Kaia (KAIA)

Kaia (KAIA)

- 46Social Sentiment Index (SSI)- (24h)

- #6Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 0%24h KOL Bullish Ratio1 Active KOL

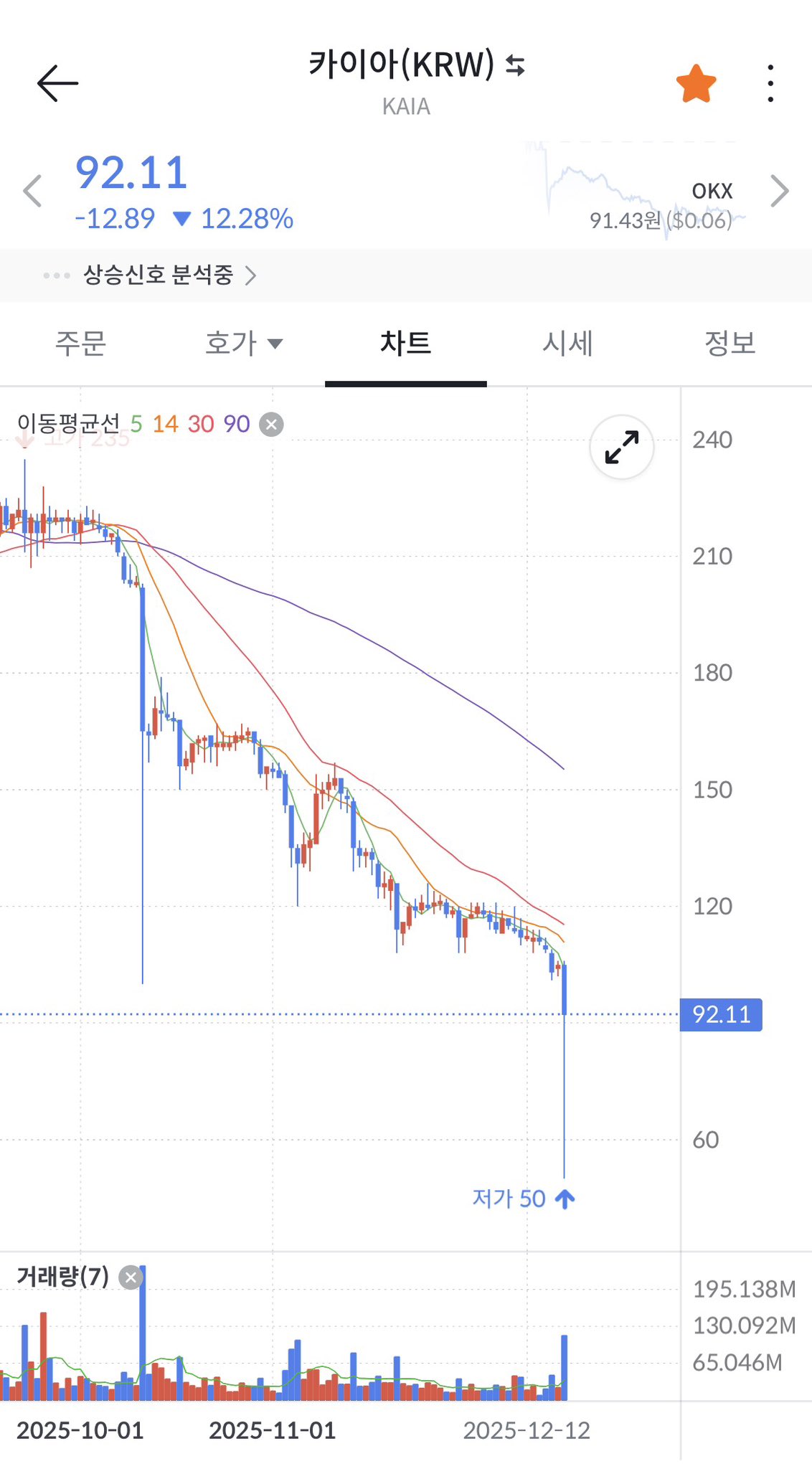

- SummaryIn the past 24h, KAIA price fell 6.27%, social hype remained flat, main tweets questioned the KRW stablecoin and blamed sustained selling.

- Bullish SignalsNo Data

- Bearish Signals

- Sustained selling

- Price down 6.27%

- Questioning the claim of a stable KRW-pegged coin

- Social hype not increasing

- Negative sentiment dominates

Social Sentiment Index (SSI)

- Data Overall46SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bearish (100%)SSI InsightsKAIA social hype is moderate (46/100) and unchanged, activity is high but positive sentiment is low (5/30), associated with selling and questioning the KRW stablecoin claim.

