Velvet (VELVET)

Velvet (VELVET)

- 50Social Sentiment Index (SSI)- (24h)

- #103Market Pulse Ranking (MPR)0

- 224h Social Mention- (24h)

- 100%24h KOL Bullish Ratio2 Active KOL

- SummaryVELVET gains governance participation, high staking returns, cross-chain and security endorsement, with a modest price increase of 0.68%.

- Bullish Signals

- Governance has substantial impact

- High APR staking rewards

- Low slippage instant swaps

- Endorsed by Binance Labs

- Multi-chain + audited security

- Bearish Signals

- Price increase only 0.68%

- Social heat remains flat

- Low interaction volume

Social Sentiment Index (SSI)

- Data Overall50SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (50%)Bullish (50%)SSI InsightsVELVET social heat is moderate (49.8/100, activity 21.5/40) remaining stable, driven by governance participation, high APR staking and cross-chain security endorsement, sentiment positive 26.3/30.

Market Pulse Ranking (MPR)

- Alert InsightVELVET warning rank #103, social abnormality 56.3/100, sentiment polarization 56.2/100 are moderate, no KOL shifts observed, aligns with a modest price rise of 0.68%, warning strength is average.

X Posts

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.09K @Alex394959

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.09K @Alex394959OK, morning habit changed Tried @Velvet_Capital as a discipline experiment: set a $100 allocation, asked the Unicorn AI for a bias check, created a vault on BNB, and staked $VELVET for multipliers What actually worked → swaps felt instant with low slippage and MEV protection → Gems started stacking after a few small trades and counted toward epoch rewards → dashboard is calm: scan, decide, move on Also the epoch rewards and staking vaults matter epochs hand out real $VELVET (recent pool near 977k) and the BNB staking vault advertised 20 35% APR in USDf, which pushed me to hold longer Backed by Binance Labs, audited by PeckShield, multi‑chain across ETH/BNB/BASE/SOL If you trade and hate tab chaos, try the flow how do you keep trading disciplined?

1 2 24 Original >Trend of VELVET after releaseBullishVelvet Capital offers low-slippage trading, high APR staking rewards, a good user experience, and is worth trying.

1 2 24 Original >Trend of VELVET after releaseBullishVelvet Capital offers low-slippage trading, high APR staking rewards, a good user experience, and is worth trying. Tyer 🇸🇦🇶🇦 NFT_Expert Influencer B15.71K @supertyer

Tyer 🇸🇦🇶🇦 NFT_Expert Influencer B15.71K @supertyerQuack Quack I don’t typically write lengthy posts like this, but after spending weeks diving into Velvet Capital, I feel compelled to share my genuine experience no hype, no guesswork, just the real deal. For me, holding $VELVET hasn’t been about the price. It’s all about alignment. I’ve staked it, traded on the platform, managed portfolios, participated in governance and truly utilized the tools that the token unlocks. That’s why my conviction has grown gradually, not in a flash. Here’s what really caught my attention 👇 Governance That Actually Matters Owning $VELVET gives you a genuine voice. I’ve taken part in votes regarding protocol changes, fees and product direction and those decisions were far from symbolic. You could see the results reflected in how the platform evolved afterward. It feels less like “DAO theatre” and more like being part of a community that’s actively shaping the protocol. If you care about the future of a platform, this aspect is crucial. Revenue Sharing That Makes Sense Staking into veVELVET has been one of the most practical moves I’ve made. A portion of the fees generated by the platform gets redistributed on-chain, meaning the yields come from actual usage, not inflation or temporary incentives. It’s steady, transparent and sustainable and over time, it really adds up. This is the kind of model that rewards those who stay engaged rather than chase after short-term noise. Gems, Epochs and Long-Term Incentives One thing Velvet excels at is aligning incentives with activity. By trading, staking, managing portfolios or even referring others, you earn Gems, which are then converted into $VELVET during epochs. I’ve been active through several epochs and the system genuinely rewards consistent participation. It naturally encouraged me to be a long-term holder not because I had to, but because the incentives just made sense. If you’re someone who trades regularly, you’ll definitely want to pay attention to the new cashback feature linked to veVELVET. Over time, lower effective fees can really boost your profitability, especially if you’re using active trading strategies. It seems like a smart way to reward loyal users instead of just chasing after short-term volume thats exactly what @Velvet_Capital has been building all along .. Quack Louder Quack Higher Trade Smarter

54 32 724 Original >Trend of VELVET after releaseExtremely BullishThe author holds a strong belief in the VELVET token due to Velvet Capital's effective governance, revenue sharing, and long‑term incentives.

