ether.fi (ETHFI)

ether.fi (ETHFI)

$0.7287 +3.03% 24H

- 54Social Sentiment Index (SSI)-2.36% (24h)

- #84Market Pulse Ranking (MPR)-2

- 224h Social Mention-33.33% (24h)

- 100%24h KOL Bullish Ratio2 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall54SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (50%)Bullish (50%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of ETHFI after releaseBearish

- Trend of ETHFI after releaseBullish

- Trend of ETHFI after releaseExtremely Bullish

- Trend of ETHFI after releaseExtremely Bearish

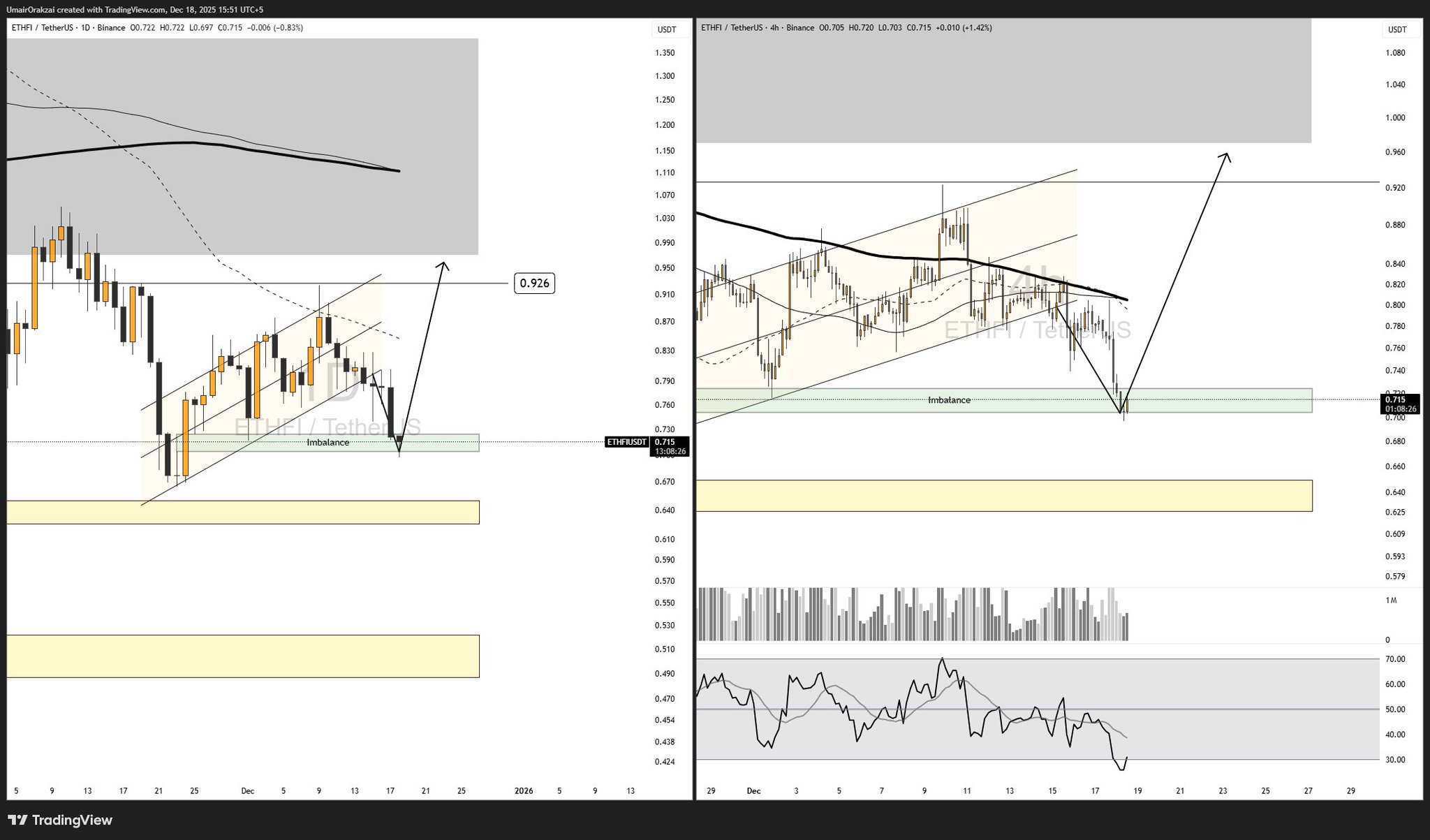

Umair Crypto OnChain_Analyst Trader B27.10K @Umairorkz

Umair Crypto OnChain_Analyst Trader B27.10K @Umairorkz

Umair Crypto OnChain_Analyst Trader B27.10K @Umairorkz

Umair Crypto OnChain_Analyst Trader B27.10K @Umairorkz 25 7 1.56K Original >Trend of ETHFI after releaseBearish

