STBL (STBL)

STBL (STBL)

$0.03595 -7.75% 24H

- 61Social Sentiment Index (SSI)-3.69% (24h)

- #107Market Pulse Ranking (MPR)-77

- 824h Social Mention-11.11% (24h)

- 100%24h KOL Bullish Ratio7 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall61SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (25%)Bullish (75%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

Javi🥥.eth Community_Lead Influencer B62.04K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.04K @jgonzalezferrer STBL D41.37K @stbl_official92 55 1.07K Original >Trend of STBL after releaseBullish

STBL D41.37K @stbl_official92 55 1.07K Original >Trend of STBL after releaseBullish 0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ Founder DeFi_Expert B34.16K @0xdahua

0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ Founder DeFi_Expert B34.16K @0xdahua

STBL D41.37K @stbl_official69 62 1.08K Original >Trend of STBL after releaseBullish

STBL D41.37K @stbl_official69 62 1.08K Original >Trend of STBL after releaseBullish- Trend of STBL after releaseBullish

Avtar Sehra Founder Tokenomics_Expert S8.94K @avtarsehra

Avtar Sehra Founder Tokenomics_Expert S8.94K @avtarsehra STBL D41.37K @stbl_official840 101 66.51K Original >Trend of STBL after releaseBullish

STBL D41.37K @stbl_official840 101 66.51K Original >Trend of STBL after releaseBullish Clever💫| ∞ KIN | MemeMax⚡️ Influencer Community_Lead B20.54K @rapperr111

Clever💫| ∞ KIN | MemeMax⚡️ Influencer Community_Lead B20.54K @rapperr111

STBL D41.37K @stbl_official108 88 2.52K Original >Trend of STBL after releaseBullish

STBL D41.37K @stbl_official108 88 2.52K Original >Trend of STBL after releaseBullish- Trend of STBL after releaseExtremely Bullish

Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb

Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb

Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb 15 13 236 Original >Trend of STBL after releaseExtremely Bullish

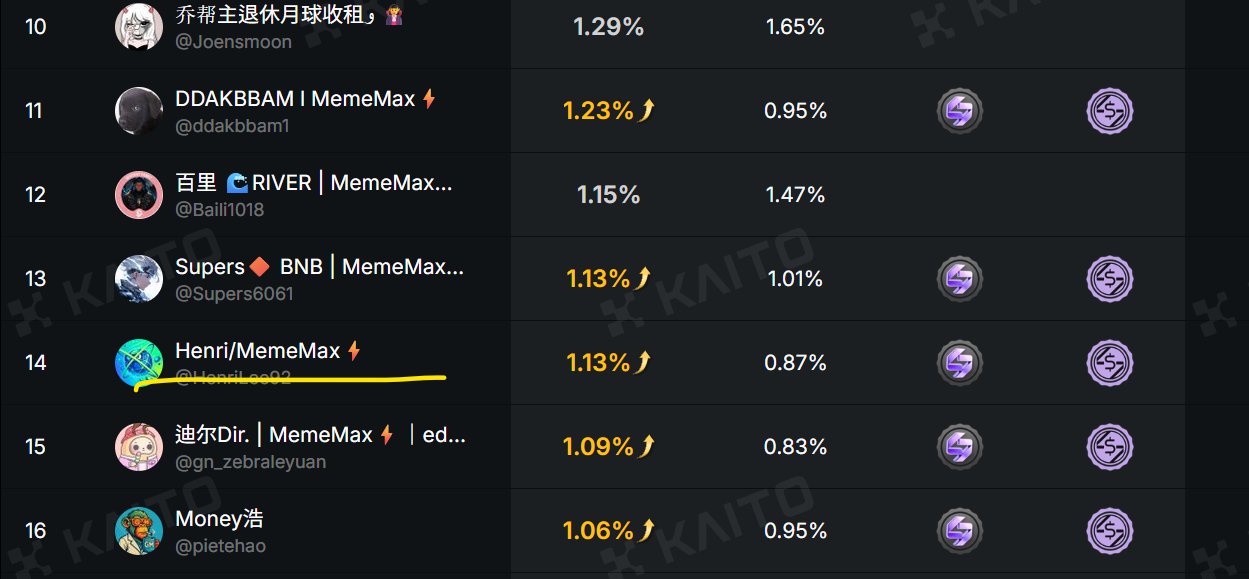

15 13 236 Original >Trend of STBL after releaseExtremely Bullish Henri/MemeMax⚡️ Trader TA_Analyst B7.07K @HenriLee92

Henri/MemeMax⚡️ Trader TA_Analyst B7.07K @HenriLee92

Henri/MemeMax⚡️ Trader TA_Analyst B7.07K @HenriLee9240 30 750 Original >Trend of STBL after releaseBullish

Henri/MemeMax⚡️ Trader TA_Analyst B7.07K @HenriLee9240 30 750 Original >Trend of STBL after releaseBullish Javi🥥.eth Community_Lead Influencer B62.04K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.04K @jgonzalezferrer Cointelegraph Media Influencer C2.89M @Cointelegraph109 51 2.34K Original >Trend of STBL after releaseBullish

Cointelegraph Media Influencer C2.89M @Cointelegraph109 51 2.34K Original >Trend of STBL after releaseBullish Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb

Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb

Ni - MemeMax ⚡️ OnChain_Analyst Trader B37.60K @ni_celeb 22 12 319 Original >Trend of STBL after releaseExtremely Bullish

22 12 319 Original >Trend of STBL after releaseExtremely Bullish