APRO (AT)

APRO (AT)

- 71Social Sentiment Index (SSI)0% (24h)

- #42Market Pulse Ranking (MPR)-21

- 124h Social Mention0% (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- SummaryAT up 6.4% today, despite a slight close down 0.5R, social heat remains flat and interaction is active.

- Bullish Signals

- 24h up 6.42%

- Social heat 70.5

- KOL interaction 75

- Sentiment unchanged

- Bearish Signals

- Close fell 0.5R

- KOL hinted error

- Volatility risk warning

- Lack of positive news

Social Sentiment Index (SSI)

- Data Overall71SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI InsightsAT social heat is flat (70.5/100, 0% change), activity at full score (40/40) driven by high sentiment (27.5/30), KOL attention low (3/30) and unchanged, in line with 6.4% price increase.

Market Pulse Ranking (MPR)

- Alert InsightAT warning rank rose to #42 (↑21), social abnormality extremely high (100/100) and KOL attention shift dropped to 0, matching moderate sentiment polarization (50/100) and lack of positive news.

X Posts

Tryrex TA_Analyst Trader A22.46K @Tryrexcrypto

Tryrex TA_Analyst Trader A22.46K @TryrexcryptoUpdate : $AT closed here. -0.5R. Can't win them all

Tryrex TA_Analyst Trader A22.46K @Tryrexcrypto

Tryrex TA_Analyst Trader A22.46K @Tryrexcrypto🟩🟩AT LONG TRADE 🟩🟩 $AT started to slow down and made a confirmation candle for a potential short squeeze. Could potentially make a strong move to the upside. Trying a long here. ENTRY: 0.0851 STOP-LOSS: 0.0795 TAKE PROFITS: Taking 50% at 0.1013and the rest at 0.1251 Leverage: 13X

51 15 4.76K Original >Trend of AT after releaseBullishAT presents a long opportunity, with expectations of a strong rise; the author has taken a long position.

51 15 4.76K Original >Trend of AT after releaseBullishAT presents a long opportunity, with expectations of a strong rise; the author has taken a long position. Tryrex TA_Analyst Trader A22.46K @Tryrexcrypto

Tryrex TA_Analyst Trader A22.46K @Tryrexcrypto🟩🟩AT LONG TRADE 🟩🟩 $AT started to slow down and made a confirmation candle for a potential short squeeze. Could potentially make a strong move to the upside. Trying a long here. ENTRY: 0.0851 STOP-LOSS: 0.0795 TAKE PROFITS: Taking 50% at 0.1013and the rest at 0.1251 Leverage: 13X

58 12 8.84K Original >Trend of AT after releaseBullishAT presents a long opportunity, with expectations of a strong rise; the author has taken a long position.

58 12 8.84K Original >Trend of AT after releaseBullishAT presents a long opportunity, with expectations of a strong rise; the author has taken a long position. Loki Educator DeFi_Expert S29.05K @kriptoloki

Loki Educator DeFi_Expert S29.05K @kriptolokiMan, does this market really have no bottom... Night after night it's stressful and nerve‑wracking, I'm honestly fed up and exhausted. Whatever we buy just stays in our hands. Haha, I bought $AT last time, CZ wasn’t shilling it, bro, whoever wants to shill can keep shilling – there’s no such thing as a bottom anymore. We thought the green candle before the last three red candles was the bottom, we bought it, but it wasn’t. What’s going to happen? We can’t even do altcoin trades, we say let’s do small buy‑sell but stay sleepless, we can’t even trade on spot, let alone margin – everything writes a loss immediately. If there are any, let’s talk at night, vent our frustrations.

121 31 38.68K Original >Trend of AT after releaseExtremely BearishThe market has no bottom, the AT token keeps falling causing the author extreme frustration and trading losses.

121 31 38.68K Original >Trend of AT after releaseExtremely BearishThe market has no bottom, the AT token keeps falling causing the author extreme frustration and trading losses. Emily Vuong FA_Analyst OnChain_Analyst B56.24K @emilyyvuong

