IOTA (IOTA)

IOTA (IOTA)

- 49Social Sentiment Index (SSI)-30.43% (24h)

- #136Marktimpuls-Ranking (MPR)-80

- 724-St. in Social Media-41.67% (24h)

- 86%24 Std-Bullisch-Verhältnis5 aktive Meinungsbildner

- ZusammenfassungIOTA shows supply chain collaboration, quantum resistance, and a surge in development, but price and hype are falling.

- Bullische Signale

- Seafood chain on-chain collaboration

- Quantum-resistant technology

- Development activity +1350%

- Positive interview exposure

- Logistics standards blue ocean

- Bärische Signale

- Price down 2.78%

- Social hype down 30%

- Limited ecosystem opportunities

- Highly competitive public chains

- Low interaction

Social Sentiment Index (SSI)

- Daten insgesamt49SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (29%)Bullisch (57%)Neutral (14%)SSI EinblickeIOTA社交热度低(49.14/100,-30.43%),活跃度降42.62%及KOL关注跌51.28%导致,仅情绪小幅上扬1.93%。

Marktimpuls-Ranking (MPR)

- WarnungseinblickIOTA预警排名跌至#136(↓80),社交异常与KOL转移均为0,情绪极化升5.59%,异常信号整体减弱。

Beiträge auf X

kowei.iota Community_Lead Educator B3.98K @kowei1995

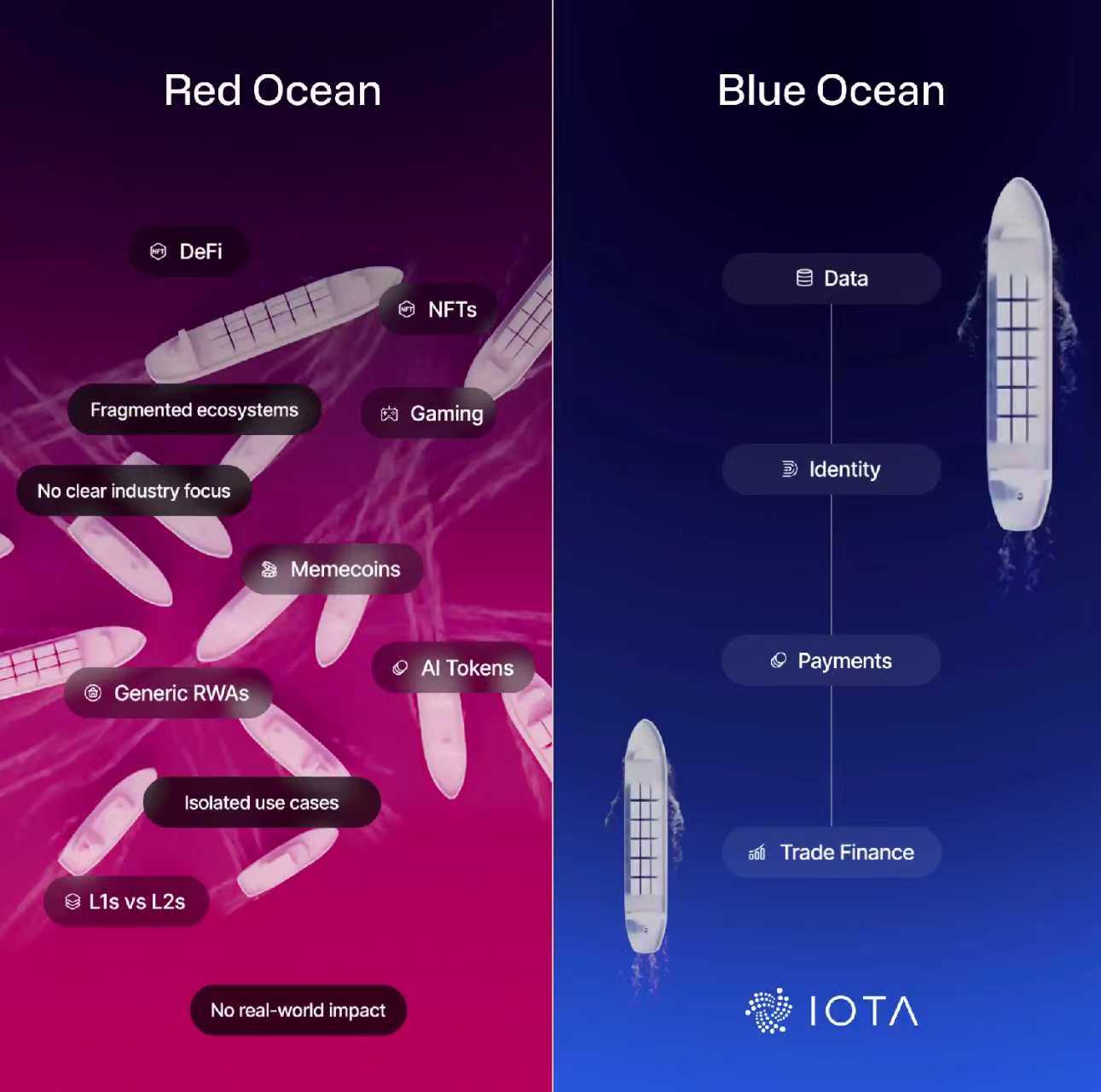

kowei.iota Community_Lead Educator B3.98K @kowei1995As the saying goes, first-tier companies sell standards, second-tier companies sell technology, third-tier companies sell products; the blockchain world is the same: IOTA's goal is to embed itself into the standards of cross-border trade logistics, which requires massive government trust to reach real-world applications today. Flowing water does not strive to be first; it strives to be relentless.

詹姆斯叉 | JamesX D44.45K @0xJamesXXX

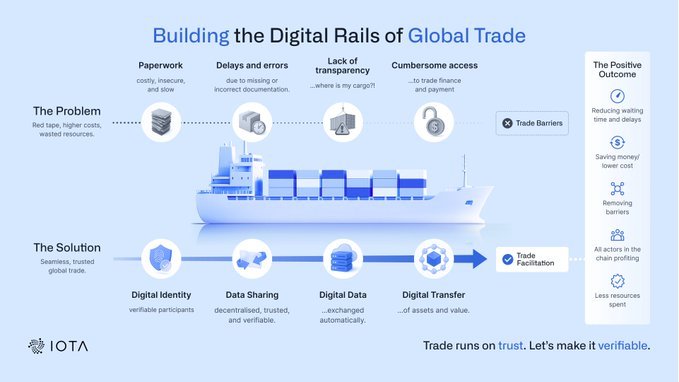

詹姆斯叉 | JamesX D44.45K @0xJamesXXXIn 2026, at this point of deep segmentation in the crypto market, we are witnessing a highly symbolic phenomenon— Projects that once survived on air narratives are gradually falling silent, while infrastructure that truly reaches the capillaries of the real economy is entering its "Age of Exploration" of thick accumulation and thin release. I have recently studied in depth the "On-Chain World Manifesto" released by @iota founder @DomSchiener, as well as the podcast in which veteran @Wuhuoqiu converses with the founder. I feel this is not just a project whitepaper, but a practical debrief of how blockchain can reconstruct global trade. I attempted to dissect, from the underlying business logic, how this decade-old infrastructure veteran carves out its own territory within the $35 trillion global trade market through vertical integration. 