IO.NET (IO)

IO.NET (IO)

$0.1062 -2.93% 24H

- 68مؤشر المعنويات الاجتماعية (SSI)- (24h)

- #25ترتيب اتجاه السوق (MPR)0

- 1الانتشار الاجتماعي 24 سا- (24h)

- 100%نسبة KOL الصاعدة خلال 24 ساعة1 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية68SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرصاعد (100%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

- اتجاه IO بعد الإصدارصاعد

- اتجاه IO بعد الإصدارمتصاعد بقوة

- اتجاه IO بعد الإصدارمتصاعد بقوة

- اتجاه IO بعد الإصدارصاعد

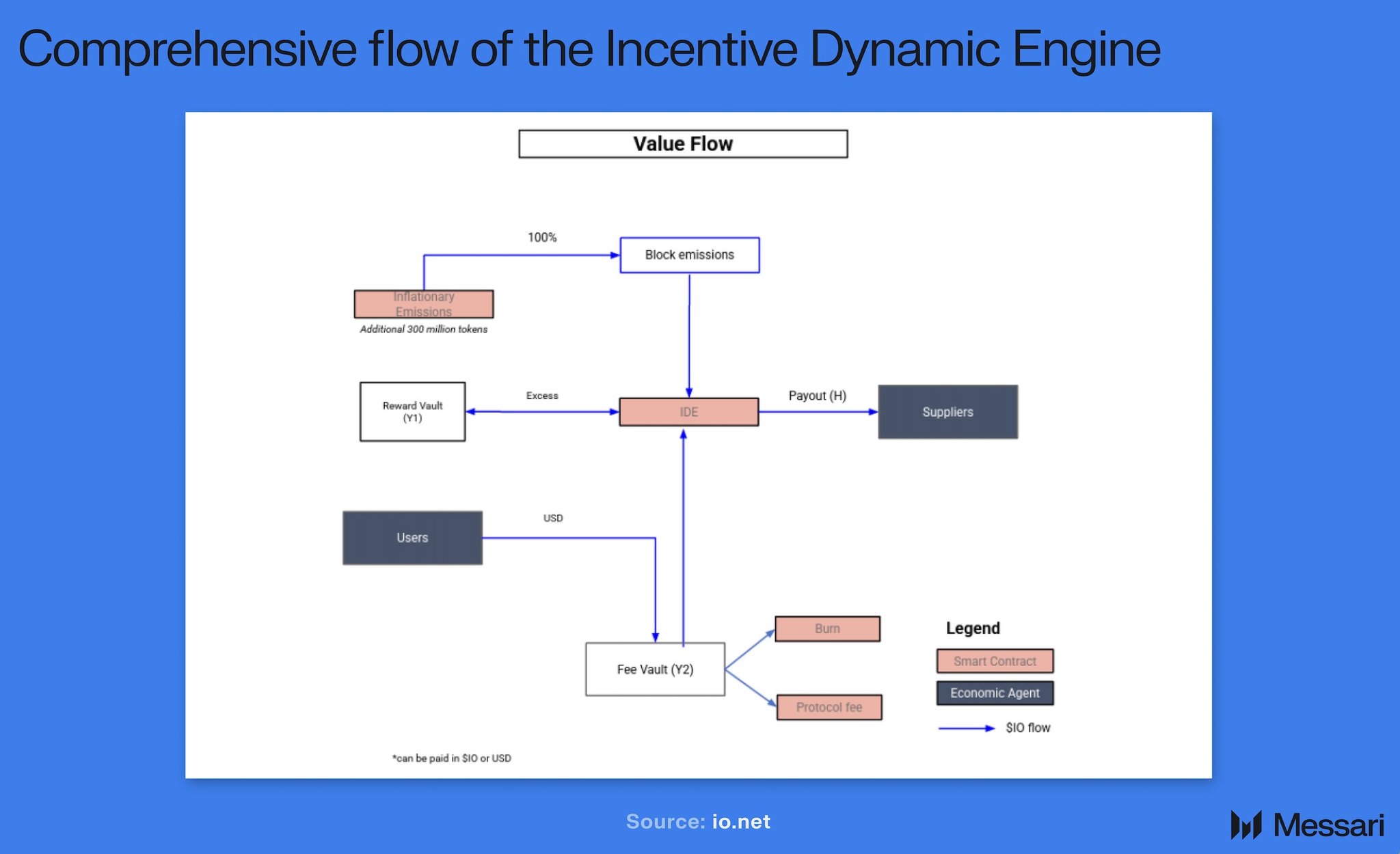

Tory | io.net 🦾 Founder Tokenomics_Expert B79.68K @MTorygreen

Tory | io.net 🦾 Founder Tokenomics_Expert B79.68K @MTorygreen Messari Media Researcher D464.75K @MessariCrypto

