Plasma (XPL)

Plasma (XPL)

$0.1224 -1.77% 24H

- 41Social Sentiment Index (SSI)-11.99% (24h)

- #47Market Pulse Ranking (MPR)+85

- 824h Social Mention+60.00% (24h)

- 0%24h KOL Bullish Ratio8 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall41SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionNeutral (13%)Bearish (38%)Extremely Bearish (49%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

ชื่อเบียร์ แต่ชอบเล่า💡💸✈️ Trader Quant B7.45K @101beere

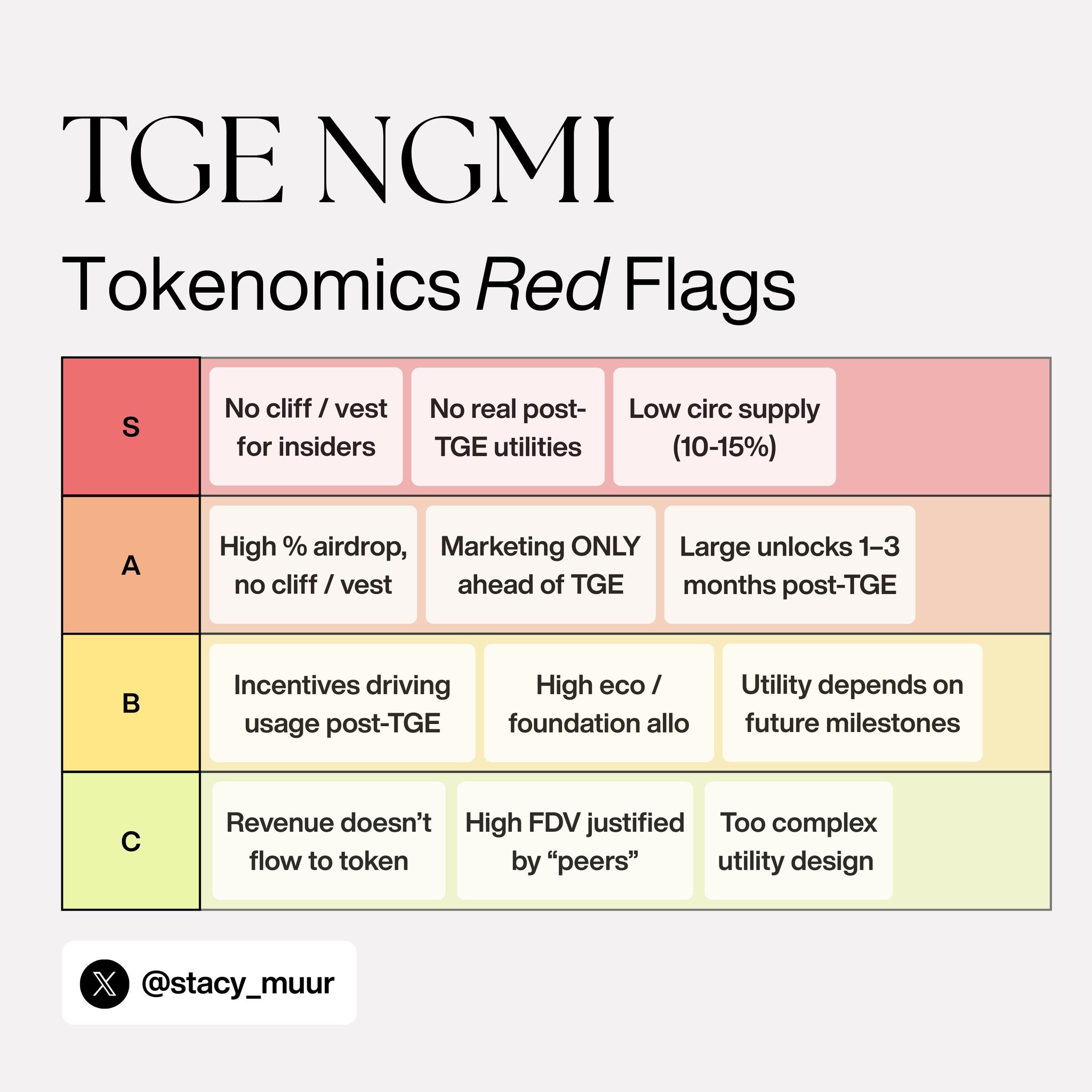

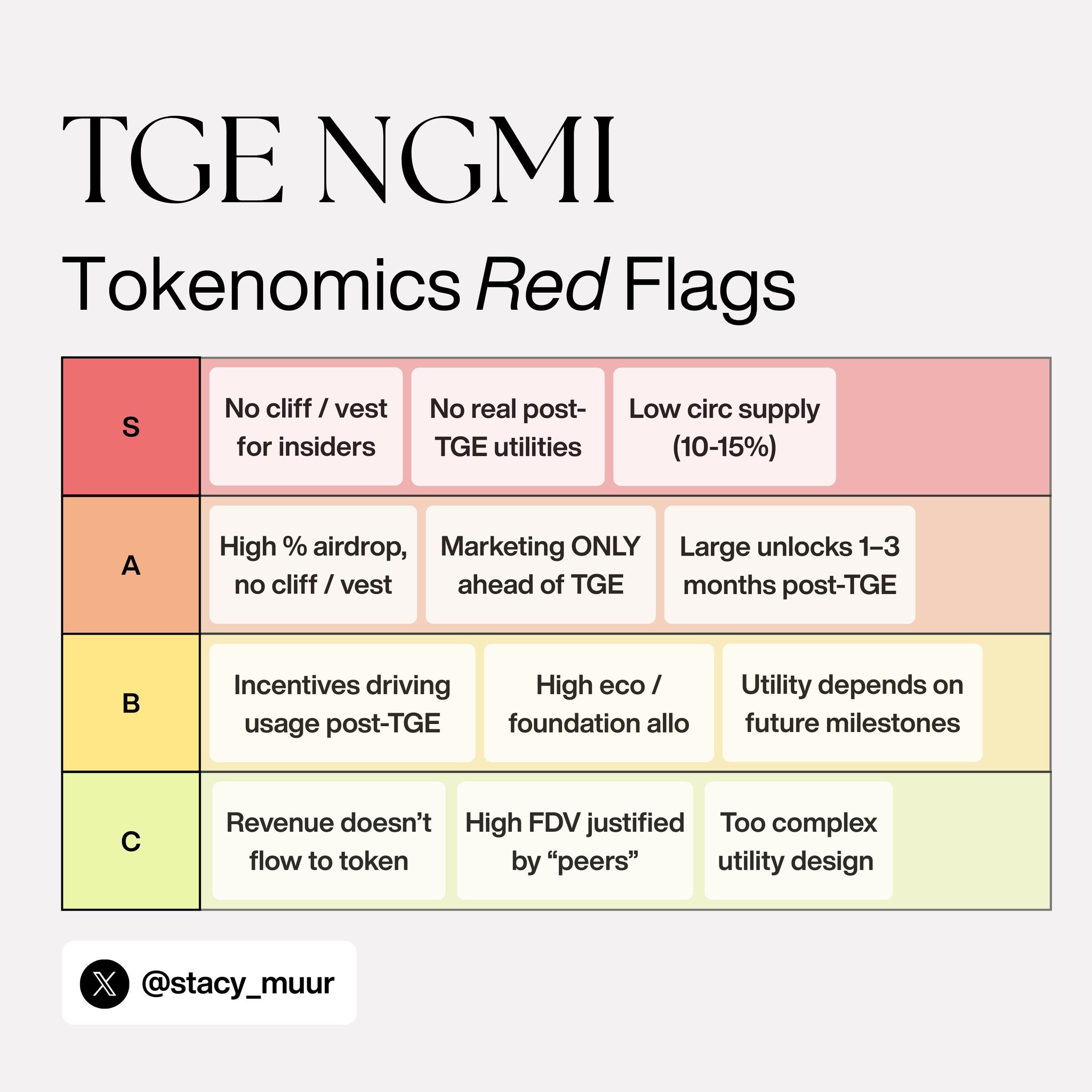

ชื่อเบียร์ แต่ชอบเล่า💡💸✈️ Trader Quant B7.45K @101beere Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur

Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur 396 61 27.83K Original >Trend of XPL after releaseExtremely Bearish

396 61 27.83K Original >Trend of XPL after releaseExtremely Bearish- Trend of XPL after releaseBearish

- Trend of XPL after releaseBearish

XENONTHEKING 1️⃣1️⃣:1️⃣1️⃣ Educator DeFi_Expert B4.04K @Double_Elevenn1

XENONTHEKING 1️⃣1️⃣:1️⃣1️⃣ Educator DeFi_Expert B4.04K @Double_Elevenn1 0x Numbers 🔢📊 D54.28K @0x366e38 16 3.12K Original >Trend of XPL after releaseBearish

0x Numbers 🔢📊 D54.28K @0x366e38 16 3.12K Original >Trend of XPL after releaseBearish- Trend of XPL after releaseExtremely Bearish

- Trend of XPL after releaseExtremely Bearish

- Trend of XPL after releaseNeutral

Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur

Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur

Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur 396 61 27.83K Original >Trend of XPL after releaseExtremely Bearish

396 61 27.83K Original >Trend of XPL after releaseExtremely Bearish- Trend of XPL after releaseBullish

CRONK 🎩 Crypto Reporter Media Influencer C31.33K @CryptoCronkite

CRONK 🎩 Crypto Reporter Media Influencer C31.33K @CryptoCronkite Sandwichin' D1.42K @Sandwichin13

Sandwichin' D1.42K @Sandwichin13 12 3 847 Original >Trend of XPL after releaseExtremely Bullish

12 3 847 Original >Trend of XPL after releaseExtremely Bullish