👇 This is a deep observation of pragmatic blockchain; I recommend friends interested in RWA and digital infrastructure read it carefully: TLDR; IOTA has chosen an extraordinarily difficult, time-consuming, yet deeply moated path. It does not chase short-term explosive myths; it pursues "non-substitutability". When 1% of global trade documents run digitally on IOTA, this network will transform from an experiment into an indispensable nervous system of the global economy. Kudos to the builders who eschew short-term noise and pioneer in the real economy. In 2026, we are at the great turning point where blockchain shifts from "toy" to "tool". 1️⃣ The origin of logic: why global trade? Not generic DeFi? The current L1 race is saturated; most public chains are locked in narrow internal loops, killing each other for existing liquidity. IOTA's brilliance lies in its "asymmetric competition" mindset. Global trade accounts for roughly 30% of global GDP, yet its underlying operating system is extremely ancient: Efficiency valley: Every day, 4 billion paper trade documents circulate worldwide; a simple cross-border order may involve 30 institutions and 240 copies. High friction: Trade-related administrative costs represent 20% of transaction volume; annual losses from forged documents reach tens of billions of dollars. Financing gap: SMEs face a $2.5 trillion financing shortfall because banks cannot transparently verify the authenticity of trade chains. IOTA does not chase Memecoin zero‑sum games; instead, by solving the above pain points, it directly taps into this blank field, ignored by traditional tech giants, yet highly dominant. 2️⃣ The power of neutrality: why IOTA succeeded while IBM failed? Many mention the IBM–Maersk partnership, but that project ultimately failed due to the lack of neutrality in its "private chain". Sovereign nations and multinational giants will never hand their lifelines to a private database controlled by competitors. IOTA positions itself as a "neutral, non‑profit, open‑source public ledger". This decentralized foundation equips it to become the "global digital public infrastructure"

3 0 32 Original >Trend von IOTA nach VeröffentlichungExtrem bullischIOTA focuses on digital infrastructure for global trade, pursuing a difficult yet deep-moat blue ocean path, with huge future potential.