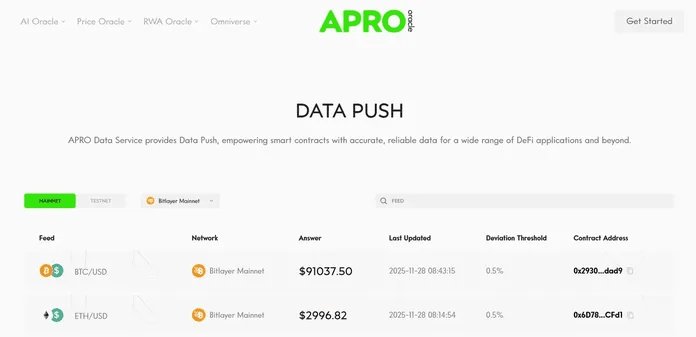

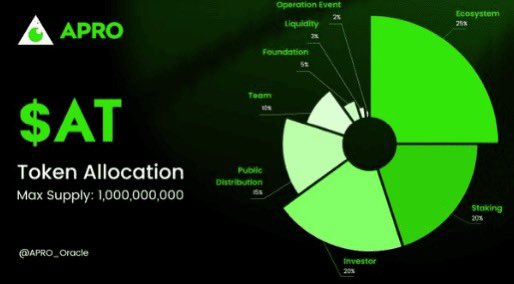

Emily Vuong FA_Analyst OnChain_Analyst B56.24K @emilyyvuong📍 APRO (AT) – A new generation of centralized Oracle for AI, DeFi and RWA @APRO_Oracle positions itself not as a traditional oracle that only serves price feeds, but as an AI-native oracle – a data layer for complex Web3 applications. The project aims to handle both structured data (price, indices, markets) and unstructured data (documents, images, social data, real-asset attributes) – something most current oracles cannot yet do. 🔸 Hybrid architecture: Data is aggregated off-chain, verified by AI/ML, then pushed on-chain through a decentralized consensus mechanism. This allows APRO to maintain high accuracy while optimizing cost and speed. 🔸 Two modes – Push / Pull: • Push suits lending, stable assets, RWA that need stable data. • Pull serves DEX, arbitrage and applications that require fast data and lower gas costs. 🔸 Multi-chain – multi-data: APRO operates on many blockchains, supports hundreds of data feeds, and expands into AI agents, prediction markets, tokenized real assets, and autonomous applications. 🔸 Token $AT plays a central role: Staking for node operators, rewards for data providers, and governance. Total supply 1 B AT, circulating ~23%, a relatively transparent mechanism for a still early-stage infrastructure project. 📌 APRO is backed by @yzilabs and has listed on #Binance. In the context of Web3 entering an AI-driven and real-asset digitization phase, #APRO is positioned to benefit from increasingly complex data demand.

19 1 3.05K Original >Trend of AT after releaseExtremely BullishAPRO is an AI-native oracle, secured $3 million financing, and its token AT is already listed on Binance.

19 1 3.05K Original >Trend of AT after releaseExtremely BullishAPRO is an AI-native oracle, secured $3 million financing, and its token AT is already listed on Binance. Ak47♛ Trader DeFi_Expert A41.91K @HolaItsAk47

Ak47♛ Trader DeFi_Expert A41.91K @HolaItsAk47Sometimes I feel like we talk non-stop about L1s, L2s, and memecoins, but completely forget the thing that actually keeps DeFi alive: data. That’s where @APRO_Oracle really clicks for me. It doesn’t try to be flashy – it just focuses on one job and does it seriously: making sure the numbers your smart contracts see are actually real. Prices, reserves, RWA feeds, gaming stats, sentiment… all cleaned, checked, and delivered on-chain like they actually matter. Because they do. What I like most is that APRO doesn’t treat data as “just a feed.” It behaves more like a risk engine: • Multiple sources instead of blind trust • Push and pull models depending on what your app needs • Protection against bad inputs instead of pretending volatility is “normal” In a world where one wrong price can liquidate half a protocol, that kind of caution isn’t a bonus – it’s survival. If Web3 is the brain, then oracles are the senses. APRO is trying to be the one that doesn’t blink when markets go crazy. I’m watching $AT as infrastructure, not just a token. Because without oracles we can trust, the rest of the ecosystem is just guessing. #APRO

173 138 14.93K Original >Trend of AT after releaseBullishAT is a reliable oracle, worthy of long-term holding. EyeOnChain OnChain_Analyst Educator C5.29K @EyeOnChain

