Curve DAO Token (CRV)

Curve DAO Token (CRV)

$0.370 -0.54% 24H

- 11Social Sentiment Index (SSI)-72.57% (24h)

- #121Marktimpuls-Ranking (MPR)+28

- 224-St. in Social Media-60.00% (24h)

- 0%24 Std-Bullisch-Verhältnis2 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt11SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungBärisch (50%)Extrem bärisch (50%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

Professor Keith 🏫📈 TA_Analyst Educator C16.89K @Carolinakeith_1

Professor Keith 🏫📈 TA_Analyst Educator C16.89K @Carolinakeith_1

Professor Keith 🏫📈 TA_Analyst Educator C16.89K @Carolinakeith_1

Professor Keith 🏫📈 TA_Analyst Educator C16.89K @Carolinakeith_1 2 0 1.16K Original >Trend von CRV nach VeröffentlichungBärisch

2 0 1.16K Original >Trend von CRV nach VeröffentlichungBärisch- Trend von CRV nach VeröffentlichungExtrem bärisch

- Trend von CRV nach VeröffentlichungBärisch

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG

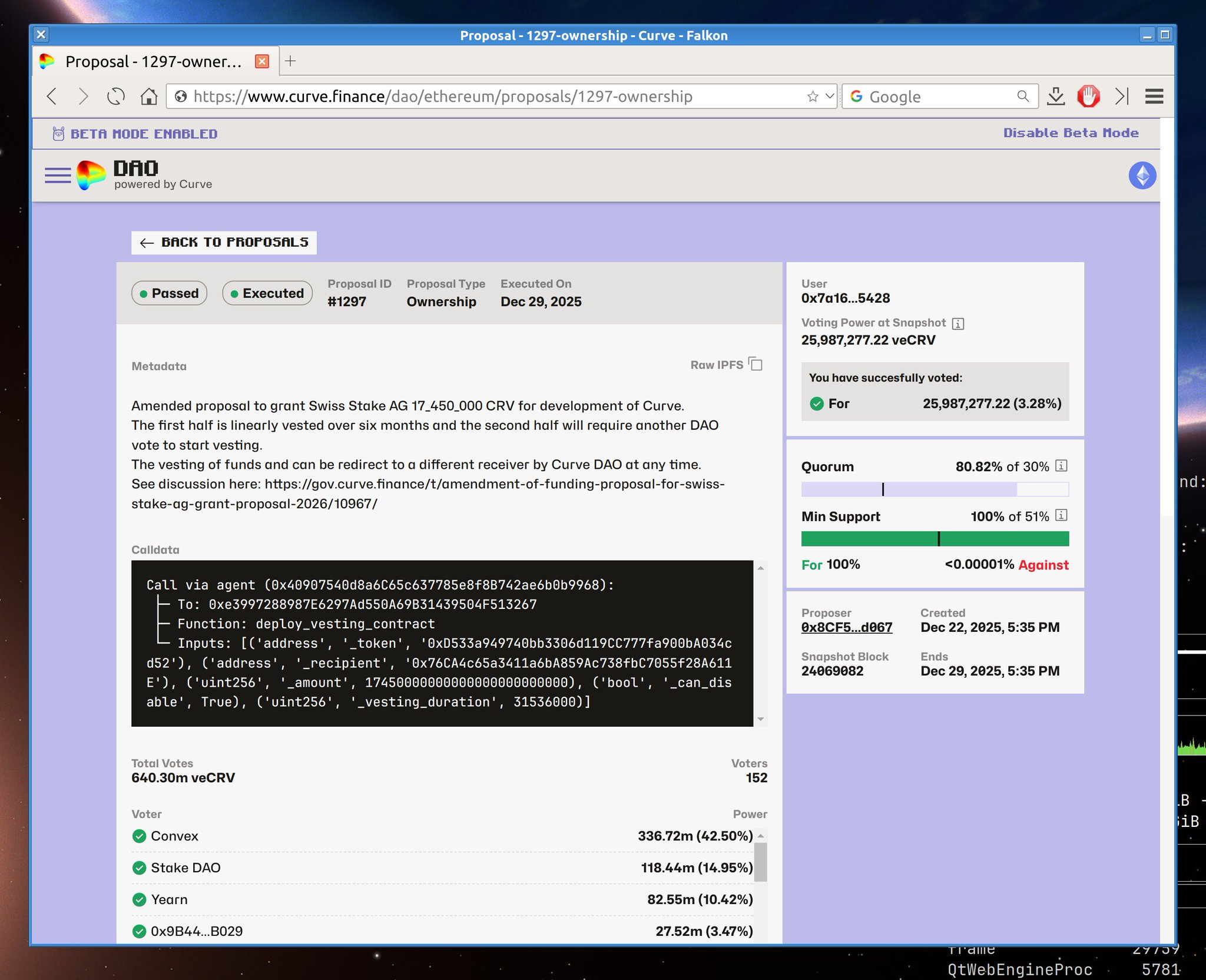

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG Curve Finance D385.26K @CurveFinance

Curve Finance D385.26K @CurveFinance 174 12 8.65K Original >Trend von CRV nach VeröffentlichungBullisch

174 12 8.65K Original >Trend von CRV nach VeröffentlichungBullisch- Trend von CRV nach VeröffentlichungBullisch

- Trend von CRV nach VeröffentlichungNeutral

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto 613 80 75.98K Original >Trend von CRV nach VeröffentlichungExtrem bullisch

613 80 75.98K Original >Trend von CRV nach VeröffentlichungExtrem bullisch- Trend von CRV nach VeröffentlichungExtrem bullisch

CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.11K @CredibleCrypto 421 52 66.61K Original >Trend von CRV nach VeröffentlichungBullisch

421 52 66.61K Original >Trend von CRV nach VeröffentlichungBullisch THEDEFIPLUG FA_Analyst OnChain_Analyst B52.73K @TheDeFiPlug

THEDEFIPLUG FA_Analyst OnChain_Analyst B52.73K @TheDeFiPlug Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi 252 70 14.63K Original >Trend von CRV nach VeröffentlichungNeutral

252 70 14.63K Original >Trend von CRV nach VeröffentlichungNeutral