3 0 32 Original >Trend von IOTA nach VeröffentlichungExtrem bullischIOTA focuses on digital infrastructure for global trade, pursuing a difficult yet deep-moat blue ocean path, with huge future potential. IOTA Community_Lead Media C294.42K @iota

IOTA Community_Lead Media C294.42K @iotaIOTA is connecting digital economies onchain. @TWINGlobalOrg proves this. TWIN enables trusted data sharing across global trade. Its updated whitepaper is out now, improving industry standards alignment and avoiding proprietary lock-in. Here’s how IOTA is evolving supply chains.

TWIN Foundation D2.34K @TWINGlobalOrg

TWIN Foundation D2.34K @TWINGlobalOrgThe 1.0 release of our Reference Architecture whitepaper cements TWIN as a neutral backbone for global trade. By leveraging open standards and decentralized trust built on @IOTA, it ensures transparency, data sovereignty, and seamless exchange across borders. ⤵️ https://t.co/0FMdcOwgHJ

40 0 800 Original >Trend von IOTA nach VeröffentlichungBullischIOTA releases an updated whitepaper through the TWIN project, empowering global trade data sharing and supply chain evolution.

40 0 800 Original >Trend von IOTA nach VeröffentlichungBullischIOTA releases an updated whitepaper through the TWIN project, empowering global trade data sharing and supply chain evolution. kowei.iota Community_Lead Educator B3.98K @kowei1995

kowei.iota Community_Lead Educator B3.98K @kowei1995IOTA believes that real‑world use cases and government partnership projects can build trust, making us proud of industry development; cross‑border trade and logistics naturally require massive coordination, which is a blue‑sea opportunity suitable for blockchain.

