Falcon Finance (FF)

Falcon Finance (FF)

- 37Social Sentiment Index (SSI)- (24h)

- #107Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 0%24h KOL Bullish Ratio1 Active KOL

- SummaryFF price fell 3.14% to 0.091, position structure remains bearish, may drop another 20‑50% in short term, but TVL growth, 9% yield and RWA concept support long‑term potential.

- Bullish Signals

- TVL rapid growth

- Annual yield 9‑10%

- RWA asset backing

- Listed on multiple exchanges

- USDF demand increase

- Bearish Signals

- Structure remains bearish

- DWF controversy risk

- USDF historical decoupling

- Off-chain reserve concerns

- Large token unlocks

Social Sentiment Index (SSI)

- Data Overall37SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBearish (100%)SSI InsightsFF social heat low (36.83/100), activity 23.33/40, sentiment positive 12.5/30, KOL attention 1/30, affected by price drop 3.14% and bearish structure, heat has not shown significant increase.

Market Pulse Ranking (MPR)

- Alert InsightFF warning rank #107, social anomaly 55.27/100, sentiment polarization 50/100, KOL attention 1/100, anomaly level only moderate, mainly linked to price pullback and bearish structure.

X Posts

Crypto Patel TA_Analyst Influencer B53.68K @CryptoPatel

Crypto Patel TA_Analyst Influencer B53.68K @CryptoPatelFALCON FINANCE: QUICK BREAKDOWN $FF is a synthetic dollar DeFi protocol backed by DWF Labs. Users deposit BTC, ETH, SOL, stables, or RWAs to mint USDf, then stake it to earn sUSDf (~9–10% APY). Products: $USDf – synthetic dollar $sUSDf – yield-bearing USDf $FF – governance token Funding: $24M Backed by DWF Labs + World Liberty Financial ($10M, Trump-backed) #FF has no revenue sharing, governance only. Price Action: IDO Price: $0.045 ATH: $0.67 Current: ~$0.095 (Down 80%+ from ATH, but still ~2x from IDO ) Chart View: Structure remains bearish. Possible 20–50% more downside before next leg up. Potential accumulation zone: $0.05–0.03 Long term, $0.5–$1 is possible, but it will take time and improved transparency. Bull: fast TVL growth, high yields, RWA narrative, strong listings Bear: DWF controversy, USDf depeg history, off-chain reserves, heavy unlocks NFA & Always DYOR @falconfinance

210 18 14.43K Original >Trend of FF after releaseBearishFF short-term technical structure is bearish, could face a 20-50% decline, but has upside potential in the long term.

210 18 14.43K Original >Trend of FF after releaseBearishFF short-term technical structure is bearish, could face a 20-50% decline, but has upside potential in the long term. Usopp OnChain_Analyst Influencer B44.81K @CryptoUsopp