Market Pulse Ranking (MPR)

- Alert InsightKAIA warning rank #6, social abnormality and sentiment polarization both 100/100, indicating abnormal volatility, linked to sustained selling and stablecoin doubts.

X Posts

BAEK_PRO🌊 Community_Lead Educator B4.13K @baek_project

BAEK_PRO🌊 Community_Lead Educator B4.13K @baek_projectWho keeps dumping KAIA... They say it's a KRW stablecoin... https://t.co/IUrTxrTDG1

17 11 163 Original >Trend of KAIA after releaseExtremely BearishKAIA price continues to plummet sharply, and the author is disappointed that it fails to achieve stability.

17 11 163 Original >Trend of KAIA after releaseExtremely BearishKAIA price continues to plummet sharply, and the author is disappointed that it fails to achieve stability. RaArΞs ⚓️ FA_Analyst Educator A42.61K @RaAres

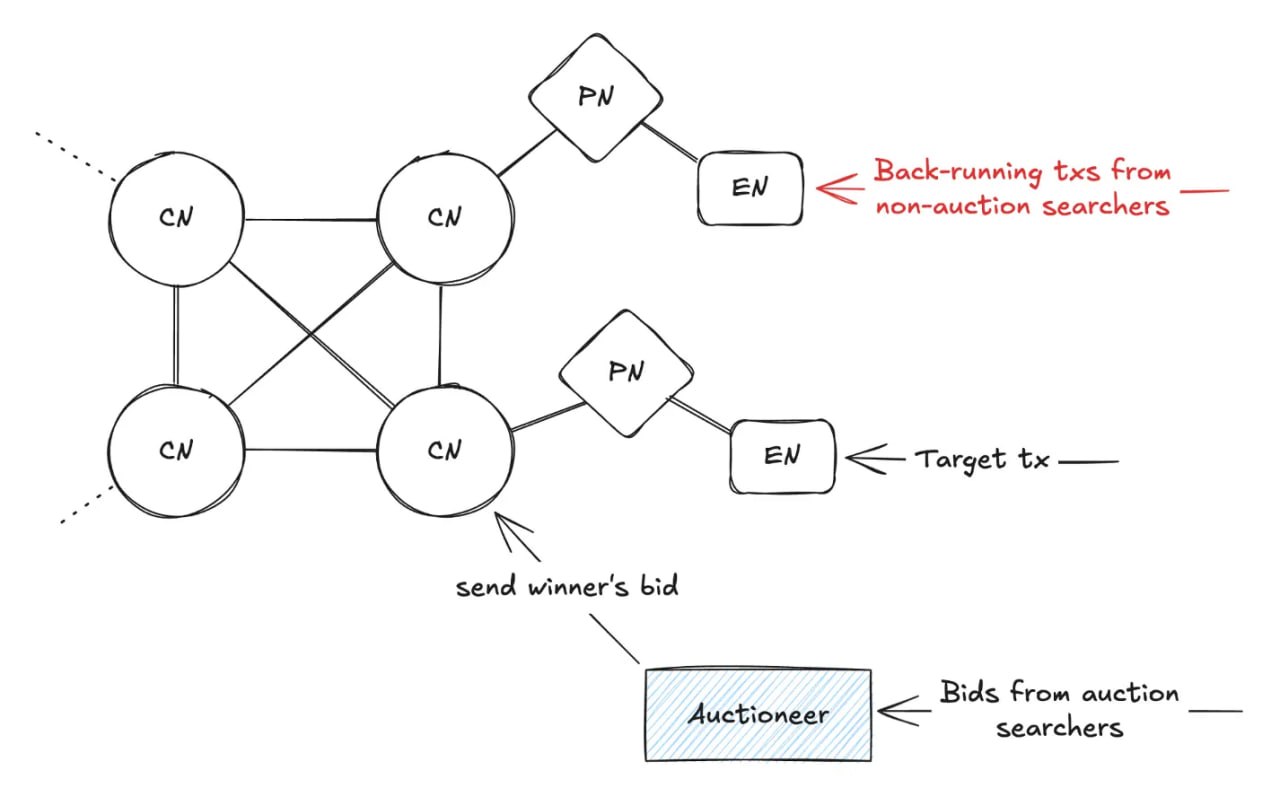

RaArΞs ⚓️ FA_Analyst Educator A42.61K @RaAreswhen a user loses $900,000 on a swap, the network is telling you something. when another swap sparks 10,000 arbitrage attempts and slows the chain to 2 minutes w/ 30x gas, it's telling you even louder... @kaiachain $KAIA MEV redesign comes straight out of these stress points i wanted to understand how they're turning those failures into a structured approach by going through their recent blog post 🧵👇 i'll explain in understandable terms here's what's on the list: → what kaia is trying to fix → how mev shows up in real life → kaia's slot auction idea → how the system works → what changes in practice ▫️what kaia is trying to fix i got curious when i saw kaia talking about controlling MEV instead of fighting it, so i went into their doc to see what they're actually solving. the first thing that hits you is how chaotic MEV can get. there's this case where a user swapped a huge amount of oXRP and got back way less KAIA than expected. the price tanked, bots rushed in, and it took minutes for things to normalize. another swap triggered more than 10,000 arbitrage attempts in seconds and pushed gas fees up 30x. so the problem isn't only that someone makes money. it's that the whole chain slows down, users get wrecked on fees, and the most powerful bots win every time. ▫️how mev shows up in real life the idea behind MEV is simple↓ • blocks group txs • someone can change the order • reordering can create profit you see it through 3 common moves↓ • arbitrage - buying cheap in one place, selling high in another • front-running - jumping ahead of someone's trade • back-running - slipping right after their trade the real pain is the "race to the bottom"... everyone fires txs at the network most of them fail the chain wastes resources users wait longer validators might even cut private deals so kaia made a