解构师 Beyond D41.09K @0xBeyondLee

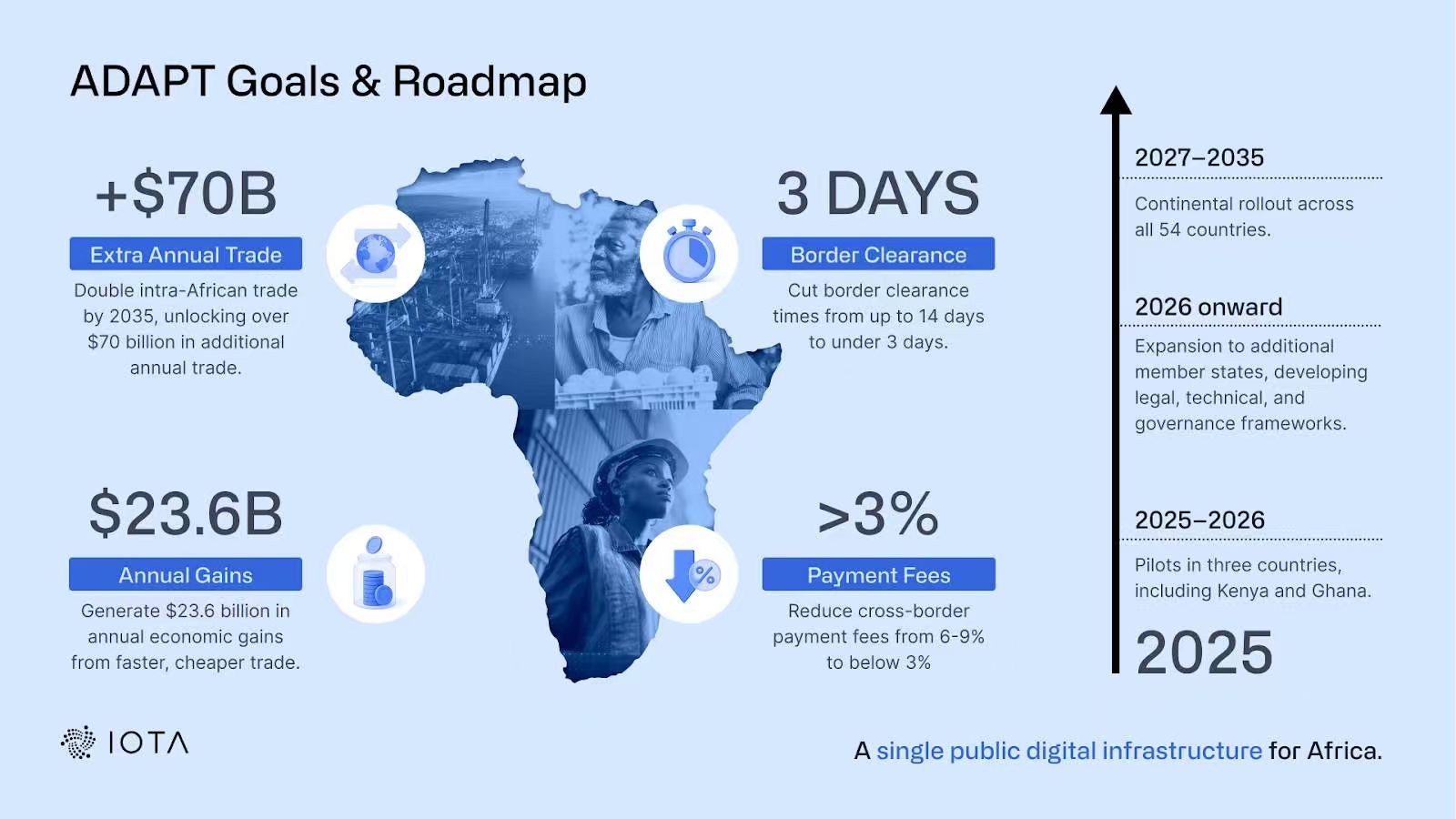

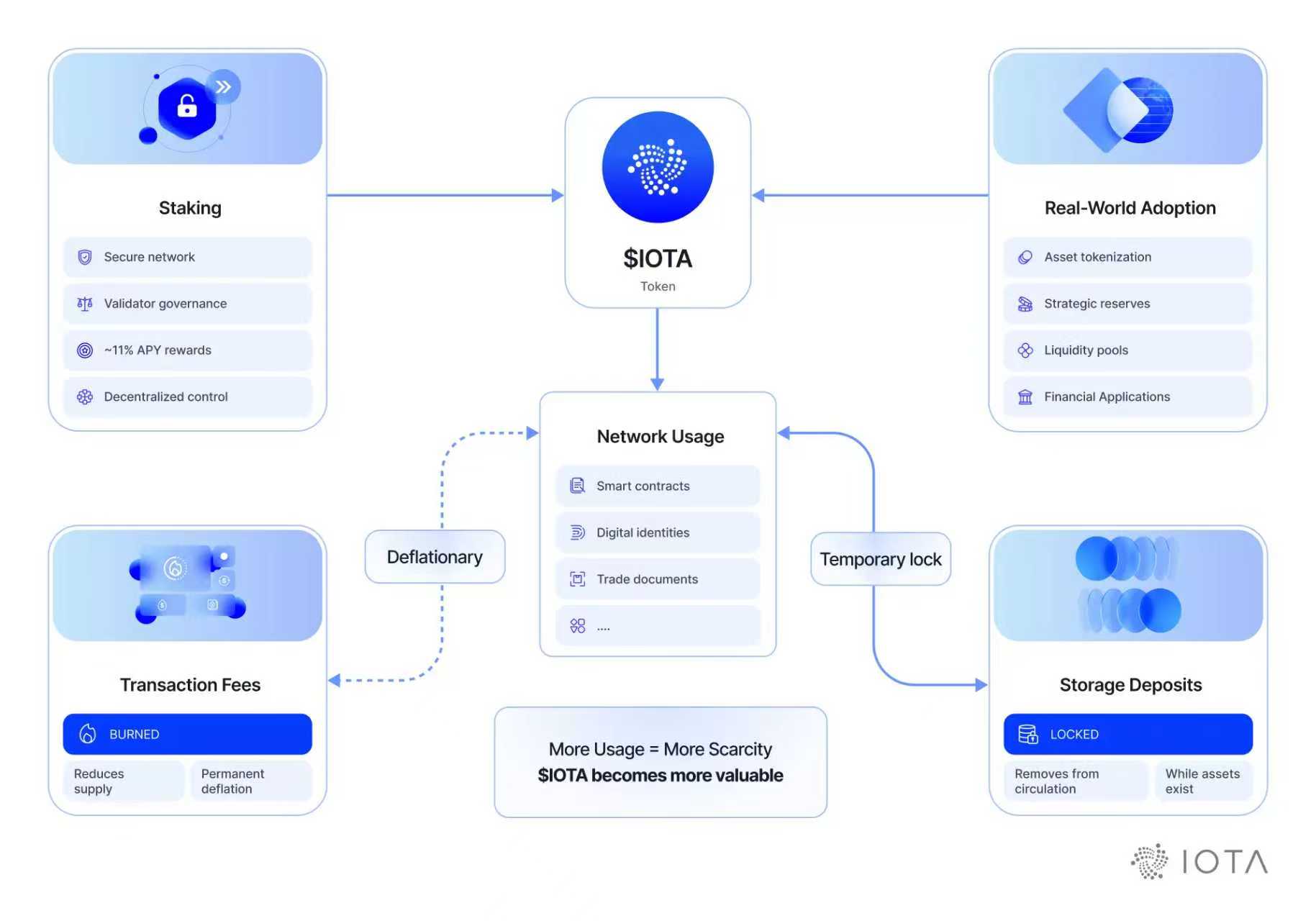

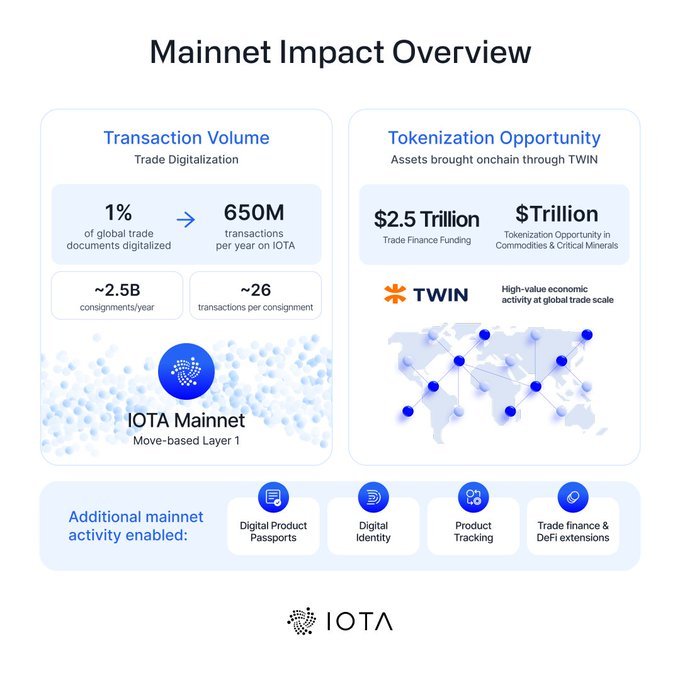

解构师 Beyond D41.09K @0xBeyondLeeThe blockchain industry is becoming riddled with holes, and anyone with a bit of face is afraid of getting stained OKX founder Xu Mingxing's speech in Phuket basically sums up this issue Frankly, blockchain can indeed bring more upward opportunities and wealth, but social status and sense of recognition have always been missing What's harder to accept is that as the industry cools, the once proud high liquidity no longer exists Besides speculation, what do we have left? / IOTA (@iota) founder Dominik Schiener (@DomSchiener) recently released the "IOTA 2026 Manifesto," which to some extent answers this question This is a transformation confession from a true OG Builder of our industry IOTA officially announces its exit from the crowded general‑purpose public chain competition, fully charging toward the $35 trillion global trade blue sea ❚ From "red‑sea speculation" to "blue‑sea infrastructure" The past decade of blockchain history is filled with expensive gas fees, scam dog coins that cut farmers, and empty talk that fails to land Dominik states bluntly in the manifesto: Blockchain should not just be a casino in the virtual world IOTA’s new positioning is crystal clear: become the digital nervous system of global trade - Background: Global trade still heavily relies on paper documents, with 4 billion documents