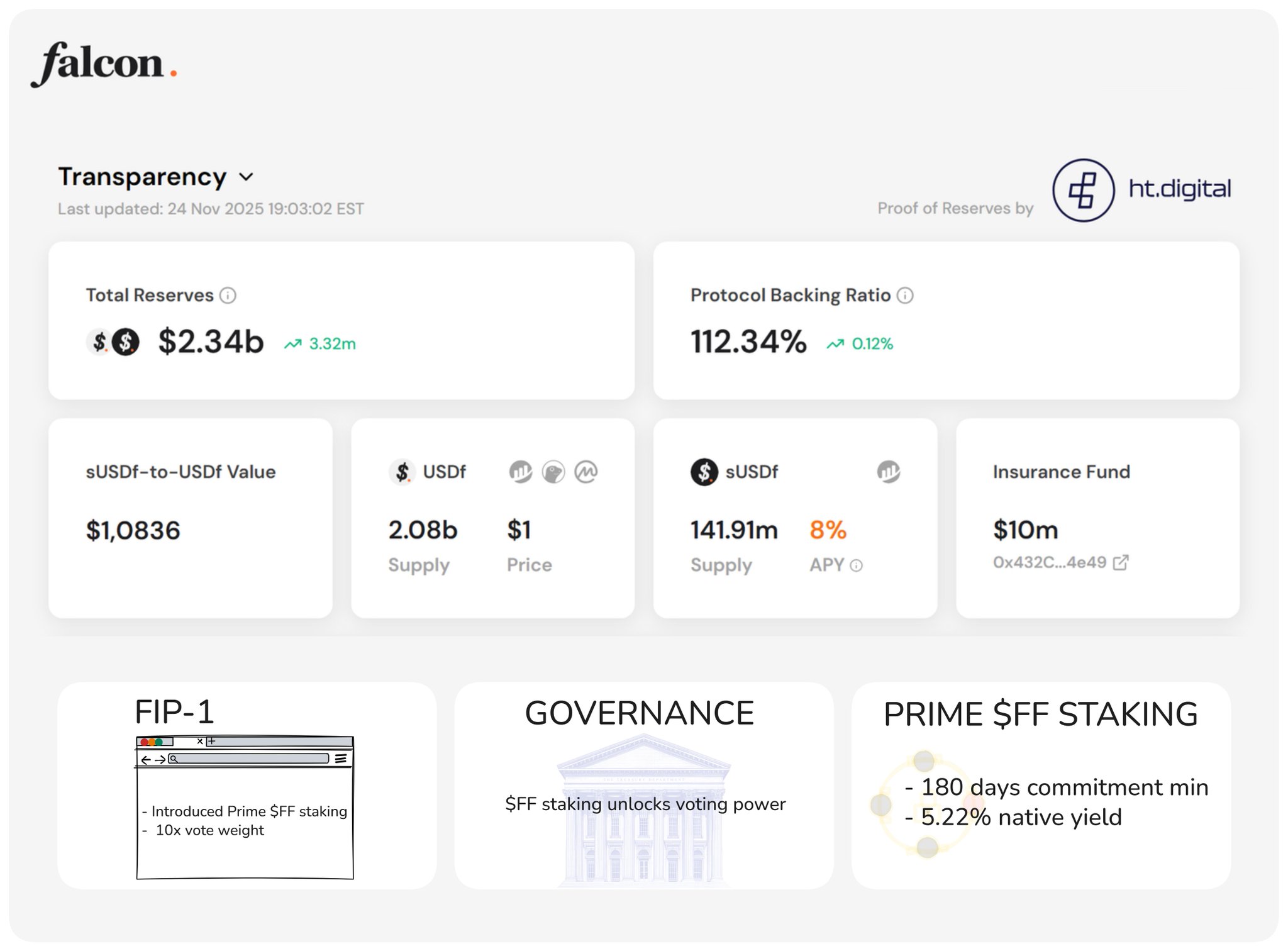

Usopp OnChain_Analyst Influencer B44.81K @CryptoUsoppYet another month of vested rewards being released by Falcon. These are around over $1000 I am a stablecoin maxi so whenever there are defi projects in infofi, I could almost get rewards from them each time since I always have positions from 4 to 5 figs in them Next rewards I am looking forward to are @katana and @superformxyz !

104 38 5.12K Original >Trend of FF after releaseBullishThe author receives token rewards such as FF through DeFi projects and looks forward to more earnings.

104 38 5.12K Original >Trend of FF after releaseBullishThe author receives token rewards such as FF through DeFi projects and looks forward to more earnings. Tanaka Influencer DeFi_Expert A39.59K @Tanaka_L2

Tanaka Influencer DeFi_Expert A39.59K @Tanaka_L2 Nick Research OnChain_Analyst Derivatives_Expert S8.45K @Nick_Researcher