clear call → MEV isn't going away, so it needs a structure. ▫️kaia's slot auction idea instead of removing MEV, kaia makes bots compete in a small, controlled auction for a single backrun slot. the design leans on 3 things↓ • only the backrun slot is auctioned • searchers bid instead of spamming • validators still build the block normally this avoids the model where block builders gain too much power. here, the proposer keeps control, and the auctioned slot is added cleanly after the target transaction. it looks more precise than the "whole block" systems we've seen elsewhere. ▫️how the system works i broke their flow into small steps to see it clearly↓ • a profitable tx appears • searchers detect it in ~100ms • sealed bids get sent • the auction closes in ~200ms • the winner gets placed immediately after the target tx the Early Deadline (ED) was the tricky part at first. the idea↓ • normal tx arriving after ED are delayed • the winning MEV bid can still make it in the next block as long as it reaches validators before mining starts that gives the MEV slot a timing advantage without messing up overall performance. other guardrails keep the system fair↓ • Auctioneer - stateless, neutral, forwarding only the winner • deposit-based model - prevents spam and bad bids • nonce checks - no replay attacks • execution runs even if it fails - prevents griefing it's a long chain of small rules, but together they block most of the nasty edge cases around MEV. ▫️what changes in practice what surprised me most is the revenue split. from each winning bid↓ • 10% goes to block proposers • 90% goes into the ecosystem fund example they give↓ • a swap creates $1,500 MEV • winning bid is $1,000 • proposer gets $100 • ecosystem gets $900 before this, that whole $1,500 went straight to the fastest bot. with this setup↓ • the network gets less spam • congestion drops • anyone can compete if they can bid • MEV value flows back into kaia's economy the system went live on Kairos testnet, and reading through it i get that they want to put MEV into a predictable lane so it stops damaging the network and starts paying for its own footprint... full blog post on their medium found this useful? consider reposting it to your network and follow @raares for more kaia updates

88 54 10.04K Original >Trend of KAIA after releaseBullishKaiachain launches MEV slot auctions, aiming to address MEV issues, reduce network congestion, and create value for the ecosystem.

88 54 10.04K Original >Trend of KAIA after releaseBullishKaiachain launches MEV slot auctions, aiming to address MEV issues, reduce network congestion, and create value for the ecosystem. CoinMarketCal Media Researcher D110.67K @CoinMarketCal

