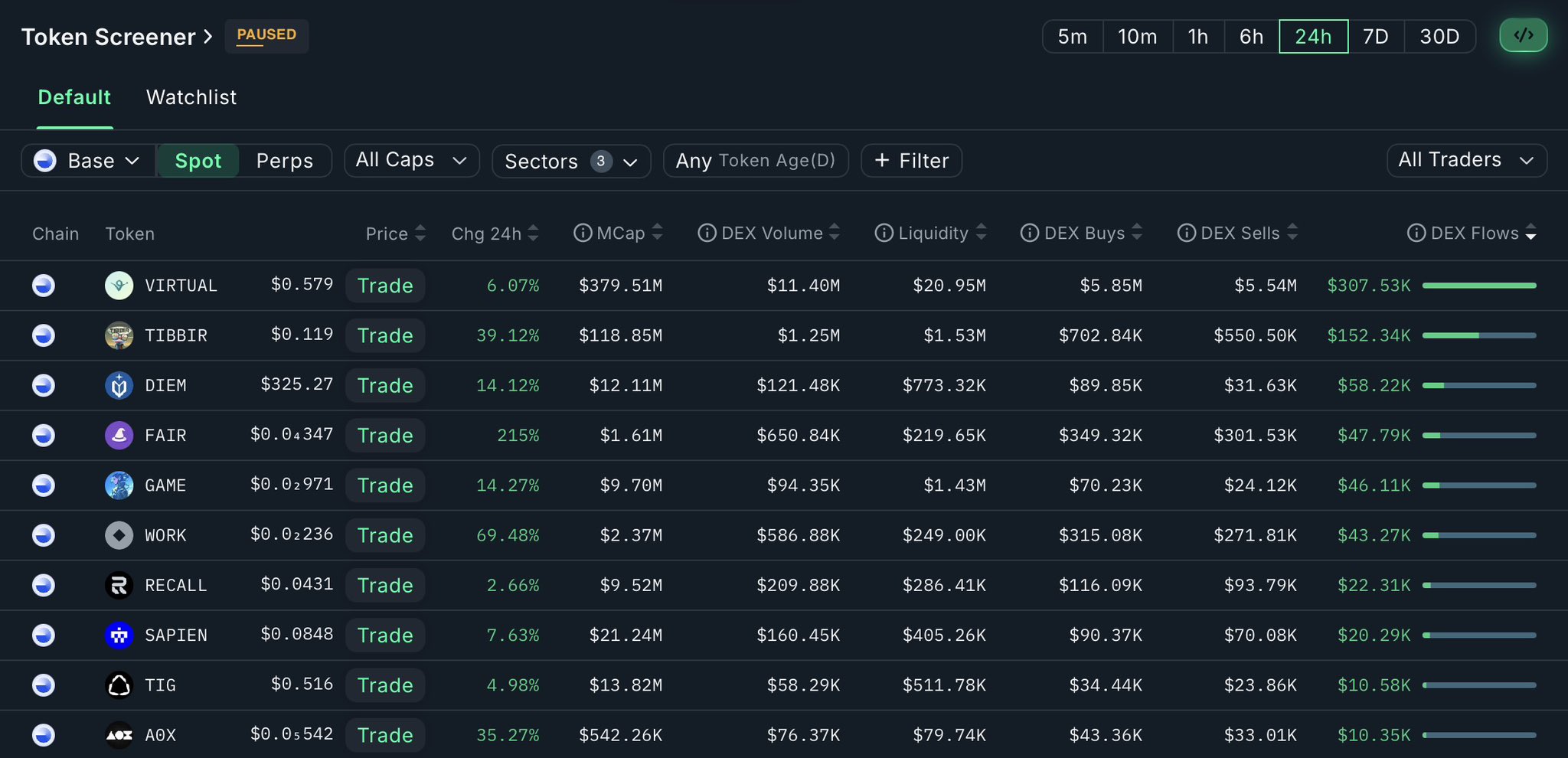

Virtual Protocol (VIRTUAL)

Virtual Protocol (VIRTUAL)

$0.6385 -2.95% 24H

- 65مؤشر المعنويات الاجتماعية (SSI)+15.49% (24h)

