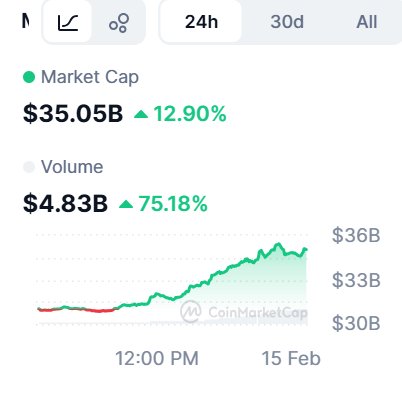

Memeland (MEME)

Memeland (MEME)

$0.000704 -8.45% 24H

- 71Social Sentiment Index (SSI)- (24h)

- #5Marktimpuls-Ranking (MPR)0

- 224-St. in Social Media- (24h)

- 100%24 Std-Bullisch-Verhältnis2 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt71SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (100%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

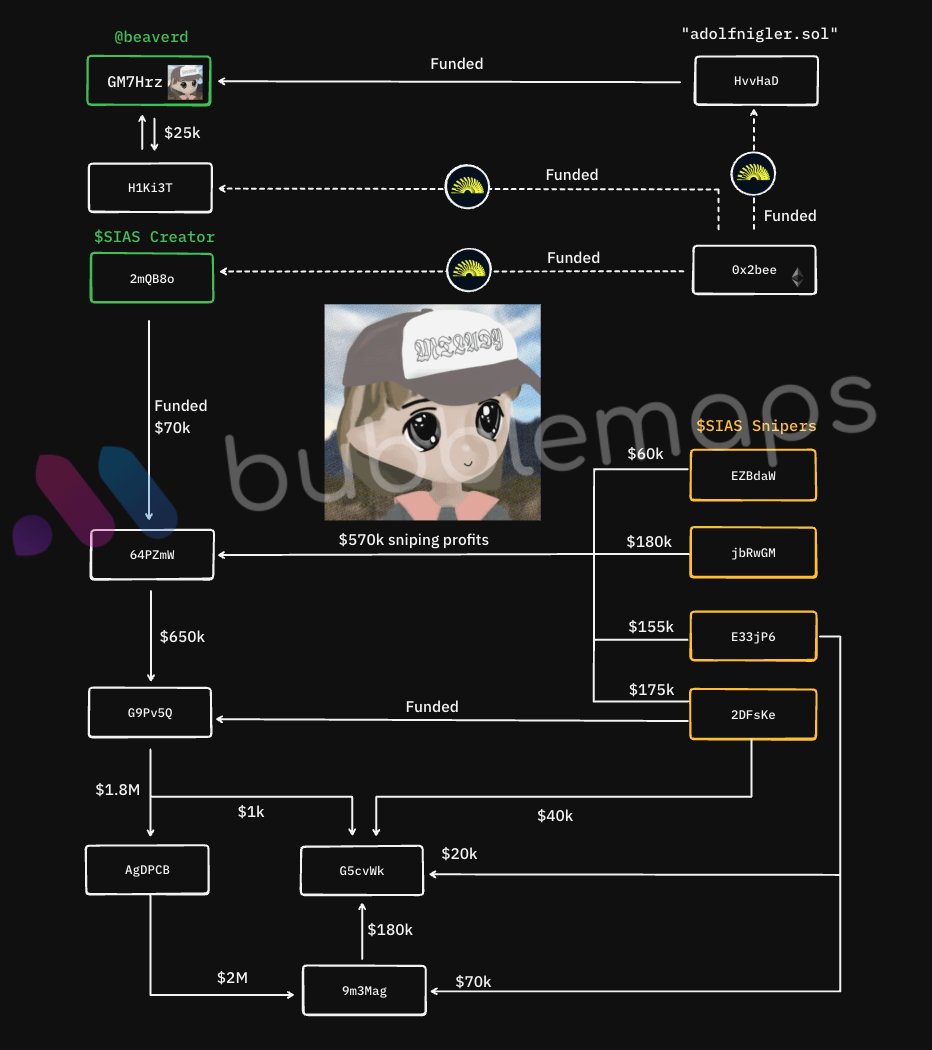

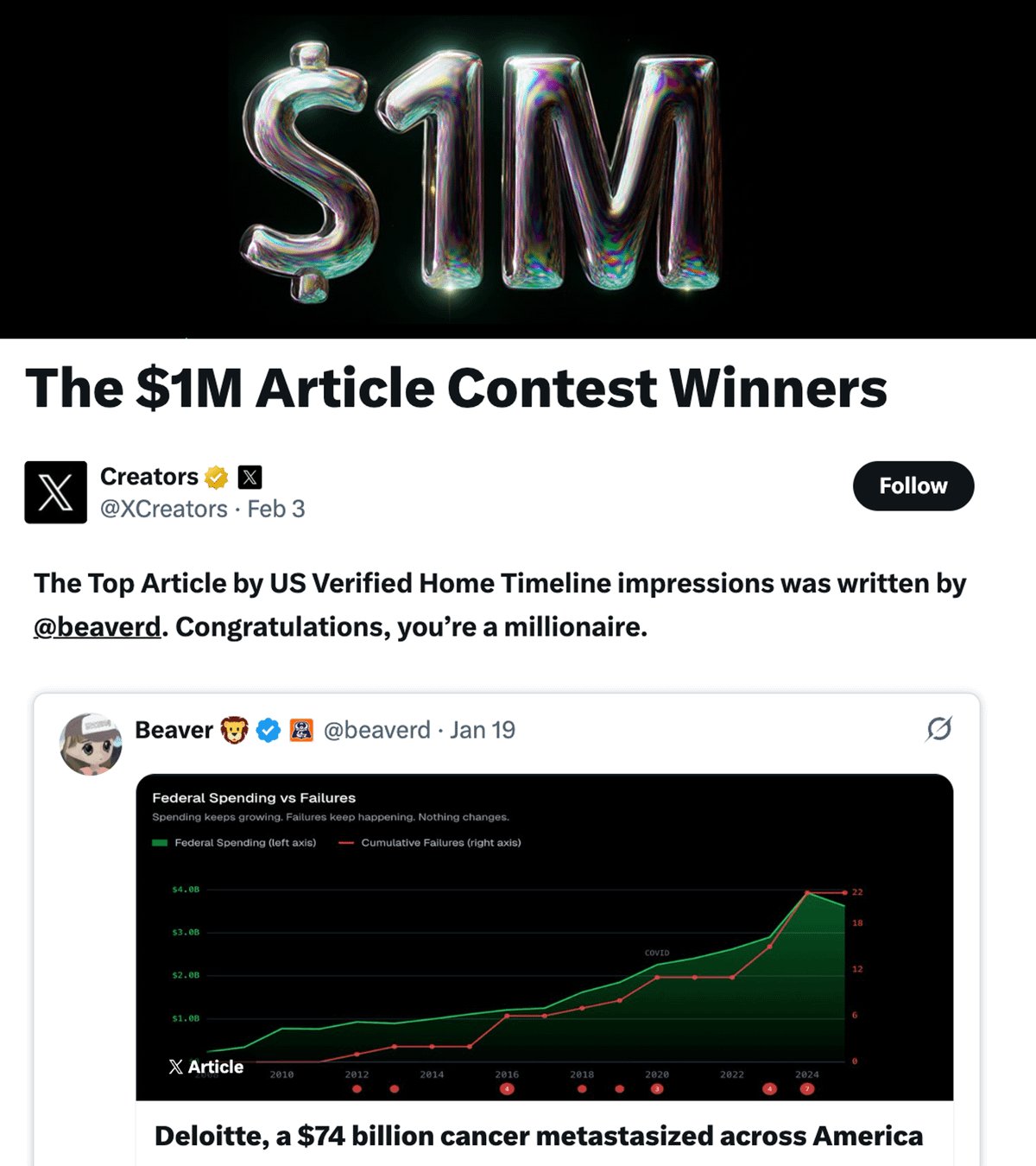

Anndy Lian FA_Analyst Influencer C193.54K @anndylian

Anndy Lian FA_Analyst Influencer C193.54K @anndylian Anndy Lian FA_Analyst Influencer C193.54K @anndylian

Anndy Lian FA_Analyst Influencer C193.54K @anndylian 134 39 6.09K Original >Trend von MEME nach VeröffentlichungExtrem bullisch

134 39 6.09K Original >Trend von MEME nach VeröffentlichungExtrem bullisch T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP Anndy Lian FA_Analyst Influencer C193.54K @anndylian

Anndy Lian FA_Analyst Influencer C193.54K @anndylian 0 0 156 Original >Trend von MEME nach VeröffentlichungExtrem bullisch

0 0 156 Original >Trend von MEME nach VeröffentlichungExtrem bullisch Adrien | CryptoSapiens OnChain_Analyst Educator S4.64K @_CryptoSapiens_

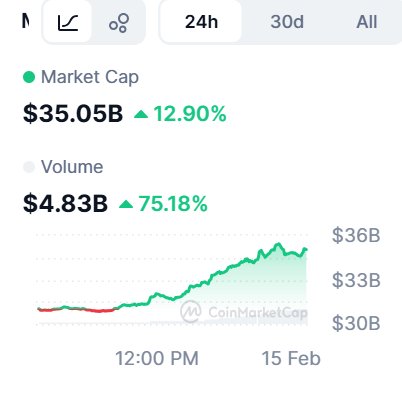

Adrien | CryptoSapiens OnChain_Analyst Educator S4.64K @_CryptoSapiens_ Bubblemaps OnChain_Analyst Influencer B277.98K @bubblemaps