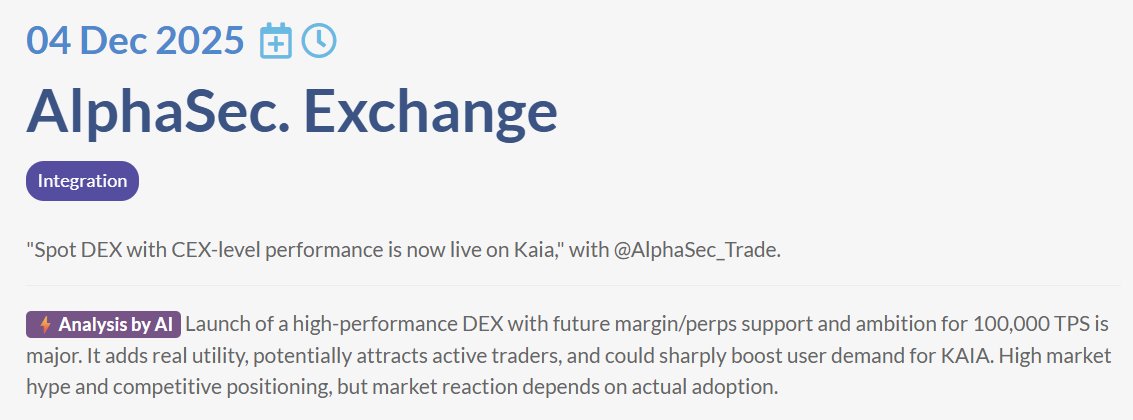

CoinMarketCal Media Researcher D110.67K @CoinMarketCalThree noteworthy events added in the last 24h ✨ $KAIA (@kaiachain) 04 Dec 2025 AlphaSec. Exchange 👉 https://t.co/67qkal8rEj $BSTY (@globalboost) 04 Dec 2025 Dex-Trade Suspension 👉 https://t.co/DcoarM1NqC $FLUID (@0xfluid), $XVS (@venusprotocol) 04 Dec 2025 Venus X & Fluid 👉 https://t.co/SFMFcjvcFs More highlights 👉 https://t.co/LhZzIYHOty

2 0 732 Original >Trend of KAIA after releaseNeutralCoinMarketCal announced KAIA new DEX integration, BSTY trading suspension, and FLUID/XVS partnership event.

2 0 732 Original >Trend of KAIA after releaseNeutralCoinMarketCal announced KAIA new DEX integration, BSTY trading suspension, and FLUID/XVS partnership event. BLADE {} Laya C76.36K @BladeDefi

BLADE {} Laya C76.36K @BladeDefi symbiote D110.17K @cryptosymbiiote

symbiote D110.17K @cryptosymbiioteUpdates on $KAIA: One week left before Korea AMA on Dec 10 with @seo_sangmin and @Iam_JohnCho AMA will be run for 2 hours with many interesting coming Will join it and pick up some $KAIA here https://t.co/wJRGqoa8BE

7 1 1.94K Original >Trend of KAIA after releaseBullishKAIA is set to hold a Korea AMA, and the tweet author is bullish and plans to buy.

7 1 1.94K Original >Trend of KAIA after releaseBullishKAIA is set to hold a Korea AMA, and the tweet author is bullish and plans to buy. CryptoJournaal Media Educator C18.62K @CryptoJournaal