circulating daily, creating a $2.5 trillion financing gap each year - Goal: By 2026, IOTA aims to provide programmable trust to the global supply chain just like AWS provides cloud services ❚ Africa, the UK, and global layout Unlike many projects still writing PPTs, IOTA emphasizes that its vision has entered the "production stage" - ADAPT plan: Cooperate with the African Continental Free Trade Area (AfCFTA) to directly tap Africa’s fastest‑growing trade market, building a digital trade backbone network - TWIN system: An already operational system that can cut customs clearance from weeks down to days, while reducing costs by 50% - Vertical integration: IOTA strives to become a complete trade closed‑loop for identity verification, RWA and logistics tracking ❚ What does this mean for us? $IOTA’s deflationary and utility logic For investors most concerned about token value, the manifesto provides logic shifting from "speculation" to "utility‑driven" - Traffic monetization: If just 1 % of global freight is digitized, the mainnet will generate 650 million transactions per year - Deflation model: With the surge in mainnet transaction volume, the fee‑burn mechanism will put $IOTA into a natural deflationary state - Asset locking: On‑chain trade finance and RWA will lock a large amount of tokens, reducing liquidity pressure in the market / Overall, Dominik believes AI provides "intelligence" while blockchain provides "trust" By 2030, the capital running on blockchain will exceed $390 billion IO