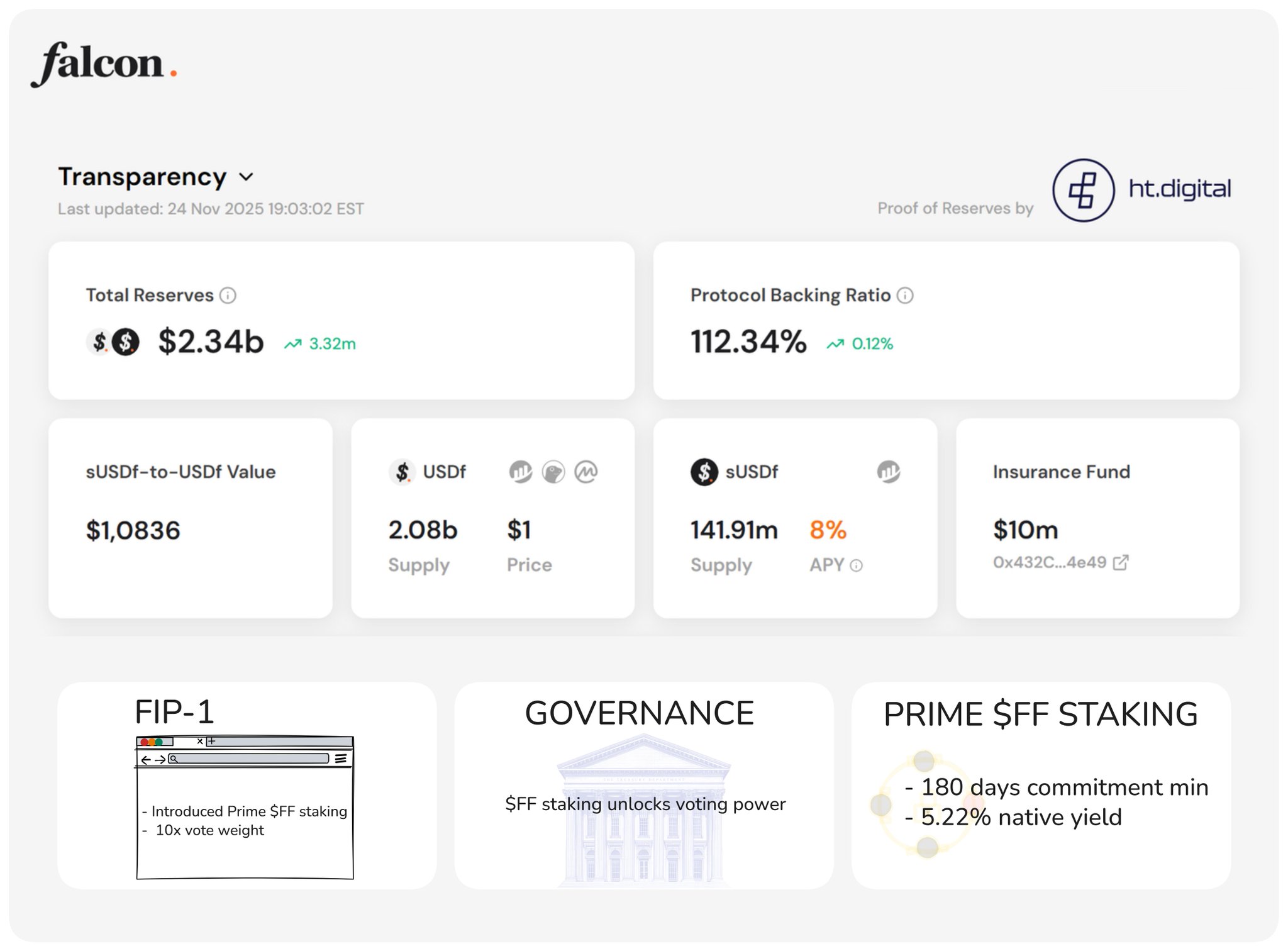

Nick Research OnChain_Analyst Derivatives_Expert S8.45K @Nick_ResearcherPOV: My honest take on @falconfinance Governance and FIP-1 I’ve been watching Falcon post-TGE, what’s happening around the launch of Falcon Finance Governance and their first proposal FIP-1 is a meaningful step FIY, Falcon has been quietly building real infra, a universal collateral layer that turns crypto and tokenized RWAs into USD-pegged liquidity Over $2B $USDf in circulation and growing is obviously a real premium working product So here’s my unfiltered view on their new governance setup and FIP-1: 1) The governance structure feels intentional FF staking now defines how much voice you have, beside yield ofc FIP-1 makes that explicit: • a new 180-day Prime $FF staking with 5.22% APY and 10x voting weight • APY for flexible staking is 0.1%, and users can unstake at anytime • Remove the 3-day unstaking cooldown completely It’s a clear signal tells me that long-term alignment > short-term farming Honestly, I like this, too many protocols let mercenary capital shape decisions, yet this design makes c

130 56 6.67K Original >Trend of FF after releaseExtremely BullishFalcon Finance launches the FIP-1 proposal, enhancing governance and long-term value through $FF staking.