CryptoJournaal Media Educator C18.62K @CryptoJournaal#Roadmap 🇳🇱 #Kaia ( $KAIA ) — Complete Roadmap 🧵 From the strategic merger of Asia’s leading blockchains to a high-performance Layer-1 Web3 ecosystem, #Kaia has become a bridge between Web2 and Web3 for millions of users in the region. Here is the full trajectory: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Kaia’s foundations trace back to the pioneering efforts of two Asian tech giants—Kakao’s Klaytn and LINE’s Finschia—whose merger created a unified, high-performance Layer-1 blockchain platform, optimized for enterprise adoption and developer innovation. Key milestones: 🔹 Early Research & Development Klaytn and Finschia established core infrastructure principles, focusing on scalable, secure, low‑latency transactions for real‑world and messaging‑integrated dApps. 🔹 Fusion Announcement The 2024 merger unified ecosystems, governance structures and technical infrastructures, leveraging Klaytn’s robust consensus and Finschia’s developer tools to shape Kaia. 🔹 Mainnet Launch The Kaia mainnet went live on August 29, 2024, rebranding from Klaytn while retaining backward compatibility. Major features include namespace updates, batch‑request support and the creation of the Kaia DLT Foundation. 🔹 Kaia Portal & Kaia Square Introduced access platforms for developers and users, strengthening Kaia’s role as the bridge for Asian Web3 innovation. 🔹 Regulation & Global Expansion Founded a foundation in Abu Dhabi Global Market for compliance‑driven growth and international outreach. Impact: Kaia transforms from separate blockchain initiatives into a unified, enterprise‑ready and developer‑friendly ecosystem that connects Web2 and Web3. #KaiaGeschiedenis ⚡ Present: Current Status & Developments Kaia today operates as a mature BFT‑based public blockchain focused on enterprise reliability, immediate block finality and EVM equivalence for seamless developer migration. Ecosystem expansion: The network supports diverse dApps, including DEXs, lending protocols and messenger‑integrated mini dApps via LINE and Kakao. Partnerships span telecom companies, stablecoins and security firms to enable payments, DeFi and tokenized real‑world assets (RWAs). Technical advancements: Kaia’s consensus is a refined Istanbul BFT variant with PBFT tweaks for fork‑less validation. Upgrades include CosmWasm‑modular smart contract support, cross‑chain bridges, KVM for Solidity compatibility, node storage optimization and MEV Auction SDKs. Governance & Incentives: A decentralized Governance Council manages protocol upgrades, fund allocation and ecosystem decisions. Validator roles are separated from policy‑making, encouraging broader participation. Ecosystem challenges: While scaling and adoption continue, security, fair transaction ordering and regulatory alignment remain critical. The ecosystem is robust, with strong developer tools, analytics integrations and cross‑chain capabilities. #KaiaNu #Layer1Groei 🚀 Future: Planned Roadmap (2025–2030+) Kaia’s roadmap focuses on decentralization, scalability, interoperability and Web3 adoption in Asia and beyond. Key directions: 🔹 Permissionless Validation Broad node participation without performance loss, democratizing network operations and enabling efficient block verification. 🔹 MEV Mitigation & Block Archiving Advanced mechanisms for fair transaction ordering and efficient historical verification, enhancing security and transparency. 🔹 Stablecoin Expansion KRW‑pegged and broader USDT adoption via gas‑abstraction for seamless fiat‑to‑crypto onboarding and payments. 🔹 Mini dApp Growth Spread of messenger‑integrated mini dApps (Kaia Wave, LINE/Kakao) focusing on DeFi yields, RWAs and fiat on‑ramps. 🔹 Scalability & Interoperability Modular client structures and CosmWasm‑native contracts for hybrid applications; cross‑border RWA and DeFi integrations. 🔹 Governance Evolution Community‑driven funds such as Kaia Ecosystem Fund (KEF) and Infrastructure Fund (KIF) stimulate dApp grants, security upgrades and DAO‑based decision‑making. 🔹 Long‑Term Vision AI‑enhanced security, zero‑knowledge proofs for privacy‑preserving RWAs, and global mobility‑dApp frameworks, keeping Kaia a timeless platform for Web3 adoption. Impact: Improved developer adoption, faster dApp execution, lower transaction costs, secure and decentralized operations, and a globally connected ecosystem. Risks & Opportunities: Market cycles, governance challenges and scaling remain, but Kaia’s robust technology, partnerships and DAO governance support long‑term resilience. #KaiaToekomst #Web3Schaalbaarheid ✅ Conclusion Kaia has evolved from separate blockchain initiatives into a unified, high‑performance and developer‑friendly Layer‑1 ecosystem. With innovations in governance, cross‑chain integrations, mini dApps, stablecoins and enterprise adoption, $KAIA links Web2 and Web3, offering a timeless platform for decentralized applications and global collaboration. #RoadmapConclusie 🛒 Want to buy $KAIA yourself? $KAIA is easy to purchase on #Bitvavo: ✅ Over 400 #Altcoins available ✅ Up to €100,000 #AccountGuarantee ✅ Registered with the Dutch Central Bank (#DNB) ✅ Sign up via the link below and trade up to €10,000 completely #Free! 🔗 https://t.co/DThEHyXfzf #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange 📚 Handy resources and extra info Want to learn more about #Kaia ( $KAIA )? Check the official channels and documentation below: 🔹GitHub: https://t.co/fx6KOSY0HR 🔹Reddit: https://t.co/rtIsvs2OZU 🔹Telegram: https://t.co/6NmkoCUdSI 🔹Website: https://t.co/DXQIClF0DS 🔹X (Twitter): https://t.co/B93lpaceJX ⚠️ Important note: 🔹 This post is purely educational and not financial advice! 🔹 Invest only what you can afford to lose! ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the place for independent crypto information: 📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR‑compliant 🔍 Knowledge always above hype 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal‑AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X profile: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNieuws #CryptoEducatie #CryptoKoersen

2 0 103 Original >Trend of KAIA after releaseExtremely BullishKaia as the Layer-1 resulting from the merger of Klaytn and Finschia is actively developing and bridging Web2 and Web3, with an optimistic outlook for the future.

2 0 103 Original >Trend of KAIA after releaseExtremely BullishKaia as the Layer-1 resulting from the merger of Klaytn and Finschia is actively developing and bridging Web2 and Web3, with an optimistic outlook for the future. RaArΞs ⚓️ FA_Analyst Educator A42.61K @RaAres