2 0 63 Original >Trend von IOTA nach VeröffentlichungBullischIOTA shifts to trade infrastructure, long‑term value looks bullish sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_

sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_ sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_

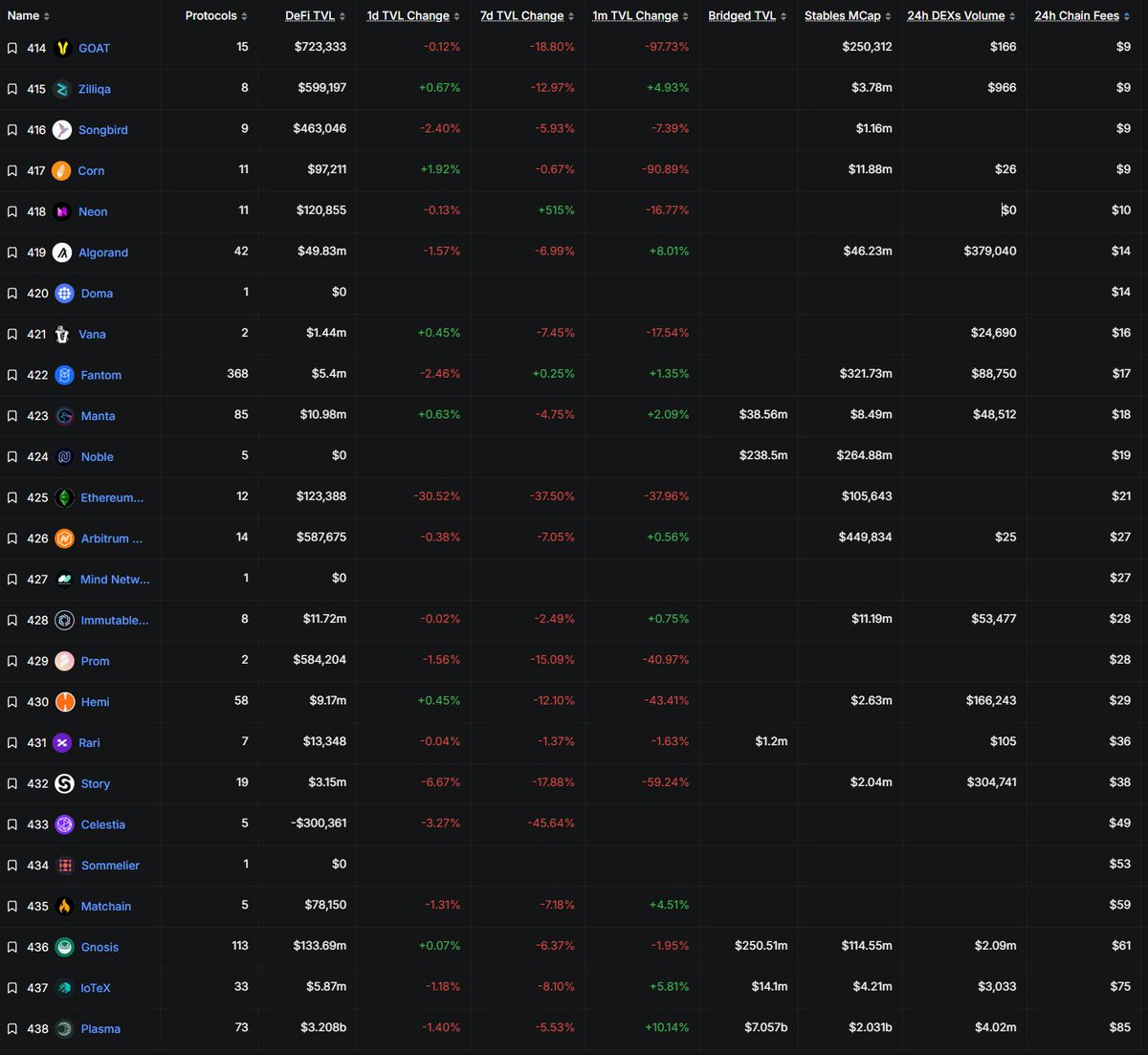

sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_Like @iota, a public chain that's been around for over a decade, it's truly hard to keep updating in today's landscape where public chains/side chains are as plentiful as hair. The last time I saw news about them was last year when they talked about the Rebased mainnet upgrade. However, at that time I thought this chain leaned a bit toward web2, and its ecosystem really didn't have many opportunities, so I skimmed over it during project research. The other day @DomSchiener posted an IOTA manifesto. The article is quite long, but the gist is In May of last year they completed the rebased upgrade, possibly considering that this veteran public chain has no soil in DeFi or memes, so they chose a different path and created a TWIN system: digitizing millions of document units and ensuring the circulation of physical goods. This core market is about 35 trillion. It includes commodities, minerals, receivables, etc. However, for IOTA to bite off even a small piece of this, the time and effort required won't be low. Nonetheless, this direction of change is essentially correct, it just requires exploring a new path. Back in 2015 they raised 50WU during their ICO, and they have been continuously updating for over a decade, which is truly difficult. If they were to start now, they'd need at least tens of millions of dollars. If they continue to allocate limited resources to memes or DeFi, honestly they can't compete with the leading players. It would be better to shift thinking, focus on RWA or web2‑leaning activities, and they might break out. While writing this article, I happened to receive a news email from the Stark wallet @ready_co. Out of curiosity I checked the transaction fees of a few familiar chains. I can only say it's really hard to sum up in a few words.

64 20 13.74K Original >Trend von IOTA nach VeröffentlichungBullischThe author is optimistic about IOTA's shift to RWA and Web2 strategies, believing it has found a way to survive in the competition among traditional public blockchains.

64 20 13.74K Original >Trend von IOTA nach VeröffentlichungBullischThe author is optimistic about IOTA's shift to RWA and Web2 strategies, believing it has found a way to survive in the competition among traditional public blockchains. IOTA Community_Lead Media C294.42K @iota

IOTA Community_Lead Media C294.42K @iotaWant to get a different perspective on what's happening at IOTA? Check out this great interview by @ChangeNOW_io ⤵️

ChangeNOW D161.87K @ChangeNOW_io

ChangeNOW D161.87K @ChangeNOW_ioInterview with @iota is live on ChangeNOW blog. Deep dive into Rebased Mainnet (50K TPS), multichain bridges, quantum-secure identity, African trade infra & Web3 talent pipeline — straight from the $IOTA team. Full interview in our blog 👇 https://t.co/P0ZmNOCgkg

95 3 4.26K Original >Trend von IOTA nach VeröffentlichungBullischIOTA mainnet upgrade to 50K TPS, multichain bridges and quantum-secure identity kowei.iota Community_Lead Educator B3.98K @kowei1995

