ZBCN nach VeröffentlichungBullisch

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH149 7 4.51K Original >Trend von ZBCN nach VeröffentlichungBullisch Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH

Angelica Saldaña S.T.B.❤️🔥 Influencer Community_Lead B23.05K @AngelofYHVH 314 Crypto D837 @off_cryptonian22 0 779 Original >Trend von ZBCN nach VeröffentlichungNeutral

314 Crypto D837 @off_cryptonian22 0 779 Original >Trend von ZBCN nach VeröffentlichungNeutral