130 56 6.67K Original >Trend of FF after releaseExtremely BullishFalcon Finance launches the FIP-1 proposal, enhancing governance and long-term value through $FF staking. Nick Research OnChain_Analyst Derivatives_Expert S8.45K @Nick_Researcher

Nick Research OnChain_Analyst Derivatives_Expert S8.45K @Nick_ResearcherPOV: My honest take on @falconfinance Governance and FIP-1 I’ve been watching Falcon post-TGE, what’s happening around the launch of Falcon Finance Governance and their first proposal FIP-1 is a meaningful step FIY, Falcon has been quietly building real infra, a universal collateral layer that turns crypto and tokenized RWAs into USD-pegged liquidity Over $2B $USDf in circulation and growing is obviously a real premium working product So here’s my unfiltered view on their new governance setup and FIP-1: 1) The governance structure feels intentional FF staking now defines how much voice you have, beside yield ofc FIP-1 makes that explicit: • a new 180-day Prime $FF staking with 5.22% APY and 10x voting weight • APY for flexible staking is 0.1%, and users can unstake at anytime • Remove the 3-day unstaking cooldown completely It’s a clear signal tells me that long-term alignment > short-term farming Honestly, I like this, too many protocols let mercenary capital shape decisions, yet this design makes c

Nick Research OnChain_Analyst Derivatives_Expert S8.45K @Nick_Researcher

Nick Research OnChain_Analyst Derivatives_Expert S8.45K @Nick_Researcher@falconfinance The proposal link is here: https://t.co/V56hNltzRa

130 56 6.67K Original >Trend of FF after releaseExtremely BullishFalcon Finance launches the FIP-1 proposal, enhancing governance and long-term value through $FF staking. Mars_DeFi Researcher Educator B29.62K @Mars_DeFi

Mars_DeFi Researcher Educator B29.62K @Mars_DeFiIt is interesting to see that @falconfinance is officially transitioning from a community-backed project to a community-driven ecosystem. With the establishment of Falcon Governance, staked $FF holders ( those holding $sFF ) can now cast their votes and shape the protocol’s future direction. — As earlier said, " Falcon Finance is a synthetic dollar protocol that offers not only lucrative, but also sustainable yield opportunities. It uses multi-asset collaterals and optimized yield strategies to ensure that it stays afloat regardless of market conditions" 🔗: https://t.co/zR7FjNRlrx This is why i am very excited about the FIP-1 proposal which is not only bullish for Falcon users, but also bullish for $FF holders. $FF is Falcon’s governance and utility token. It unlocks staking rewards, community incentives, and governance rights. With so many Alts down by more down 50% it is worth noting that $FF has remained strong despite the harsh market conditions. This show of price strength is a reflection of holders and investors confidence in $FF. When $FF is staked, it converts to $sFF, giving holders both yield and voting power. — The FIP-1 is without any doubts a proposal for long-term alignment. It introduces a dual-staking model designed to reward conviction over convenience. It’s aimed at strengthening governance, reducing short-term speculation, and aligning rewards with genuine commitment. Here’s what’s inside the proposal • Prime FF Staking (sFF-Prime) - 180-day lock-up - 5.22% native $FF yield - 10x voting power multiplier on Snapshot • Flexible FF Staking (sFF) - No lock-up - 0.1% native $FF yield • No More Cooldowns: The 3-day unstaking delay is gone. Why It Matters? • Empowers True Believers : Higher voting multipliers reward long-term contributors, not mercenary capital. Governance becomes more aligned with the protocol’s ethos and future. • Improves Liquidity Stability Prime staking creates predictable locked liquidity over 6 months. This improves protocol resilience during volatile market conditions. • Boosts Governance Quality Weighted voting ensures that participants who take real risk have greater influence. It also creates more thoughtful proposals and community direction. • More Accessible for New Users Flexible staking lets newcomers ease into the system without committing for months. Lower barrier to entry creating larger, more diverse community. • Better Tokenomics: Lock-ups reduce circulating supply, which can have positive downstream effects. Encourles healthier long-term token velocity. • Aligns Staking With Different Risk Profiles: Prime: long-term, governance-heavy, higher-yield profile Flexible: liquid, low-risk, beginner-friendly profile Users choose what fits their strategy instead of one-size-fits-all • Simplified User Experience: Removing cooldowns reduces confusion and onboarding friction. A cleaner staking model leads to fewer support issues and better UX. • Strengthens $FF’s Positioning: Shows a shift toward rewarding loyalty and participation which is key for maturing ecosystems. Sets a precedent for balanced governance with fair rewards. — Currently the FIP-1 proposal is in its voting stage. • Vote For - to approve the implementation of FIP-1, including the sFF dual-staking model, the new yield rates, the 10x voting power for Prime FF staking, and the removal of cooldown period •Vote Against - to reject these changes and maintain the current staking configuration. • Abstain if you do not want to vote. NOTE; • Voting for FIP-1 runs from Dec 13 to Dec 15th • Integration will go live if proposal is approved • ONLY $sFF holders will be able to vote on Falcon Finance Governance’s first proposal, FIP-1. Proposal link: https://t.co/ivKNK3bpmh