kowei.iota Community_Lead Educator B3.98K @kowei1995IOTA’s ten‑year history is about embedding itself into international trade‑logistics standards; the blue‑ocean strategy’s real‑world deployments create deflation and solve real‑world problems. Indeed, it’s not about being first, but about a relentless flow 🌊

加密小师妹|Monica Educator DeFi_Expert C147.21K @Monica_xiaoM

加密小师妹|Monica Educator DeFi_Expert C147.21K @Monica_xiaoMAfter several narrative shifts, discussions about public chains seem increasingly “data‑only.” Reviewing the market recently, I increasingly feel that when we evaluate public‑chain value we overly rely on a single metric: capital flow. TVL, DEX trading volume are certainly important, but the problem is obvious. In this market, capital has almost no loyalty; it moves wherever returns are slightly higher. Such booms come fast and go fast. This makes me wonder, in a relatively mature cycle like 2026, whether there are other lenses that can reflect a chain’s long‑term survivability. A simple business concept I’ve been leaning toward lately: switching cost. If a chain only offers an alternative trading or investment option, it is essentially interchangeable. But when it is embedded into real‑world business processes, especially cross‑border trade, logistics, or administrative systems, the situation is entirely different. The recent strategic report from @iota appeared on my timeline, sparking a lot of discussion in the English‑speaking community. Several concrete numbers caught my eye: - In Kenya, data related to flower exports covers roughly 7 million physical items per day and has entered a stable on‑chain processing workflow. - In the UK, a trade pilot with the EU has already covered thousands of real shipments, with data used in actual cross‑border customs and regulatory procedures, providing border agencies with a visual record of goods movement. These are not just “showcase” collaborations like issuing a statement or an NFT. For governments or large supply‑chain players, replacing such a foundational system means re‑integrating processes, retraining staff, and undergoing compliance reviews again. That cost itself forms a moat. Another point that interests me is how these real‑world activities translate into on‑chain behavior. According to publicly available IOTA data, a single shipment generates about 26 on‑chain transactions on average, including document uploads, status updates, etc. If we scale this model, digitizing merely 1 % of global trade processes could generate roughly 650 million non‑speculative transactions per year on the IOTA mainnet. These transactions are stable, repeatable, and unavoidable. $IOTA fees are burned at the protocol level, introducing deflationary pressure and acting more like an infrastructure usage fee. At the same time, tokenizing trade documents and assets requires locking tokens as storage or existence guarantees; as long as the business continues, those $IOTA tokens cannot exit circulation. Putting these points together reveals an interesting phenomenon: When the business itself has high switching costs and the on‑chain mechanism turns usage into continuous consumption and locking, the chain’s value source no longer depends solely on market sentiment. A steady flow doesn’t fight to be first; it fights to be relentless. By 2030, the amount of capital operating on blockchains each year is expected to exceed $393 billion. But the market won’t pay for every hype; most blockchain networks lacking clear objectives, unique value propositions, and real use‑cases will ultimately be weeded out by the real world.

