For tokenization of US stocks, there is a view that the blow to crypto projects is fatal, and there will be no chance for any copycat projects in the future. The reason is that money that would have been used for crypto will be drawn to high‑quality US equities. It is undeniable that some of the capital originally in crypto will flow into tokenized US stocks. But this is only one side of the coin; the other side exists.

Because asset tokenization—including tokenizing the dollar, US Treasurys, US equities, physical gold, etc.—will greatly increase the amount of assets on‑chain, and crypto finance is composable. If Ethereum scales and solves privacy issues, one possible outcome is a huge explosion of on‑chain trading, not only in DEXs, PERPs, prediction markets, etc., but also that some of the capital that used to trade US stocks will flow into the crypto market. Capital that wanted to trade US stocks but previously had no chance will also enter, overall expanding liquidity.

More importantly, US equities circulating on‑chain are not necessarily one‑way; they could be two‑way. What people worry about is that crypto projects lack hard revenue and cannot compete. Yet wealth effects do not depend entirely on revenue; there are industries with revenue but low market cap.

Of course, this inevitably means the end of the pervasive “copycat season” that characterized the previous two cycles. Nevertheless, high‑quality copycats and on‑chain infrastructure—including public chains like Ethereum, DeFi, oracles, privacy tech, digital identity, wallets, etc.—will still be in demand. Moreover, crypto AI agents, asset tokenization, etc., have a high probability of spawning new combinations, leading to new tracks similar to prediction markets / PERP.

The core message here is: don’t assume that tokenized US stocks spell the end of crypto and that liquidity will be seized away. Stablecoins, tokenized US stocks, once on‑chain, won’t just sit idle; they will need liquidity, and crypto’s composability will be fully leveraged. With a good narrative and good projects, not only crypto‑circle capital will flow in, but also capital from outside the circle – it’s just a common arena.

A small number of high‑quality crypto projects, once they have a narrative, may not necessarily underperform US equities. In the next cycle, it is highly likely we’ll see projects akin to prediction markets, PERP, etc., which traditional finance lacks and which have crypto‑specific return profiles. I believe the power of newly added on‑chain liquidity and composability will be unleashed. People’s thirst for money and pursuit of innovation are so strong that, through continual exploration, new crypto species are created from the ground up.

Furthermore, expecting another full‑blown copycat season like previous cycles is unrealistic. Even without tokenized US stocks, a comprehensive copycat season like the last two cycles has already left the crypto stage. Yet a small portion of high‑quality crypto projects still have opportunities, especially those that serve as infrastructure and applications for tokenized US stocks.

Finally, every cycle has its “version child”; the “version child” of the cycle before last, the last cycle, and this cycle are all different, and the next cycle’s will be different as well.

The most golden “wild west” of crypto is gradually winding down. With institutions entering, crypto is moving into a new stage of financial innovation.

In this stage, big‑return opportunities still exist. Compared with the previous golden era, the probability of hitting them is much lower, but not impossible. Perhaps the next cycle’s “version child” is still a senior in college, or maybe it lost a lot of money in this cycle; the hidden dragon is in the field, waiting for the next cycle’s soaring dragon opportunity.

Ethereum (ETH)

Ethereum (ETH) Trader T FA_Analyst Trader A13.68K @thepfund

Trader T FA_Analyst Trader A13.68K @thepfund

Trader T FA_Analyst Trader A13.68K @thepfund

Trader T FA_Analyst Trader A13.68K @thepfund 6 0 492 Original >Trend of ETH after releaseBearish

6 0 492 Original >Trend of ETH after releaseBearish Trader T FA_Analyst Trader A13.68K @thepfund

Trader T FA_Analyst Trader A13.68K @thepfund

Trader T FA_Analyst Trader A13.68K @thepfund

Trader T FA_Analyst Trader A13.68K @thepfund 3 0 626 Original >Trend of ETH after releaseBearish

3 0 626 Original >Trend of ETH after releaseBearish Digital Perspectives Media Influencer C204.31K @DigPerspectives

Digital Perspectives Media Influencer C204.31K @DigPerspectives PaulBarron Media Influencer A192.51K @paulbarron142 29 9.75K Original >Trend of ETH after releaseBullish