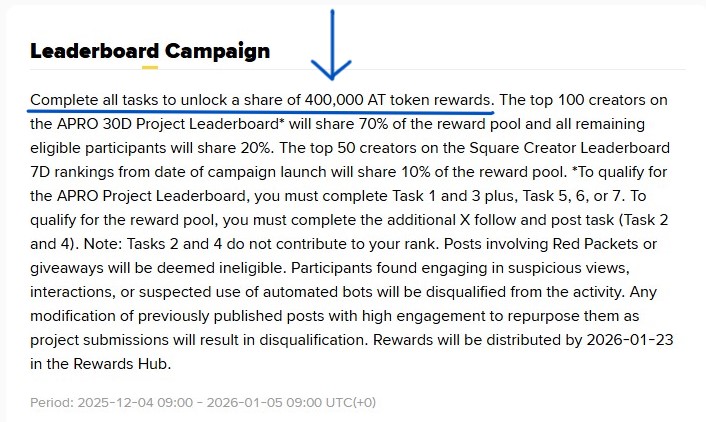

EyeOnChain OnChain_Analyst Educator C5.29K @EyeOnChainAPRO Oracle Is Slowly Becoming the Project Everyone Keeps Bumping Into Some projects try to make noise. Others don’t need to, the industry talks about them on its own. That’s exactly what’s happening with @APRO_Oracle . While the whole space keeps debating “scalability” and “interoperability,” APRO is quietly solving a far more fundamental issue: trustworthy data flowing across chains --- fast, secure, and decentralized. $AT isn’t just another token; it’s the fuel behind a real infrastructure layer that Web3 builders actually need. And if this week was any hint of what’s coming, the momentum is getting real: #APRO was the only project showcased at the recent alumni event --- and the hall absolutely loved Yi and Ella’s talk. As part of the BNBuilders & EASY Residency program via YZi Labs, the team isn’t just attending events… they’re in the center of high-impact innovation circles. A brand-new CreatorPad campaign just launched on Binance Square, unlocking 400,000 AT token vouchers for creators who complete tasks a massive way to expand awareness and user growth. Put all of that together, and it’s hard not to imagine investors starting to look twice at AT. Not a signal, not advice --- just one trader’s observation of momentum forming where real innovation is happening. As always: DYOR, protect your capital, and trade what you understand. But one thing’s for sure, APRO isn’t acting like a project chasing attention… attention is chasing APRO.

2 0 175 Original >Trend of AT after releaseExtremely BullishAPRO Oracle (AT)通过行业认可、战略合作及大规模代币奖励活动,正获得显著发展势头。

2 0 175 Original >Trend of AT after releaseExtremely BullishAPRO Oracle (AT)通过行业认可、战略合作及大规模代币奖励活动,正获得显著发展势头。 Kriptoloji 🫶 OnChain_Analyst Influencer B27.40K @Kriptolooo

Kriptoloji 🫶 OnChain_Analyst Influencer B27.40K @KriptoloooApro protocol is designed as an infrastructure that collects and verifies the external data needed by cross‑chain applications not from a single central source, but from a distributed pool of resources. The system first passes the received data through multiple control layers, then performs consistency analysis using AI‑based filtering, converting it into a format usable by blockchains. This approach creates a more stable data foundation especially for RWA solutions, algorithmic models, and DeFi protocols that require automation. A notable aspect of APRO's architecture is that node groups operating on different networks perform parallel control on the same data set, and securely feed the results onto the chain. The staking model used during the @BinanceTR airdrop period was entirely participation‑focused, and the distribution was automatically completed by the system on 27 Kasım. Since oracle structures generally rely on off‑chain sources, no solution—including APRO—can guarantee absolute accuracy, but the design aims to minimize such errors. While the involvement of institutional investors shows that the technical approach is being developed with long‑term goals in mind, the price side still depends on overall market flow. In my view, APRO's decisive factor is not data provision but the claim to standardize the process of restructuring this data with AI and moving it onto the chain. If this model scales, a common data language could emerge across multi‑chain ecosystems. Nevertheless, as with any technical infrastructure, conducting personal due diligence before making decisions remains the healthiest approach. This does not constitute investment advice; it is for informational purposes only.

157 61 5.32K Original >Trend of AT after releaseBullishAPRO protocol utilizes AI‑enhanced data verification, aiming for multi‑chain data standards.