54 32 724 Original >Trend of VELVET after releaseExtremely BullishThe author holds a strong belief in the VELVET token due to Velvet Capital's effective governance, revenue sharing, and long‑term incentives. AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.09K @Alex394959

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.09K @Alex394959GM CT tried out @Velvet_Capital properly today and I actually moved from curiosity to conviction in under an hour Price sitting ~ $0.20 (+2% 24h), market cap ~ $200M, RSI ~70 so momentum is real. as long as $VELVET holds $0.195 $0.198 support a short push to $0.21 $0.22 looks plausible. felt the product more than read the whitepaper cross-chain from Base → Solana → BNB was one continuous action, not a chain of chores what hooked me: launchpad runner drops tied to Gems, trading fee cuts based on veVELVET, and treasury fees from AI products flowing to stakers (featured token fees 50% to stakers). agentic portfolios require veVELVET to keep managers running utility beyond governance. I moved some capital, stacked Gems, and veVELVET for the automation who else is testing the agentic portfolios or stacking Gems for the next Epoch curious how you’re sizing in #DeFi with Velvet?

2 3 48 Original >Trend of VELVET after releaseExtremely BullishThe author is confident about VELVET, believing the short‑term price has upside potential.

2 3 48 Original >Trend of VELVET after releaseExtremely BullishThe author is confident about VELVET, believing the short‑term price has upside potential. Tyer 🇸🇦🇶🇦 NFT_Expert Influencer B15.71K @supertyer

