IN (IN)

IN (IN)

$0.06532 -4.59% 24H

- 69مؤشر المعنويات الاجتماعية (SSI)- (24h)

- #14ترتيب اتجاه السوق (MPR)0

- 1الانتشار الاجتماعي 24 سا- (24h)

- 100%نسبة KOL الصاعدة خلال 24 ساعة1 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية69SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرصاعد (100%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

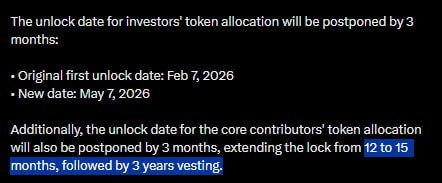

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav8 3 246 أصلي >اتجاه IN بعد الإصدارصاعد

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav8 3 246 أصلي >اتجاه IN بعد الإصدارصاعد OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct 1 1 83 أصلي >اتجاه IN بعد الإصدارمتصاعد بقوة

1 1 83 أصلي >اتجاه IN بعد الإصدارمتصاعد بقوة- اتجاه IN بعد الإصدارمحايد

- اتجاه IN بعد الإصدارصاعد

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu Cryptor ⚡️ D10.12K @cryptorinweb341 20 2.28K أصلي >اتجاه IN بعد الإصدارصاعد

Cryptor ⚡️ D10.12K @cryptorinweb341 20 2.28K أصلي >اتجاه IN بعد الإصدارصاعد- اتجاه IN بعد الإصدارمتصاعد بقوة

- اتجاه IN بعد الإصدارمتصاعد بقوة

- اتجاه IN بعد الإصدارصاعد

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros6868

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros6868 Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros686815 16 597 أصلي >اتجاه IN بعد الإصدارصاعد

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros686815 16 597 أصلي >اتجاه IN بعد الإصدارصاعد- اتجاه IN بعد الإصدارصاعد