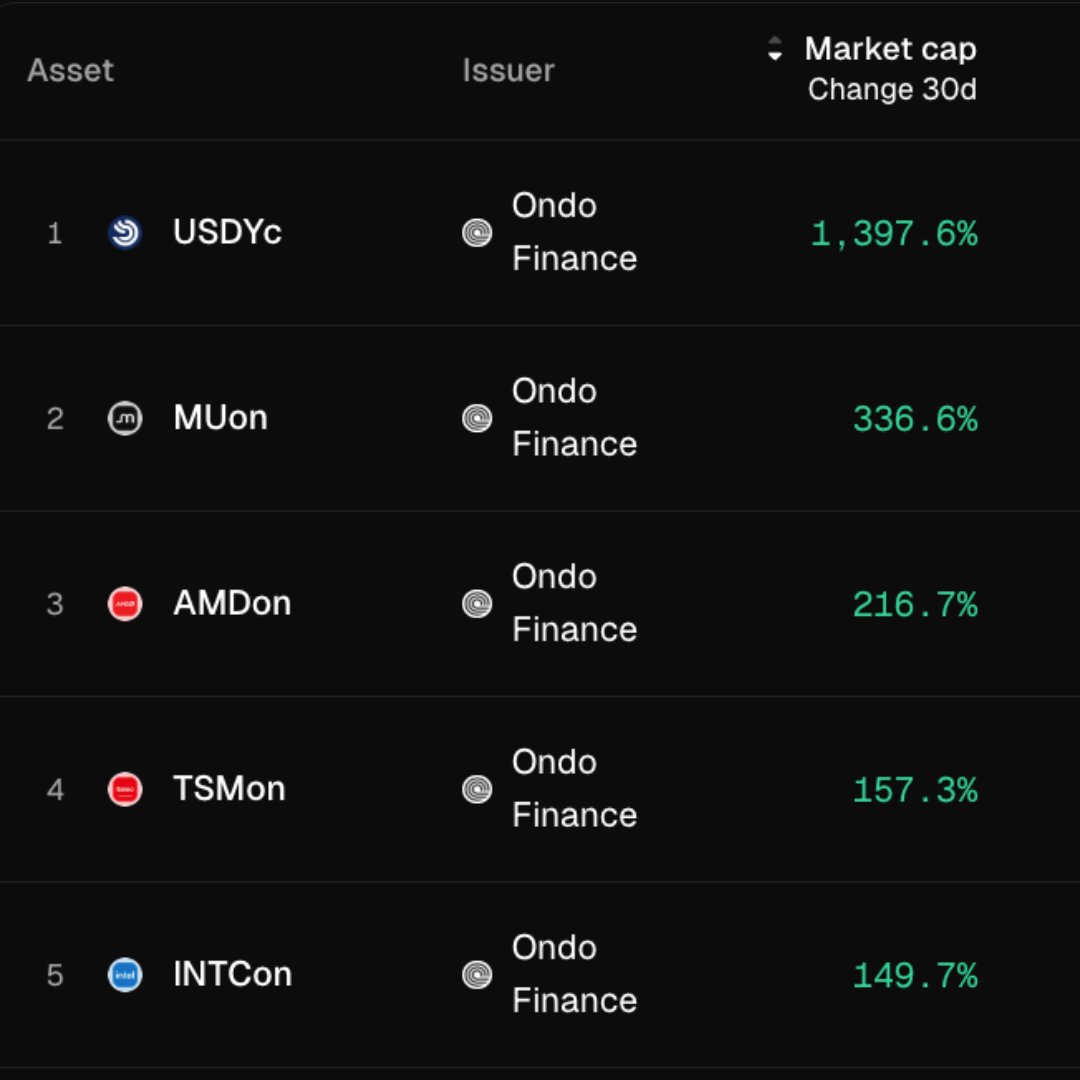

Ondo (ONDO)

Ondo (ONDO)

$0.2779 -2.04% 24H

- 30مؤشر المعنويات الاجتماعية (SSI)-30.12% (24h)

- #107ترتيب اتجاه السوق (MPR)-4

- 4الانتشار الاجتماعي 24 سا-42.86% (24h)

- 75%نسبة KOL الصاعدة خلال 24 ساعة4 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية30SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرمتصاعد بقوة (25%)صاعد (50%)هابط (25%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

- اتجاه ONDO بعد الإصدارصاعد

jules.kas Founder Community_Lead B1.80K @Julian4crypto

jules.kas Founder Community_Lead B1.80K @Julian4crypto Ondo Finance Founder Regulatory_Expert B361.68K @OndoFinance

Ondo Finance Founder Regulatory_Expert B361.68K @OndoFinance 0 0 97 أصلي >اتجاه ONDO بعد الإصدارمتصاعد بقوة

0 0 97 أصلي >اتجاه ONDO بعد الإصدارمتصاعد بقوة- اتجاه ONDO بعد الإصدارهابط

- اتجاه ONDO بعد الإصدارصاعد

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi Dami-Defi TA_Analyst Trader B91.39K @DamiDefi

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi 540 62 39.99K أصلي >اتجاه ONDO بعد الإصدارمتصاعد بقوة

540 62 39.99K أصلي >اتجاه ONDO بعد الإصدارمتصاعد بقوة- اتجاه ONDO بعد الإصدارصاعد

- اتجاه ONDO بعد الإصدارصاعد

- اتجاه ONDO بعد الإصدارصاعد

- اتجاه ONDO بعد الإصدارمتصاعد بقوة

- اتجاه ONDO بعد الإصدارمتصاعد بقوة