RaArΞs ⚓️ FA_Analyst Educator A42.61K @RaAresi started digging into @KaiaChain $KAIA FlatTrie update because i kept seeing the number 35TB thrown around for archive nodes 🤯 i needed to understand where that space disappears i needed to understand where that space disappears and while reading, i kept comparing it to how ethereum + polygon hit the same wall in the past. here's what i'll explore: → why archive nodes explode → how the trie inflates → what other chains tried → Kaia's roadblocks → what FlatTrie changes in real numbers → limits worth noting → where this direction might go → what does it mean for an user like me ▫️why archive nodes explode full nodes prune. archive nodes keep everything. that alone creates a huge difference, but Kaia's numbers are extreme. • full node → ~5TB • archive node → ~35TB • state alone → ~31TB here's what ends up stored there: • every account balance • every contract variable • every version of every state change • across hundreds of millions of blocks it made me wonder whether pruning could help, but archive nodes simply can't delete anything. ▫️how the trie inflates Kaia uses an MPT structure like other EVM chains. the part that inflates is the branch structure, not the actual data. you get duplication because each block stores: • the full state root • every branch node • every unchanged leaf • even when almost nothing changed this diagram shows this clearly: R1, R2, R3 all keep nearly identical trees. and i caught myself asking: why repeat 99% of the structure for 1% of changes? ▫️what other chains tried Ethereum ran into the same issue years ago. Erigon (eth client built to sync the chain fast and store data efficiently) showed that you only need historical leaf nodes. everything else can be rebuilt later. their approach flattened accounts like this: • account A → A1, A3 • account B → B1, B3 • account C → C1 • account D → D1, D2 branches are thrown away for old blocks. the latest block still keeps a full trie for fast writes. this cut eth archive size from 13TB to 3TB. Polygon now recommends Erigon for archive use. ▫️Kaia's roadblocks when reading Kaia's writeup, i expected them to reuse Erigon. but 2 constraints stopped them. Kaia accounts use more complex structures: • role based keys • humanReadable flag • accountKey • codeInfo • Erigon's hasher can't parse that their fix was interesting: • hash accounts as raw bytes • don't parse anything • stay format agnostic the second roadblock was MDBX (database engine used by erigon): • MDBX is single threaded • Kaia's client uses many goroutines so they built DomainsManager: • each worker has its own MDBX transaction • shared in memory layer • avoids constant disk commits this made the architecture multithreaded again w/o breaking MDBX rules. ▫️what FlatTrie changes in real numbers the Kairos tests show the difference: • original archive → 4,341GB total, 3,970GB state • FlatTrie archive → 982GB total, 631GB state that's: • 6x smaller state • 4x smaller total size i tried mapping this mentally to Ethereum's improvements and the scale is similar. there are tradeoffs though: • memory jumps to ~30GB • goroutines ~950 • block finalization ~500ms vs <100ms so the storage win is massive, but compute needs tuning. ▫️limits worth noting FlatTrie disables: • block rewinding ((you can’t jump the node back to a previous block) • merkle proofs (you can’t generate historical state proofs for wallets or contracts) • pruning (you can’t delete old state to save extra space) but archive use cases rarely depend on these. still, they're notable constraints. ▫️where this direction might go FlatTrie is marked experimental and must sync from genesis. future work targets: • lower memory • fewer goroutines • faster finalization • mainnet validation • snapshot distribution eth and pol/matic already validated this design path. Kaia is adapting it to their own account format and threading model while trying to keep speeds manageable.

130 69 9.01K Original >Trend of KAIA after releaseBullishKaiaChain's FlatTrie technology reduces archive node state size by 6x and total size by 4x, significantly optimizing storage.

130 69 9.01K Original >Trend of KAIA after releaseBullishKaiaChain's FlatTrie technology reduces archive node state size by 6x and total size by 4x, significantly optimizing storage. 0xTodd OnChain_Analyst Trader B70.13K @0xTodd