PaulBarron Media Influencer A192.51K @paulbarron142 29 9.75K Original >Trend of ETH after releaseBullish BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C353.77K @Bitwux

BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C353.77K @Bitwux

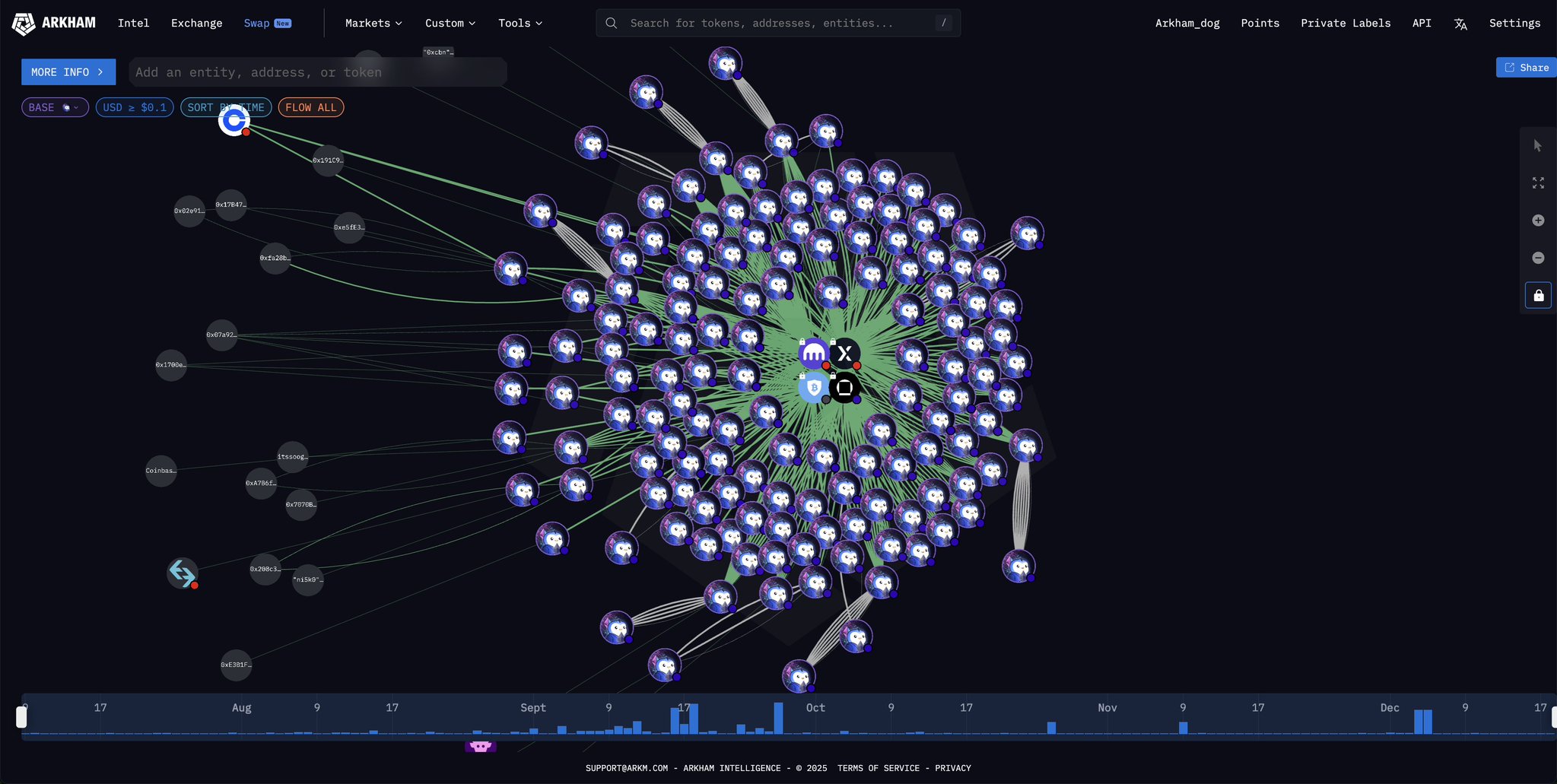

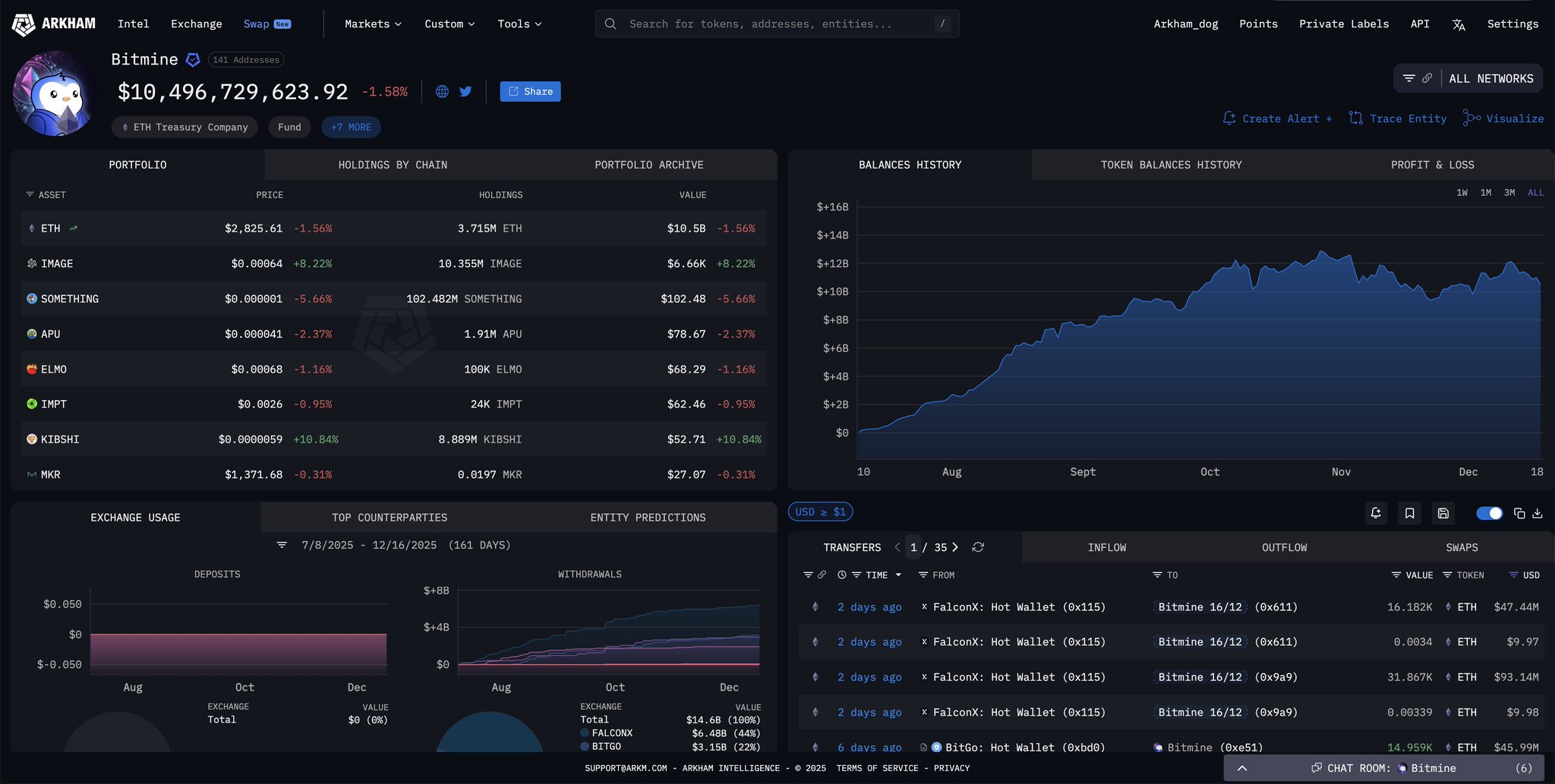

Arkham D1.55M @arkham

Arkham D1.55M @arkham

40 25 4.76K Original >Trend of ETH after releaseBullish

40 25 4.76K Original >Trend of ETH after releaseBullish Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.09K @CestrianInc

Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.09K @CestrianInc Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.09K @CestrianInc

Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.09K @CestrianInc 2 1 663 Original >Trend of ETH after releaseBullish

2 1 663 Original >Trend of ETH after releaseBullish