157 61 5.32K Original >Trend of AT after releaseBullishAPRO protocol utilizes AI‑enhanced data verification, aiming for multi‑chain data standards. Loki Educator DeFi_Expert S29.05K @kriptoloki

Loki Educator DeFi_Expert S29.05K @kriptolokiI compiled a lot of information for you about the newly listed and TGE-ed APRO | $AT. I prepared it bullet by bullet for easy reading. I gathered all the details I could find. It turned out to be a fairly comprehensive review. First, @APRO_Oracle What is APRO? •It is an oracle protocol that transfers real-world data to the blockchain in a secure, fast, and decentralized manner. •Provides data to RWA, AI, prediction markets and DeFi applications. •With 40+ blockchain integrations and 1,400+ data streams, it is one of the oracles with the widest coverage in the industry. •The entire verification process is supported by machine learning and artificial intelligence. APRO’s Purpose: •Enable the blockchain to establish a reliable bridge with the outside world. •Transport variable data such as prices, market data, RWA valuations onto the chain securely. •Provide critical data infrastructure for DeFi, DEX, prediction markets and RWA tokenization. •Ensure maximum security with multi-source verification + AI analysis layer that prevents data manipulation. APRO How It Works? Two Models: Data Pull & Data Push Data Pull: •Data is fetched only when needed → low cost, minimal latency. •Price, timestamps and signatures are verified on-chain. •4 scenarios: instant price, timestamped price, price verification, verified price read. Data Push: •Automatic updates based on price thresholds or heartbeat intervals. •Ideal for DeFi, Bitcoin L2 and projects requiring high frequency. Proof of Reserve (PoR): •Verifies reserves of tokenized RWA assets in real time. •APIs, banks, reports, regulatory documents → analyzed with AI. •Generates asset‑liability summary, collateral ratio, compliance and risk reports. Technical Infrastructure: •Two‑layer oracle network: •OCMP: Nodes collect data, detect anomalies, compare with other nodes. •Eigenlayer: Provides arbitration in case of disputes. •Node Security System: •Wrong data → margin is slashed. •Faulty escalation → margin is slashed. •Consensus: PBFT → 7+ verification nodes and a 2/3 majority requirement. •Risk Protection: Multi‑source data, TVWAP pricing, Z‑score anomaly, dynamic thresholds. APRO Use Cases: •DeFi & Derivatives: Real‑time price feed. •RWA Tokenization: Stock, bond, commodity, real‑estate prices. •Prediction Markets: Fair settlement with event‑based data. •Gaming / Social: Special data sets. •Enterprise: RWA verification, risk assessment, reserve monitoring. APRO Advantages: •Broad coverage with 40+ chains and 1,400+ data streams. •AI‑assisted verification → minimal manipulation risk. •Data Pull model → gas costs drop dramatically. •Dual‑layer security → OCMP + Eigenlayer. •Flexible usage → high‑frequency + event‑based data scenarios. Tokenomics & Investors: •Gas and service fees are paid with chain tokens or ERC20 versions. •Costs in Data Pull are optimized; a discount model can operate based on gas dynamics. •Investors include: •Polychain Capital •Franklin Templeton •YZi Labs •abcde •CMS •Oak Grove Ventures •UTXO •Comma3 •Presto •A strongly funded, Web3 data‑layer growth‑focused ecosystem.

223 19 10.42K Original >Trend of AT after releaseExtremely BullishDetailed introduction of APRO project's technical advantages and investment background

223 19 10.42K Original >Trend of AT after releaseExtremely BullishDetailed introduction of APRO project's technical advantages and investment background Şevki Kara TA_Analyst Trader A77.52K @sevkikara

Şevki Kara TA_Analyst Trader A77.52K @sevkikaraLet's close the day with another review ..🤝 #BinanceTR listed the 39th HODLer project with the $AT / $TRY trading pair. @APRO_Oracle is a platform that enables AI agents and blockchain applications to share data securely. It makes communication between different systems seamless and ensures that the data is correct. The purpose is very clear ⁉️ By bringing together AI and blockchain ecosystems, it makes data usage in the Web3 world reliable and standardized, ensuring that applications can always make decisions based on correct information. Now let's look at the Technical Infrastructure 🛠️ 1️⃣ Protocol Architecture Built on the ATTPs protocol that provides secure and verifiable data transfer among AI agents. The protocol uses a five-layer architecture: data transmission, data validation, identity management, trust score, and blockchain integration. These layers work together to make data transfer both fast and secure. 2️⃣ Data Validation The protocol uses advanced cryptographic methods such as Merkle tree and ZKP to ensure data accuracy. Data from AI agents is first validated off-chain, then recorded on-chain. This prevents data manipulation and makes the whole process transparently traceable. Additionally, the platform supports both Data Push and Data Pull models: Push: Nodes send data at certain thresholds or time intervals, ideal for real-time price changes. Pull: dApps request data when needed, suitable for high‑frequency access and low‑latency applications. 3️⃣ Identity Verification Each AI agent is identified by a unique on‑chain identity. This identity allows agents to recognize each other securely and conduct data exchange in a verified environment. Thus, false or unauthorized agents sending data within the system are prevented❗️ 4️⃣ Trust Score It measures each agent's reliability with a trust score. The score is based on past data accuracy, peer evaluation, and performance history. Agents with low trust scores have their data transmission limited, while high‑scoring agents can perform more operations. 5️⃣ Blockchain Integration All verification and recording operations are performed on the blockchain, making data immutable and traceable. This architecture makes @APRO_Oracle suitable as an infrastructure for oracle services and secure data feeding. Finally, thanks to multichain support, it can operate compatibly with different blockchains such as $ETH and $SOL.