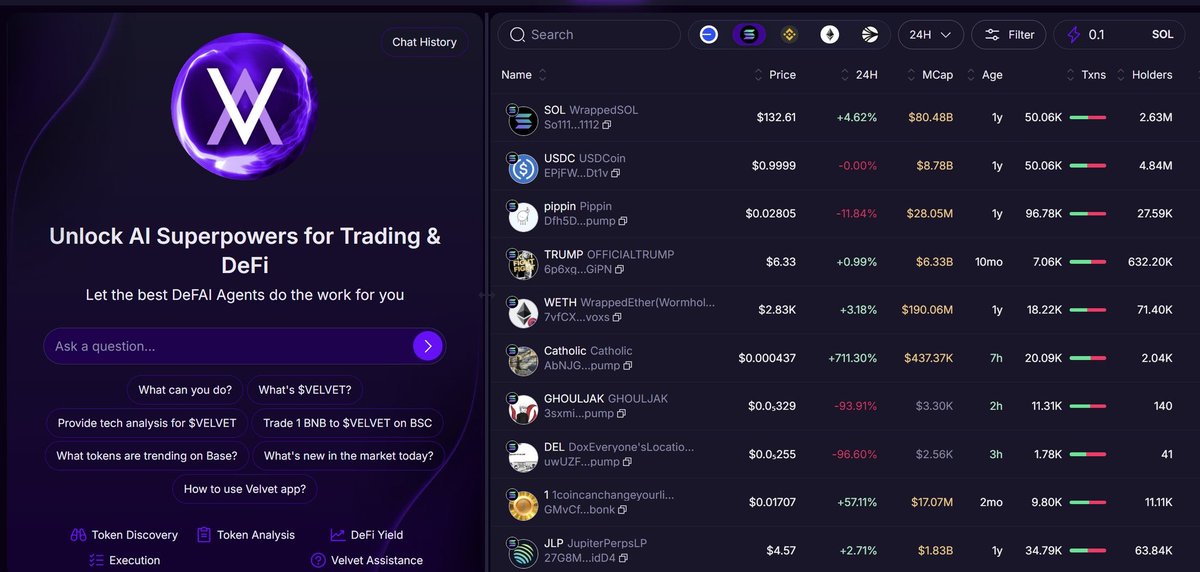

Tyer 🇸🇦🇶🇦 NFT_Expert Influencer B15.71K @supertyerQuack Quack I want to take a moment to share my thoughts for anyone seriously using @Velvet_Capital isn’t about hype, clout or financial advice. It’s just a glimpse into how I use the platform in my daily routine, what strategies have worked for me, what I steer clear of and where I genuinely see value if you approach it with a disciplined mindset. Velvet has really evolved over the past year. The product has matured significantly, liquidity is looking much healthier and the tools finally feel designed for real traders and capital managers, rather than just for those who click buttons. • Velvet has handled over $100M in cumulative volume • It's active across Base, Ethereum, Solana, BNB Chain and Sonic • VU has transitioned from being just an “interesting idea” to something I truly depend on • Vaults stand out as the most significant differentiator compared to other DeFi platforms How I Use the Trading Terminal (VU) No Guessing, No Overtrading I don’t rely on VU to dictate my purchases. Instead, I use it to sift through information quickly and keep my focus sharp. My daily routine is pretty straightforward: • I check out Trending, Gainers and New Pairs • I usually filter by Base because fees are important • I pay attention to volume expansion rather than just price When I see volume spike before the price, I take note. If the price shifts without any volume backing it, I let it go. Execution • I go for Quick Buy when timing is crucial • I set Limit orders when I’ve already mapped out my entry and exit points • I always use Hard stops I’m not aiming to win every single trade, my goal is to steer clear of the bad ones. How I actually communicate with VU I keep my questions clear and to the point: • “Which Base assets experienced the biggest volume increase in the last hour?” • “What’s the current sentiment around $VELVET?” • “Which assets are seeing inflows but have flat price action?” VU is a tool in my toolkit, not a signal service. That distinction is key. Quack Louder Quack Harder Trade Smarter

46 30 549 Original >Trend of VELVET after releaseBullishThe author highly praises Velvet Capital's platform maturity and practicality, supporting multi-chain trading with cumulative volume exceeding $100 million.

46 30 549 Original >Trend of VELVET after releaseBullishThe author highly praises Velvet Capital's platform maturity and practicality, supporting multi-chain trading with cumulative volume exceeding $100 million. Nofuturistic.eth 👻 Founder Influencer C12.88K @nofuture