25 7 1.56K Original >Trend of ETHFI after releaseBearish- Trend of ETHFI after releaseExtremely Bullish

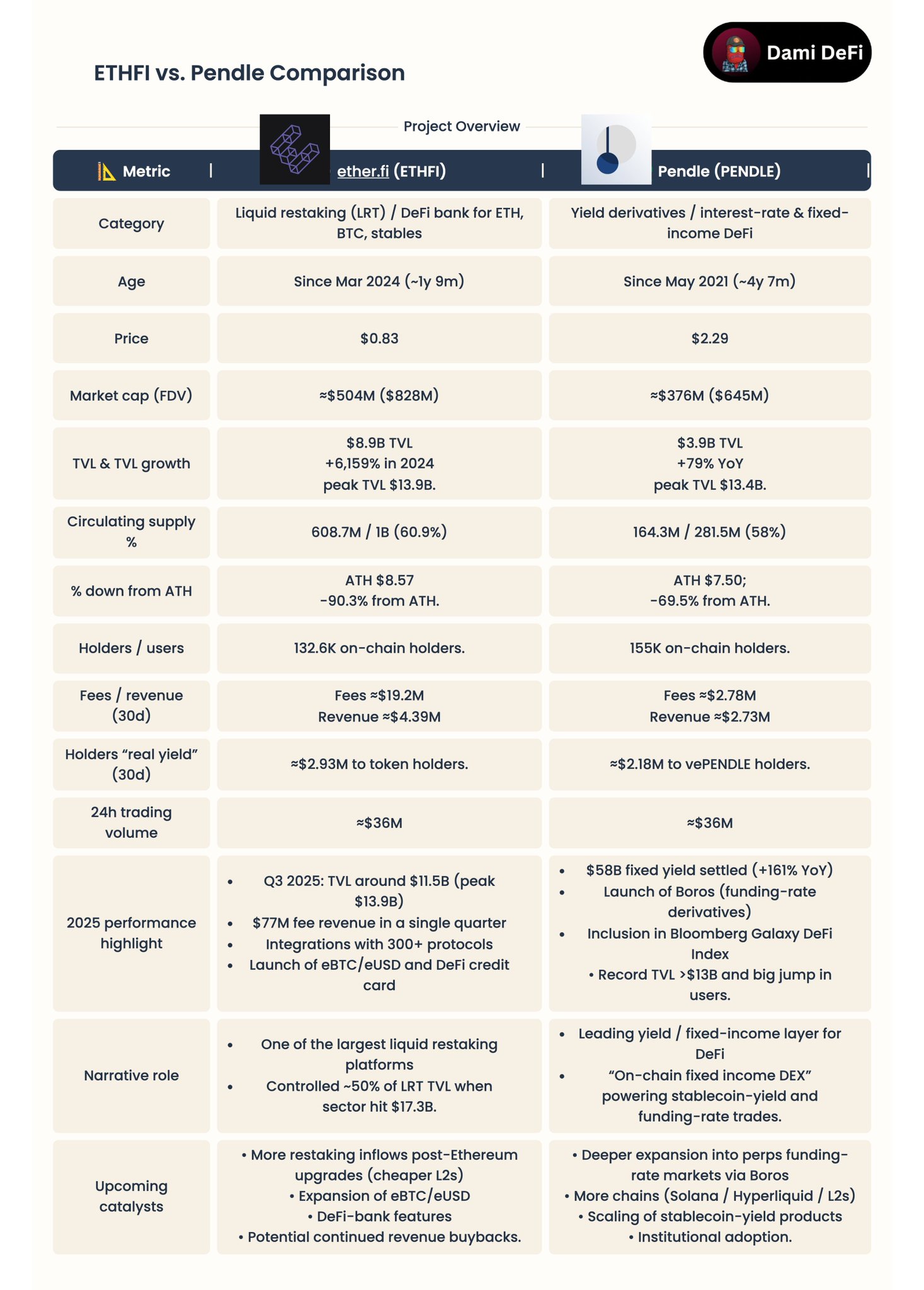

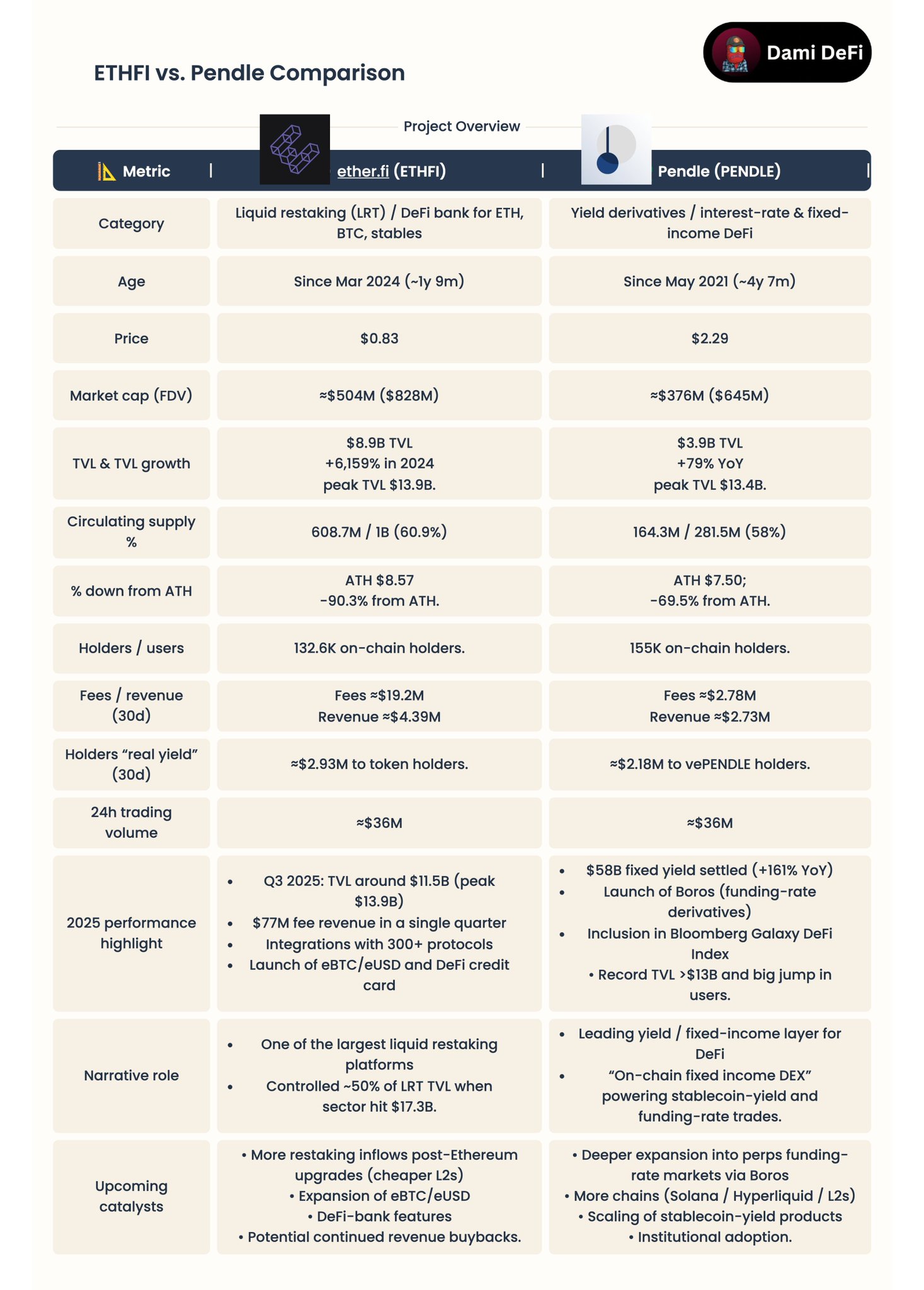

DeFi Warhol FA_Analyst OnChain_Analyst B35.14K @Defi_Warhol

DeFi Warhol FA_Analyst OnChain_Analyst B35.14K @Defi_Warhol

DeFi Warhol FA_Analyst OnChain_Analyst B35.14K @Defi_Warhol82 21 6.95K Original >Trend of ETHFI after releaseBullish

DeFi Warhol FA_Analyst OnChain_Analyst B35.14K @Defi_Warhol82 21 6.95K Original >Trend of ETHFI after releaseBullish- Trend of ETHFI after releaseExtremely Bullish

Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur

Stacy Muur OnChain_Analyst Researcher B73.47K @stacy_muur Dami-Defi DeFi_Expert Trader B90.41K @DamiDefi

Dami-Defi DeFi_Expert Trader B90.41K @DamiDefi 157 28 15.80K Original >Trend of ETHFI after releaseBullish

157 28 15.80K Original >Trend of ETHFI after releaseBullish Dami-Defi DeFi_Expert Trader B90.41K @DamiDefi

Dami-Defi DeFi_Expert Trader B90.41K @DamiDefi Dami-Defi DeFi_Expert Trader B90.41K @DamiDefi

Dami-Defi DeFi_Expert Trader B90.41K @DamiDefi 157 28 15.80K Original >Trend of ETHFI after releaseBullish

157 28 15.80K Original >Trend of ETHFI after releaseBullish