Sei Network (SEI)

Sei Network (SEI)

$0.0745 -4.73% 24H

- 42Social Sentiment Index (SSI)-31.23% (24h)

- #119Marktimpuls-Ranking (MPR)-64

- 724-St. in Social Media-41.67% (24h)

- 85%24 Std-Bullisch-Verhältnis7 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt42SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (14%)Bullisch (71%)Bärisch (15%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

- Trend von SEI nach VeröffentlichungBullisch

- Trend von SEI nach VeröffentlichungExtrem bullisch

Gilmo FA_Analyst OnChain_Analyst B15.30K @0xgilllee

Gilmo FA_Analyst OnChain_Analyst B15.30K @0xgilllee Sei Media Community_Lead C780.46K @SeiNetwork206 30 4.60K Original >Trend von SEI nach VeröffentlichungBullisch

Sei Media Community_Lead C780.46K @SeiNetwork206 30 4.60K Original >Trend von SEI nach VeröffentlichungBullisch- Trend von SEI nach VeröffentlichungBullisch

- Trend von SEI nach VeröffentlichungBullisch

- Trend von SEI nach VeröffentlichungBullisch

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz 43 13 3.81K Original >Trend von SEI nach VeröffentlichungBärisch

43 13 3.81K Original >Trend von SEI nach VeröffentlichungBärisch Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork Sei Media Community_Lead C780.46K @SeiNetwork

