Don’t let these Binance and $ASTER promo shills fool you.

When a big account has to shill centralized scams for attention, they are loosers.

The moment you buy into this narrative you are putting your capital into the exact same hands that have been draining this space for years.

The same centralized power structures, the same market-maker driven rotations, the same paid influencer pipelines that turn retail into exit liquidity.

That applies just as much to $ASTER as it does to $WLFI and everything connected to that fraud family.

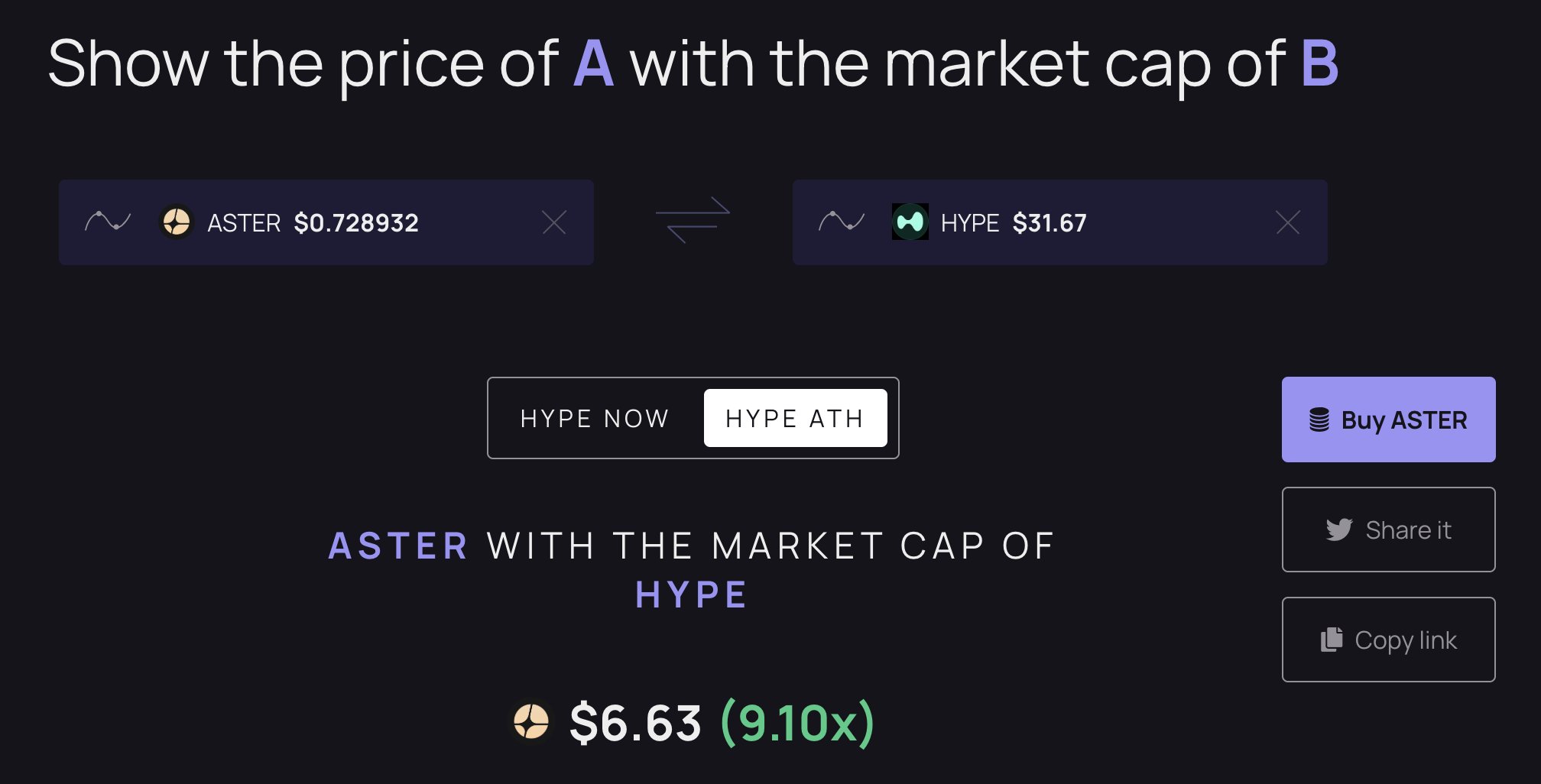

Here the real questions about $Aster;

Suddenly every red flag is supposed to disappear?

Where is the money actually coming from that is pushing this move, real demand or the usual recycled liquidity and incentives?

"Backed by the biggest in the space" is not a metric.

It is often the opposite. In this space "the biggest" is also one of the most hated figures, and his orbit is where paid promoters get hired to manufacture hype.

If your credibility depends on famous faces and paid shillers, you are showing a marketing budget designed to turn retail into exit liquidity.

Show the chart on higher timeframes. Is it organic growth with volume expansion or a thin order book getting walked up?

What does it look like against BTC and ETH, not cherry-picked USD candles.

Who holds the supply? Give the wallet distribution.

Top 10. Top 50. Team allocation. Vesting. Unlock schedule.

If a handful of wallets control the float, then it is exit liquidity waiting for a narrative.

Here are the facts:

Max supply is 8,000,000,000 ASTER. Circulating is about 2,454,947,754 which is 30.69% unlocked, meaning most supply is still waiting to hit the market.

Token allocation per their own docs: 53.5% airdrops, 30% ecosystem and marketing and APX upgrade, 7% treasury, 5% team with 1 year cliff then 40 months vesting, 4.5% liquidity and listings.

In reality, most of it is probably sitting with CZ and a few of his puppets.

Also 704,000,000 tokens were set to unlock immediately at TGE for incentive participants.

So when someone screams “best investment for 12 months”, the obvious reply is: show the unlock calendar and tell people exactly what dilution they are signing up for.

“Revenue machine” from what exactly? Real users paying real fees, or emissions and foundation wallets looping tokens to manufacture activity? Post the on-chain numbers.

Also, your “revenue” talking point gets abused constantly. Yes, Aster has been reported as topping 24h protocol revenue on a specific day using DeFiLlama data, but that is not a blank cheque for the next 12 months, and it says nothing about how sustainable that revenue is, or who extracts it.

Mainnet next month? Fine. The project itself has been stating mainnet in March 2026. That is the oldest play in the book: pre event pump, launch day headlines, then distribution when attention peaks.

And the core question: why would anyone rotate capital into another centrally influenced, market-maker driven narrative when the entire risk sits in opaque treasury wallets and undisclosed token economics?

If this is supposed be the “best investment”, then it should survive basic due diligence.

Post the distribution. Post the unlocks.

Without that....💩

Aster (ASTER)

Aster (ASTER) doji crow TA_Analyst Trader B11.55K @conviction_meta

doji crow TA_Analyst Trader B11.55K @conviction_meta

doji crow TA_Analyst Trader B11.55K @conviction_meta

doji crow TA_Analyst Trader B11.55K @conviction_meta

6 1 1.42K Original >Trend von ASTER nach VeröffentlichungBullisch

6 1 1.42K Original >Trend von ASTER nach VeröffentlichungBullisch Bazzi Influencer Trader B47.36K @bazzicrypto

Bazzi Influencer Trader B47.36K @bazzicrypto Bazzi Influencer Trader B47.36K @bazzicrypto

Bazzi Influencer Trader B47.36K @bazzicrypto 107 23 14.15K Original >Trend von ASTER nach VeröffentlichungExtrem bullisch

107 23 14.15K Original >Trend von ASTER nach VeröffentlichungExtrem bullisch