Messari Media Researcher D464.75K @MessariCrypto 7 1 300 أصلي >اتجاه IO بعد الإصدارصاعد

7 1 300 أصلي >اتجاه IO بعد الإصدارصاعد- اتجاه IO بعد الإصدارمحايد

- اتجاه IO بعد الإصدارمحايد

- اتجاه IO بعد الإصدارصاعد

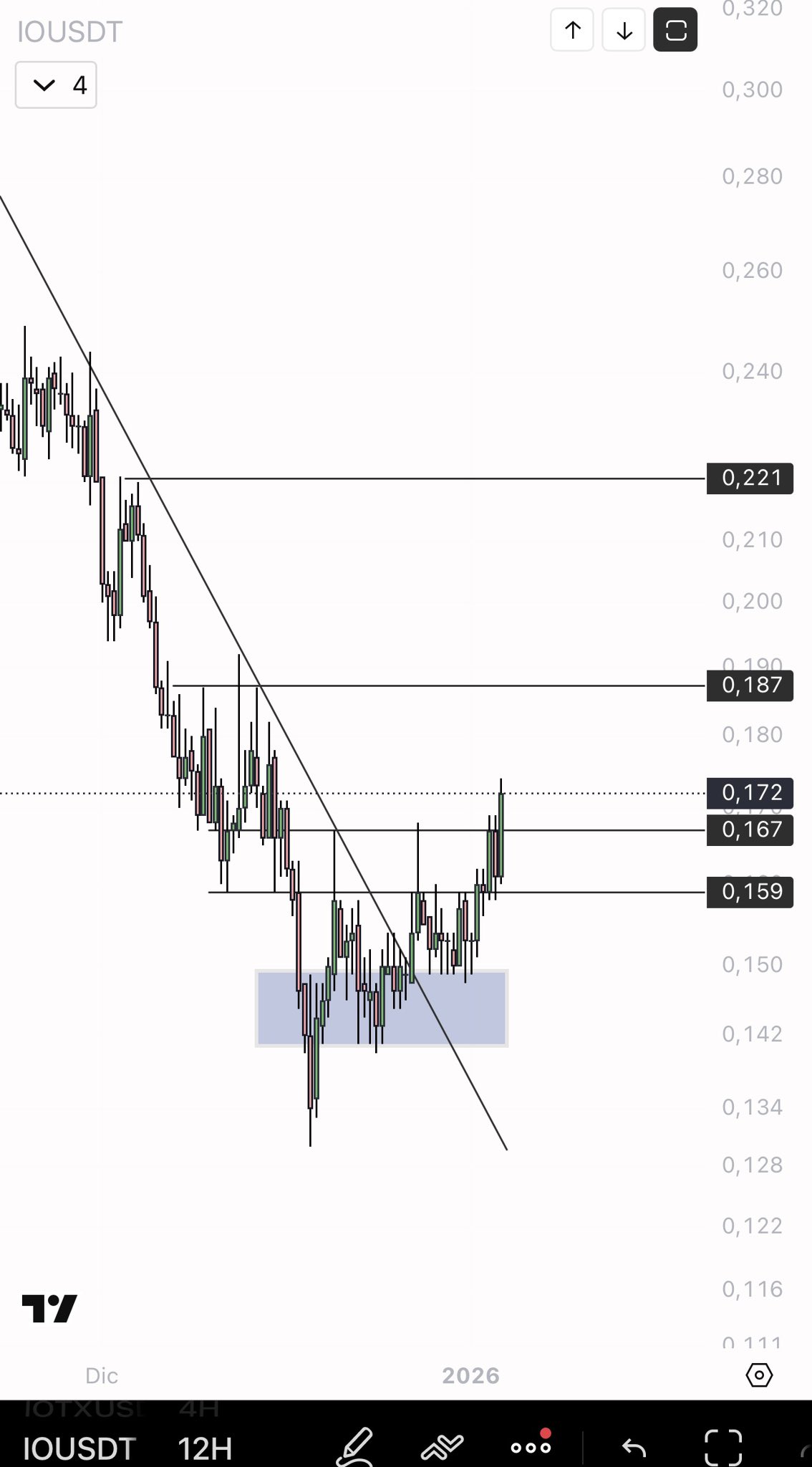

EliZ TA_Analyst Trader B603.25K @eliz883

EliZ TA_Analyst Trader B603.25K @eliz883

EliZ TA_Analyst Trader B603.25K @eliz883

EliZ TA_Analyst Trader B603.25K @eliz883 285 38 44.74K أصلي >اتجاه IO بعد الإصدارمتصاعد بقوة

285 38 44.74K أصلي >اتجاه IO بعد الإصدارمتصاعد بقوة- اتجاه IO بعد الإصدارصاعد