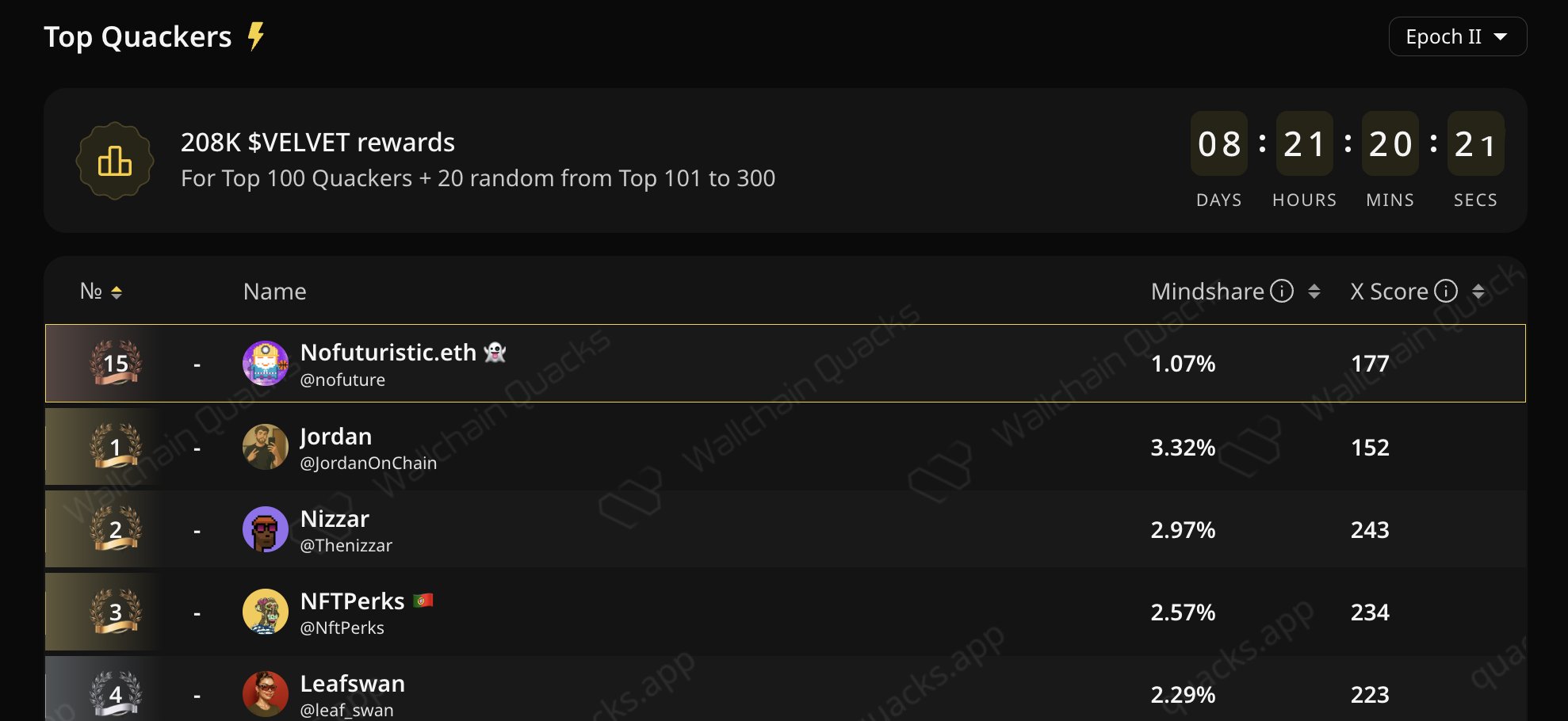

Nofuturistic.eth 👻 Founder Influencer C12.88K @nofutureI've held on to my top 20 spot on the @Velvet_Capital Epoch 2 leaderboard on Wallchain. Velvet's DeFAI platform is running trading competitions as well as this InfoFi campaign. There are 8 more days to move up on the leaderboard for a share of 208K VELVET. Good luck fam! https://t.co/YbP1KhYXOw

19 12 258 Original >Trend of VELVET after releaseBullishThe author remains in the top 20 of the Velvet Capital Epoch 2 competition, promotes the event and encourages participation to win 208K VELVET rewards.

19 12 258 Original >Trend of VELVET after releaseBullishThe author remains in the top 20 of the Velvet Capital Epoch 2 competition, promotes the event and encourages participation to win 208K VELVET rewards. icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.50K @icefrog_sol

icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.50K @icefrog_solI turned my weekly trading into a simple workflow on @Velvet_Capital - Spot narrative heat with the Virtuals Screener on the Trade tab - Spin up a vault around the basket I like or execute directly from wallet - Let the multi‑agent DeFAI track momentum, flows, volatility, and correlation shifts - Define rebalance logic and risk limits while staking rewards keep stacking - Rely on the execution engine to compress routes into one transaction, pick the most gas‑efficient path, and shield me from MEV and slippage - Keep permissions minimal per action so I’m never signing blanket approvals Result: fewer clicks, cleaner entries, faster decisions, and way less micromanaging. Feels like an execution layer for narratives, not another dashboard What’s your playbook with $VELVET right now in #DeFi #AI #CryptoTrading?

57 29 426 Original >Trend of VELVET after releaseExtremely BullishVelvet Capital provides efficient trading workflows, streamlining operations and accelerating decision speed.

57 29 426 Original >Trend of VELVET after releaseExtremely BullishVelvet Capital provides efficient trading workflows, streamlining operations and accelerating decision speed. Tyer 🇸🇦🇶🇦 NFT_Expert Influencer B15.71K @supertyer

Tyer 🇸🇦🇶🇦 NFT_Expert Influencer B15.71K @supertyerQuack Quack I've been with @Velvet_Capital ever since Wallchain introduced me to the team. I trade on it regularly, have built vaults and locked in a good chunk into $veVELVET. I'm not here to hype things up or persuade anyone just sharing why holding $VELVET still makes sense for me based on my actual experience with the platform. Governance That Actually Matters When you lock $VELVET into $veVELVET, you gain genuine voting power. It's not just voting on trivial matters, it's about upgrades, new chains, fee structures and how the treasury is managed. The longer you lock, the more influence you have, which encourages a long-term mindset rather than just chasing quick profits. Why Fees Matter for Frequent Traders If you trade often, this part will resonate with you right away. Staking $veVELVET provides real fee discounts on swaps and vault usage. The more you lock, the more you save, it’s that straightforward. Plus, there's volume based cashback that you receive automatically. Across BNB, Base, and Solana, I've saved a noticeable amount just by being staked. The Real Revenue Share (This Is the Key) This is the main reason I'm in it for the long haul. A whopping 50% of all protocol revenue from trading fees, AI agents to vault management is used to buy back $VELVET and distribute it to $veVELTET lockers. This isn’t about emissions or inflated APRs, it’s real yield directly tied to actual platform usage. If activity increases, holders benefit. That alignment is crucial. Gems → Monthly $VELVET Rewards Everything you do on Velvet earns you Gems, whether it's trading, staking, deposits or referrals. You can claim them daily (just a reminder they reset) and at the end of each epoch, they convert into $VELVET rewards. Velvet consistently seen over 1M $VELVET distributed per epoch and those veVELVET boosts really make a difference if you're active. If you're on the hunt for reliable returns, the Falcon Vault is definitely worth a look. By locking up your $VELVET, you can earn around 20–35% APR in stablecoins, all while keeping your stake in the token. Just keep in mind there’s a 180-day lock period with a brief cooldown, it’s not for those looking to flip quickly, but it’s perfect for those who are in it for the long haul. Liquidity Feels Healthy • $36M circulating market cap • $195M fully diluted valuation (FDV) • $5M in daily trading volume • Over 22,000 holders Liquidity on the BNB Chain is holding up nicely, even for larger trades, and slippage has remained manageable. The price, hovering around $0.1950, has been quite steady given the current market conditions. Value Comes From Real Usage What I really appreciate is the source of demand. The buying pressure isn’t just based on hype, it stems from genuine usage: People are trading, running AI agents and managing their vaults. More activity leads to more revenue, which translates to greater value for holders. That’s the kind of ecosystem I’m happy to be a part of. Final Take: $VELVET isn’t about chasing quick gains. It’s designed to reward those who actively engage with the platform and think long term. If you’re involved with Velvet, holding and locking your $VELVET makes everything more affordable, profitable and aligned with your goals. Quack Louder Quack Harder Trade Smarter

