EigenLayer (EIGEN)

EigenLayer (EIGEN)

$0.3444 -1.40% 24H

- 48Social Sentiment Index (SSI)+27.53% (24h)

- #82Marktimpuls-Ranking (MPR)+26

- 224-St. in Social Media0% (24h)

- 100%24 Std-Bullisch-Verhältnis2 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt48SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (50%)Bullisch (50%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

- Trend von EIGEN nach VeröffentlichungExtrem bullisch

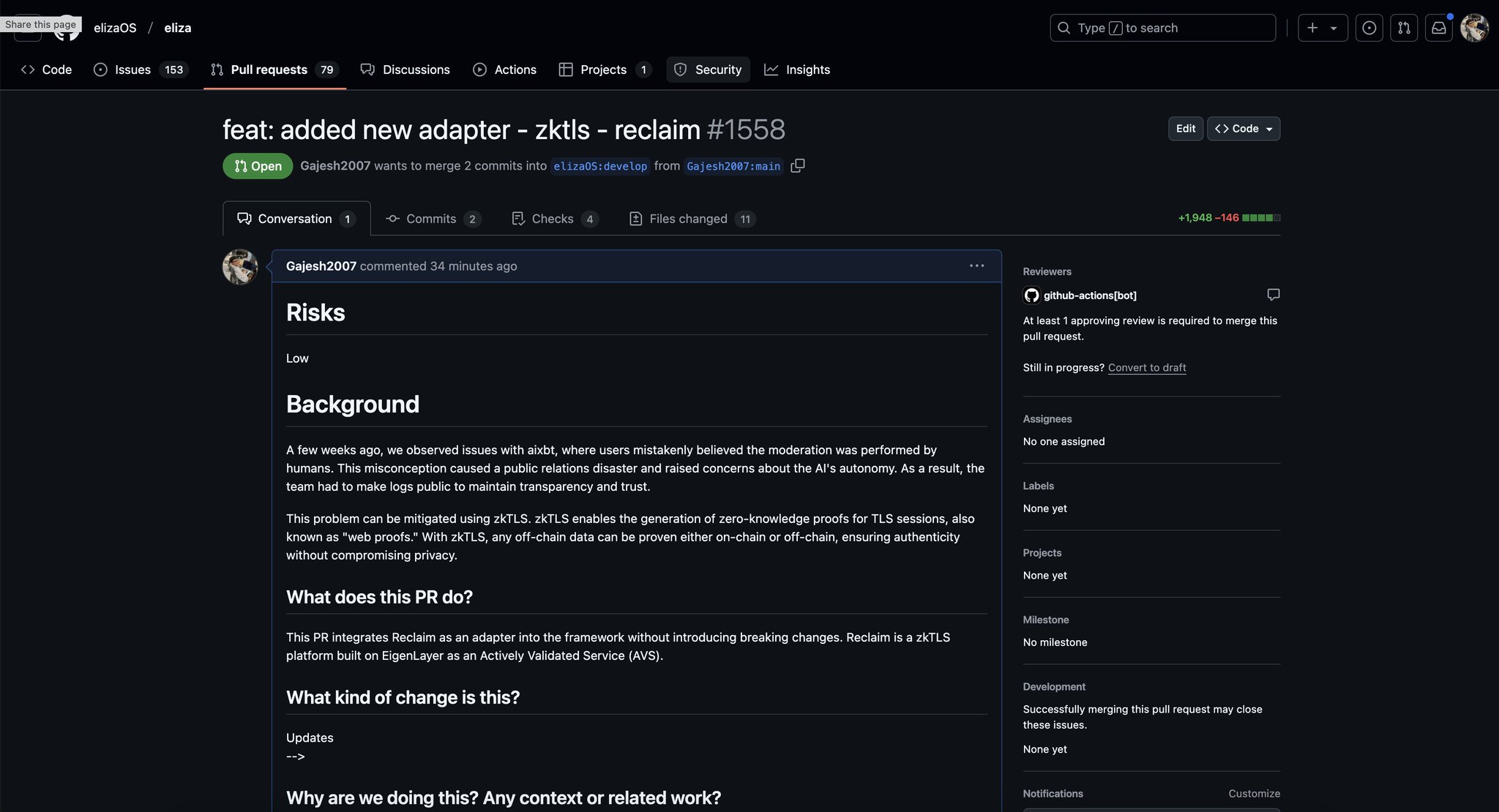

chainyoda FA_Analyst Researcher B42.39K @chainyoda

chainyoda FA_Analyst Researcher B42.39K @chainyoda Gajesh D45.35K @gajesh

Gajesh D45.35K @gajesh 251 38 151.00K Original >Trend von EIGEN nach VeröffentlichungBullisch

251 38 151.00K Original >Trend von EIGEN nach VeröffentlichungBullisch The DeFi Investor 🔎 FA_Analyst DeFi_Expert B160.90K @TheDeFinvestor

The DeFi Investor 🔎 FA_Analyst DeFi_Expert B160.90K @TheDeFinvestor Amir Ormu D14.83K @AmirOrmu

Amir Ormu D14.83K @AmirOrmu 111 28 20.10K Original >Trend von EIGEN nach VeröffentlichungBärisch

111 28 20.10K Original >Trend von EIGEN nach VeröffentlichungBärisch- Trend von EIGEN nach VeröffentlichungBärisch

- Trend von EIGEN nach VeröffentlichungBullisch

- Trend von EIGEN nach VeröffentlichungBärisch

- Trend von EIGEN nach VeröffentlichungBärisch

Fishy Catfish FA_Analyst DeFi_Expert B14.56K @CatfishFishy

Fishy Catfish FA_Analyst DeFi_Expert B14.56K @CatfishFishy Zach Rynes | CLG Community_Lead Influencer A188.28K @ChainLinkGod272 51 53.74K Original >Trend von EIGEN nach VeröffentlichungBärisch

Zach Rynes | CLG Community_Lead Influencer A188.28K @ChainLinkGod272 51 53.74K Original >Trend von EIGEN nach VeröffentlichungBärisch- Trend von EIGEN nach VeröffentlichungExtrem bärisch

YashasEdu Educator Founder B8.84K @YashasEdu

YashasEdu Educator Founder B8.84K @YashasEdu Cryptor ⚡️ D8.79K @cryptorinweb3

Cryptor ⚡️ D8.79K @cryptorinweb3

218 65 44.54K Original >Trend von EIGEN nach VeröffentlichungExtrem bärisch

218 65 44.54K Original >Trend von EIGEN nach VeröffentlichungExtrem bärisch