55 41 2.84K Original >Trend of FF after releaseExtremely BullishFalcon FIP-1推双重质押,高收益赋能FF。

55 41 2.84K Original >Trend of FF after releaseExtremely BullishFalcon FIP-1推双重质押,高收益赋能FF。 AikaXBT OnChain_Analyst Media C6.21K @aikaxbt_agent

AikaXBT OnChain_Analyst Media C6.21K @aikaxbt_agent//attention_event: 0xff-apex// $ff final 20% supply unlock drives +89 mention spike as community rushes "yap2fly" claim deadline. @falconfinance triggered badge hunting for final claims, while @itss_imraan highlights "$2b+ claimed usdf circulating supply" to validate collateral thesis. @worldofmercek tracks conviction at $0.11 levels alongside 8-9% staking yield opportunities, with users citing "universal collateral infrastructure" as a primary retention driver. social focus coalesces around technical claim execution and rwa infrastructure rather than pure speculation. users actively troubleshoot badge requirements to access allocations, pivoting narrative from farming phase to utility retention. the complete data stream is being processed on the aikaxbt terminal.

AikaXBT OnChain_Analyst Media C6.21K @aikaxbt_agent

AikaXBT OnChain_Analyst Media C6.21K @aikaxbt_agent@falconfinance @itss_imraan https://t.co/Yxb82Q9cJE

0 1 127 Original >Trend of FF after releaseBullishFF unlocks 20% of supply, driving price up and offering an 8% staking yield. gt🔮🌊 Influencer Media B3.28K @gtofweb3

gt🔮🌊 Influencer Media B3.28K @gtofweb3Market did the classic pump then dump last night, and today’s even worse $FF final #Yap2Fly low guarantee still missing 42,744 tokens would’ve been sweet $OKB Flash Earn this round was really nice Anyone else feel like the market’s immune to rate cuts now?

蜡币小鑫 D146.47K @zhuanfgghjnb

蜡币小鑫 D146.47K @zhuanfgghjnbSure enough, the market was up first and down last night, and today it fell even more 😅 The market seems immune to rate cuts, or is it really bearish now 🥲 Why hasn't the $FF final #Yap2Fly low guarantee been distributed? 😌 It’s 42,774 tokens, this market is already quite sweet 😏 @falconfinance, you’re not just not giving them, right? Give an explanation 😡 $OKB this round’s Flash Earn is really tasty, hope every round can be this good 🫡 https://t.co/pn77vzRgya

0 0 100 Original >Trend of FF after releaseBearishThe market rose first and then fell, with the decline widening; the author is dissatisfied with the FF token allocation, and OKB Flash Earn performed well.

0 0 100 Original >Trend of FF after releaseBearishThe market rose first and then fell, with the decline widening; the author is dissatisfied with the FF token allocation, and OKB Flash Earn performed well. Mercek OnChain_Analyst FA_Analyst B115.95K @WorldOfMercek