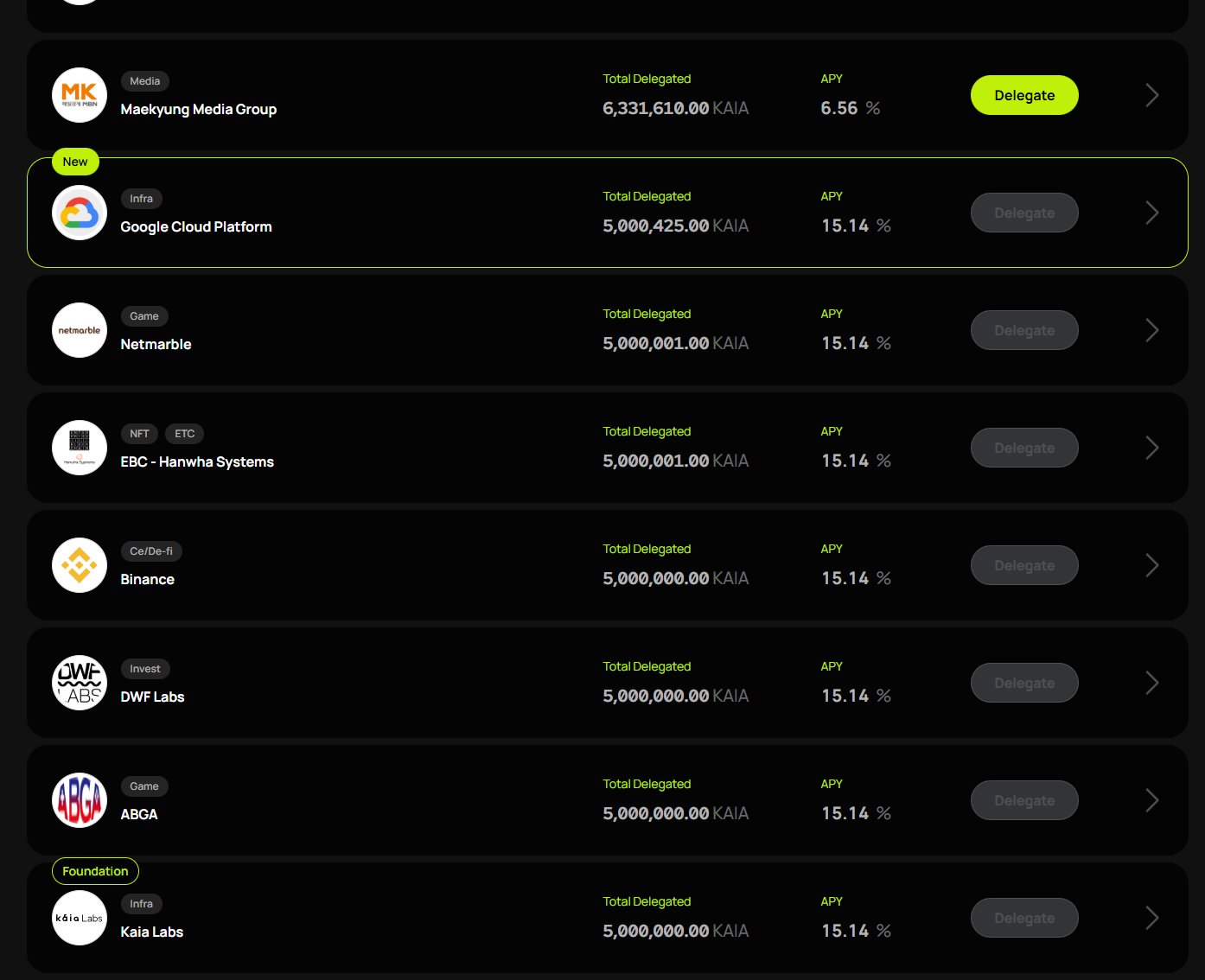

0xTodd OnChain_Analyst Trader B70.13K @0xToddKaia is finally starting the transition to a permissionless network. The transition plan is to open PoS validator nodes to the public. From foundation-approval to self-registration (but poorly performing nodes will be eliminated). PS: Because Kaia originates from the merger of Klaytn and Finschia, the validator management contracts are still those from Klaytn’s genesis, and they should be upgraded this time as well. Looking at it, many nodes have already fully staked $Kaia, such as those on Google Cloud, Binance, and the foundation. If shifting to permissionless, I wonder if more staking capacity will be opened?

Kaia D209.34K @KaiaChain

Kaia D209.34K @KaiaChain1/4 Kaia is starting the transition toward a permissionless network. Previously, the validator and network structure had limits that the team is now removing.

39 41 5.59K Original >Trend of KAIA after releaseBullishThe Kaia network is transitioning to a permissionless PoS, enhancing decentralization, with high validator staking amounts. BLADE {} Laya C76.36K @BladeDefi

BLADE {} Laya C76.36K @BladeDefi symbiote D110.17K @cryptosymbiiote

symbiote D110.17K @cryptosymbiioteConsidering the current market, $KAIA looks good here 1d TF shows a strong imbalance to retest and bounce from rn Might be a good entry https://t.co/SMKcnLL78m

17 8 2.95K Original >Trend of KAIA after releaseBullishThe KAIAUSDT daily chart shows a strong imbalance area, which may trigger a rebound, making it a good entry point.

17 8 2.95K Original >Trend of KAIA after releaseBullishThe KAIAUSDT daily chart shows a strong imbalance area, which may trigger a rebound, making it a good entry point. BLADE {} Laya C76.36K @BladeDefi

BLADE {} Laya C76.36K @BladeDefi symbiote D110.17K @cryptosymbiiote

symbiote D110.17K @cryptosymbiioteUpdates on $KAIA: @KaiaChain team continues to build hard even in such a terrible market - Sake USDT on Kaia on @SpoonFinanceX - Korea AMA on early Dec - Gas-free USDT withdrawal on Kaia Looks like a good entry rn

8 1 3.38K Original >Trend of KAIA after releaseBullishKAIA recent feature launch, market environment is poor, still worth entering 0xTodd OnChain_Analyst Trader B70.13K @0xTodd

