USDC (USDC)

USDC (USDC)

$1.000004 +0.03% 24H

- 57Social Sentiment Index (SSI)-16.03% (24h)

- #97Marktimpuls-Ranking (MPR)-7

- 2224-St. in Social Media-37.14% (24h)

- 68%24 Std-Bullisch-Verhältnis19 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt57SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (18%)Bullisch (50%)Neutral (23%)Bärisch (9%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

riddler DeFi_Expert OnChain_Analyst B55.58K @RiddlerDeFi

riddler DeFi_Expert OnChain_Analyst B55.58K @RiddlerDeFi Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph 147 37 9.89K Original >Trend von USDC nach VeröffentlichungBullisch

147 37 9.89K Original >Trend von USDC nach VeröffentlichungBullisch- Trend von USDC nach VeröffentlichungNeutral

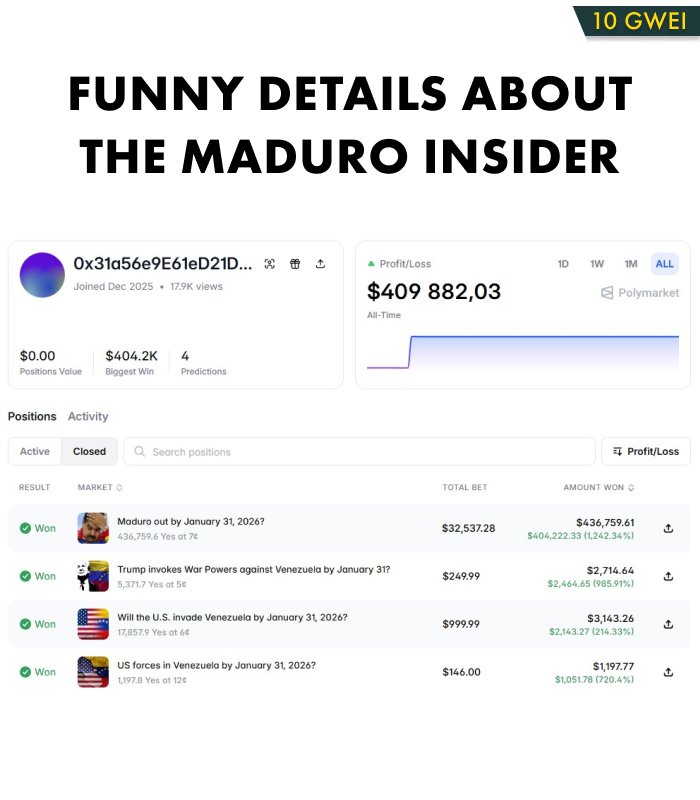

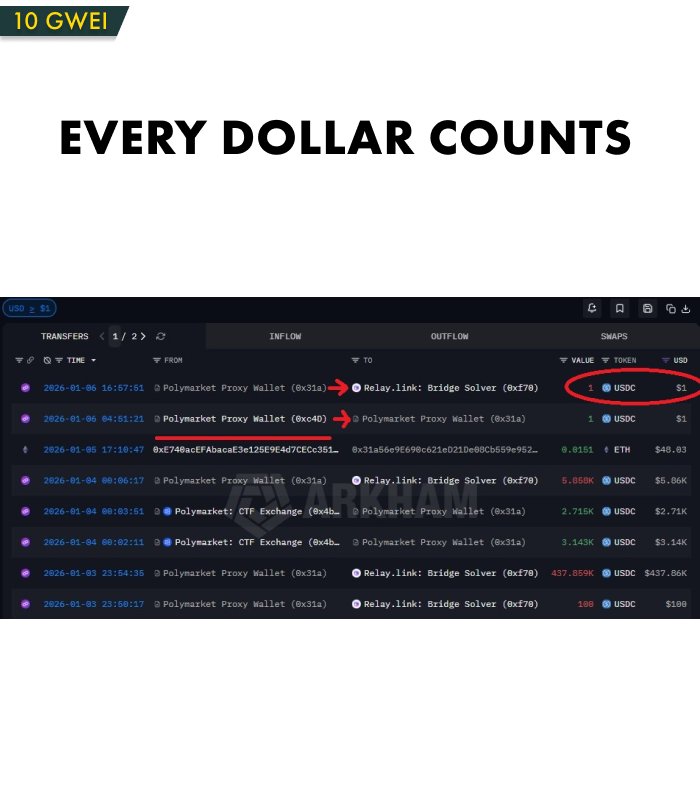

Andrew 10 GWEI OnChain_Analyst Influencer S6.06K @Andrey_10gwei

Andrew 10 GWEI OnChain_Analyst Influencer S6.06K @Andrey_10gwei Andrew 10 GWEI OnChain_Analyst Influencer S6.06K @Andrey_10gwei

Andrew 10 GWEI OnChain_Analyst Influencer S6.06K @Andrey_10gwei

91 27 10.88K Original >Trend von USDC nach VeröffentlichungNeutral

91 27 10.88K Original >Trend von USDC nach VeröffentlichungNeutral- Trend von USDC nach VeröffentlichungBullisch

- Trend von USDC nach VeröffentlichungBullisch

- Trend von USDC nach VeröffentlichungBullisch

Sandeep | CEO, Polygon Foundation (※,※) Founder Tokenomics_Expert C350.09K @sandeepnailwal

Sandeep | CEO, Polygon Foundation (※,※) Founder Tokenomics_Expert C350.09K @sandeepnailwal Marc | Polygon Labs (💜,⚔️, ※) D24.24K @0xMarcB129 15 5.52K Original >Trend von USDC nach VeröffentlichungNeutral

Marc | Polygon Labs (💜,⚔️, ※) D24.24K @0xMarcB129 15 5.52K Original >Trend von USDC nach VeröffentlichungNeutral CW OnChain_Analyst TA_Analyst B18.61K @CW8900

CW OnChain_Analyst TA_Analyst B18.61K @CW8900 Whale Alert D2.86M @whale_alert278 15 34.73K Original >Trend von USDC nach VeröffentlichungNeutral

Whale Alert D2.86M @whale_alert278 15 34.73K Original >Trend von USDC nach VeröffentlichungNeutral gum DeFi_Expert Tokenomics_Expert A64.47K @0xGumshoe

gum DeFi_Expert Tokenomics_Expert A64.47K @0xGumshoe Whale Alert D2.86M @whale_alert138 8 8.59K Original >Trend von USDC nach VeröffentlichungNeutral

Whale Alert D2.86M @whale_alert138 8 8.59K Original >Trend von USDC nach VeröffentlichungNeutral Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA 30 17 1.57K Original >Trend von USDC nach VeröffentlichungExtrem bullisch

30 17 1.57K Original >Trend von USDC nach VeröffentlichungExtrem bullisch