34 0 402 Original >Trend von IOTA nach VeröffentlichungExtrem bullischIOTA demonstrates long‑term value through real‑world logistics applications, using non‑speculative transactions and a deflationary mechanism.

34 0 402 Original >Trend von IOTA nach VeröffentlichungExtrem bullischIOTA demonstrates long‑term value through real‑world logistics applications, using non‑speculative transactions and a deflationary mechanism. kowei.iota Community_Lead Educator B3.98K @kowei1995

kowei.iota Community_Lead Educator B3.98K @kowei1995 Chain Broker 🇺🇦 D33.77K @chain_broker

Chain Broker 🇺🇦 D33.77K @chain_broker🎯 TOP PROJECTS BY DEVELOPMENT ACTIVITY GROWTH @iota +1350% @Optimism +690% @OasisProtocol +390% @AcrossProtocol +280% @wormholecrypto +270% @cosmos +227% @graphprotocol +210% @LidoFinance +200% @chia_project +193% @CelestiaOrg +142% $IOTA $OP $ROSE $ACX $W $ATOM $GRT $LDO $XCH $TIA

147 6 7.32K Original >Trend von IOTA nach VeröffentlichungNeutralTop 10 Projects with Highest Development Activity SMQKE FA_Analyst Media A73.85K @SMQKEDQG

SMQKE FA_Analyst Media A73.85K @SMQKEDQGIOTA = Quantum Resistant✅ Documented.📝👇 https://t.co/7ZfTLWDJBX

213 3 6.77K Original >Trend von IOTA nach VeröffentlichungBullischIOTA is emphasized for its seven technical advantages, such as quantum resistance, high scalability, and zero transaction fees.

213 3 6.77K Original >Trend von IOTA nach VeröffentlichungBullischIOTA is emphasized for its seven technical advantages, such as quantum resistance, high scalability, and zero transaction fees. ID.iota FA_Analyst OnChain_Analyst S3.44K @id_iota

ID.iota FA_Analyst OnChain_Analyst S3.44K @id_iotaWe do fish now 🐟

kingloui.iota D566 @kingloui96

kingloui.iota D566 @kingloui96👀 Kalalohko is EU-backed. 🎣 🇪🇺 That already tells you this isn’t a toy. Real supply chains. Real accountability. Transparency that has to hold up later, not just look good today. That’s why $IOTA makes sense. Quietly underneath, keeping the record verifiable.⚡️⚡️⚡️ https://t.co/xbc5GPZ5Mi

39 0 1.27K Original >Trend von IOTA nach VeröffentlichungExtrem bullischIOTA achieves real-world application in EU-supported fishery supply chains, demonstrating its reliability.

39 0 1.27K Original >Trend von IOTA nach VeröffentlichungExtrem bullischIOTA achieves real-world application in EU-supported fishery supply chains, demonstrating its reliability. IOTA Community_Lead Media C294.42K @iota

IOTA Community_Lead Media C294.42K @iota Crypto News Flash D34.12K @CryptoNewsFlas3

Crypto News Flash D34.12K @CryptoNewsFlas3IOTA Brings Seafood Supply Chains On-Chain With Kalalohko Partnership #IOTA https://t.co/wdg7nCEOqs https://t.co/09sXGxBJhg

103 2 3.16K Original >Trend von IOTA nach VeröffentlichungBullischIOTA partners with Kalalohko to bring seafood supply chains on-chain, expanding its real-world applications.

103 2 3.16K Original >Trend von IOTA nach VeröffentlichungBullischIOTA partners with Kalalohko to bring seafood supply chains on-chain, expanding its real-world applications.