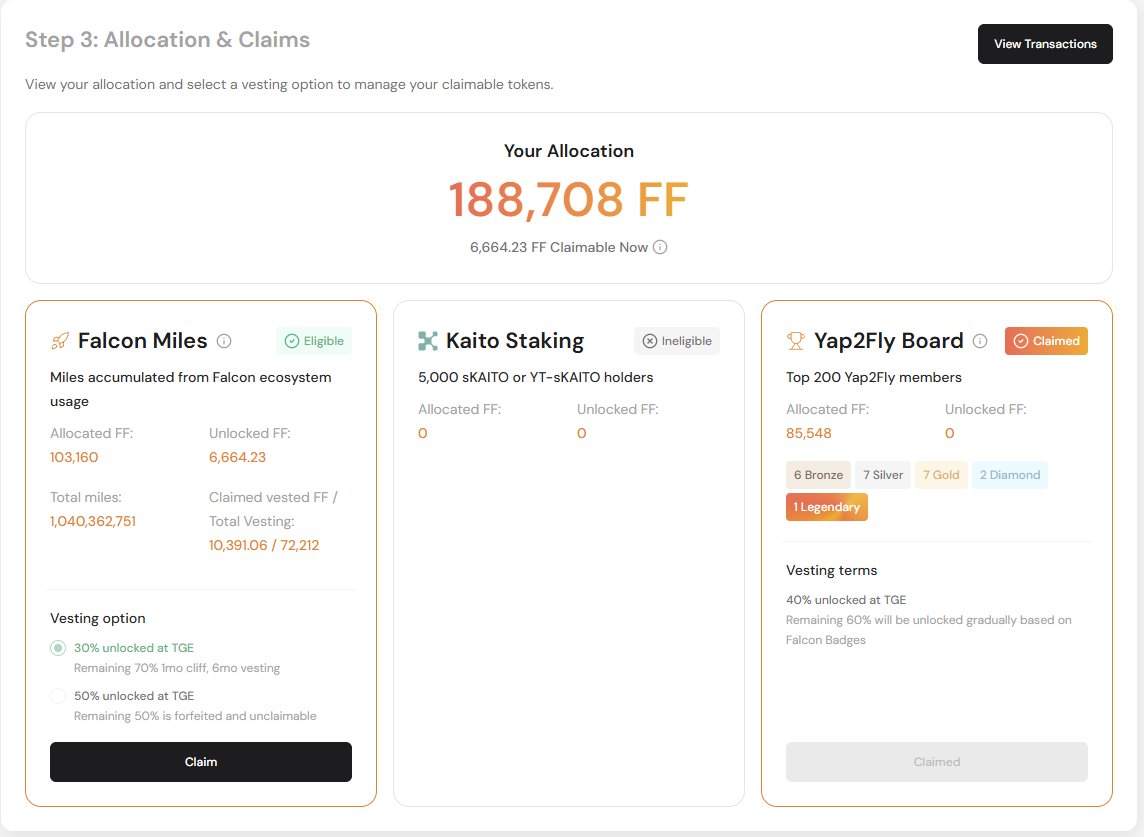

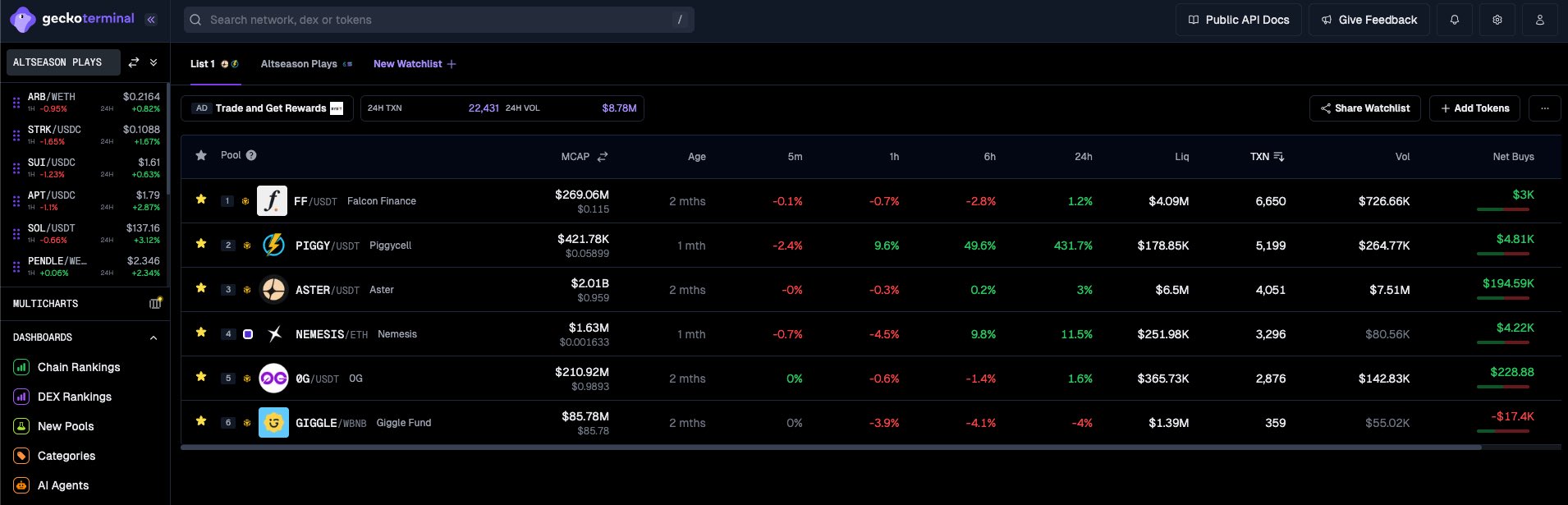

Mercek OnChain_Analyst FA_Analyst B115.95K @WorldOfMercekHere’s how I found signal in $FF: a token that’s flown under the radar lately 👇🏻 Each day starts with a quick scan of my custom watclists on @GeckoTerminal. Price action alone showed $FF was flat, barely moved since October. But when I opened the Top Traders tab, the story changed: ➜ One wallet is still sitting on a $1.15M position ➜ Another has held 1500 $FF buys at $0.32 average without selling a single unit ➜ Multiple entries from Oct-Nov still show massive unrealized gains While retail chops around small moves, these whales are sitting tight with size and conviction. I keep using these tools because tracking conviction through wallet behavior gives you clarity you’ll never get from price alone. The next move often starts where nobody’s looking!

144 35 14.98K Original >Trend of FF after releaseBullishAlthough FF token’s price remains stable, whale addresses keep accumulating and not selling, indicating strong conviction and hinting at a potential upside.

144 35 14.98K Original >Trend of FF after releaseBullishAlthough FF token’s price remains stable, whale addresses keep accumulating and not selling, indicating strong conviction and hinting at a potential upside. vanxyrus 🌊 Trader TA_Analyst B4.08K @0xVanxyrus

vanxyrus 🌊 Trader TA_Analyst B4.08K @0xVanxyrusjust a delicious serving of unagi for dinner while waiting to claim my last 20% of $ff from @falconfinance (wen) the best part? the skin is still crispy when you bite into it https://t.co/pvfe0794VB

20 11 735 Original >Trend of FF after releaseNeutralThe author mentions waiting to claim the remaining portion of their $FF token while enjoying a meal.