22 18 283 Original >Trend of VELVET after releaseExtremely BullishThe author is extremely bullish on VELVET and recommends long-term holding and staking for profit.

22 18 283 Original >Trend of VELVET after releaseExtremely BullishThe author is extremely bullish on VELVET and recommends long-term holding and staking for profit. Nofuturistic.eth 👻 Founder Influencer C12.88K @nofuture

Nofuturistic.eth 👻 Founder Influencer C12.88K @nofutureThe Santa Rally has been a real thing in the past and it seems @Velvet_Capital is calling for it. I wonder if they got this insight from their AI Agent 🤣 I could really use a Santa Rally for real. https://t.co/aURSge2uh5

22 23 316 Original >Trend of VELVET after releaseBullishThe author and Velvet Capital are looking forward to a Christmas rally boosting the market.

22 23 316 Original >Trend of VELVET after releaseBullishThe author and Velvet Capital are looking forward to a Christmas rally boosting the market. AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.09K @Alex394959

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.09K @Alex394959GM CT legends I started poking around @Velvet_Capital this week and treated it like an assistant, not a trading terminal. I asked for a safe swap, it found better prices, routed my tokens, and flagged liquidity shifts using on-chain and social signals so I didn't have to babysit. I picked up a Gem after staking $VELVET and the veVELVET mechanics finally clicked longer locks mean more influence, clearer incentives, and rewards that favor presence over noise. The AI even remembered yesterday's volume shifts and sentiment changes, which stopped me from making a panic swap If you're curious how to move from fomo to discipline, write one clear intent, lock a bit of $VELVET, let the AI execute, and watch habits compound #DeFi #AI Anyone else stacking Gems or locking veVELVET?

1 1 49 Original >Trend of VELVET after releaseExtremely BullishVelvet Capital AI优化交易,管理流动性,助用户避免FOMO,鼓励质押VELVET。

1 1 49 Original >Trend of VELVET after releaseExtremely BullishVelvet Capital AI优化交易,管理流动性,助用户避免FOMO,鼓励质押VELVET。 Devmustee🥑🇨🇦 Dev OnChain_Analyst B29.53K @Dev_Mustee

Devmustee🥑🇨🇦 Dev OnChain_Analyst B29.53K @Dev_MusteeEpoch 6 is live on @Velvet_Capital with a major upgrade to the engine. The standout change is the full Cashback System every trade now feeds back into your balance, scaled by monthly volume and $VELVET position. Active traders and long-term stakers gain compounding advantages designed to reward real participation. Core earning paths remain intact: referrals generate Gems plus 50% fee share, staking veVELVET boosts multipliers, portfolio TVL generates Gems, and daily streaks carry extra bonuses. Slashing continues to favor committed users over early reward flippers. Epoch 6 lays the foundation for a stronger Q1 where alignment drives measurable upside for all participants. Velvet is doubling down on fairness and compounding rewards.

9 9 149 Original >Trend of VELVET after releaseBullishVelvet Capital upgrades Epoch 6, launches a cashback system, and Q1 outlook is optimistic.

9 9 149 Original >Trend of VELVET after releaseBullishVelvet Capital upgrades Epoch 6, launches a cashback system, and Q1 outlook is optimistic.