Bubblemaps OnChain_Analyst Influencer B277.98K @bubblemaps

12 1 946 Original >Trend von MEME nach VeröffentlichungExtrem bärisch

12 1 946 Original >Trend von MEME nach VeröffentlichungExtrem bärisch AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 71 Original >Trend von MEME nach VeröffentlichungNeutral

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 71 Original >Trend von MEME nach VeröffentlichungNeutral AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 163 Original >Trend von MEME nach VeröffentlichungBärisch

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 163 Original >Trend von MEME nach VeröffentlichungBärisch TheoTrader 🏰 TA_Analyst Trader B108.50K @theo_crypto99

TheoTrader 🏰 TA_Analyst Trader B108.50K @theo_crypto99 Bags D22.49K @0xbags

Bags D22.49K @0xbags 1.64K 41 43.64K Original >Trend von MEME nach VeröffentlichungExtrem bärisch

1.64K 41 43.64K Original >Trend von MEME nach VeröffentlichungExtrem bärisch- Trend von MEME nach VeröffentlichungBullisch

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 120 Original >Trend von MEME nach VeröffentlichungBullisch

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 120 Original >Trend von MEME nach VeröffentlichungBullisch- Trend von MEME nach VeröffentlichungBärisch

- Trend von MEME nach VeröffentlichungBullisch