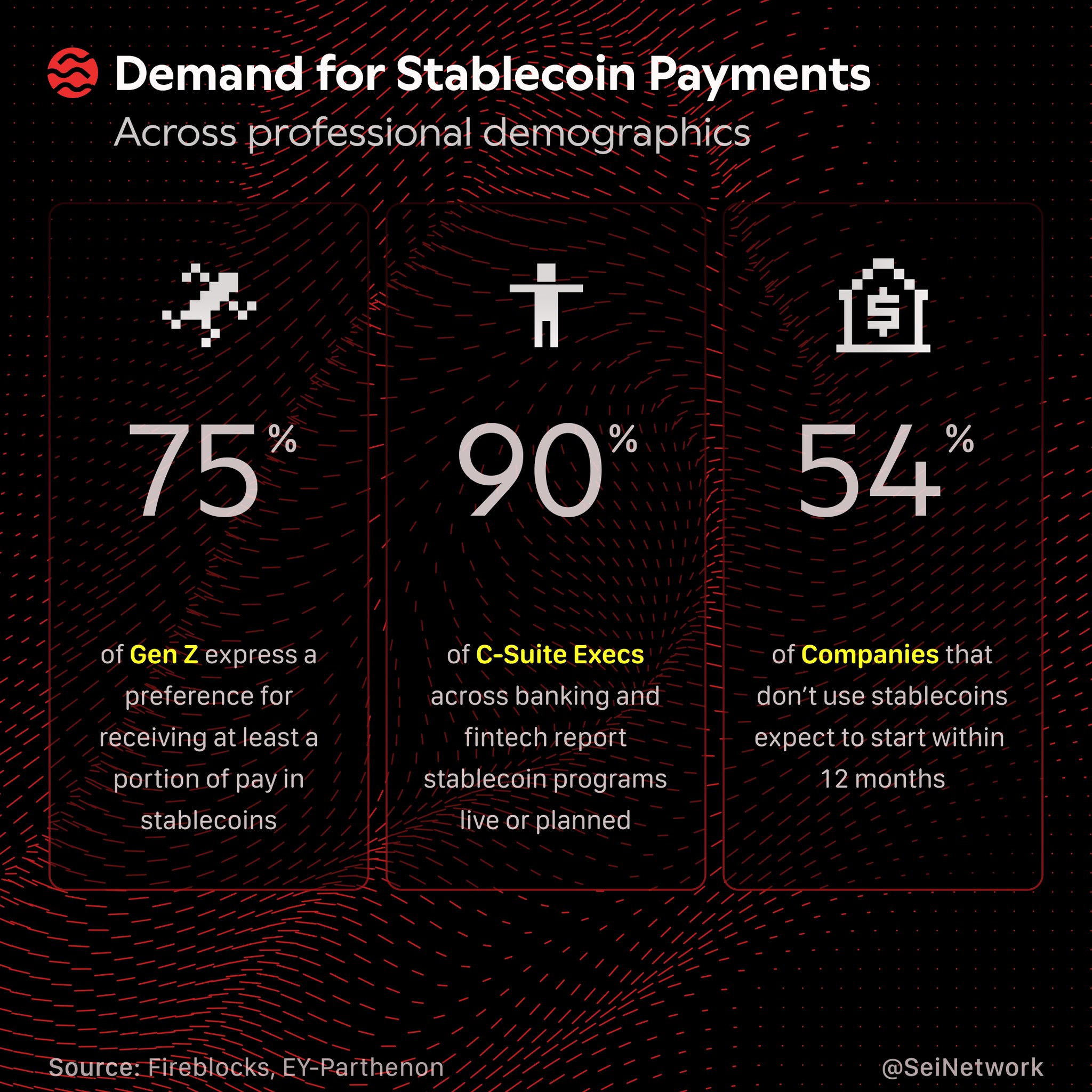

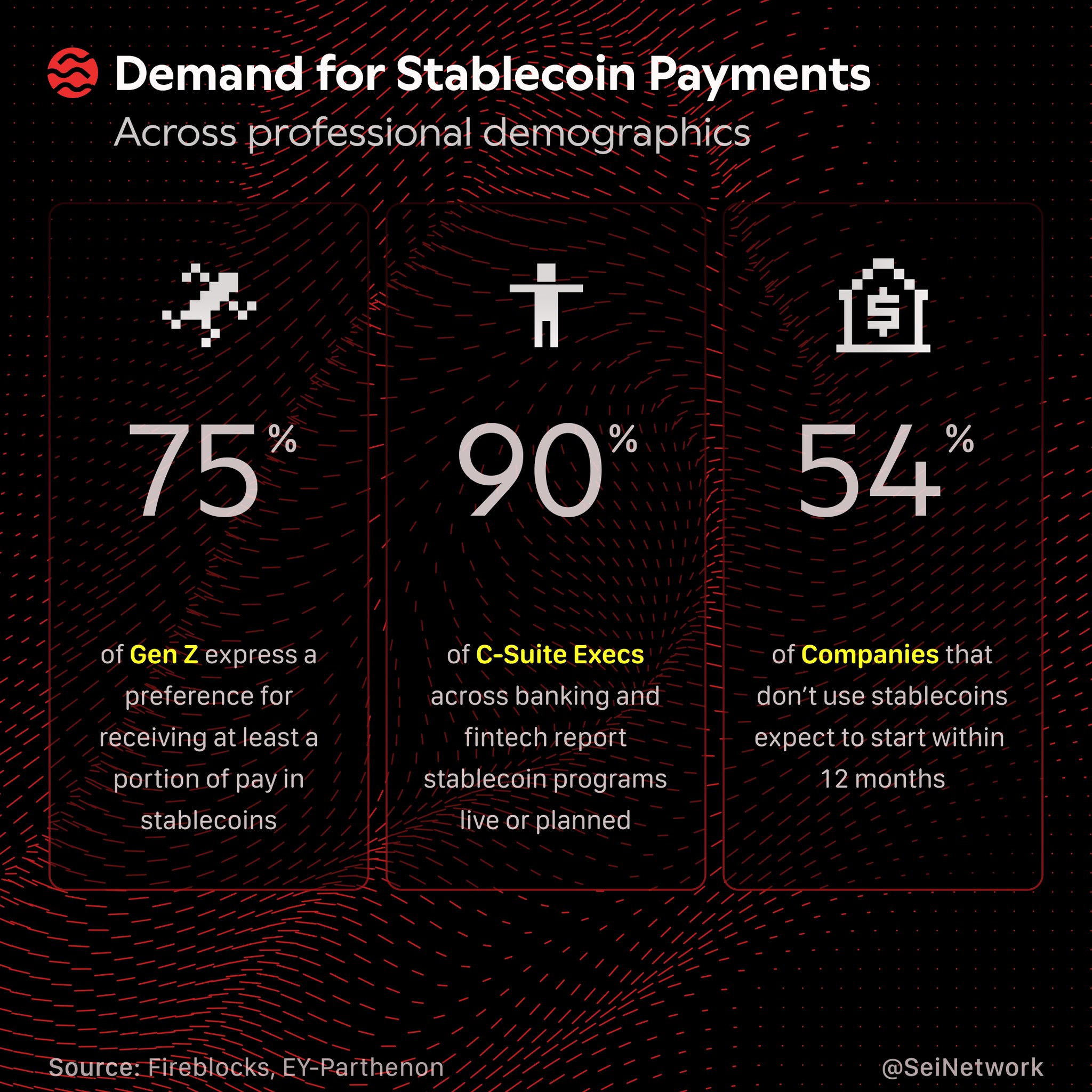

Sei Media Community_Lead C780.46K @SeiNetwork 403 36 11.16K Original >Trend von SEI nach VeröffentlichungExtrem bullisch

403 36 11.16K Original >Trend von SEI nach VeröffentlichungExtrem bullisch Nick Research Derivatives_Expert OnChain_Analyst S10.27K @Nick_Researcher

Nick Research Derivatives_Expert OnChain_Analyst S10.27K @Nick_Researcher Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork 403 36 11.16K Original >Trend von SEI nach VeröffentlichungExtrem bullisch

403 36 11.16K Original >Trend von SEI nach VeröffentlichungExtrem bullisch Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork Sei Media Community_Lead C780.46K @SeiNetwork449 30 34.25K Original >Trend von SEI nach VeröffentlichungBullisch

Sei Media Community_Lead C780.46K @SeiNetwork449 30 34.25K Original >Trend von SEI nach VeröffentlichungBullisch