136 24 10.49K Original >Trend of AT after releaseBullishThe AT project is listed on BinanceTR, is multichain compatible and has a solid technical architecture, worth attention onchainschool.pro OnChain_Analyst Educator A5.25K @how2onchain

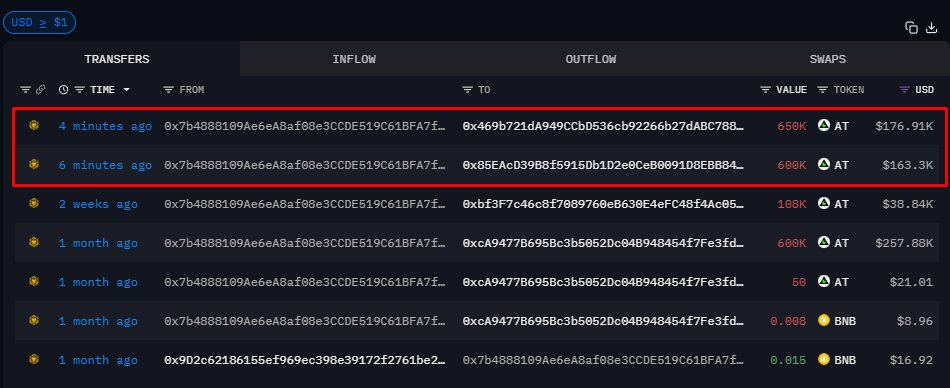

onchainschool.pro OnChain_Analyst Educator A5.25K @how2onchain$AT MOVED TO FRESH WALLETS Just recently, $AT was transferred from the team wallet to two fresh wallets The total amount moved is $340K. There’s a high chance these tokens will be sent to exchanges soon Team wallet: 0x7b4888109Ae6eA8af08e3CCDE519C61BFA7f2380 Wallets that received the tokens: 0x469b721dA949CCbD536cb92266b27dABC78806E1 0x85EAcD39B8f5915Db1D2e0CeB0091D8EBB845b28

onchainschool.pro OnChain_Analyst Educator A5.25K @how2onchain

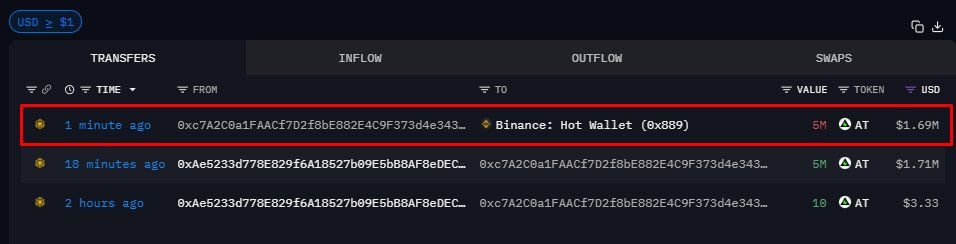

onchainschool.pro OnChain_Analyst Educator A5.25K @how2onchain$AT TOKENS SENT TO BINANCE Recently, $AT was transferred from the team wallet to a newly created wallet, from which the tokens were already withdrawn to Binance The amount moved is $1.7M These tokens are potentially intended for providing liquidity on the exchange The token will soon be available for spot trading, so it’s important to watch how the price reacts If there are further transfers from team wallets, we will report them Wallet used for the transfer: 0xAe5233d778E829f6A18527b09E5bB8AF8eDECf35

6 0 1.93K Original >Trend of AT after releaseBullishThe AT token was moved from the team wallet to Binance, indicating an imminent listing for trading.

6 0 1.93K Original >Trend of AT after releaseBullishThe AT token was moved from the team wallet to Binance, indicating an imminent listing for trading.