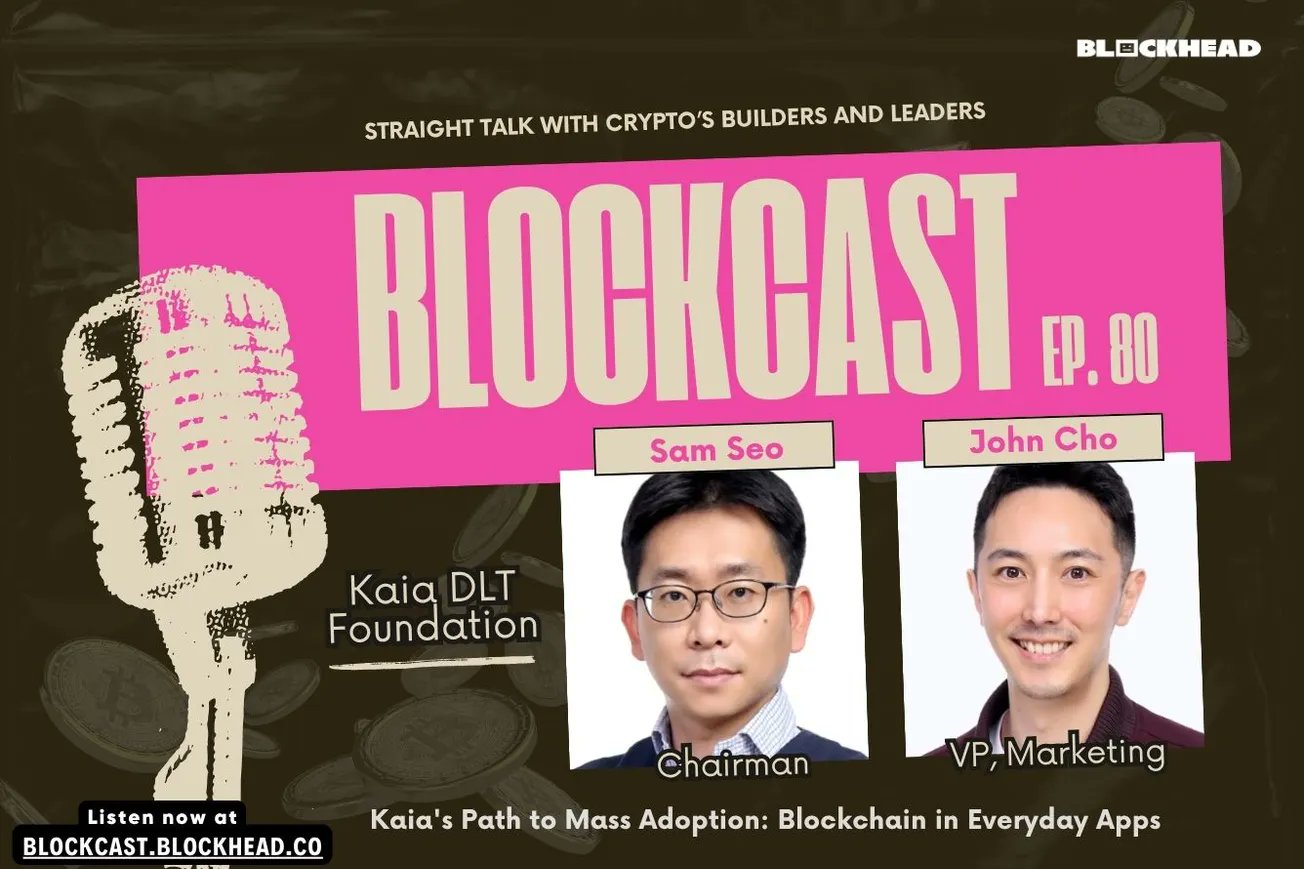

0xTodd OnChain_Analyst Trader B70.13K @0xToddThe core point this podcast wants to convey is: We should not underestimate the user base and capital that these veteran social apps (Kakao, Line) can bring. Your coverage, like TG, mainly includes the CIS region + India + Indonesia, where client net worth is relatively limited. In contrast, although Kakao and Line have fewer total users than TG, they cover Japan, South Korea, and Taiwan, which are all high‑net‑worth regions in Asia. Therefore, it's reasonable for Kaia to call itself the stablecoin payment infrastructure of Asia.

Blockhead D6.28K @blockhead_co

Blockhead D6.28K @blockhead_co🎙️ New Episode: #Blockcast 80 ➤ Kaia's Path to Mass Adoption: Blockchain in Everyday Apps Dr. Sangmin Seo and John Cho talk #Kaia's strategies for mass adoption, the evolving regulatory landscape in Asia, and the integration of blockchain technology into messaging platforms. https://t.co/NZdAFsjvnw

40 64 9.90K Original >Trend of KAIA after releaseExtremely BullishKaia integrates Klaytn and Finschia, targeting the high‑net‑worth Asian market, and is poised to become the stablecoin payment infrastructure.

40 64 9.90K Original >Trend of KAIA after releaseExtremely BullishKaia integrates Klaytn and Finschia, targeting the high‑net‑worth Asian market, and is poised to become the stablecoin payment infrastructure.