- #57ترتيب اتجاه السوق (MPR)+34

- 6الانتشار الاجتماعي 24 سا+100.00% (24h)

- 34%نسبة KOL الصاعدة خلال 24 ساعة5 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية65SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرمتصاعد بقوة (17%)صاعد (17%)محايد (50%)هابط بشدة (16%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

- اتجاه VIRTUAL بعد الإصدارمتصاعد بقوة

- اتجاه VIRTUAL بعد الإصدارصاعد

- اتجاه VIRTUAL بعد الإصدارمتصاعد بقوة

Crypto Katze Influencer Educator B2.59K @CryptoKatze

Crypto Katze Influencer Educator B2.59K @CryptoKatze Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan83 11 16.04K أصلي >اتجاه VIRTUAL بعد الإصدارمحايد

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan83 11 16.04K أصلي >اتجاه VIRTUAL بعد الإصدارمحايد Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

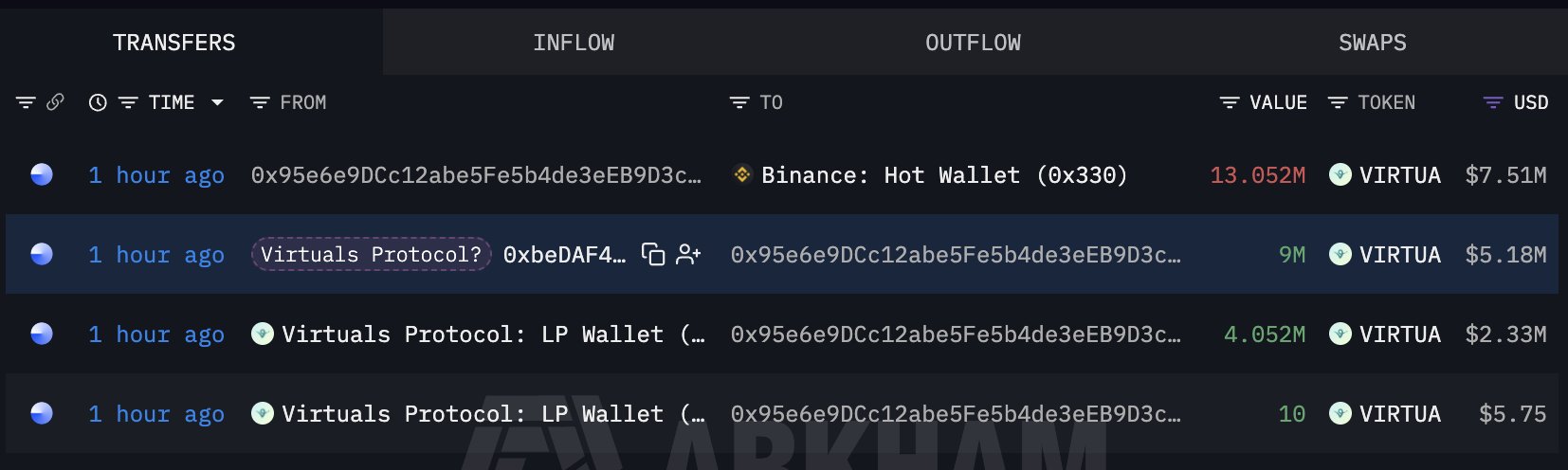

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3 Lookonchain OnChain_Analyst Media C680.83K @lookonchain

Lookonchain OnChain_Analyst Media C680.83K @lookonchain 2 2 444 أصلي >اتجاه VIRTUAL بعد الإصدارهابط بشدة

2 2 444 أصلي >اتجاه VIRTUAL بعد الإصدارهابط بشدة- اتجاه VIRTUAL بعد الإصدارمحايد

- اتجاه VIRTUAL بعد الإصدارمحايد

- اتجاه VIRTUAL بعد الإصدارهابط

- اتجاه VIRTUAL بعد الإصدارهابط

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan43 11 4.99K أصلي >اتجاه VIRTUAL بعد الإصدارمتصاعد بقوة

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan43 11 4.99K أصلي >اتجاه VIRTUAL بعد الإصدارمتصاعد بقوة