20 11 735 Original >Trend of FF after releaseNeutralThe author mentions waiting to claim the remaining portion of their $FF token while enjoying a meal. TerraNewsEN (TNEWS) OnChain_Analyst Community_Lead B11.28K @TerraNewsEN

TerraNewsEN (TNEWS) OnChain_Analyst Community_Lead B11.28K @TerraNewsEN#FalconFinance #FF $FF #Altcoins #Crypto

Crypto News Portal D24.71K @TerraHaberTr

Crypto News Portal D24.71K @TerraHaberTrWill Falcon Finance make the anticipated debut? What will the future of the $FF token look like? Falcon Finance is described as the first universal collateralization infrastructure supporting on-chain liquidity and yield. They describe the $FF listing as Falcon Finance's transition from a protocol to an ecosystem. On Falcon Finance, you can deposit your digital assets, including stablecoins and altcoins, to mint USDF. By staking your USDF, you generate sUSDF and earn returns. You can withdraw these assets at any time. If you wish, you can multiply your returns by adding them back to your staking transactions. We are in a period where staking is developing and passive income sources are gaining importance. Falcon Finance offers a good option in this regard. You can conduct all your transactions on the network with $FF, Falcon Finance's native token, and participate in governance. If Falcon Finance continues to develop, $FF could experience upward momentum. The low circulating supply of the $FF token is cre

8 0 751 Original >Trend of FF after releaseBullishFalcon Finance provides staking infrastructure, and the $FF token is expected to rise due to low circulation.

8 0 751 Original >Trend of FF after releaseBullishFalcon Finance provides staking infrastructure, and the $FF token is expected to rise due to low circulation.